4QFY2017 Result Update | Agrichemical

June 15, 2017

United Phosphorus

NEUTRAL

CMP

`849

Performance Highlights

Target Price

-

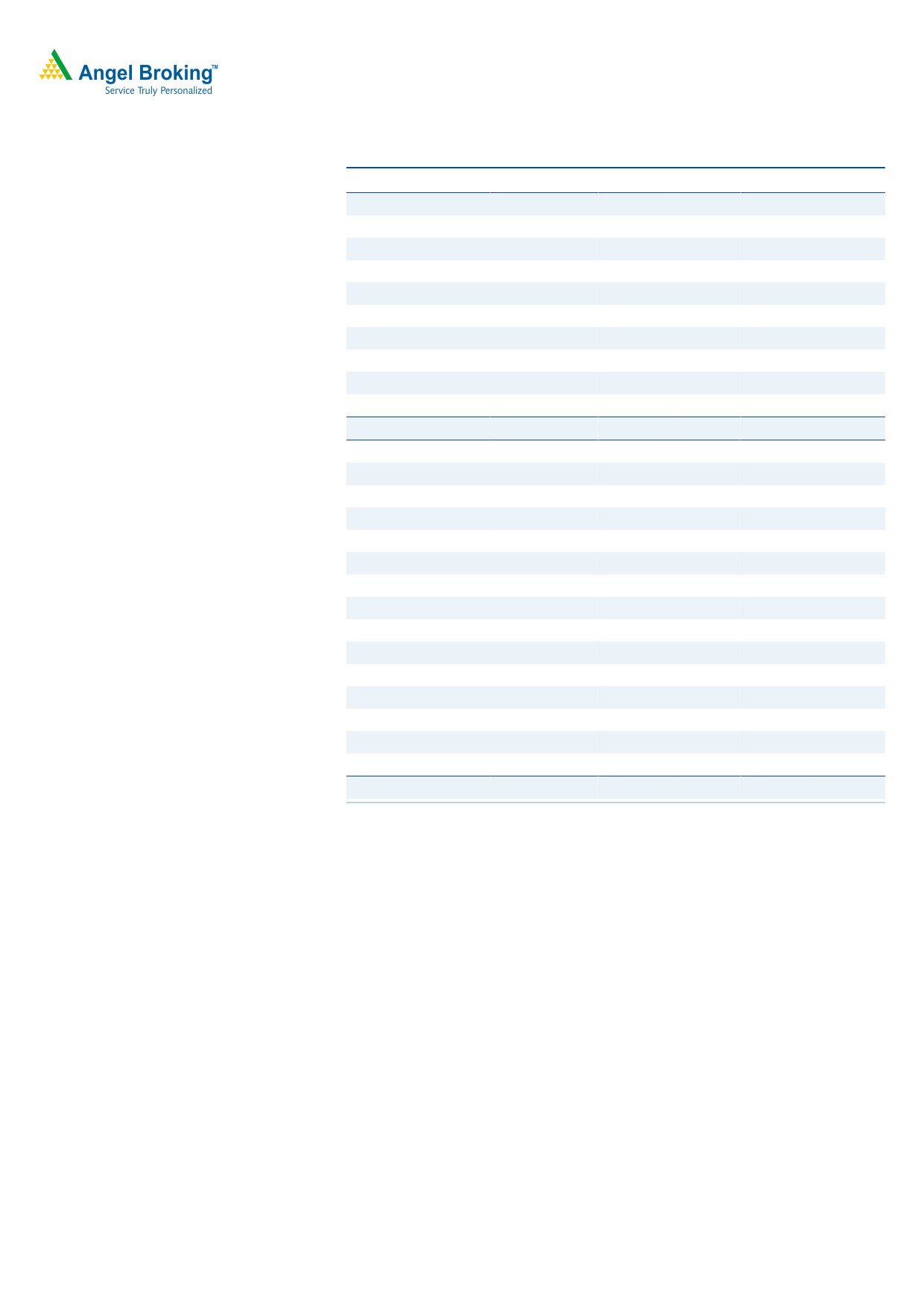

Y/E March (` cr)

4QFY2017

3QFY2017

% chg (qoq)

4QFY2016

% chg (yoy)

Investment Period

-

Net sales

5,341

3855

38.6

4434

20.5

Other income

147

164

(10.1)

89

65.9

Stock Info

Gross profit

2569

2052

25.2

2145

19.8

Sector

Agrichemical

Operating profit

1037

685

51.4

597

73.9

Market Cap (` cr)

43,142

Adj. net profit

740

457

62.0

208

256.2

Net Debt (` cr)

3,231

Source: Company, Angel Research,

Beta

1.0

United Phosphorus Ltd. (UPL) posted robust numbers for 4QFY2017. In sales, the

52 Week High / Low

822/491

company posted gross revenues of `5,341cr v/s `4,434cr in 4QFY2016, growth of

Avg. Daily Volume

1,14,734

20.5% yoy. The growth was driven by volumes (21% yoy), while dip in pricing was

Face Value (`)

2

around 4%, which coupled with exchange gains added 3% to the top-line rise. On

BSE Sensex

31,103

EBITDA front, the company posted an EBITDA of 19.4% v/s 13.5% in 4QFY2016.

Nifty

8,603

Along with this, dip of 6.1% in the depreciation & 65.9% yoy growth in other

Reuters Code

UNPO.BO

income aided the PBT to grow by 151.6% yoy. Consequently, PAT came in at

Bloomberg Code

UNTP@IN

`740cr v/s `208cr in 4QFY2016, growth of 256.2% yoy. The management has

maintained guidance of 12-15% revenue growth (owing to presence in fast-growing

countries) and 50-70bps improvement in EBITDA margin. We maintain our Neutral

Shareholding Pattern (%)

Promoters

27.7

rating on the stock.

MF / Banks / Indian Fls

14.0

Quarterly highlights: UPL posted robust numbers for 4QFY2017. In sales, the

FII / NRIs / OCBs

51.5

company posted gross revenues of `5,341cr v/s `4,434cr in 4QFY2016, growth of

Indian Public / Others

6.8

20.5% yoy. The growth was driven by volumes (21% yoy), while pricing growth was

around 4%, which coupled with exchange gains added 3% to the top-line rise. On

EBITDA front, the company posted an EBITDA of 19.4% v/s 13.5% in 4QFY2016.

Abs. (%)

3m 1yr

3yr

Along with this, dip of 6.1% in the depreciation & 65.9% yoy growth in other

Sensex

5.8

18.0

23.7

income aided the PBT to grow by 151.6% yoy. Consequently, PAT came in at

UPL

20.5

45.4

180.4

`740cr v/s `208cr in 4QFY2016, growth of 256.2% yoy.

Outlook and Valuation: We expect UPL to post a CAGR of 16.0% and 12.3% in its

sales and PAT respectively over FY2017-19E. At the current market price, we

3-year price chart

1000

maintain our Neutral rating on the stock.

