3QCY2015 Result Update | Cement

October 27, 2015

ACC

BUY

CMP

`1,397

Performance Highlights

Target Price

`1,630

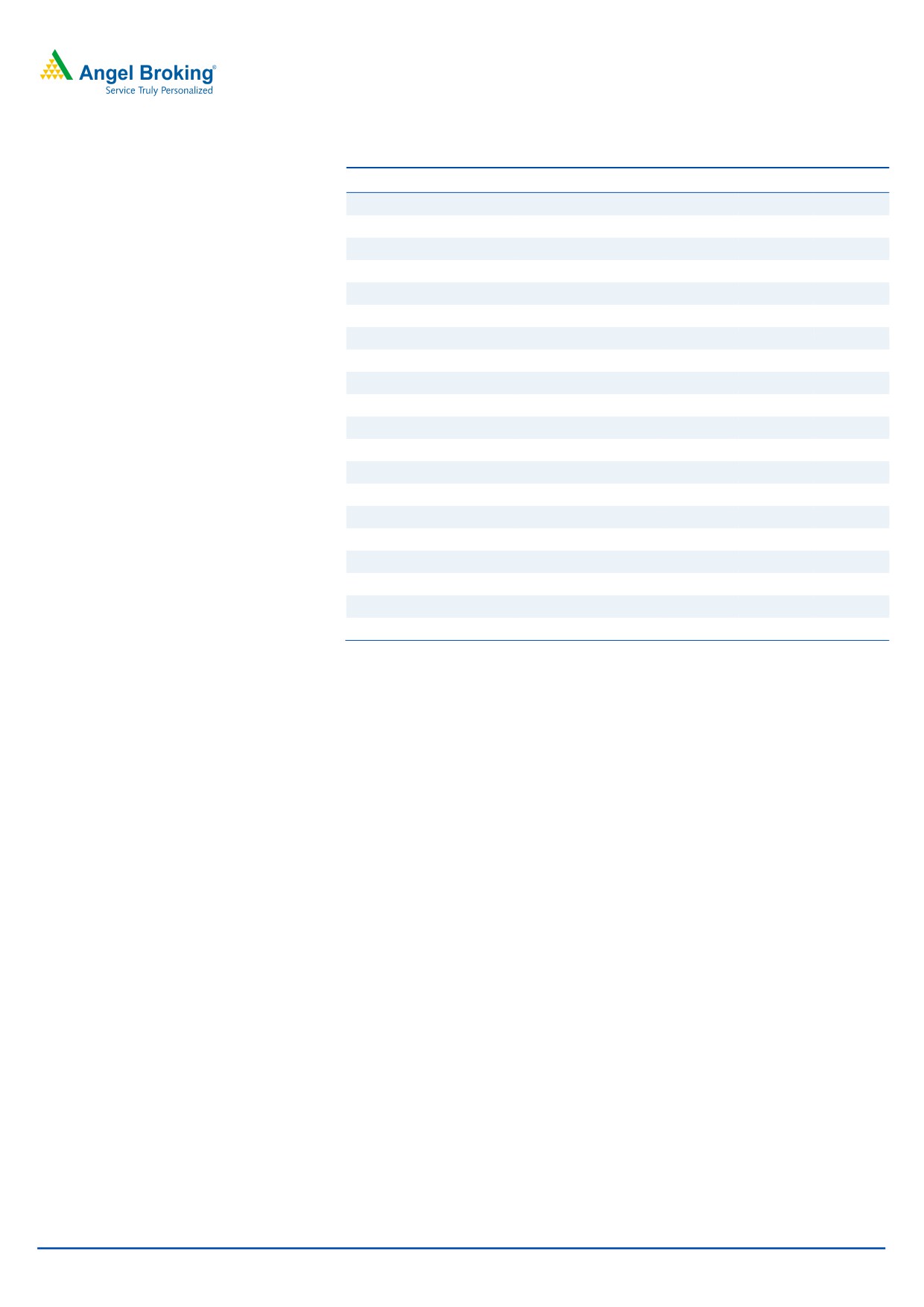

Quarterly results (Standalone)

Investment Period

12 Months

Y/E Dec (` cr)

3QCY2015

2QCY2015

% chg qoq 3QCY2014

% chg yoy

Net revenue

2,740

2,961

(7.5)

2,742

(0.1)

Stock Info

Operating profit

314

334

(6.0)

379

(17.2)

Sector

Cement

OPM (%)

11.4%

11.3%

10bp

13.8%

(236bp)

Market Cap (` cr)

26,221

Net profit

117

131

(10.9)

205

(42.9)

Source: Company, Angel Research

Net Debt (` cr)

(2,217)

Beta

0.8

ACC’s net sales during 3QCY2015 remained flat yoy at `2,740cr, but were

52 Week High / Low

1775/1303

above our expectation of `2,686cr. Volumes declined by 0.2% yoy to 5.61mt (vs

Avg. Daily Volume

315,151

our expectation of 5.56mt); and realization/tonne declined by 1.8% yoy to `4,438

Face Value (`)

10

(in line with our estimate of `4,429), mainly due to muted demand for cement.

