2QFY2018 Result Update | Agrichemical

November 22, 2017

United Phosphorus

ACCUMULATE

CMP

`754

Performance Highlights

Target Price

`805

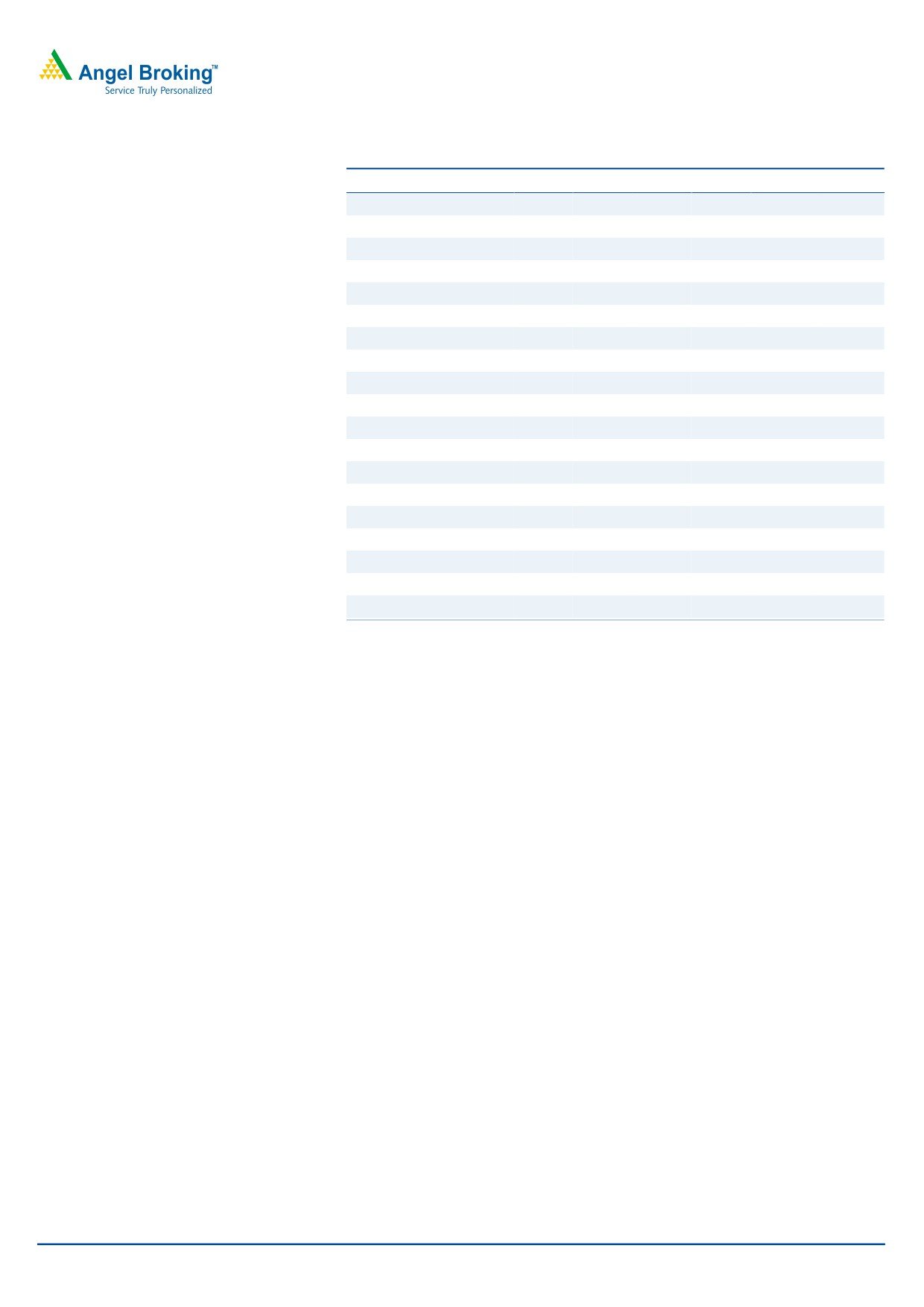

Y/E March (` cr)

2QFY2018 1QFY2018

% chg (qoq) 2QFY2017

% chg (yoy)

Investment Period

12 months

Net sales

3,770

3723

1.3

3541

6.5

Other income

76

101

(24.8)

82

(7.3)

Gross profit

2114

2204

(4.1)

1892

11.7

Operating profit

677

691

(2.0)

548

23.5

Adj. net profit

263

492

(46.6)

214

23.0

Source: Company, Angel Research,

Stock Info

Sector

Agrichem ical

UPL posted robust numbers for 2QFY2018. In sales, the company posted gross

Market Cap (` cr)

38,340

revenues of `3,770cr v/s `3,541cr in 2QFY2017, growth of 6.5% yoy. The sales growth

Net Debt (` cr)

1,113

Beta

1.0

was driven by volume (11% yoy), while price dip was 2% and exchange losses

52 Week High / Low

902/584

deducted 3% from the top-line rise. On EBITDA front, the company posted an

Avg. Daily Volum e

100,243

EBITDA of 18.0% v/s 15.5% in 2QFY2017. Consequently, Adj. PAT came in at `263cr

Face Value (`)

2

BSE Sensex

33,478

v/s `214cr in 2QFY2017, growth of 23.0% yoy. The management has maintained

Nifty

10,327

guidance of 12-15% revenue growth and 50-75bps improvement in EBITDA margin.

Reuters Code

UNPO.BO

We recommend our Accumulate rating on the stock.

Bloom berg Code

UNTP@IN

Quarterly highlights: In sales, the company posted gross revenues of `3,770cr v/s

Shareholding Pattern (%)

`3,541cr in 2QFY2017, growth of 6.5% yoy. The growth was driven by volume (11%

Prom oters

27.9

yoy), while price dip was 2% and exchange losses deducted 3% from the top-line

MF / Banks / Indian Fls

13.8

rise. In terms of geography, revenues were higher overall - India (`997cr, up 10%

FII / NRIs / OCBs

50.4

Indian Public / Others

8.0

yoy), Latin America (`1,385cr, up 5% yoy), ROW (`632cr, yoy rise of 5%), Europe

(`363cr, posted a yoy growth of 7%). US (`393cr) sales posted a yoy growth of 5%.

Abs . (%)

3m

1yr

3yr

On EBITDA front, the company posted an EBITDA of 18.0% v/s 15.5% in 2QFY2017.

Sensex

7.0

29.9

18.2

Consequently, Adj. PAT came in at `263cr v/s `214cr in 2QFY2017, growth of 23.0%

UPL

(5.5)

24.0

115.5

yoy.

Outlook and Valuation: We expect UPL to post a CAGR of 15.0% and 11.3% in its

sales and PAT respectively over FY2017-19E. The management has maintained

guidance of 12-15% revenue growth and 50-75bps improvement in EBITDA margin.