900

800

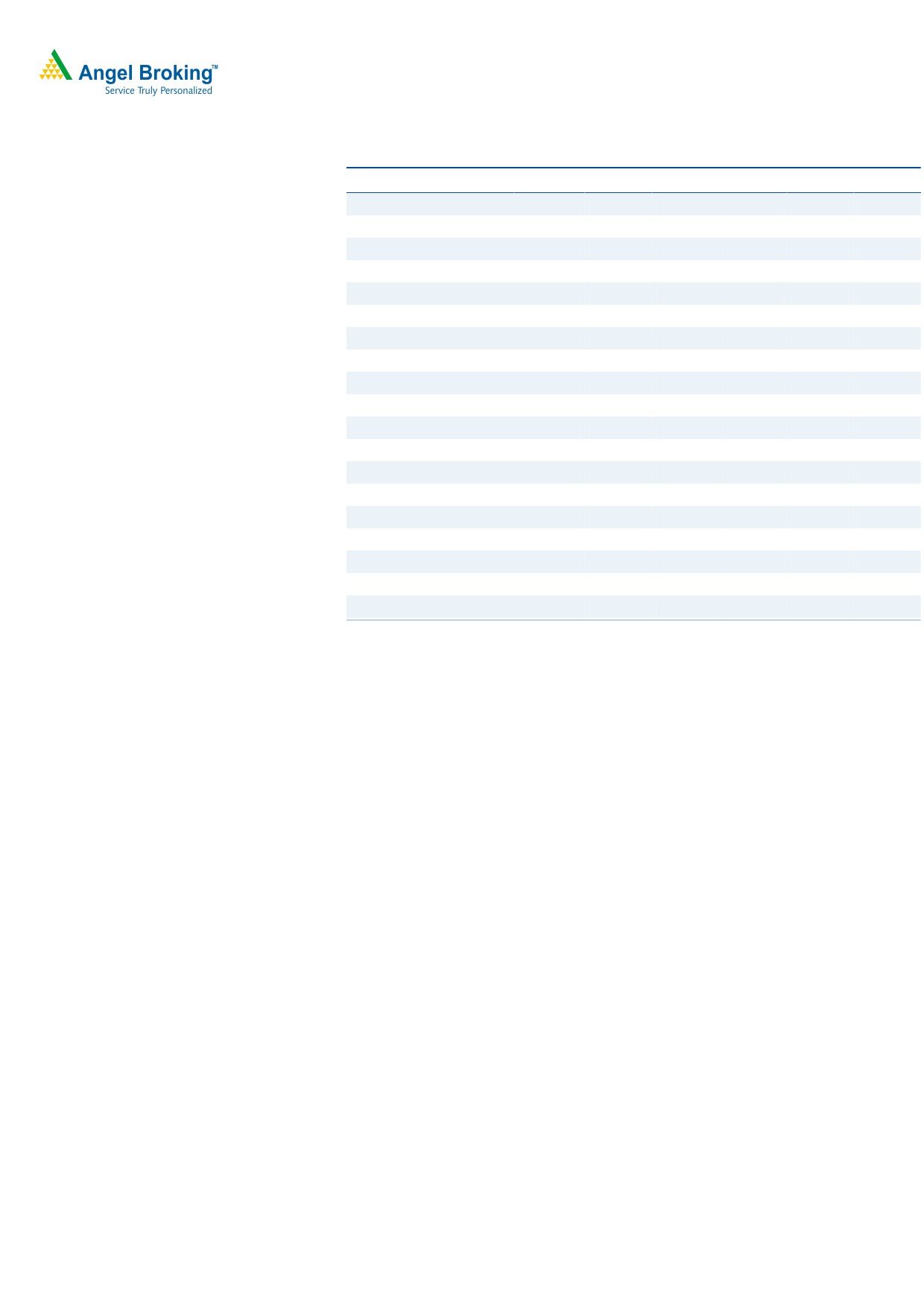

Key financials (Consolidated)

700

600

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

500

Total revenue

13,083

16,312

18,922

21,949

400

300

% chg

9.8

24.7

16.0

16.0

200

Adj. profit

1,352

1,800

1,889

2,272

100

0

% chg

17.9

33.2

4.9

20.3

EBITDA (%)

18.5

17.8

17.8

17.8

EPS (`)

31.5

35.5

37.3

44.8

Source: Company, Angel Research

P/E (x)

26.9

23.9

22.8

19.0

P/BV (x)

5.4

10.5

8.8

7.3

RoE (%)

21.4

25.4

23.3

23.3

RoCE (%)

20.8

20.8

21.7

22.5

EV/Sales (x)

3.4

2.8

2.4

2.0

Sarabjit Kour Nangra

EV/EBITDA (x)

18.5

15.8

13.5

11.3

+91-22-3935 7800 ext. 6806

Source: Company, Angel Research; Note: CMP as of June 13, 2017

Please refer to important disclosures at the end of this report

1

United Phosphorus | 4QFY2017 Result Update

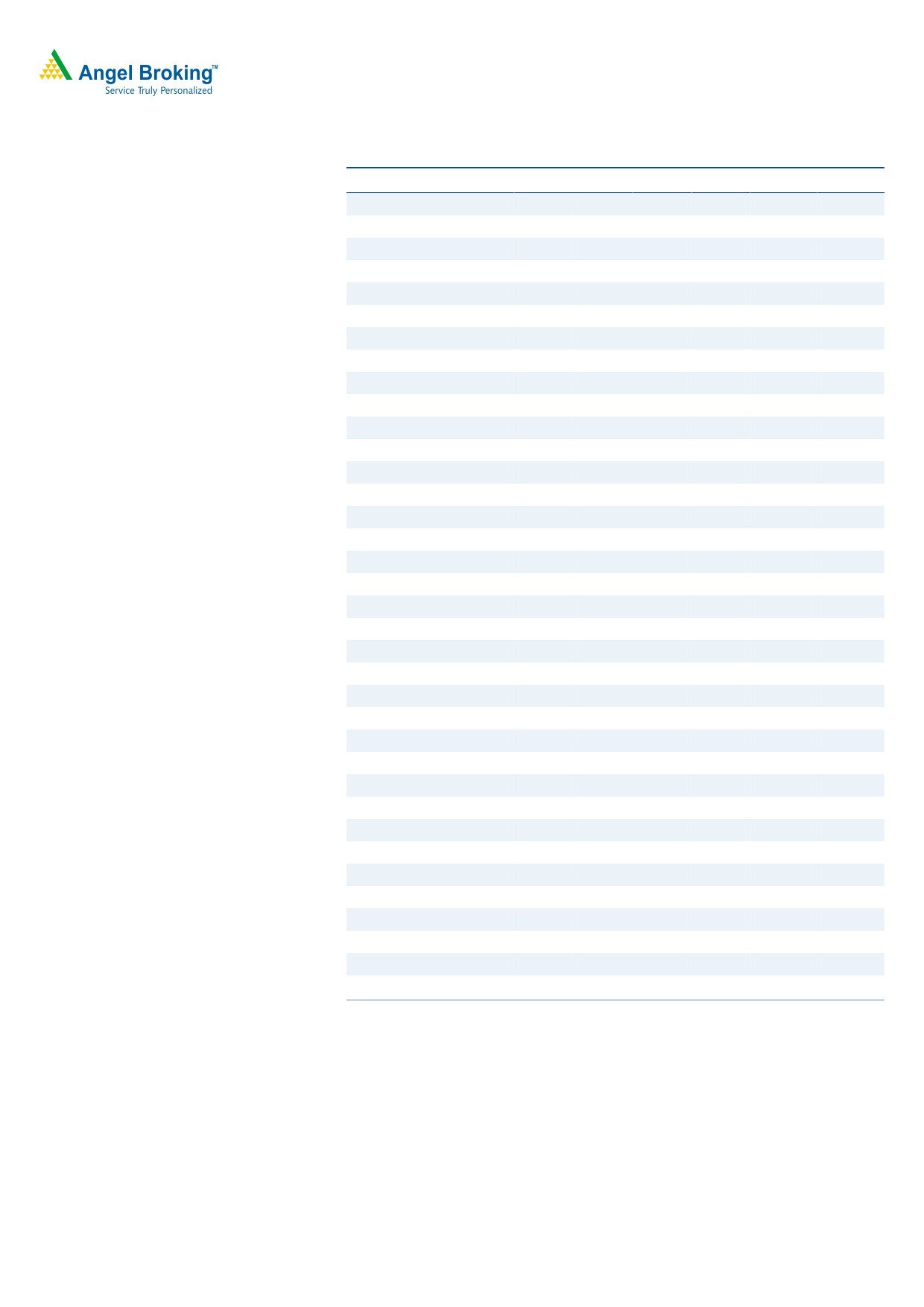

Exhibit 1: 4QFY2016 Performance (Consolidated)

