4QFY2018 Result Update | Finance

May 19, 2018

Aditya Birla Capital

BUY

CMP

`148

Performance Highlights

Target Price

`218

Particulars (` cr)

4QFY18

3QFY18

% chg (qoq) 4QFY17

% chg (yoy)

Investment Period

12 Months

PBT

398

409

(2.7)

240

65.8

PAT

208

217

(4.1)

109

90.8

Source: Company, Angel Research

Stock Info

Aditya Birla Capital (ABCL), a financial service provider, continued its robust growth

Sector

Finance

Market Cap (` cr)

32,598

in business operation in 4QFY18 as well. The company’s consolidated revenue

Beta

0.9

increased by 25%yoy and PAT jumped by 91%yoy to `208cr in said quarter.

52 Week High / Low

255/144

Consistent growth throughout the year took the company’s net profit for the FY18 to

Avg. Daily Volume

3,44,102

`824cr, up by 44%. Its business development was supported by an increase in

Face Value (`)

10

lending business by all the segments of the company. The consolidated AUM rose by

BSE Sensex

35,249

Nifty

10,712

24% to `3,05,295cr and simultaneously, loan book expanded by 32% to `51,378cr

Reuters Code

ADTB.NS

for the FY18.

Bloomberg Code

ABCAP.IN

Coherent strategies for each segment propels overall growth

The company’s operations are divided in 8 segments. Of these, major income

generation comes NBFC, Asset Management, Life insurance and housing finance.

Shareholding Pattern (%)

NBFC: This segment is comprised of retail, SME and UHNI lending, constituting 47%

Promoters

72.8

of the loan mix. Loan book increased by 25% to `34,703cr in FY18. GNPA and

MF / Banks / Indian Fls

7.0

NPA were maintained at 0.9% and 0.6%, respectively. NIM was healthy at 4.4%.

Asset Management: Revenues from this segment increased by 10%yoy in 4QFY18

FII / NRIs / OCBs

7.6

and 25% in FY18. Share of equity AUM rose by 35% and revenues grew by 73%.

Indian Public / Others

10.2

This was primarily due to doubling in SIP contribution which increased to `956cr

from `503cr in the previous year.

Insurance : In 4QFY18 ABCL’s first year premium (FYP) increased by 20%yoy. It also

Abs. (%)

3m 1yr

3yr

managed to report positive VNB margin of 4.3% compared to (5.5%) in the year

Sensex

3.0

14.0

26.0

ago. Further, it has also widened its presence through branch channel of HDFC.

Housing finance: Started just 7 quarters back, this segment generated profits before

ABCL

(9.0)

-

-

tax for the first time in 4QFY18. EBIT was `24cr over a loss of `15cr in the year-go,

favoured by a sharp decrease in cost/income ratio to 71% from 86% in 4QFY17.