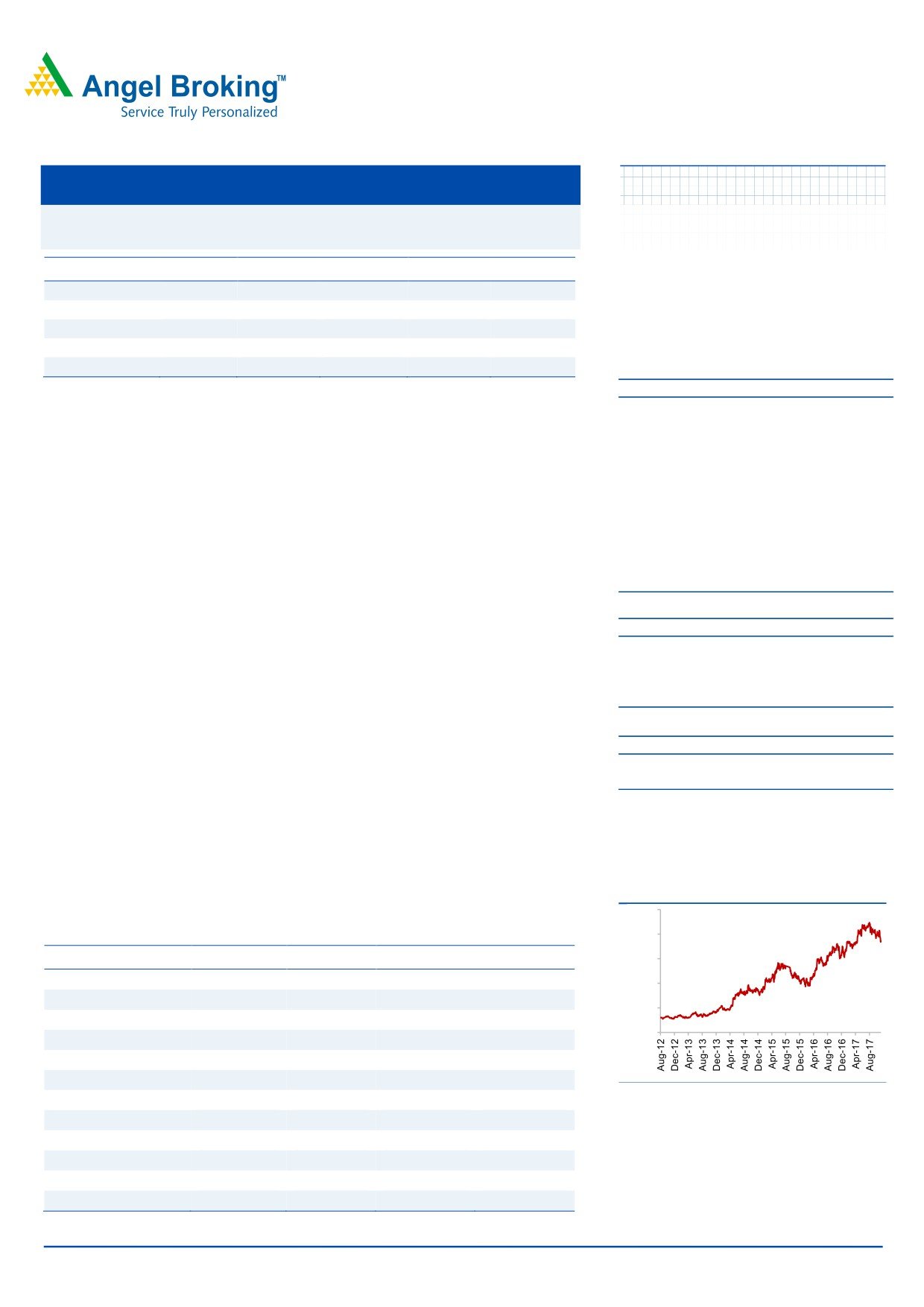

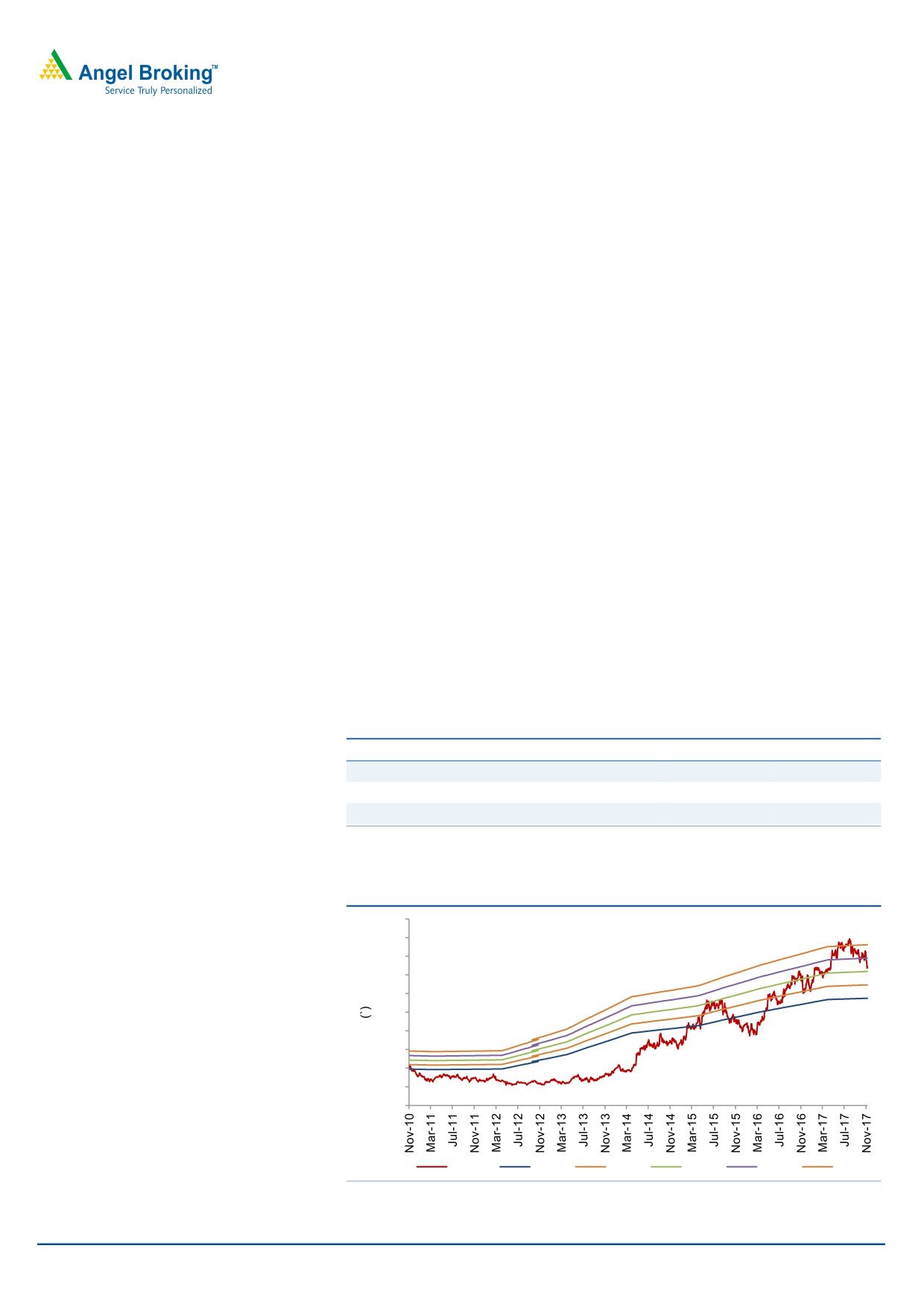

3-year price chart

We recommend an Accumulate.