Y/E March (` cr)

4QFY2017

3QFY2017

% chg (qoq)

4QFY2016

% chg (yoy)

FY2017

FY2016

% chg

Net sales

5,341

3,855

38.6

4,434

20.5

16,312

14,048

16.1

Other income

147

164

(10.1)

89

65.9

444

316

40.5

Total income

5,488

4,018

36.6

4,523

21.3

16,755

14,364

16.6

Gross profit

2569

2052

25.2

2145

19.8

8496

7268

16.9

Gross margin (%)

48.1

53.2

48.4

52.1

51.7

Operating profit

1037

685

51.4

597

73.9

2904

2266

28.2

Operating margin (%)

19.4

17.8

13.5

17.8

16.1

Financial cost

213

176

20.6

174

22.0

735

704

Depreciation

187

162

15.3

199

(6.1)

672

676

-0.6

PBT

785

511

53.7

312

151.6

1941

1202

61.5

Provision for taxation

56

46

79

-

189

165

14.6

PAT Before Exc. And MI

729

464

57.0

234

212.2

1753

1037

69.0

Minority Income/ ( Exp.)

1

3

8

6

12

Income from Associate/ (Exp)

13

(3)

(42)

(19)

(85)

Extra ordinary Income/( Exp.)

1

2

(19)

(73)

(111)

Reported PAT

741

459

61.4

184

302.6

1,727

940

83.8

Adjusted PAT

740

457

62.0

208

256.2

1800

1051

71.3

EPS (`)

14.6

9.0

4.8

35.5

24.5

Source: Company, Angel Research,

Top-line growth mainly led by ROW & North America

In sales, the company posted gross revenues of

`5,341cr v/s `4,434cr in

4QFY2016, growth of 20.5% yoy. The growth was driven by volume (21% yoy),

while pricing dip was around 4% and exchange gains added 3% to the top-line

rise. In terms of geography - Latin America (`1,646cr, up 17.0% yoy), India

(`442cr, rose by 6%), ROW (`1127cr, yoy rise of 28.0%), Europe (`916cr, yoy

growth of 21%). USA (`1,215cr), the key market, posted a yoy growth of 25.0%.

USA sales grew by 25% yoy, whereas the market grew by 1.1%. The company

launched three new products - two herbicides and one fungicide. Farm grower

income continues to be low, affecting consumption of inputs.

The ROW sales grew by 28% yoy, led by a better monsoon in Asia, especially

Australia after several years of drought. Company expanded its non-selective

herbicide to key markets, including China, and also established a distribution

partnership in Nigeria, resulting in significant growth.

Latin America sales grew by 17.0% despite the market declining by 6.6%. Low

disease pressure on soybean in Brazil led to reduced consumption of fungicides.

Company successfully launched eight new products in the LatAm market, which

comprised six herbicides, one fungicide and one insecticide. The company saw

higher penetration for resistant weeds in soybean.

Indian sales grew due to a better monsoon (except in Karnataka, Tamil Nadu,

parts of Andhra Pradesh and Maharashtra). The planted area increased

significantly for pulses and oilseeds, whereas cotton acreages reduced, especially

in the North. Brands like Ullala, Saaf and Phoskill have joined the `1,000cr club.

Company introduced biological and nutritional products and has achieved

substantial growth in vegetable and fruit crops over the previous year.

January 15, 2017

2

United Phosphorus | 4QFY2017 Result Update

European sales grew 21%, despite the market declining by 1.9%. The sugar beet

area in Europe increased by 15% yoy, which helped company’s portfolio grow.

Wet weather in North Europe resulted in high disease pressure on potatoes.

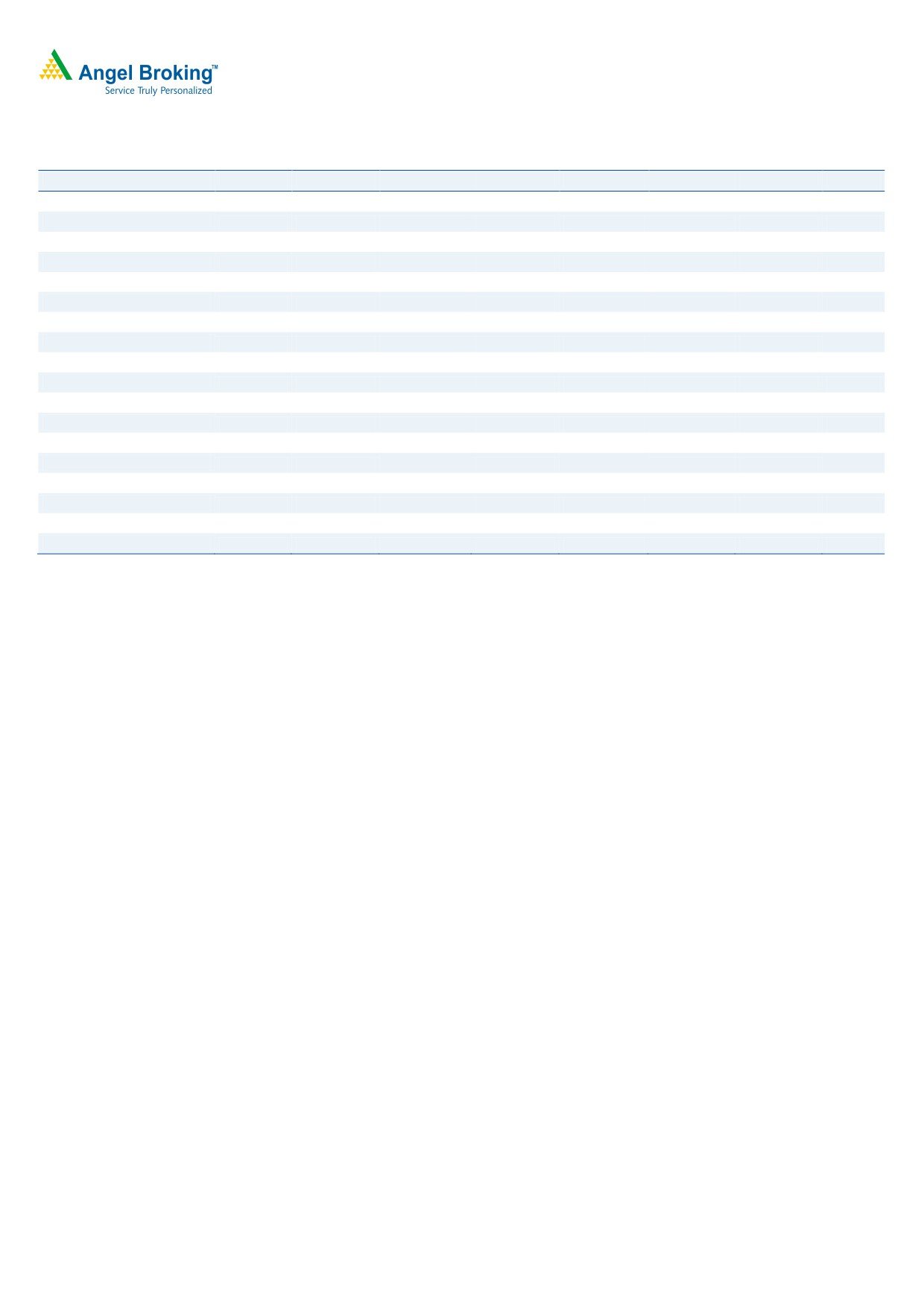

Exhibit 2: Sales break-up (Marketwise)