BSE Sensex

27,362

The EBITDA at `313.6cr has come in above our estimate of `244.8cr on account

of cost efficiency measures followed by the company in terms of incurring lower

Nifty

8,261

power and employee costs. Hence, the EBIDTA margin for the quarter, at 11.4%,

Reuters Code

ACC.BO

is also above our expectation of 9.1%. The net profit saw a decline of 42.9% yoy

Bloomberg Code

ACC IN

to `117cr, weighed down by lower other income.

EBITDA margin dips 236bp yoy to 11.4%: For 3QCY2015, ACC reported an

Shareholding Pattern (%)

EBITDA of `313.6cr, a decrease of 17.2% yoy, but is above our estimate of

Promoters

50.3

`244.8cr. The EBITDA came in higher than our estimate, led by lower power and

MF / Banks / Indian Fls

13.2

employee costs. The total operating cost increased by 1.7% yoy to `2,476.2cr, led

FII / NRIs / OCBs

17.7

by 5.1% and 11.9% yoy increase in net raw material and other expenses,

respectively. The EBITDA margin fell by 236bp yoy to 11.4%; the same is above

Indian Public / Others

18.8

our expectation of 9.1%. Strong RMC sales and a modest increase in operating

costs delivered the better than expected EBIDTA margin during the quarter. The

Abs. (%)

3m 1yr

3yr

EBITDA/tonne declined by 17% yoy to `559 but was ahead of our estimate of

`440.

Sensex

2.7

1.9

46.9

ACC

(0.7)

(5.8)

(0.1)

Outlook and valuation: Going ahead, we expect ACC’s bottom-line to grow at a

CAGR of

22.2% over CY2014-17E, considering capacity addition and

operational efficiency post commissioning of new capacity in the east region. We

3-year price chart

have introduced estimates for CY2017E and recommend a Buy rating on the

2,000

1,800

stock with a revised target price of `1,630 on 10x EV/EBIDTA and EV/tonne of

1,600

US$120 on CY2017E installed capacity.