1000

800

Key financials (Consolidated)

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

600

Total revenue

14,048

16,312

18,759

21,572

400

% chg

17.9

16.1

15.0

15.0

200

Adj. profit

1,051

1,800

1,848

2,267

0

% chg

(8.3)

71.3

2.7

22.7

EBITDA (%)

16.1

17.8

18.4

18.7

EPS (`)

24.5

35.5

36.5

44.7

Source: Company, Angel Research

P/E (x)

30.8

21.2

20.7

16.9

P/BV (x)

5.5

5.2

4.4

3.6

RoE (%)

17.9

27.1

22.8

23.4

Sarabjit Kour Nangra

RoCE (%)

15.4

19.1

19.9

21.2

+91-22-3935 7800 ext. 6806

EV/Sales (x)

3.4

2.9

2.5

2.1

EV/EBITDA (x)

21.4

16.3

13.7

11.4

Source: Company, Angel Research; Note: CMP as of November 21, 2017,

Please refer to important disclosures at the end of this report

1

United Phosphorus | 2QFY2018 Result Update

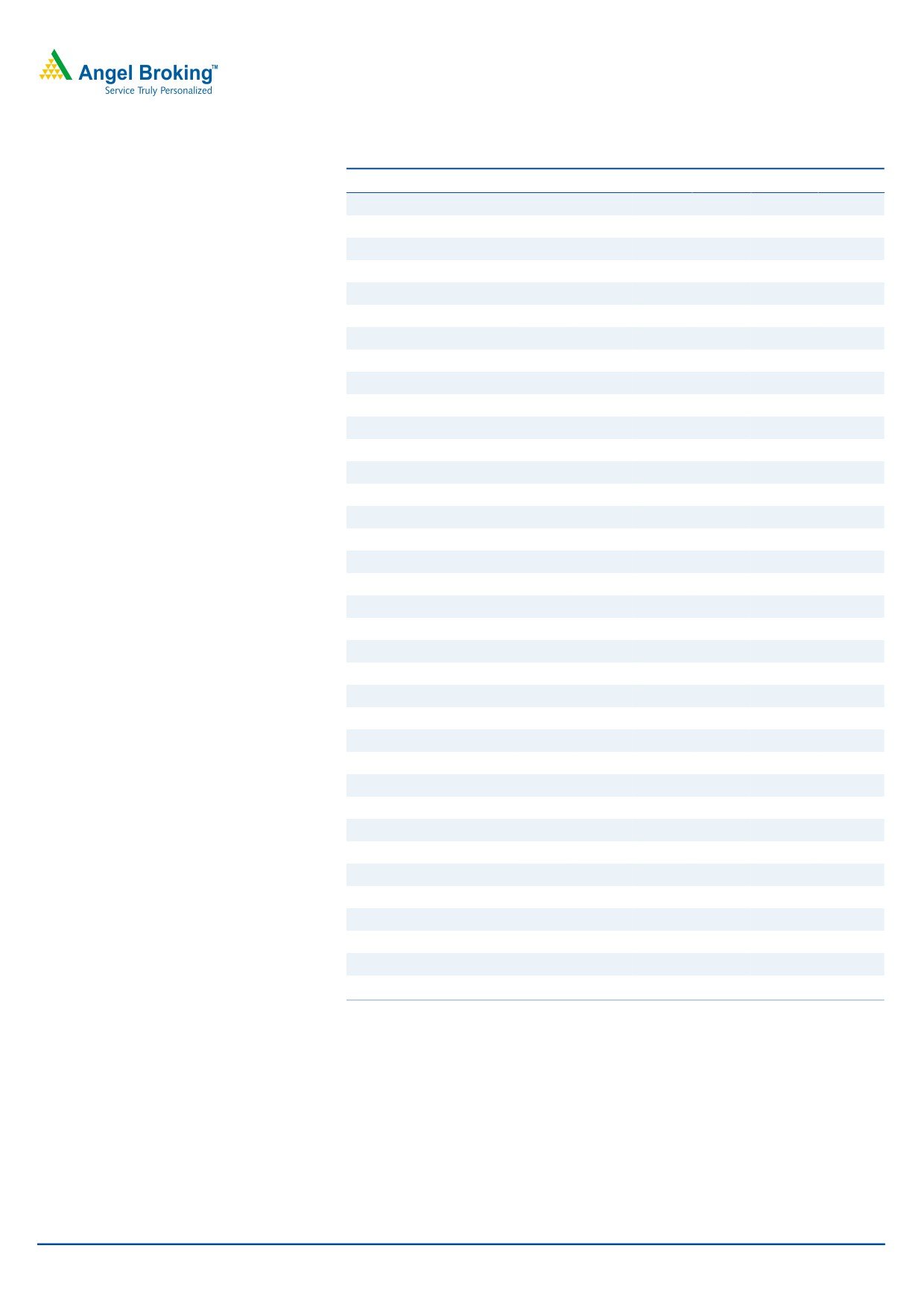

Exhibit 1: 2QFY2018 Performance (Consolidated)

Y/E March (` cr)

2QFY2018 1QFY2018

% chg (qoq) 2QFY2017

% chg (yoy) 1HFY2018 1HFY2017

% chg

Net sales

3,770

3,723

1.3

3,541

6.5

7,493

7,051

6.3

Other income

76

101

(24.8)

82

(7.3)

177

169

4.7

Total income

3,846

3,824

0.6

3,623

6.2

7,670

7,220

6.2

Gross profit

2114

2204

(4.1)

1892

11.7

4318

3802

13.6

Gross margin (%)

56.1

59.2

53.4

57.6

53.9

Operating profit

677

691

(2.0)

548

23.5

1368

1187

15.3

Operating margin (%)

18.0

18.6

15.5

18.3

16.8

Financial cost

182

80

127.5

180

1.1

262

339

Depreciation

165

158

4.4

154

7.1

323

323

0.0

PBT

406

554

(26.7)

296

37.2

960

694

38.4

Provision for taxation

75

48

43

74.4

123

86

43.0

PAT Before Exc. And MI

331

506

(34.6)

253

30.8

837

608

37.8

Minority Income/ ( Exp.)

0

0

1

0

0

Income from Associate/ (Exp)

(62)

(12)

(31)

(74)

(29)

Extra ordinary Income/( Exp.)

(31)

(19)

(56)

(50)

(49)

Reported PAT

238

475

(49.9)

166

43.4

714

530

34.7

Adjusted PAT

263

492

(46.6)

214

23.0

758

572

32.3

5.2

9.7

4.4

14.9

11.3

EPS (`)

Source: Company, Angel Research

Top-line growth mainly led by India and Europe

In sales, the company posted gross revenues of `3,770cr v/s `3,541cr in 2QFY2017,

growth of 6.5% yoy. The growth was driven by volume (11% yoy), while price dip

was around 2% and exchange losses deducted 3% from the top-line rise. In terms

of geography, revenues were higher overall - India (`997cr, up 10% yoy), Latin

America (`1,385cr, up 5% yoy), ROW (`632cr, yoy rise of 5%), Europe (`363cr, posted

a yoy growth of 7%). US (`393cr) sales posted a yoy growth of 5%.

In India, the growth of the company is driven by the power brands. Poor rainfall

affected Southern States. However, Rabi prospects should improve after late rains.

Potential 3 million hectares of rice expected to be planted in Rabi in South.