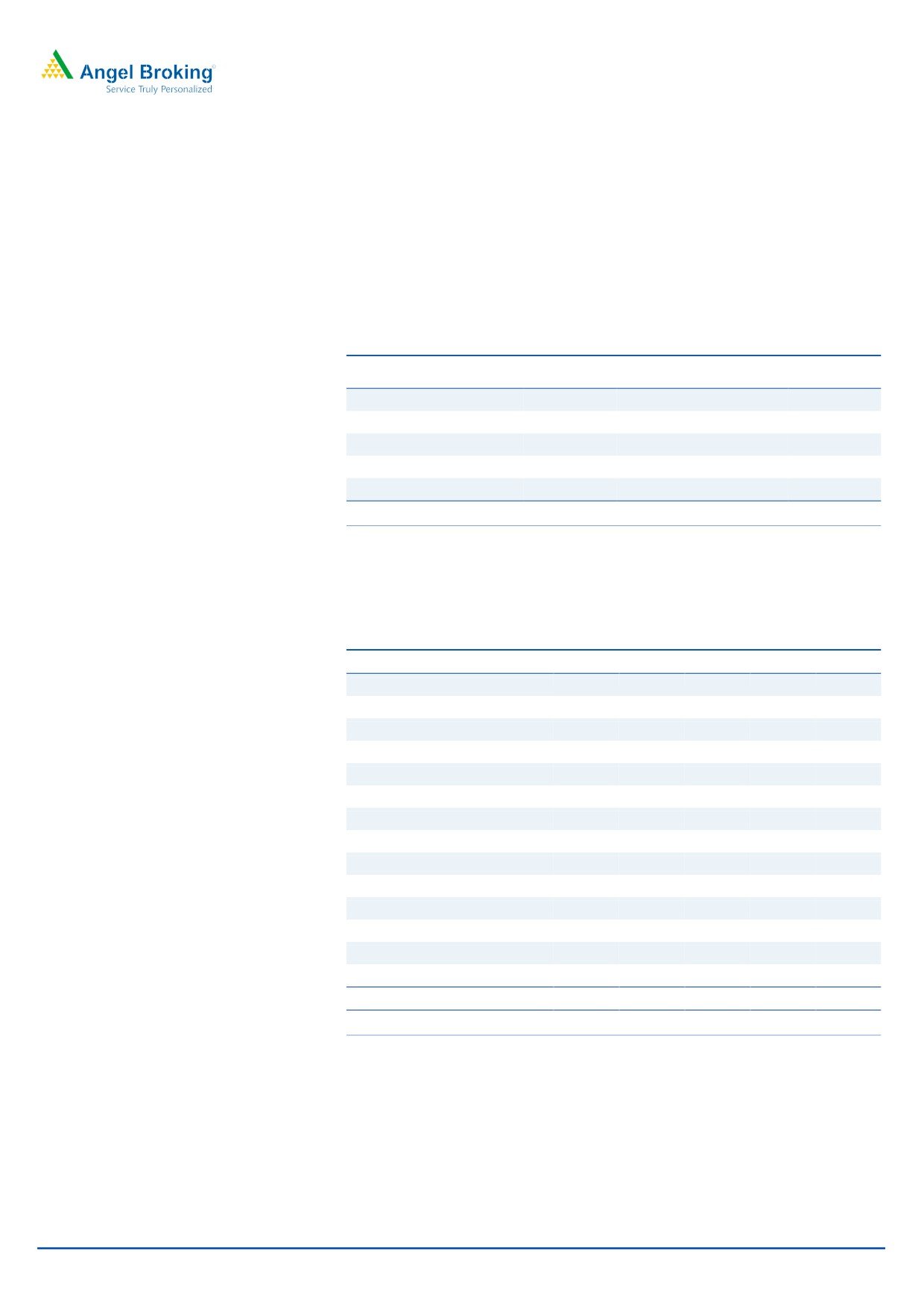

Price chart

The HFC loan book almost doubled to `8,137cr in FY18, maintaining the asset

300

quality at GNPA of 0.5% and NPA of 0.4%. The segment’s NIM was 3% at the end

250

of FY18.

200

150

Outlook & Valuation: We believe broad based and integrated financial offerings

100

would enable ABCL to take benefit of financialisation of savings. We expect ABCL’s

50

0

PAT to grow at CAGR of 47% over FY2018-20E, largely driven by Lending segment

and AMC. We recommend a Buy rating on the stock, with a target price of `218.

Key Financials

Source: Company, Angel Research

Y/E March (` cr)

FY16

FY17

FY18

FY19E

FY20E

PBT

869

1,065

1,554

2,309

3,319

% chg

23

46

49

44

PAT

380

529

847

1,266

1,822

% chg

39

60

49

44

EPS

2

2

4

6

8

Jaikishan Parmar

ROE

9

8

10

13

16

022 - 39357600 Ext: 6810

P/B

7.3

4.9

3.8

3.3

2.8

P/E

85

61

38

26

18

Source: Company, Angel Research; Note: CMP as of May18, 2018

Please refer to important disclosures at the end of this report

1

Aditya Birla Capital Ltd | Q4FY2018 Result Update

Outlook & Valuation:

We believe broad based and integrated financial offering enable ABCL to take

benefit of finacialisation of savings. Core lending business (after adjusting

value of AMC, Life Insurance, ABML & Other) is available at 1.7x of FY20E BV.

We expect ABCL PAT to grow at CAGR of 47% over FY18-FY20E, largely

driven by Lending segment and AMC. We recommend a buy rating on the

stock and an SOTP-based target price of `218.

Exhibit 1: SOTP valuation summary

Valuation

Particulars

Stake

Value/share (`)

Methodology

NBFC

100%

3.2x FY20E PBV

127

HFC

100%

3.5x FY20E PBV

15

AMC

51%

7.3% of AUM

45

Life Insurance

51%

3x FY18 EV

30

ABML

74%

CMP

1

Fair value per share

218

Consolidated Profit & Loss

Y/E March (` cr)

FY16

FY17

FY18E

FY19E

FY20E

Segment PBT

NBFC

626

832

1,108

1,481

1,948

Life Insurance

-

-

166

199

239

Asset Management

314

337

493

729

1,012

HFC

(30)

(15)

31

70

217

Other Financial Services

9

(45)

(101)

(86)

(73)

Total PBT

928

1,064

1,554

2,309

3,319

- YoY Growth (%)

15

46

49

44

Consolidated Adj

(50)

(44)

-

-

-

Consolidated PBT

869

1,065

1,554

2,309

3,319

Taxes

345

375

528

785

1,128

Tax Rate (%)

40

35

34

34

34

Consolidated PAT

524

690

1,026

1,524

2,190

Minority Interest

144

161

179

258

369

Consolidated PAT Post MI

380

529

847

1,266

1,822

- YoY Growth (%)

39

60

49

44

May 19, 2018

2

Aditya Birla Capital Ltd | Q4FY2018 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Aditya Birla Capital Ltd

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

May 19, 2018

3