100%

1,250

80%

2,195

1,916

2,818

2,372

60%

562

341

40%

757

916

329

1,060

417

442

1,026

626

20%

971

1,215

638

660

375

0%

4QFY2016

1QFY2017

2QFY2017

3QFY2017

4QFY2017

North America

India

EU

Others

Source: Company

Exhibit 3: Sales performance (including export incentives)

Exhibit 4: Growth break-up

6000

25

5,391

21

5400

20

4800

4,292

3,987

4200

15

3,658

3,510

3600

10

3000

5

3

2400

1800

0

1200

(5)

600

(4)

0

(10)

4QFY2016 1QFY2017 2QFY2017 3QFY2017 4QFY2017

Exchange impact

Realisation

Volume

Source: Company, Angel Research

Source: Company, Angel Research

January 15, 2017

3

United Phosphorus | 4QFY2017 Result Update

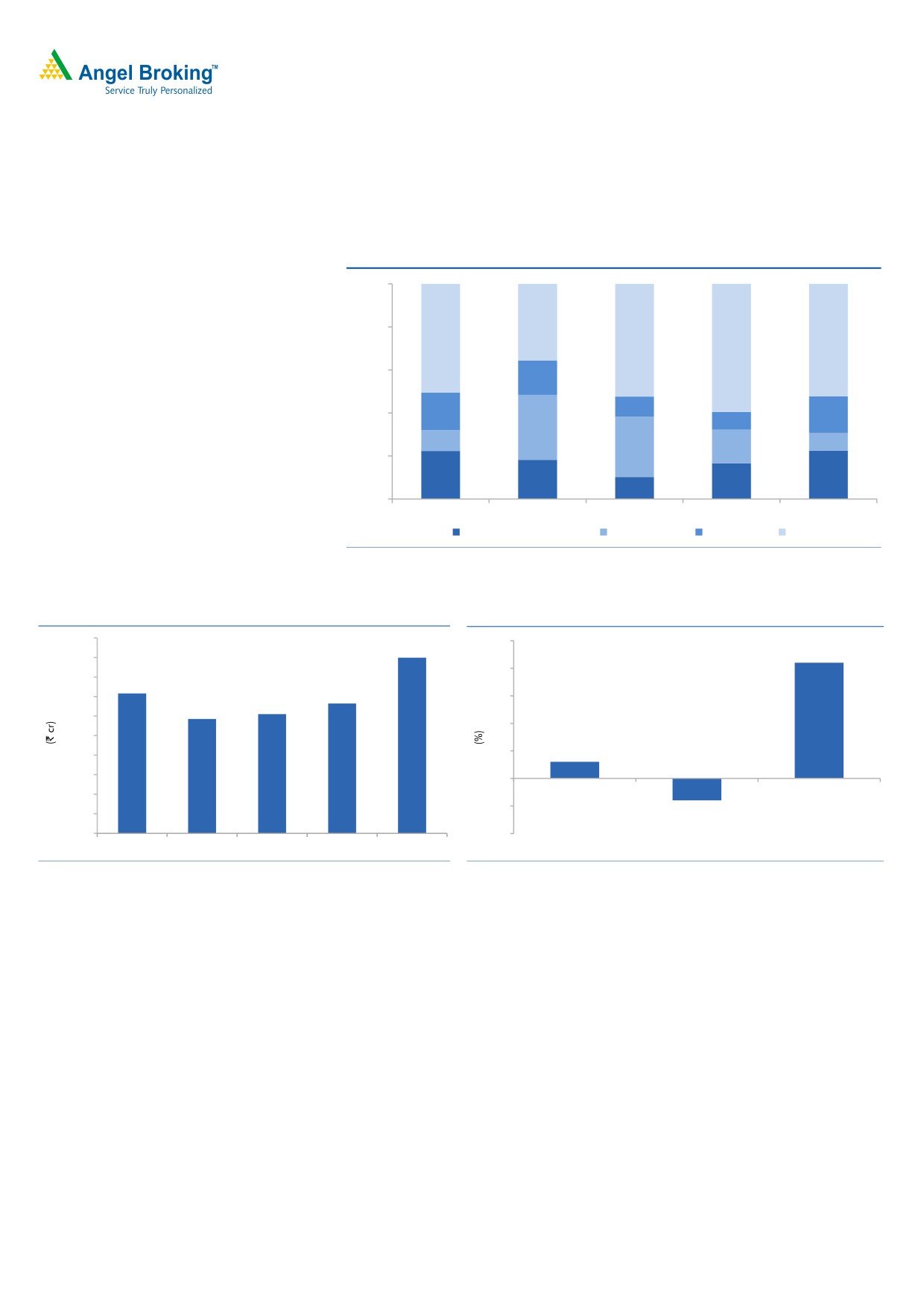

Exhibit 5: Volume and realization break-up (yoy)

30

26

25

23

21

20

18

15

10

8

5

1

(5)

(3)

(4)

0

(2)

(5)

4QFY2016

1QFY2017

2QFY2017

3QFY2017

4QFY2017

Realisation

Volume

Source: Company, Angel Research

EBITDA margin expands

On EBITDA front, the company posted an EBITDA of 19.4% v/s 13.5% in

4QFY2016. The expansion in OPM was more than the gross margin expansion,

on the back of employee expenses, which rose only by 7.4% yoy.