In Europe, business grew in Potato, Oil Seed Rape and Cereals (herbicides). Sugar

Beet herbicide pipeline dry, increased acreage and product shortage provides good

opportunities for UPL.

For Latin America, there was revival in Mexico with good rains, though late.

Management is expecting better 3QFY2018 as distributors/farmers were playing

wait and watch before ordering. Also, collaboration with Bayer on joint promotion

of fungicides on Asian Rust in Brazil should be beneficial.

November 21, 2017

2

United Phosphorus | 2QFY2018 Result Update

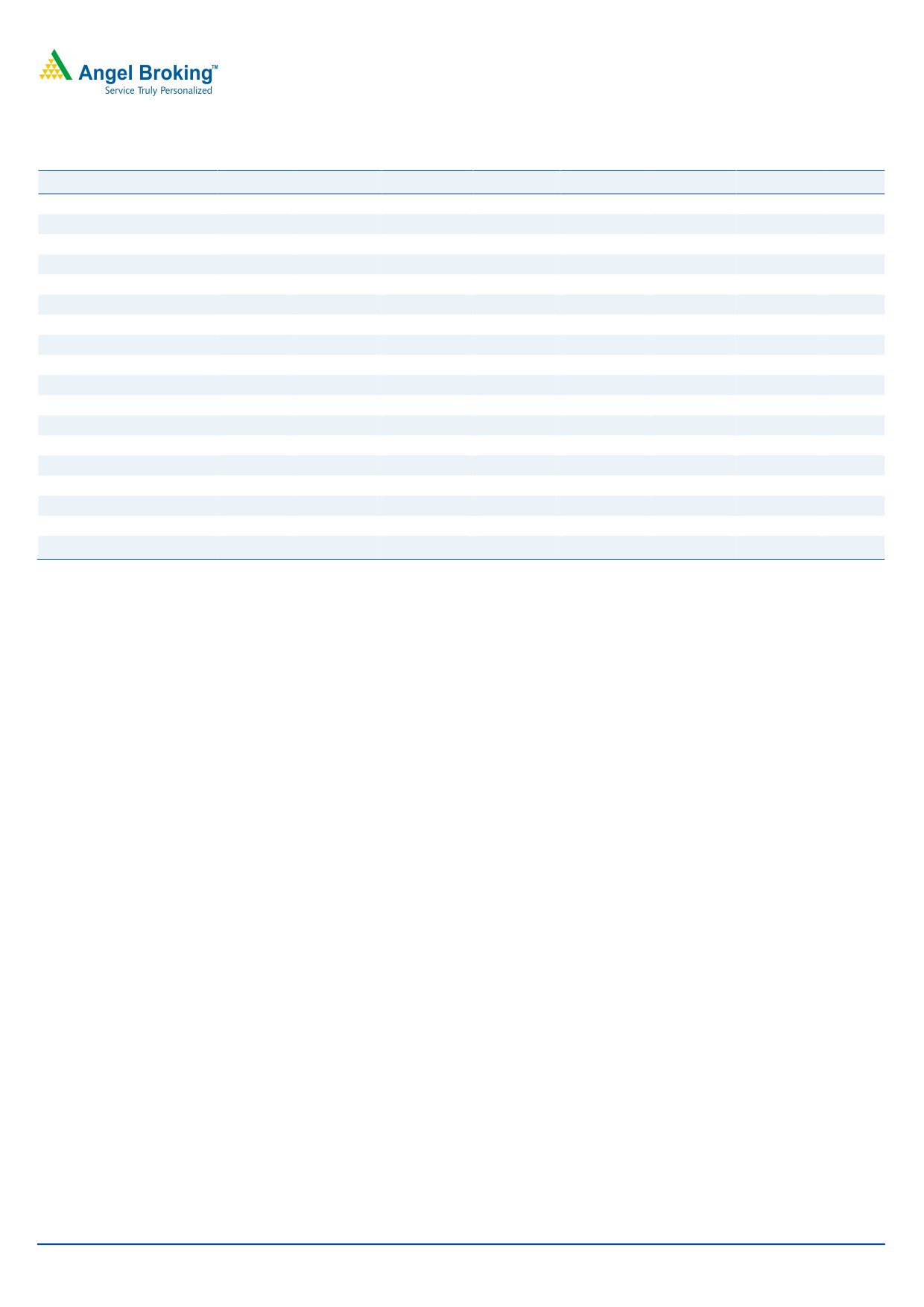

Exhibit 2: Sales Break-up (Marketwise)

100%

375

393

660

681

1,215

80%

599

632

636

602

341

363

1,172

329

60%

585

1,026

626

997

916

40%

442

1,246

20%

1,736

1,317

1,385

1,646

737

0%

2QFY2017

3QFY2017

4QFY2017

1QFY2018

2QFY2018

Latin America

India

EU

Others

North America

Source: Company

Exhibit 3: Sales performance (including export incentives)

Exhibit 4: Growth break-up

6000

12

11

5,391

5400

10

4800

3,987

8

4200

3,851

3,770

3,658

3600

6

3000

4

2400

2

1800

0

1200

(2)

600

(2)

0

(4)

(3)

2QFY2017

3QFY2017

4QFY2017

1QFY2018

2QFY2018

Exchange impact

Realisation

Volume

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 5: Volume and realization break-up (yoy)

30

23

25

21

20

18

15

11

10

10

5

0

(1)

(3)

(2)

(5)

(4)