1,400

1,200

1,000

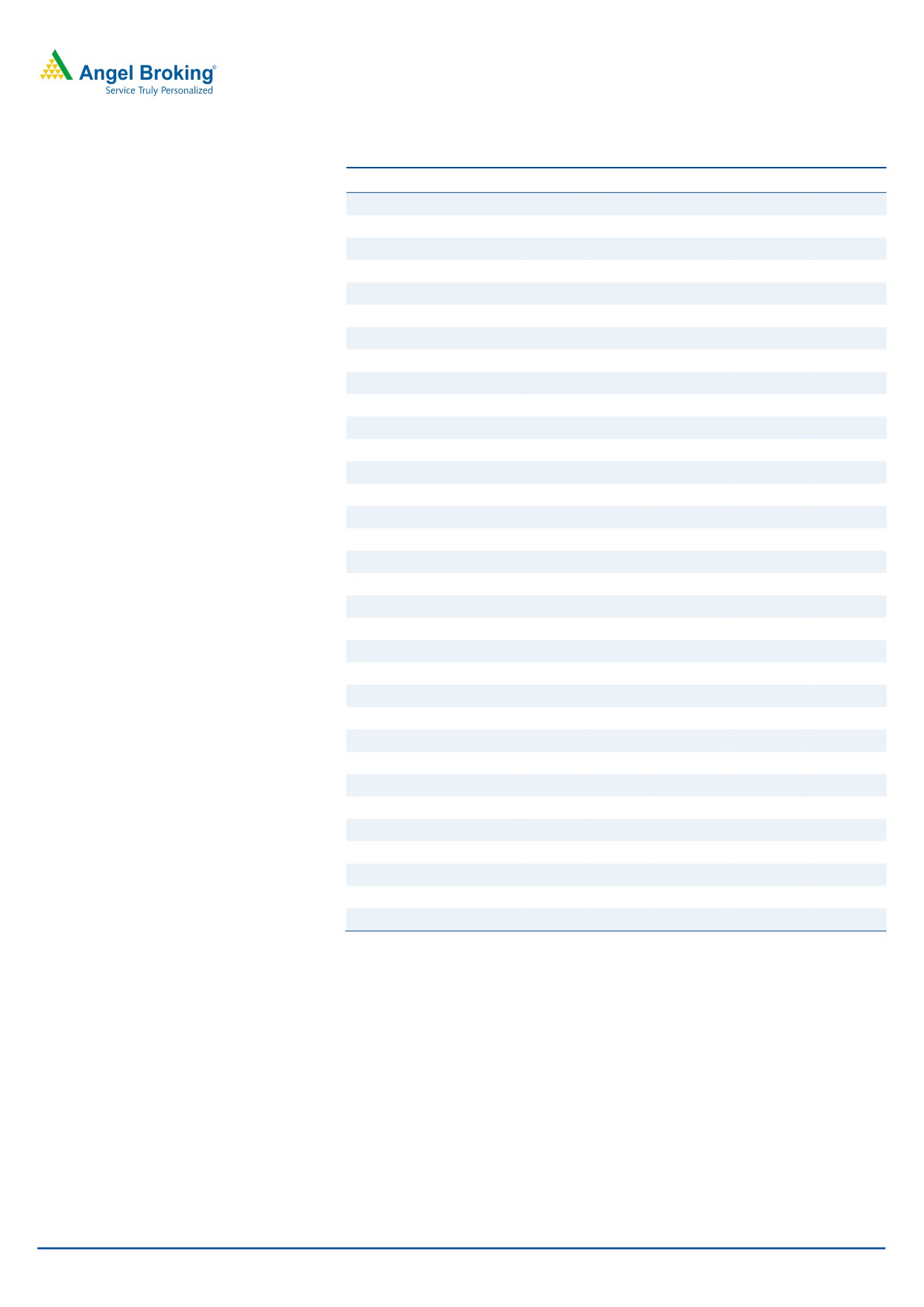

Key financials (Standalone)

800

Y/E December ( ` cr)

CY2013

CY2014

CY2015E CY2016E CY2017E

600

400

Net Sales

10,908

11,481

11,738

13,151

14,757

200

% chg

(1.8)

5.2

2.2

12.0

12.2

0

Net Profit

880

934

871

1,201

1,568

% chg

(33.0)

6.1

1.4

37.9

30.6

FDEPS (`)

46.8

49.7

46.4

64.0

83.5

Source: Company, Angel Research

OPM

14.9

13.1

14.1

16.4

18.3

P/E(x)

29.9

30.6

30.2

21.9

16.8

P/BV(x)

3.4

3.2

3.0

2.8

2.6

RoE(%)

14.4

10.7

10.3

13.3

16.1

RoCE(%)

12.3

10.8

11.1

14.6

18.2

Shrenik C. Gujrathi

EV/Sales (x)

2.1

2.0

2.1

1.9

1.6

022-39357800 Extn: 6872

EV/EBITDA

14.3

15.2

14.6

11.3

8.6

Source: Company, Angel Research; Note: CMP as of October 26, 2015.

Please refer to important disclosures at the end of this report

1

ACC | 3QCY2015 Result Update

Exhibit 1: Quarterly Performance (Standalone)

Y/E March (` cr)

3QCY2015

2QCY2015

% Chg 3QFY2014

% Chg

9MCY2015

9MCY2014

% Chg

Net sales

2,740

2,961

(7.5)

2,742

(0.1)

8,587

8,718

(1.5)

Net raw-material costs

373

475

(21.5)

355

5.1

1,238

1,311

(5.6)

(% of sales)

13.6

16.0

12.9

14.4

15.0

Power & fuel

618

610

1.4

625

(1.1)

1,850

1,855

(0.3)

(% of sales)

22.6

20.6

22.8

21.5

21.3

Staff costs

166

200

(17.1)

192

(13.3)

537

554

(3.1)

(% of sales)

6.1

6.8

7.0

6.3

6.4

Freight & forwarding

613

740

(17.1)

596

2.8

2,038

1,939

5.1

(% of sales)

22.4

25.0

21.7

23.7

22.2

Other expenses

684

629

8.7

611

11.9

1,880

1,844

1.9

(% of sales)

25.0

21.2

22.3

21.9

21.2

Total Expenditure

2,476

2,682

(7.7)

2,436

1.65

7,630

7,647

(0.2)

Operating Profit

314

334

(6.0)

379

(17.2)

1,116

1,254

(11.0)