Exhibit 6: EBITDA margin trend

25.0

24.0

23.0

22.0

21.0

20.0

19.0

19.4

18.0

18.6

17.0

17.8

16.0

15.0

14.0

14.6

13.0

13.5

12.0

4QFY2016

1QFY2017

2QFY2017

3QFY2017

4QFY2017

Source: Company, Angel Research

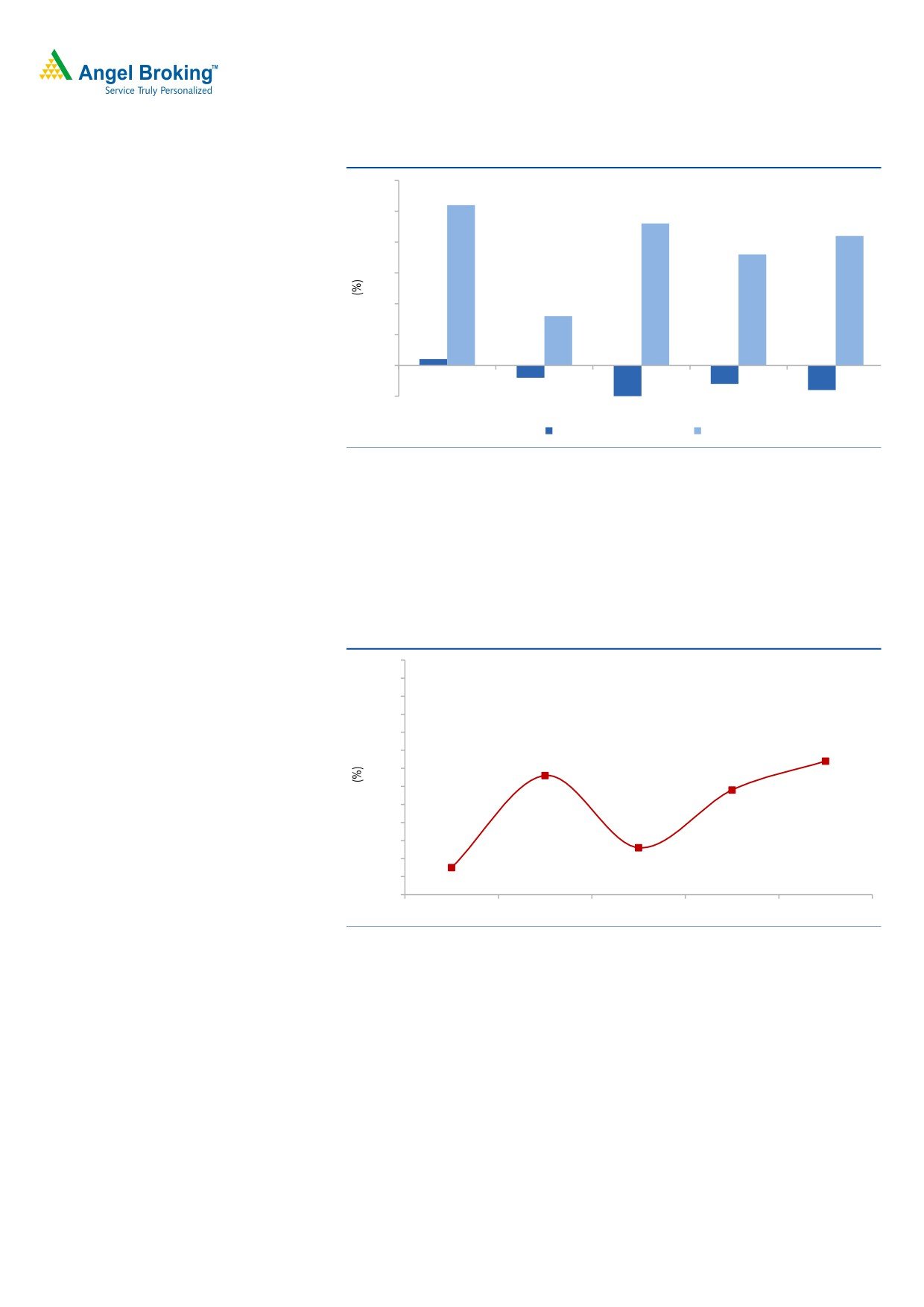

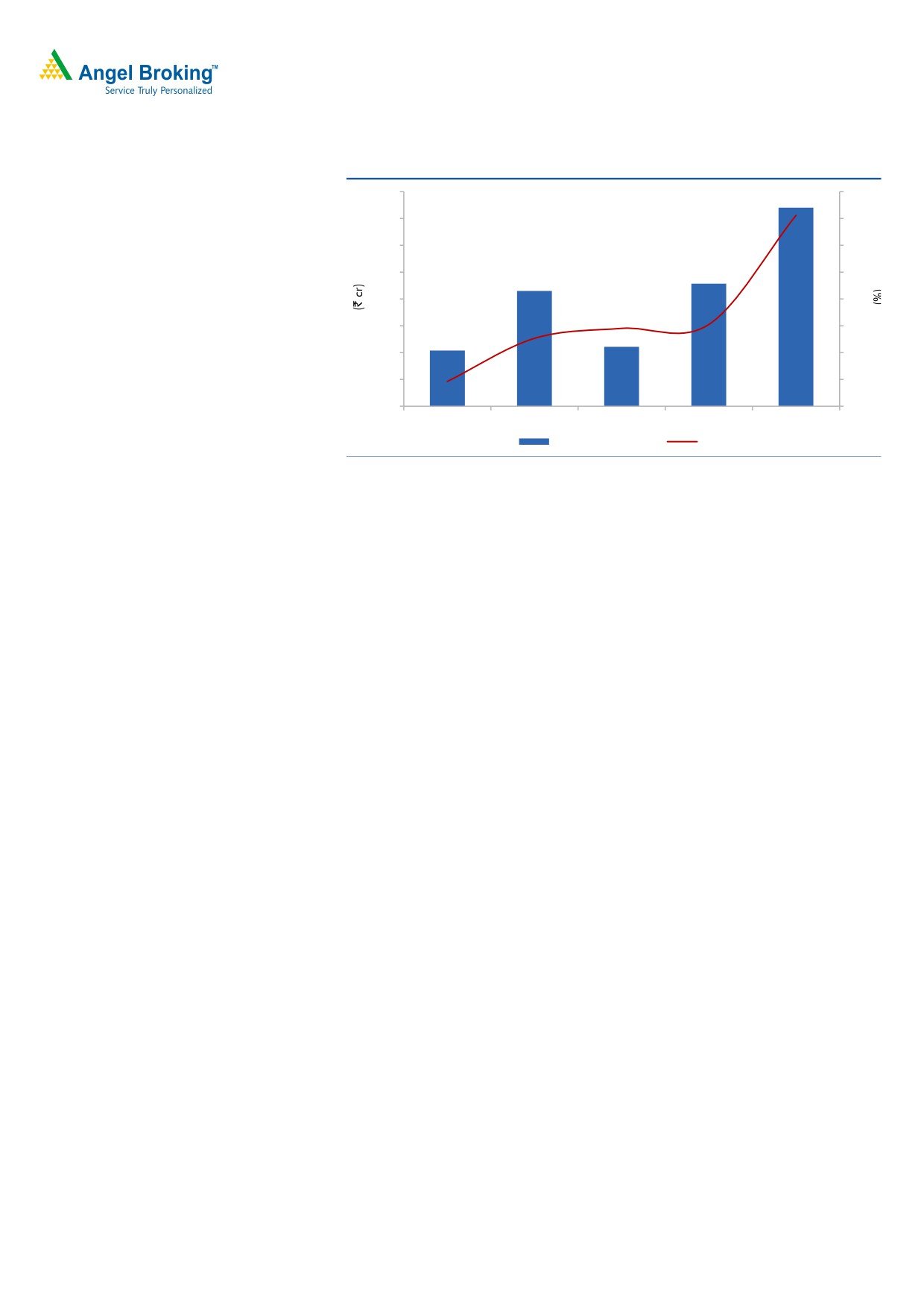

Adjusted Net Profit grew 256.4% yoy

Along with this, dip of 6.1% in the deprecation & 65.9% yoy growth in other

income aided the PBT to grow by 151.6% yoy. Consequently, PAT came in at

`740cr v/s `208cr in 4QFY2016, growth of 256.2% yoy.