2QFY2017

3QFY2017

4QFY2017

1QFY2018

2QFY2018

Realisation

Volume

Source: Company, Angel Research

November 21, 2017

3

United Phosphorus | 2QFY2018 Result Update

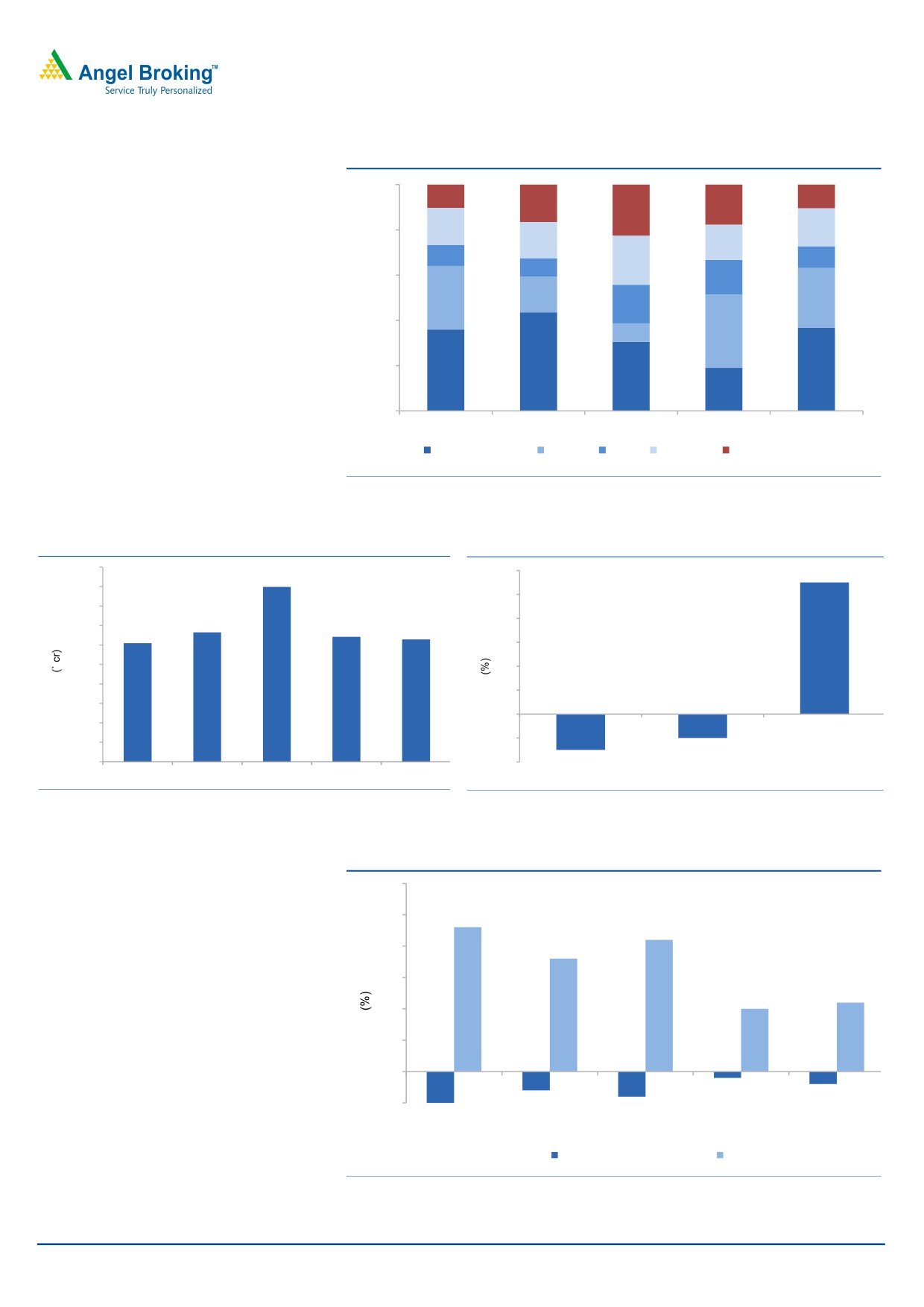

EBITDA margin expands

On the operating front, the gross margin came in at 56.1% (v/s 53.4% in 2QFY2017),

which aided the OPM for the quarter to come in at 18.0% (v/s 15.5% in 2QFY2017).

The expansion in OPM was slightly less than the gross margin expansion, on the

back of staff expenses, which rose by 11.8% yoy.

Exhibit 6: EBITDA margin trend

25.0

20.0

19.4

18.6

17.8

18.0

15.0

15.5

10.0

5.0

0.0

2QFY2017

3QFY2017

4QFY2017

1QFY2018

2QFY2018

Source: Company, Angel Research

Adjusted Net Profit grew 23.0% yoy

The company posted a 23.0% yoy growth in its Adjusted PAT, excluding the extra

ordinaries and profits from associates and subsidiaries. The Reported PAT was

`238cr V/s `166cr in 2QFY2017; a yoy rise of 43.4%.

Exhibit 7: Adjusted PAT trend

800

300

700

250

600

200

500

400

150

300

100

200

50

100

222

457.1

740

491

268

0

0

2QFY2017

3QFY2017

4QFY2017

1QFY2018

2QFY2018

Adj PAT

% YoY

Source: Company, Angel Research

November 21, 2017

4

United Phosphorus | 2QFY2018 Result Update

Investment arguments

Innovators dominant in the off-patent space; Generic firms in

a sweet spot

The global agrichemical industry, valued at US$56bn (CY2015), is dominated by the

top six innovators, viz. Bayer, Syngenta, Monsanto, BASF, DuPont and Dow, which

enjoy a large market share of the patented (23%) and off-patent (54%) market. The

top six innovators enjoy a large share of the off-patent market due to high entry

barriers for pure generic players. Thus, of the total pie worth US$30bn, which is

controlled

by

the

top

six

innovators

through

proprietary

off-patent products, provides a high-growth opportunity for larger integrated

generic players like UPL.

Generic segment’s market share to increase

The industry registered a CAGR of 3% over 1998-2006, while generic players

outpaced the industry with a CAGR of 6%. Going ahead, given the opportunities

and a drop in the rate of new molecule introduction by innovators, we expect

generic players to continue to outpace the industry’s growth rate and augment

their market share in the overall pie. Historically, global agrichem players have been

logging in-line growth with global GDP. Going ahead, over CY2017-18, the global

economy is expected to grow by 3-4%. Assuming this trend plays out in terms of

growth for the agrichemical industry and the same rate of genericization occurs,

then the agrichemical generic industry could log in 6-8% yoy growth during the

period and garner a higher market share.

A global generic play

UPL is the third largest global generic agrichemical player with presence across

major markets including the US, EU, Latin America, and India. Given the high entry

barriers by way of high investments, entry of new players is restricted. Thus, amidst

this

scenario and on account of having a low-cost base,

we believe UPL enjoys an edge over competition and is placed in a sweet spot to

leverage the upcoming opportunities in the global generic space.

Advanta - An Entry into seeds business

During FY2016, UPL announced a merger of Advanta with itself. With this, the

company has made its foray into the seed business, thus, widening its business

offerings in the Agri-business. The company had sales of around US$204mn in

2015, with OPM of around 15-16%. It is the 11th largest seed company globally,

with world leadership in Sorghum. Along with this, it also completes the company’s

business portfolio, in-line with the other major Agri-businesses, who have around

5-20% (Monsanto and DuPont have around 65% of their sales mix through seeds)

of their sales mix through seeds business. While the acquisition improves the

presence of the company in the low capital intensive industry coupled with the

propriety products, which will yield long term profitability the near term challenges

include high R&D cost coupled with long legislation period for the product

commercialization.

November 21, 2017

5

United Phosphorus | 2QFY2018 Result Update

According to the industry numbers, the international seed sector is growing at 6%

per annum. In value terms, the Indian hybrid seed sector, estimated to be worth

`12,000cr comprises some 14 states seed corporations and two national-level

corporations, 20 large players including multinationals and around 500 small

regional players. About 10 domestic and multinational companies control over 80%

of the market. The market has been growing at 15-20% annually over the past

several years, and is projected to reach around `18,000cr by 2018. Though, we have

included the Advanta numbers in our projections, we have been conservative on

the same.