OPM

11.4

11.3

13.8

13.0

14.4

Interest

15

14

5.0

11

30.8

52

33

55.4

Depreciation

161

166

(3.0)

139

15.3

496

414

20.0

Other income

18

23

(23.5)

45

(59.7)

399

372

7.4

PBT

156

177

(12.0)

272

(42.8)

808

996

(18.9)

Provision for taxation

39

46

(14.9)

67

(42.4)

166

151

9.6

(% of PBT)

24.9

25.8

24.8

20.5

15.2

PAT but before exceptional item

117

131

(10.9)

205

(42.9)

642

845

(24.0)

Exceptional item

0

0

0

153

0

PAT after exceptional item

117

131

(10.9)

205

(42.9)

489

845

(42.1)

PATM

4.3

4.4

7.5

5.7

9.7

Reported EPS (`)

6.2

7.0

10.9

26.0

39.0

Source: Company, Angel Research

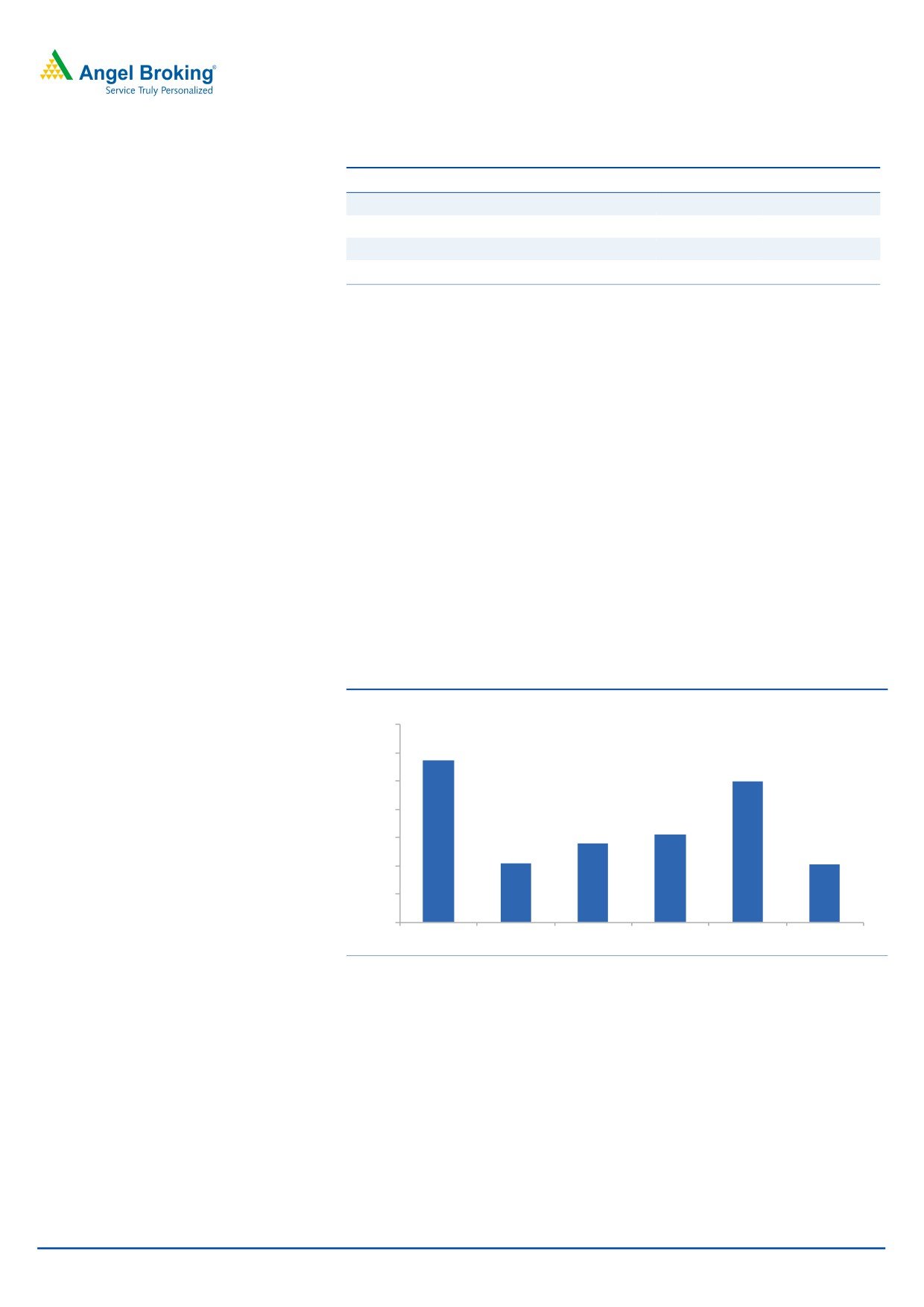

Exhibit 2: Financial performance

(`cr)