January 15, 2017

4

United Phosphorus | 4QFY2017 Result Update

Exhibit 7: Adjusted PAT trend

800

300

700

250

600

200

500

150

400

100

300

50

200

0

100

-50

208

430

222

457.1

740

0

-100

4QFY2016 1QFY2017 2QFY2017 3QFY2017 4QFY2017

Adj PAT

% YoY

Source: Company, Angel Research

January 15, 2017

5

United Phosphorus | 4QFY2017 Result Update

Invvestment arguments

Innovators dominant in the off-patent space; Generic firms in

a sweet spot

The global agrichemical industry, valued at US$56bn (CY2015), is dominated by

the top six innovators, viz. Bayer, Syngenta, Monsanto, BASF, DuPont and Dow,

which enjoy a large market share of the patented (23%) and off-patent (54%)

market. The top six innovators enjoy a large share of the off-patent market due to

high entry barriers for pure generic players. Thus, of the total pie worth US$30bn,

which is controlled by the top six innovators through proprietary

off-patent products, provides a high-growth opportunity for larger integrated

generic players like UPL.

Generic segment’s market share to increase

The industry registered a CAGR of 3% over 1998-2015, while generic players

outpaced the industry with a CAGR of 6%. Going ahead, given the opportunities

and a drop in the rate of new molecule introduction by innovators, we expect

generic players to continue to outpace the industry’s growth rate and augment

their market share in the overall pie. Historically, global agrichem players have

been logging in-line growth with global GDP. Going ahead, over CY2017-18, the

global economy is expected to grow by 3-4%. Assuming this trend plays out in

terms of growth for the agrichemical industry and the same rate of genericization

occurs, the agrichemical generic industry could log in 6-8% yoy growth during the

period and garner a higher market share.

A global generic play

UPL is the second largest global generic agrichemical player with presence across

major markets including the US, EU, Latin America, and India. Given the high

entry barriers by way of high investments, entry of new players is restricted. Thus,

amidst this scenario and on account of having a low-cost base,

we believe UPL enjoys an edge over competition and is placed in a sweet spot to

leverage the upcoming opportunities in the global generic space.

Advanta - An Entry into seeds business

During FY2016, UPL announced a merger of Advanta with itself. With this, the

company has made its foray into the seed business, thus, widening its business

offerings in the Agri-business. The company had sales of around US$204mn in

2015, with OPM of around 15-16%. It is the 11th largest seeds company globally,

with world leadership in Sorghum. Along with this, it also completes the company’s

business portfolio, in-line with the other major Agri-businesses, who have around

5-20% (Monsanto and DuPont have around 65% of their sales mix through seeds)

of their sales mix through seeds business. While the acquisition improves the

presence of the company in the low capital intensive industry coupled with the

propriety products, which will yield long term profitability; the near term challenges

include high R&D cost coupled with long legislation period for the product

commercialization.

According to the industry numbers, the international seeds sector is growing at 6%

per annum. In value terms, the Indian hybrid seed sector, estimated to be worth

January 15, 2017

6

United Phosphorus | 4QFY2017 Result Update

`12,000cr comprises some 14 states seeds corporations and two national-level

corporations, 20 large players including multinationals and around 500 small

regional players. About 10 domestic and multinational companies control over

80% of the market. The market has been growing at 15-20% annually over the

past several years, and is projected to reach around `18,000cr by 2018. Though,

we have included the Advanta numbers in our projections, we have been

conservative on the same.

Outlook and valuation

Over the last few years, the global agriculture sector has been reviving on the back

of rising food prices. Food security is also a top priority for most governments, and

reducing food loss is one of the easiest ways to boost food inventory. Hence, we

believe agrichemical companies would continue to do well in the wake of

heightened food security risks, and strong demand is likely to be witnessed across

the world. Overall, we expect the global agrichemical industry to perform well

from here on. Generics are expected to register a healthy growth due to - (a)

increasing penetration and wresting market share from innovators, and (b) patent

expiries worth US$3bn-4bn during the next five years.

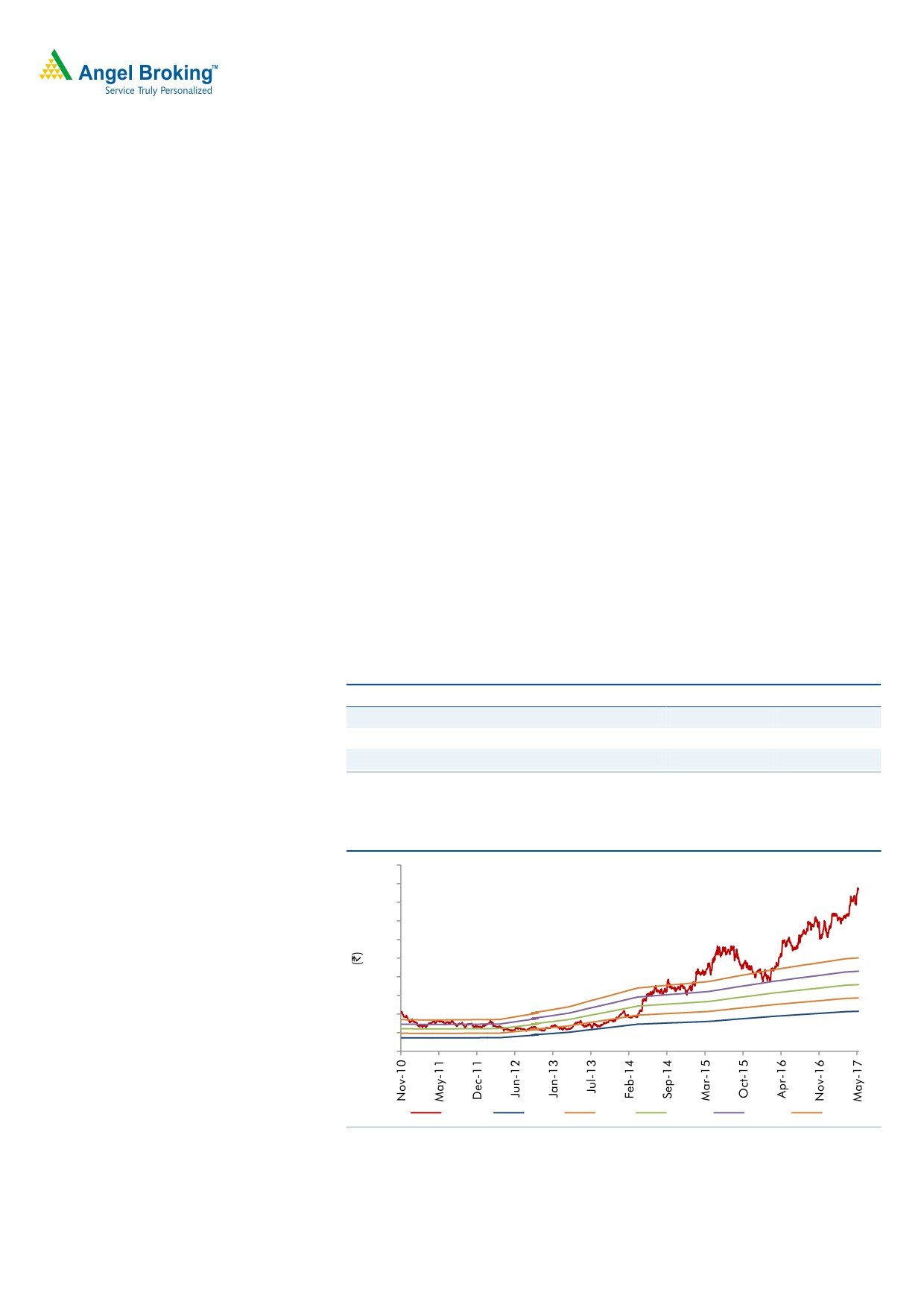

We estimate UPL to post a 16.0% and 12.3% CAGR in sales and PAT respectively

over FY2017-19E. The stock is trading at 19.0x FY2019E EPS, which we believe

provides very little room for appreciation. Hence, we maintain our Neutral rating

on the stock.