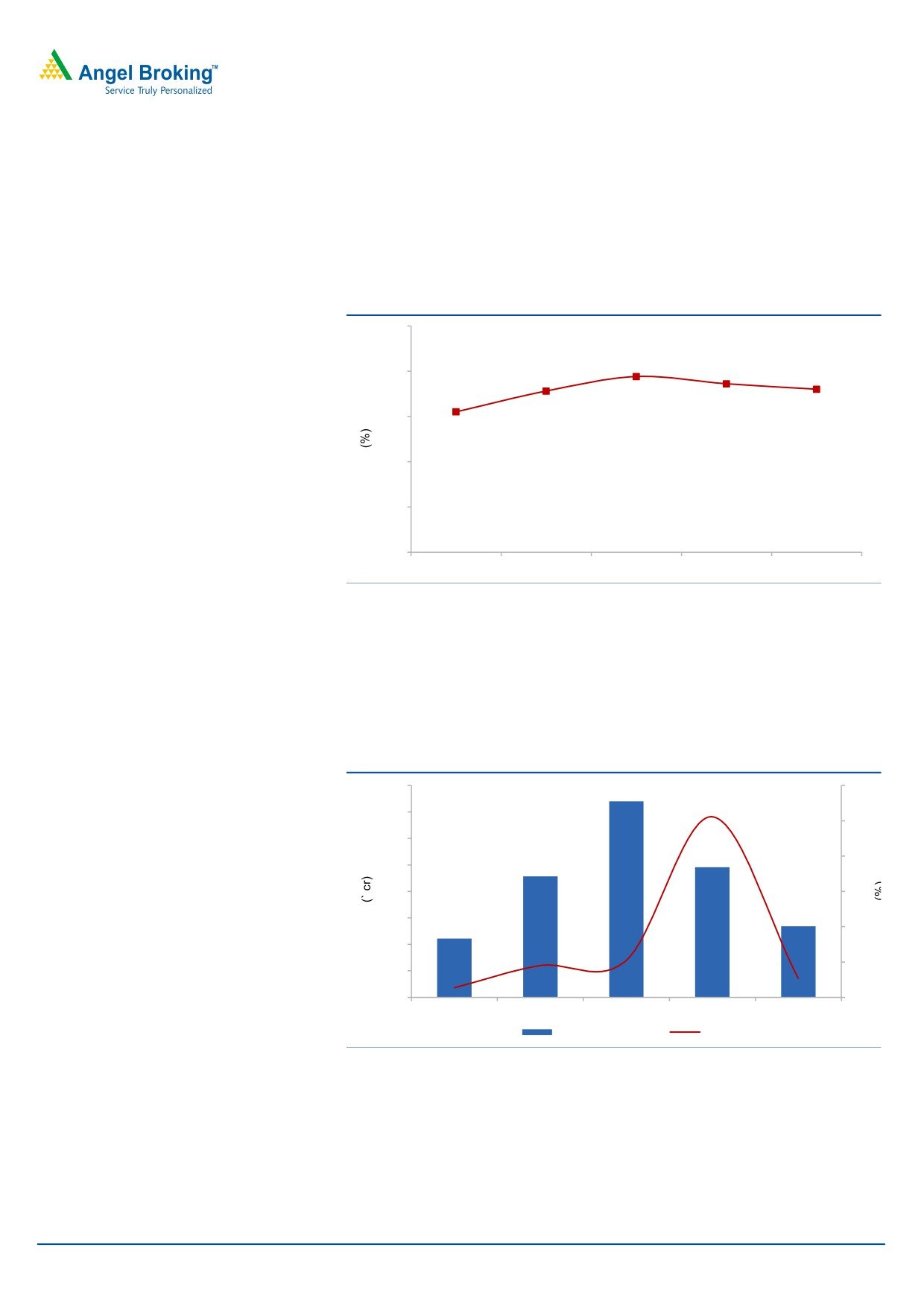

Outlook and valuation

Over the last few years, the global agriculture sector has been reviving on the back

of rising food prices. Food security is also a top priority for most governments, and

reducing food loss is one of the easiest ways to boost food inventory. Hence, we

believe agrichemical companies would continue to do well in the wake of

heightened food security risks, and strong demand is likely to be witnessed across

the world. Overall, we expect the global agrichemical industry to perform well from

here on. Generics are expected to register a healthy growth due to - (a) increasing

penetration and wresting market share from innovators, and b) patent expiries

worth US$3bn-4bn during the next five years.

We estimate UPL to post a 15.0% and 11.3% CAGR in sales and PAT

respectively over FY2017-19E. The stock is trading at 16.9x FY2019E EPS,

which we believe provides little room for appreciation. Hence, we recommend

an Accumulate rating on the stock.

Exhibit 8: Key assumption

FY2018E

FY2019E

Sales growth

15.0

15.0

EBITDA margin

18.4

18.7

Tax rate

20.0

20.0

Source: Company, Angel Research

Exhibit 9: P/E band

1000

900

800

700

600

500

400

300

200

100

0

Price

16x

18x

20x

22x

24x

Source: Company, Angel Research

November 21, 2017

6

United Phosphorus | 2QFY2018 Result Update

Exhibit 10: Peer valuation

Company Reco

Mcap

CMP TP Upside

P/E (x)

EV/Sales (x) EV/EBITDA (x)

RoE (%)

CAGR (%)

(` cr)

(`)

(`)

(%) FY17 FY18 FY17 FY18 FY17 FY18 FY17 FY18 Sales PAT

Rallis

Sell

4,501

230

189

(18.3)

25.0

20.8

2.3

2.0

15.1

12.7

15.5

16.9

10.5

24.9

Accumulate

44,006

754 805

7.0

20.7

16.9

2.5

2.1

13.7

11.4

22.8

23.4

15.0

12.2

UPL

Source: Company, Angel Research, Bloomberg, All numbers in FY17 and FY18 are expected numbers

Company background

United Phosphorus (UPL) is a global generic crop protection, chemicals and seeds

company. The company is fully backward and forward integrated by taking

advantage of the consolidation opportunities within the agrochemical industry. UPL

is the largest Indian agrochemical company and had revenue of about `11,911cr for

the year ended March 2015. During FY2016, UPL announced its merger with

Advanta. With this, the company has made its foray into the seed business, thus,

widening its business offerings in the Agri-business.