(%)

3,500

18.0

3,009

2,742

2,961

16.0

3,000

2,763

2,885

16.2

2,740

15.0

14.0

2,500

13.8

12.0

11.3

11.4

2,000

10.0

1,500

9.2

8.0

6.0

1,000

451

469

4.0

379

334

314

500

253

2.0

0

0.0

2QCY14

3QCY14

4QCY14

1QCY15

2QCY15

3QCY15

Net Sales

EBITDA

EBITDA %

Source: Company, Angel Research

October 27, 2015

2

ACC | 3QCY2015 Result Update

Exhibit 3: 3QCY2015 - Actual vs Angel estimates

(` cr)

Actual

Estimates

Variation (%)

Net sales

2,740

2,686

2.0

Operating profit

314

245

28.1

OPM (%)

11.4

9.1

235bp

Adjusted PAT

117

107

9.9

Source: Company, Angel Research

Performance highlights

Top-line remained flat yoy

For 3QCY2015, ACC’s top-line remained flat yoy at `2,740cr, which is above our

estimate of `2,685.7cr. Cement volumes remained flat yoy to 5.61mt (as against

our estimate of 5.56mt). Realization/tonne declined by 1.8 yoy (but increased 1.2%

qoq) to `4,438 (in line with our estimate of `4,429), due to muted demand for

cement during the period. ACC’s volumes declined by 4% yoy during 9MCY2015;

however, going forward, we expect demand for cement to improve gradually over

the next couple of quarters, with the government increasing focus on infrastructure

development and promising new projects including “Smart Cities” and “Housing

for All”. We expect the company’s top-line to grow at a CAGR of 8.7% during

CY2014-17, with new capacity addition (2.5mtpa grinding unit at Jamul) in the

east region.