Exhibit 8: Key assumption

FY2018E

FY2019E

Sales growth

16.0

16.0

EBITDA margin

17.8

17.8

Tax rate

20.0

20.0

Source: Company, Angel Research

Exhibit 9: P/E band

1000

900

800

700

600

500

400

300

200

100

0

Price

6x

8x

10x

12x

14x

Source: Company, Angel Research

January 15, 2017

7

United Phosphorus | 4QFY2017 Result Update

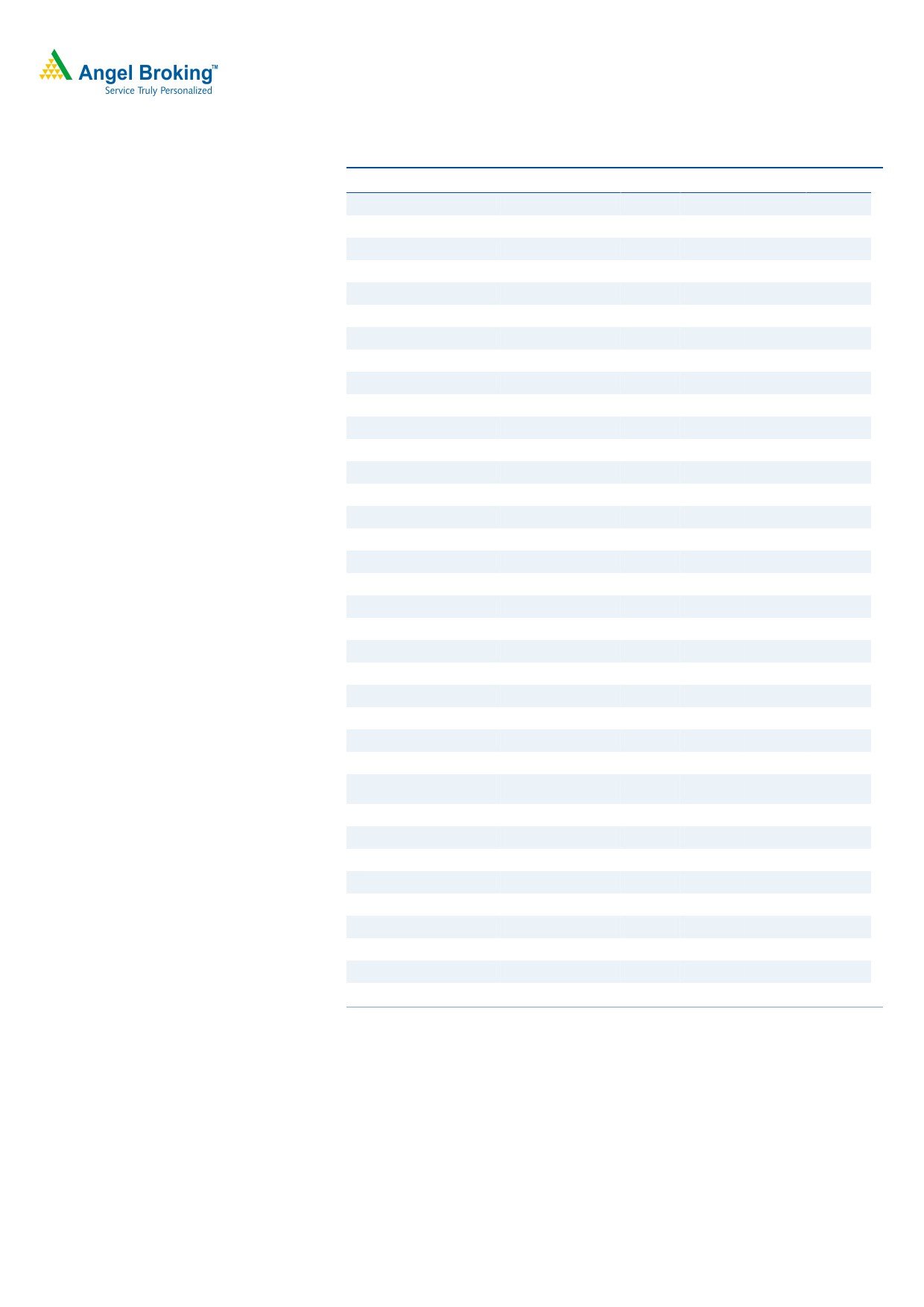

Exhibit 10: Peer valuation

Company

Reco

Mcap

CMP

TP

Upside

P/E (x)

EV/Sales (x)

EV/EBITDA (x)

RoE (%)

CAGR (%)

(` cr)

(`)

(`)

(%)

FY18 FY19 FY18 FY19 FY18 FY19 FY18 FY19 Sales PAT

Rallis

Neutral

4,808

247

-

-

26.1

23.4

2.1

1.9

13.7

12.4

15.8

16.0

11.5

21.6

UPL

Neutral

43,142

847

-

-

22.8

19.0

2.4

2.0

13.5

11.3

23.3

23.3

16.0

12.3

Source: Company, Angel Research, Bloomberg, All numbers in FY18 and FY19 are expected numbers

Company background

United Phosphorus (UPL) is a global generic crop protection, chemicals and seeds

company. The company is fully backward and forward integrated by taking

advantage of the consolidation opportunities within the agrochemical industry. UPL

is the largest Indian agrochemical company and had revenue of about `16,312cr

for the year ended March 2017. During FY2016, UPL announced its merger with

Advanta. With this, the company has made its foray into the seed business, thus,

widening its business offerings in the Agri-business.

January 15, 2017

8

United Phosphorus | 4QFY2017 Result Update

Profit & Loss Statement (Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017

FY2018E

FY2019E

Net Sales

10,580

11,911

13,083

16,312

18,922

21,949

Other operating income

191

45

219

332

332

332

Total operating income

10,771

11,956

13,302

16,644

19,254

22,281

% chg

17.1

11.0

11.3

25.1

15.7

15.7

Total Expenditure

8,751

9,736

10,663

13,407

15,552

18,041

Net Raw Materials

5,441

6,016

6,411

7,816

9,067

10,517

Other Mfg costs

942

842

1,164

1,452

1,684

1,953

Personnel

946

1,043

1,224

1,627

1,887

2,189

Other

1,422

1,835

1,864

2,512

2,914

3,381

EBITDA

1,829

2,175

2,419

2,904

3,369

3,908

% chg

26.8

19.0

11.2

20.1

16.0

16.0

(% of Net Sales)

17.3

18.3

18.5

17.8

17.8

17.8

Dep. & Amortisation

407

425

502

672

629

685

EBIT

1,613

1,796

2,137

2,565

3,072

3,555

% chg

26.7

11.4

19.0

20.0

19.8

15.7

(% of Net Sales)

15.0

15.0

16.1

15.4

16.0

16.0

Interest & other Charges

487

517

622

735

788

788

Other Income

131

131

112

112

112

112

(% of PBT)

10

9

7

6

5

4

Recurring PBT

1,257

1,410

1,626

1,941

2,396

2,879

% chg

37.1

12.2

15.3

19.4

23.4

20.2

Extraordinary Exp./(Inc.)