November 21, 2017

7

United Phosphorus | 2QFY2018 Result Update

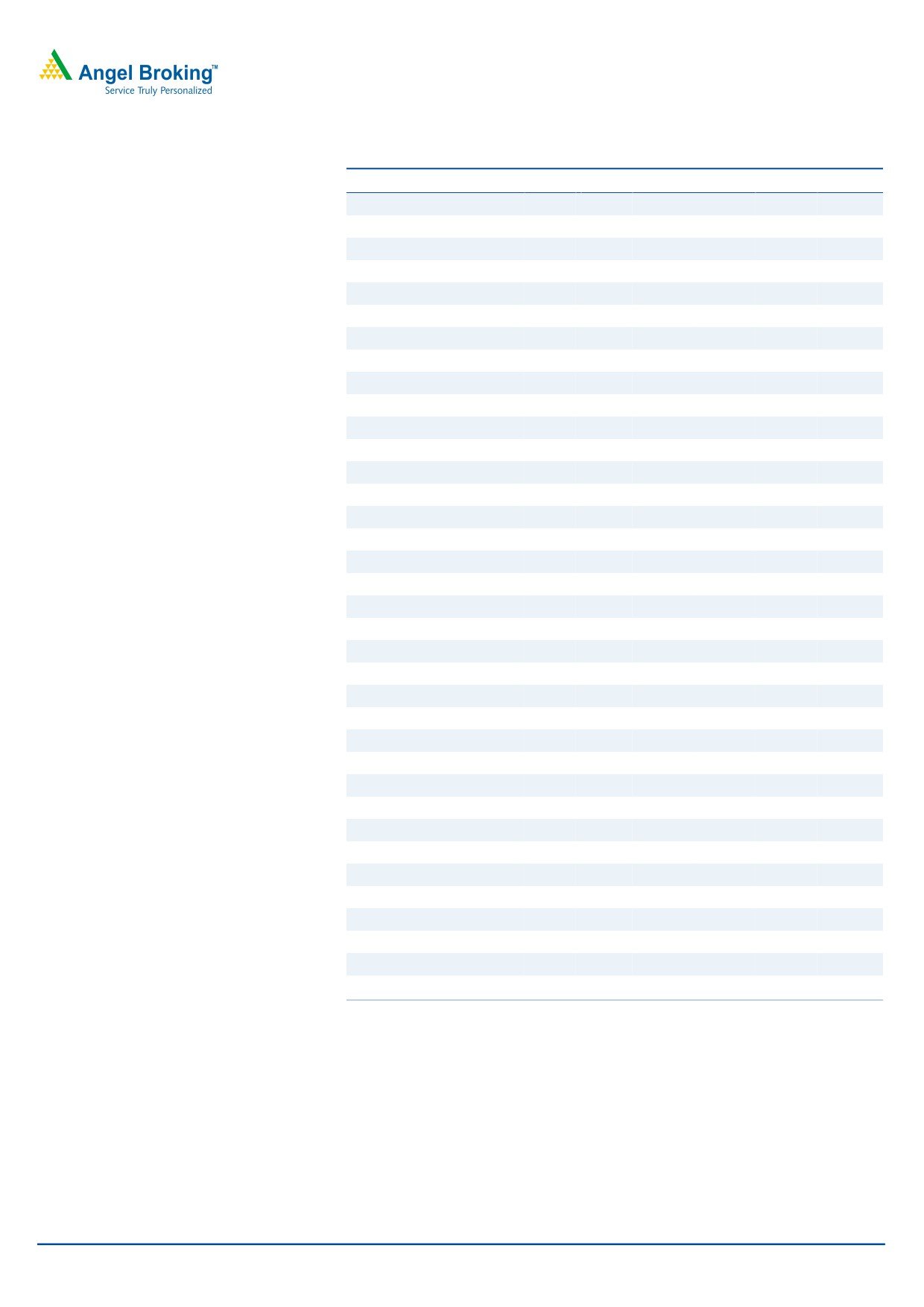

Profit & Loss Statement (Consolidated)

Y/E March (` cr)

FY2014 FY2015 FY2016 FY2017 FY2018E FY2019E

Net Sales

10,580

11,911

14,048

16,312

18,759

21,572

Other operating income

191

45

-

128

100

100

Total operating income

10,771

11,956

14,048

16,440

18,859

21,672

% chg

17.1

11.0

17.5

17.0

14.7

14.9

Total Expenditure

8,751

9,736

11,782

13,407

15,306

17,537

Net Raw Materials

5,441

6,016

6,780

7,816

8,989

10,337

Other Mfg costs

942

842

1,250

1,452

1,557

1,726

Personnel

946

1,043

1,434

1,627

1,871

2,152

Other

1,422

1,835

2,318

2,512

2,889

3,323

EBITDA

1,829

2,175

2,266

2,904

3,453

4,035

% chg

26.8

19.0

4.2

28.2

18.9

16.9

(% of Net Sales)

17.3

18.3

16.1

17.8

18.4

18.7

Dep. & Amortisation

407

425

676

672

736

792

EBIT

1,613

1,796

1,590

2,361

2,817

3,343

% chg

26.7

11.4

(11.5)

48.5

19.3

18.7

(% of Net Sales)

15.0

15.0

11.3

14.4

14.9

15.4

Interest & other Charges

487

517

704

735

788

788

Other Income

131

131

316

316

316

316

(% of PBT)

10

9

26

16

13

11

Recurring PBT

1,257

1,410

1,202

1,941

2,345

2,871

% chg

37.1

12.2

(14.8)

61.6

20.8

22.5

Extraordinary Exp./(Inc.)

85

(2)

(111)

(73)

-

-

PBT (reported)

1,172

1,413

1,313

1,941

2,345

2,871

Tax

222

244

165

189

469

574

(% of PBT)

18.9

17.3

12.6

9.7

20.0

20.0

PAT (reported)

950

1,169

1,148

1,753

1,876

2,297

Add: Share of earnings of asso.

30

21

(85)

(19)

(21)

(24)

Less: Minority interest (MI)

7

43

12

6

6

6

Prior period items

24

-

-

-

-

-

PAT after MI (reported)

950

1,144

940

1,727

1,848

2,267

ADJ. PAT

1,040

1,147

1,051

1,800

1,848

2,267

% chg

38.0

10.2

(8.3)

71.3

2.7

22.7

(% of Net Sales)

9.8

9.6

7.5

11.0

9.9

10.5

Basic EPS (`)

24.3

26.7

24.5

35.5

36.5

44.7

Fully Diluted EPS (`)

24.3

26.7

24.5

35.5

36.5

44.7

% chg

42.5

10.2

(8.3)