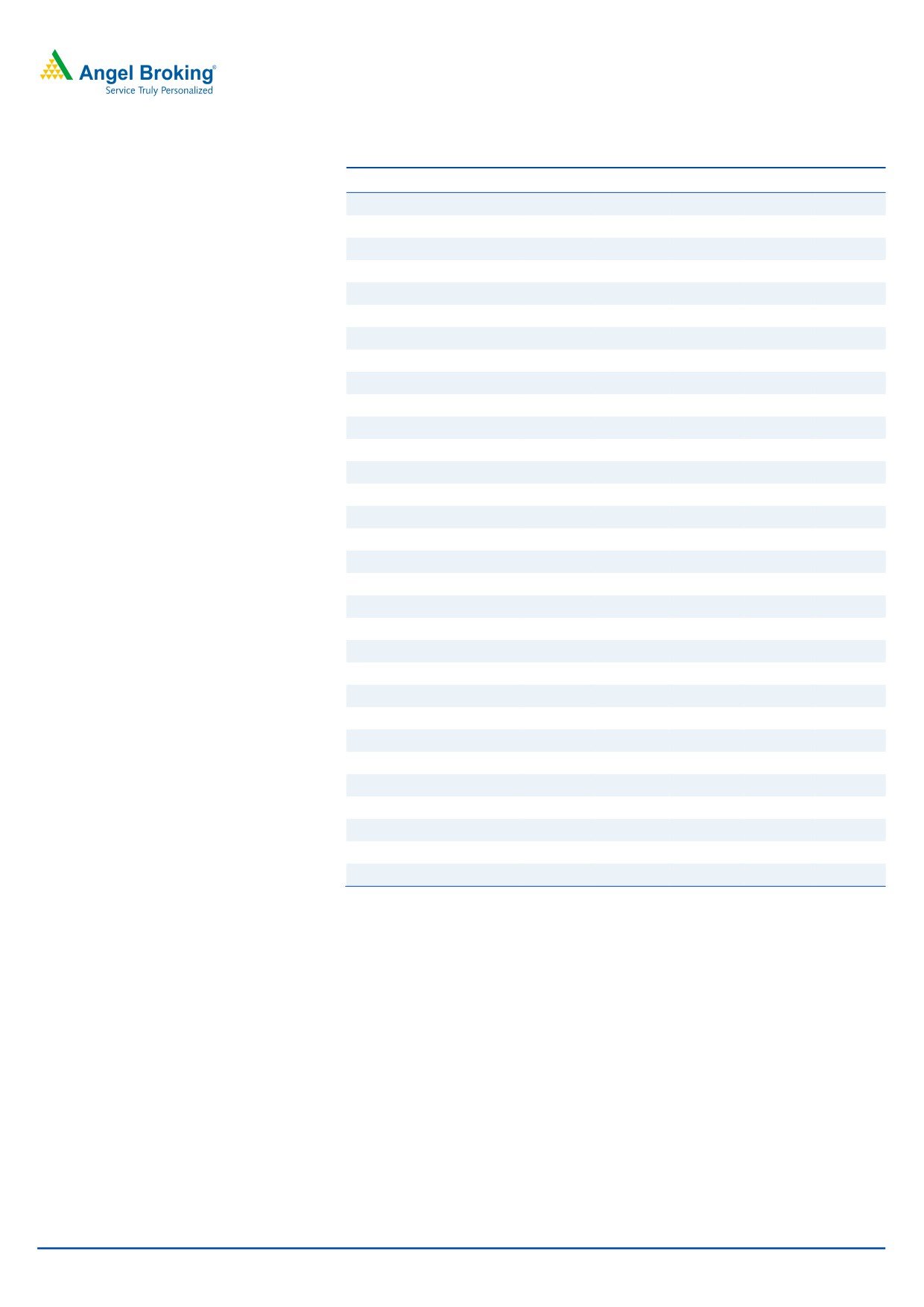

Exhibit 4: Volume performance

(mn tn)

6.6

6.4

6.4

6.2

6.2

6.0

5.8

5.8

5.8

5.6

5.6

5.6

5.4

5.2

2QCY14

3QCY14

4QCY14

1QCY15

2QCY15

3QCY15

Source: Company, Angel Research

EBITDA/tonne declines by 17.0% yoy

The EBIDTA margin for the quarter fell by 236bp yoy to 11.4% but was better than

our estimate of

9.1%, on account of lower employee expenses. The total

cost/tonne increased by 1.8% yoy to `4,414, led by increase in net raw material

and other expenses, which increased by 5.1% and 11.9% yoy respectively. Other

expenses increase on account of DMF provisions as per requirements of the New

MMDR Act. The EBITDA/tonne came in at `559, a decline of 17% yoy, due to

lower realization and higher raw material and other expenses/tonne.

October 27, 2015

3

ACC | 3QCY2015 Result Update

Per-tonne analysis

During 3QCY2015, ACC’s realization/tonne fell by 1.8% yoy. On the costs front,

raw material cost/tonne increased by 5.3% yoy, while power and fuel cost/tonne

declined by 0.9% yoy mainly due to lower diesel prices. Freight cost/tonne rose by

3% yoy but declined 8.4% qoq as no busy season surcharge was imposed by

Indian Railways. The company’s operating profit/tonne fell by 17% yoy to `559

during the quarter.

Exhibit 5: Per tonne analysis

Particulars (`/tonne)

3QCY2015 2QCY2015 3QCY2014 qoq chg (%) yoy chg (%)

Net Realization/tonne

4,438

4,385

4,521

1.2

(1.8)

Raw-Material* Cost/tonne

664

766

631

(13.3)

5.3

Power and Fuel cost/tonne

1,102

984

1,113

12.0

(0.9)

Freight Cost/tonne

1,093

1,193

1,061

(8.4)

3.0

Operating costs/tonne

4,414

4,325

4,334

2.0

1.8

Operating Profit/tonne

559

538

674

3.9

(17.0)

Source: Company, Angel Research

Change in estimates

We have revised our CY2015/16E numbers following disappointing 3QCY2015

results and delay in commissioning of its new plant. We have reduced our cement

volume estimate by

1.4%/6.7% to

23.4/24.7mt for CY2015/16E. Revenue

estimate has also been revised down by 1.0/6.7% for CY2015/16. The EBITDA

estimate has also been downgraded by 16.9/23.2% for CY2015/16, due to

increase in operating cost. Hence, we expect the EBITDA margin to be adversely

impacted by 230/320bp during CY2015/16 as compared to our earlier estimate.