85

(2)

(53)

(73)

-

-

PBT (reported)

1,172

1,413

1,679

1,941

2,396

2,879

Tax

222

244

283

189

479

576

(% of PBT)

18.9

17.3

16.9

9.7

20.0

20.0

PAT (reported)

950

1,169

1,396

1,753

1,917

2,303

Add: Share of earnings of

30

21

(31)

(19)

(21)

(24)

asso.

Less: Minority interest (MI)

7

43

13

6

6

6

Prior period items

24

-

-

-

-

1

PAT after MI (reported)

950

1,144

1,299

1,727

1,889

2,272

ADJ. PAT

1,040

1,147

1,352

1,800

1,889

2,272

% chg

38.0

10.2

17.9

33.2

4.9

20.3

(% of Net Sales)

9.8

9.6

10.3

11.0

10.0

10.4

Basic EPS (`)

24.3

26.7

31.5

35.5

37.3

44.8

Fully Diluted EPS (`)

24.3

26.7

31.5

35.5

37.3

44.8

% chg

42.5

10.2

17.9

12.6

4.9

20.3

January 15, 2017

9

United Phosphorus | 4QFY2017 Result Update

Balance Sheet (Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017

FY2018E

FY2019E

SOURCES OF FUNDS

Equity Share Capital

86

86

86

183

183

183

Preference Capital

-

-

-

-

-

-

Reserves& Surplus

5,162

5,775

6,705

7,214

8,645

10,459

Shareholders’ Funds

5,247

5,860

6,791

7,398

8,828

10,642

Minority Interest

172

44

42

33

39

45

Total Loans

2,873

2,781

3,860

6,058

6,058

6,058

Other Long term liab.

311

594

464

446

446

446

Long Term Provisions

53

53

53

-

-

-

Deferred Tax Liability

57

45

(5)

(501)

(501)

(501)

Total Liabilities

8,713

9,378

11,205

13,434

14,870

16,690

APPLICATION OF FUNDS

Gross Block

6,039

6,792

7,791

8,591

9,391

10,191

Less: Acc. Depreciation

3,580

4,005

4,507

5,178

5,807

6,493

Net Block

2,459

2,787

3,285

2,738

3,584

3,699

Capital Work-in-Progress

378

378

378

378

378

378

Goodwill / Intangilbles

1,212

1,449

1,463

1,747

1,747

1,747

Investments

737

764

1,066

379

379

379

Long Term Loan & Adv.

389

418

537

811

664

770

Current Assets

7,572

8,372

10,069

13,657

15,727

18,544

Cash

1,023

1,010

1,068

2,894

3,382

4,475

Loans & Advances

771

586

840

1,380

1,581

1,582

Other

5,779

6,776

8,162

9,383

10,764

12,487

Current liabilities

4,033

4,789

5,593

6,277

7,608

8,825

Net Current Assets

3,539

3,582

4,476

7,380

8,119

9,718

Others

-

-

-

-

-

-

Total Assets

8,714

9,378

11,205

13,434

14,870

16,690

January 15, 2017

10

United Phosphorus | 4QFY2017 Result Update

Cash Flow Statement (Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017

FY2018E

FY2019E

Profit before tax

1,172

1,413

1,679

1,941

2,396

2,879

Depreciation

407

425

502

672

629

685

Change in Working Capital

171

(86)

(955)

(1,352)

(103)

(612)

Less: Other income

-

-

-

-

-

1

Direct taxes paid

(222)

(244)

(283)

(189)

(479)

(576)

Cash Flow from Operations

1,528

1,508

942

1,072

2,443

2,377

(Inc.)/ Dec. in Fixed Assets

(653)

(753)

(1,000)

(800)

(800)

(800)

(Inc.)/ Dec. in Investments

-

-

-

-

-

-

Inc./ (Dec.) in loans and adv.

-

-

-

-

-

-

Other income

-

-

-

-

-

-

Cash Flow from Investing

(653)

(753)

(1,000)

(800)

(800)

(800)

Issue of Equity

(3)

-

-

98

-

-

Inc./(Dec.) in loans

1,413

(192)

(949)

(2,127)

(0)

(0)

Dividend Paid (Incl. Tax)

(201)

(214)

(214)

(642)

(458)

(458)

Others

(2,612)

(362)

1,278

4,323

(696)

(26)

Cash Flow from Financing

(1,403)

(768)

115

1,652

(1,155)

(484)

Inc./(Dec.) in Cash

(525)

(13)

58

1,826

488

1,093

Opening Cash balances

1,548

1,023

1,010

1,068

2,894

3,382

Closing Cash balances

1,023

1,010

1,068

2,894

3,382

4,475

January 15, 2017

11

United Phosphorus | 4QFY2017 Result Update

Key Ratios

Y/E March

FY2014

FY2015

FY2016

FY2017

FY2018E

FY2019E

Valuation Ratio (x)

P/E (on FDEPS)

35.0

31.7

26.9

23.9

22.8

19.0

P/CEPS

25.2

23.2

19.6

19.8

19.2

16.2

P/BV

6.9

6.2

5.4

10.5

8.8

7.3

Dividend yield (%)

0.4

0.4

0.4

0.4

0.4

0.4

EV/Sales

4.2

3.7

3.4

2.8

2.4

2.0

EV/EBITDA

24.2

20.3

18.5

15.8

13.5

11.3

EV / Total Assets

5.1

4.7

4.0

3.4

3.1

2.7

Per Share Data (`)

EPS (Basic)

24.3

26.7

31.5

35.5

37.3

44.8

EPS (fully diluted)

24.3

26.7

31.5

35.5

37.3

44.8

Cash EPS

33.8

36.7

43.2

42.8

44.1

52.3

DPS

2.5

2.5

2.5

2.5

2.5

2.5

Book Value

122.4

136.7

158.4

80.7

96.3

116.1

DuPont Analysis

EBIT margin

15.0

15.0

16.1

15.4

16.0

16.0

Tax retention ratio

81.1

82.7

83.1

90.3

80.0

80.0

Asset turnover (x)

1.5

1.6

1.6

1.7

1.8

1.9

ROIC (Post-tax)

18.5

20.3

21.0

23.6

22.7

24.4

Cost of Debt (Post Tax)

11.2

15.1

15.6

13.4

10.4

10.4

Leverage (x)

0.5

0.3

0.4

0.4

0.4

0.2

Operating ROE

21.9

22.0

22.9

27.9

27.2

27.6

Returns (%)

ROCE (Pre-tax)

17.7

19.9

20.8

20.8

21.7

22.5

Angel ROIC (Pre-tax)

23.2

24.7

25.6

26.7

28.9

31.0

ROE

21.0

20.6

21.4

25.4

23.3

23.3

Turnover ratios (x)

Asset Turnover (Gross Block)

1.9

1.9

1.8

2.0

2.1

2.3

Inventory / Sales (days)

83

86

86

81

83

84

Receivables (days)

83

86

86

81

83

84

Payables (days)

69

72

73

68

70

70

WCcycle (ex-cash) (days)

92

78

83

88

89

83

Solvency ratios (x)

Net debt to equity

0.6

0.4

0.3

0.4

0.4

0.3

Net debt to EBITDA

1.8

1.0

0.8

1.2

1.1

0.8

Interest Coverage (EBIT / Int.)

3.3

3.5

3.4

3.5

3.9

4.5

January 15, 2017

12

United Phosphorus | 4QFY2017 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

UPL

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

January 15, 2017

13