44.8

2.7

22.7

November 21, 2017

8

United Phosphorus | 2QFY2018 Result Update

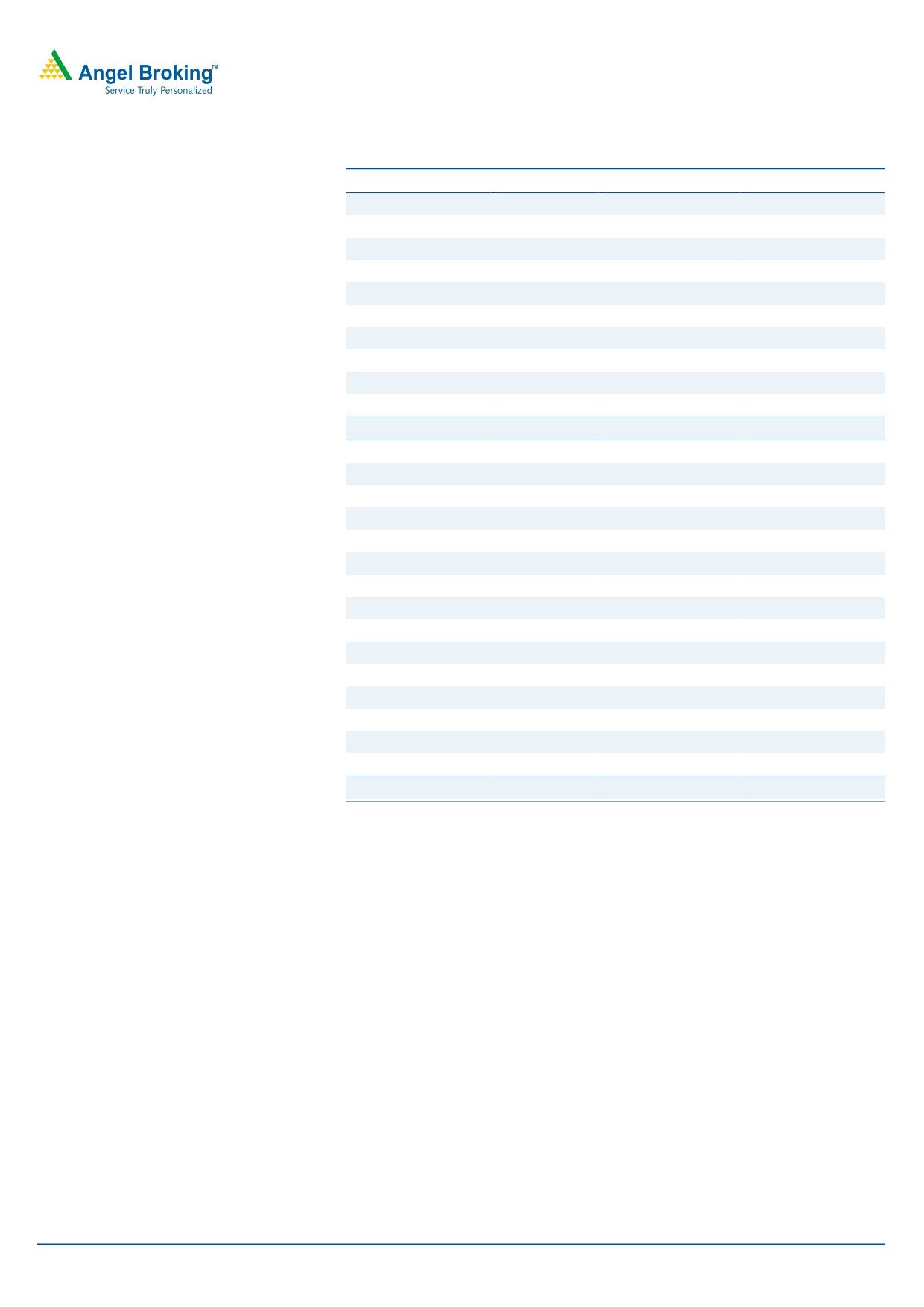

Balance Sheet (Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017

FY2018E FY2019E

SOURCES OF FUNDS

Equity Share Capital

86

86

86

183

183

183

Preference Capital

-

-

-

-

-

-

Reserves& Surplus

5,162

5,775

5,803

7,214

8,604

10,413

Shareholders’ Funds

5,247

5,860

5,889

7,398

8,788

10,596

Minority Interest

172

44

44

33

39

45

Total Loans

2,873

2,781

5,258

6,058

6,058

6,058

Other Long term liab.

311

594

449

446

446

446

Long Term Provisions

53

53

53

-

-

-

Deferred Tax Liability

57

45

(390)

(501)

(501)

(501)

Total Liabilities

8,713

9,378

11,303

13,434

14,830

16,645

APPLICATION OF FUNDS

Gross Block

6,039

6,792

9,315

10,115

10,915

11,715

Less: Acc. Depreciation

3,580

4,005

5,870

6,542

7,278

8,070

Net Block

2,459

2,787

3,445

2,632

3,637

3,645

Capital Work-in-Progress

378

378

484

484

484

484

Goodwill / Intangilbles

1,212

1,449

417

1,747

1,747

1,747

Investments

737

764

335

379

379

379

Long Term Loan & Adv.

389

418

591

811

658

757

Current Assets

7,572

8,372

11,207

13,657

15,467

18,306

Cash

1,023

1,010

1,189

2,894

3,214

4,452

Loans & Advances

771

586

840

1,380

1,581

1,582

Other

5,779

6,776

9,178

9,383

10,672

12,272

Current liabilities

4,033

4,789

5,176

6,277

7,542

8,674

Net Current Assets

3,539

3,582

6,031

7,380

7,924

9,633

Others

-

-

-

-

-

-

Total Assets

8,714

9,378

11,303

13,434

14,830

16,645

November 21, 2017

9

United Phosphorus | 2QFY2018 Result Update

Cash Flow Statement (Consolidated)

Y/E March (` cr)

FY2013 FY2014 FY2015 FY2016 FY2017E FY2018E

Profit before tax

1,172

1,413

1,313

1,941

2,345

2,871

Depreciation

407

425

676

672

736

792

Change in Working Capital

171

(86)

(2,443)

135

(70)

(569)

Less: Other income

-

-

-

-

-

-

Direct taxes paid

(222)

(244)

(165)

(189)

(469)

(574)

Cash Flow from Operations

1,528

1,508

(619)

2,559

2,542

2,520

(Inc.)/ Dec. in Fixed Assets

(653)

(753)

(2,630)

(800)

(800)

(800)

(Inc.)/ Dec. in Investments

-

-

-

-

-

-

Inc./ (Dec.) in loans and adv.

-

-

-

-

-

-

Other income

-

-

-

-

-

-

Cash Flow from Investing

(653)

(753)

(2,630)

(800)

(800)

(800)

Issue of Equity

(3)

-

-

98

-

-

Inc./(Dec.) in loans

1,413

(192)

(2,331)

(744)

(0)

(0)

Dividend Paid (Incl. Tax)

(201)

(214)

(214)

(642)

(458)

(458)

Others

(2,612)

(362)

5,973

1,331

(963)

(24)

Cash Flow from Financing

(1,403)

(768)

3,427

43

(1,422)

(482)

Inc./(Dec.) in Cash

(525)

(13)

179

1,705

320

1,238

Opening Cash balances

1,548

1,023

1,010

1,189

2,894

3,214

Closing Cash balances

1,023

1,010

1,189

2,894

3,214

4,452

November 21, 2017

10

United Phosphorus | 2QFY2018 Result Update

Key Ratios

Y/E March

FY2013 FY2014 FY2015 FY2016 FY2017E FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

31.1

28.2

30.8

21.2

20.7

16.9

P/CEPS

22.3

20.6

18.7

15.5

14.8

12.5

P/BV

6.2

5.5

5.5

5.2

4.4

3.6

Dividend yield (%)

0.5

0.7

0.7

0.9

0.9

0.9

EV/Sales

4.3

3.8

3.4

2.9

2.5

2.1

EV/EBITDA

25.1

21.0

21.4

16.3

13.7

11.4

EV / Total Assets

5.3

4.9

4.3

3.5

3.2

2.8

Per Share Data (`)

EPS (Basic)

24.3

26.7

24.5

35.5

36.5

44.7

EPS (fully diluted)

24.3

26.7

24.5

35.5

36.5

44.7

Cash EPS

33.8

36.7

40.3

48.8

51.0

60.3

DPS

4.0

5.0

5.0

7.0

7.0

7.0

Book Value

122.4

136.7

137.4

145.9

173.3

209.0

DuPont Analysis

EBIT margin

15.0

15.0

11.3

14.4

14.9

15.4

Tax retention ratio

81.1

82.7

87.4

90.3

80.0

80.0

Asset turnover (x)

1.5

1.6

1.6

1.6

1.8

1.9

ROIC (Post-tax)

18.5

20.3

16.0

21.2

20.9

23.1

Cost of Debt (Post Tax)

11.2

15.1

15.3

11.7

10.4

10.4

Leverage (x)

0.5

0.3

0.5

0.6

0.4

0.2

Operating ROE

21.9

22.0

16.3

26.5

24.9

26.1

Returns (%)

ROCE (Pre-tax)

17.7

19.9

15.4

19.1

19.9

21.2

Angel ROIC (Pre-tax)

23.2

24.7

18.3

23.7

26.3

29.0

ROE

21.0

20.6

17.9

27.1

22.8

23.4

Turnover ratios (x)

Asset Turnover (Gross Block)

1.9

1.9

1.7

1.7

1.8

1.9

Inventory / Sales (days)

83

86

84

84

85

85

Receivables (days)

83

86

84

84

85

85

Payables (days)

69

72

68

70

71

71

WCcycle (ex-cash) (days)

92

78

96

104

89

84

Solvency ratios (x)

Net debt to equity

0.6

0.4

0.3

0.7

0.4

0.3

Net debt to EBITDA

1.8

1.0

0.8

1.8

1.1

0.8

Interest Coverage (EBIT / Int.)

3.3

3.5

2.3

3.2

3.6

4.2

November 21, 2017

11

United Phosphorus | 2QFY2018 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits

and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

UPL

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 21, 2017

12