Exhibit 6: Change in estimate

CY2015E

CY2016E

CY2017E

( ` cr )

Revised Earlier

% chg Revised Earlier

% chg

New

Volume (mn tn)

23.43

23.77

(1.4)

24.72

26.49

(6.7)

26.37

Net Sales

11,738

11,856

(1.0)

13,151

14,092

(6.7)

14,757

EBITDA

1,429

1,720

(16.9)

1,921

2,502

(23.2)

2450

EBITDA (%)

12.2

14.5

(230bp)

14.6

17.8

(320bp)

16.6

Net Profit

871

894

(2.6)

1201

1430

(16.0)

1568

Source: Company, Angel Research

October 27, 2015

4

ACC | 3QCY2015 Result Update

Investment rationale

Update on capacity addition plans: ACC, which currently has capacity of 30mtpa,

is expanding its capacity by 3mtpa in the east region of India. The new plant at

Jamul, Chhattisgarh is expected to be delayed by one quarter and now the

production from its 2.8mtpa clinker capacity will start by the end of CY2015 and

grinding production from Jamul and Sindhri unit is expected to commence from

1QCY2016. We do not expect the company to get full benefit from this new

capacity before 2QCY2016.

Outlook and valuation

We expect ACC to register a top-line CAGR of

8.7% over CY2014-17E,

considering capacity addition and improving cement demand, going forward. The

bottom-line is expected to grow at a CAGR of 22.2% over the same period. We

have introduced estimates for CY2017E and provide a Buy rating on the stock with

a target price of `1,630 on 10x EV/EBIDTA and EV/tonne of US$120 on CY2017E

installed capacity.

October 27, 2015

5

ACC | 3QCY2015 Result Update

Company Background

In 2005, ACC was acquired by the world's second largest cement company,

Holcim. Currently, the Holcim Group in India (ACC and Ambuja Cements taken

together) has the largest cement capacity in the country (57mtpa). ACC has a

standalone total capacity of 30mtpa, with 16 cement plants spread across the

country. Similar to UltraTech, the company is also a pan-India player but with a

southern inclination (33% of its total capacity is in south as against 20% in north,

20% in east and northeast, 15% in central and 12% in west).

October 27, 2015

6

ACC | 3QCY2015 Result Update

Profit and loss statement (Standalone)

Y/E December (` cr)

CY2013

CY2014

CY2015E CY2016E CY2017E

Net Sales

10,908

11,481

11,738

13,151

14,757

Other operating income

261

257

231

241

253

Total operating income

11,169

11,738

11,969

13,392

15,010

% chg

(1.5)

5.1

2.0

11.9

12.1

Total Expenditure

9,540

10,231

10,309

11,230

12,308

Net Raw Materials

1,861

1,971

1,919

2,082

2,282

Power and Fuel

2,382

2,442

2,445

2,642

2,875

Personnel

662

747

784

847

897

Freight & Forwarding charges

2,316

2,598

2,669

2,956

3,311

EBITDA

1,629

1,507

1,660

2,162

2,703

% chg

(25.3)

(7.5)

10.1

30.2

25.0

(% of Net Sales)

14.9

13.1

14.1

16.4

18.3

Depreciation& Amortisation

574

558

662

770

832

EBIT

1,055

950

998

1,392

1,871

% chg

(34.9)

(10.0)

5.1

39.5

34.4

(% of Net Sales)

9.7

8.3

8.5

10.6

12.7

Interest & other Charges

52

83

86

49

49

Other Income

224

268

333

373

419

(% of PBT)

18.2

23.6

26.8

21.7

18.7

Recurring PBT

1,227

1,135

1,245

1,716

2,240

% chg

(30.7)

(7.5)

9.6

37.9

30.6

Exceptional item

(216)

(309)

(0)

-

-

Tax

131

(33)

373

515

672

(% of PBT)

10.7

(2.9)

30.0

30.0

30.0

Reported PAT

1,096

1,168

871

1,201

1,568

% chg

(20.6)

6.6

(25.4)

37.9

30.6

(% of Net Sales)

10.0

10.2

7.4

9.1

10.6

Adj. PAT

879.8

859.1

871.1

1,201.1

1,568.1

Basic EPS (`)

46.8

45.7

46.4

63.9

83.4

Fully Diluted EPS (`)

46.8

45.7

46.4

63.9

83.4

% chg

(46.7)

(2.3)

1.4

37.9

30.6

October 27, 2015

7

ACC | 3QCY2015 Result Update

Balance sheet (Standalone)

Y/E December (`cr)

CY2013

CY2014

CY2015E CY2016E CY2017E

SOURCES OF FUNDS

Equity Share Capital

188

188

188

188

188

Reserves& Surplus

7,637

8,048

8,512

9,151

9,986

Shareholders Funds

7,825

8,236

8,700

9,339

10,174

Total Loans

-

-

-

-

-

Deferred Tax Liability

507

536

536

536

536

Total Liabilities

8,739

8,771

9,235

9,875

10,710

APPLICATION OF FUNDS

Gross Block

10,400

10,997

12,497

13,997

14,597

Less: Acc. Depreciation

4,896

5,484

6,147

6,916

7,748

Net Block

5,504

5,513

6,351

7,081

6,849

Capital Work-in-Progress

820

2,000

800

300

200

Investments

2,194

1,573

1,573

1,573

1,573

Current Assets

3,576

3,585

4,116

4,965

6,565

Inventories

1,121

1,256

1,653

1,805

1,990

Sundry Debtors

397

411

420

470

528

Cash

503

304

214

585

1,764

Other

1,554

1,615

1,829

2,104

2,282

Current liabilities

3,355

3,900

3,605

4,044

4,477

Net Current Assets

221

(315)

511

921

2,088

Mis. Exp. not written off

-

-

-

-

Total Assets

8,739

8,771

9,235

9,875

10,710

October 27, 2015

8

ACC | 3QCY2015 Result Update

Cash flow statement (Standalone)

Y/E December (`cr)

CY2013

CY2014

CY2015E CY2016E CY2017E

Profit before tax

1,227

1,135

1,245

1,716

2,240

Depreciation

574

558

662

770

832

Interest Expense

52

83

86

49

49

Change in Working Capital

(681)

337

(917)

(38)

12

Less: Other income

224

268

333

373

419

Direct taxes paid

131

(33)

373

515

672

Others

Cash Flow from Operations

816

1,877

370

1,609

2,043

(Inc)/ Dec in Fixed Assets

(689)

(1,778)

(300)

(1,000)

(500)

(Inc)/ Dec in Investments

360

621

-

-

-

Other income

224

268

333

373

419

Cash Flow from Investing

(106)

(889)

33

(627)

(81)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

(137)

(407)

-

-

-

Dividend Paid (Incl. Tax)

411

402

407

562

733

Cash Flow from Financing

(549)

(808)

(407)

(562)

(733)

Others

337

379

86

49

49

Inc./(Dec.) in Cash

(175)

(199)

(90)

371

1,179

Opening Cash balances

678

503

304

214

585

Closing Cash balances

503

304

214

585

1,764

October 27, 2015

9

ACC | 3QCY2015 Result Update

Key ratios (Standalone)

Y/E December

CY2013

CY2014

CY2015E

CY2016E

CY2017E

Valuation Ratio (x)

P/E (on FDEPS)

29.9

30.6

30.2

21.9

16.8

P/CEPS

15.8

15.2

17.2

13.4

11.0

P/BV

3.4

3.2

3.0

2.8

2.6

Dividend yield (%)

1.3

1.3

1.3

1.8

2.4

EV/Sales

2.1

2.0

2.1

1.9

1.6

EV/EBITDA

14.3

15.2

14.6

11.3

8.6

EV / Total Assets

2.7

2.6

2.6

2.5

2.2

Per Share Data (`)

EPS (Basic)

46.8

45.7

46.4

63.9

83.4

EPS (fully diluted)

46.8

45.7

46.4

63.9

83.4

Cash EPS

88.8

91.8

81.6

104.9

127.7

DPS

18.9

18.4

18.7

25.8

33.6

Book Value

416.3

438.2

462.9

496.9

541.3

Dupont Analysis

EBIT margin

9.4

8.1

8.3

10.4

12.5

Tax retention ratio

89.3

102.9

70.0

70.0

70.0

Asset turnover (x)

1.9

1.6

1.5

1.6

1.6

ROIC (Post-tax)

16.2

13.3

9.0

11.9

14.4

Returns (%)

ROCE (Pre-tax)

12.3

10.8

11.1

14.6

18.2

Angel ROIC (Pre-tax)

20.8

18.8

17.3

19.8

25.6

ROE

14.4

10.7

10.3

13.3

16.1

Turnover ratios (x)

Asset Turnover (Gross Block)

1.1

1.1

1.0

1.0

1.0

Inventory / Sales (days)

37

37

45

47

46

Receivables (days)

11

13

13

12

12

Payables (days)

131

129

133

124

126

WC cycle (ex-cash) (days)

(20)

(14)

(5)

9

8

Solvency ratios (x)

Net debt to equity

(0.3)

(0.0)

(0.3)

(0.1)

(0.2)

Net debt to EBITDA

(1.5)

(0.2)

(1.3)

(0.3)

(0.7)

Interest Coverage (EBIT / Int.)

20.4

11.5

11.6

28.4

38.2

October 27, 2015

10

ACC | 3QCY2015 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

ACC

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

October 27, 2015

11