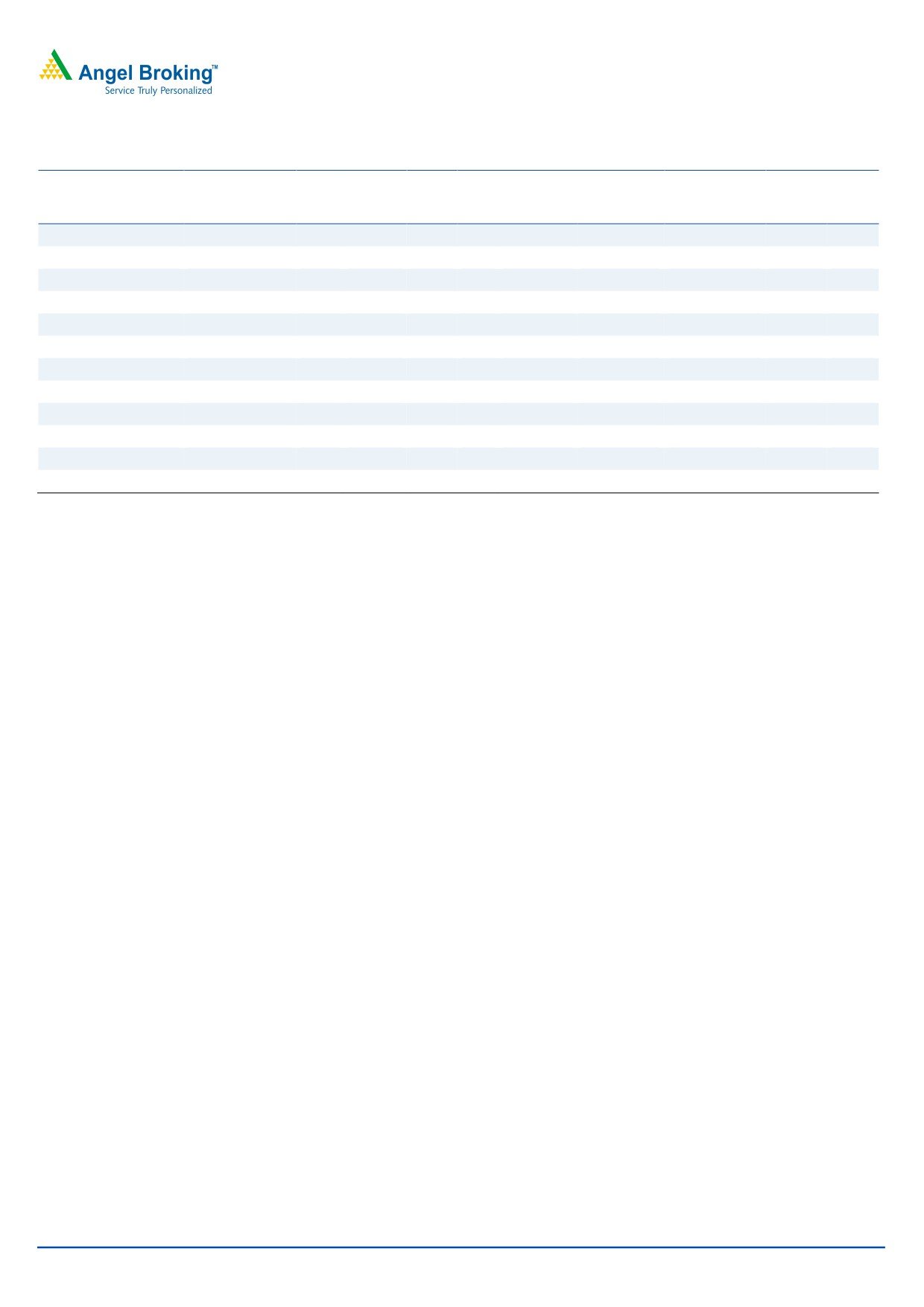

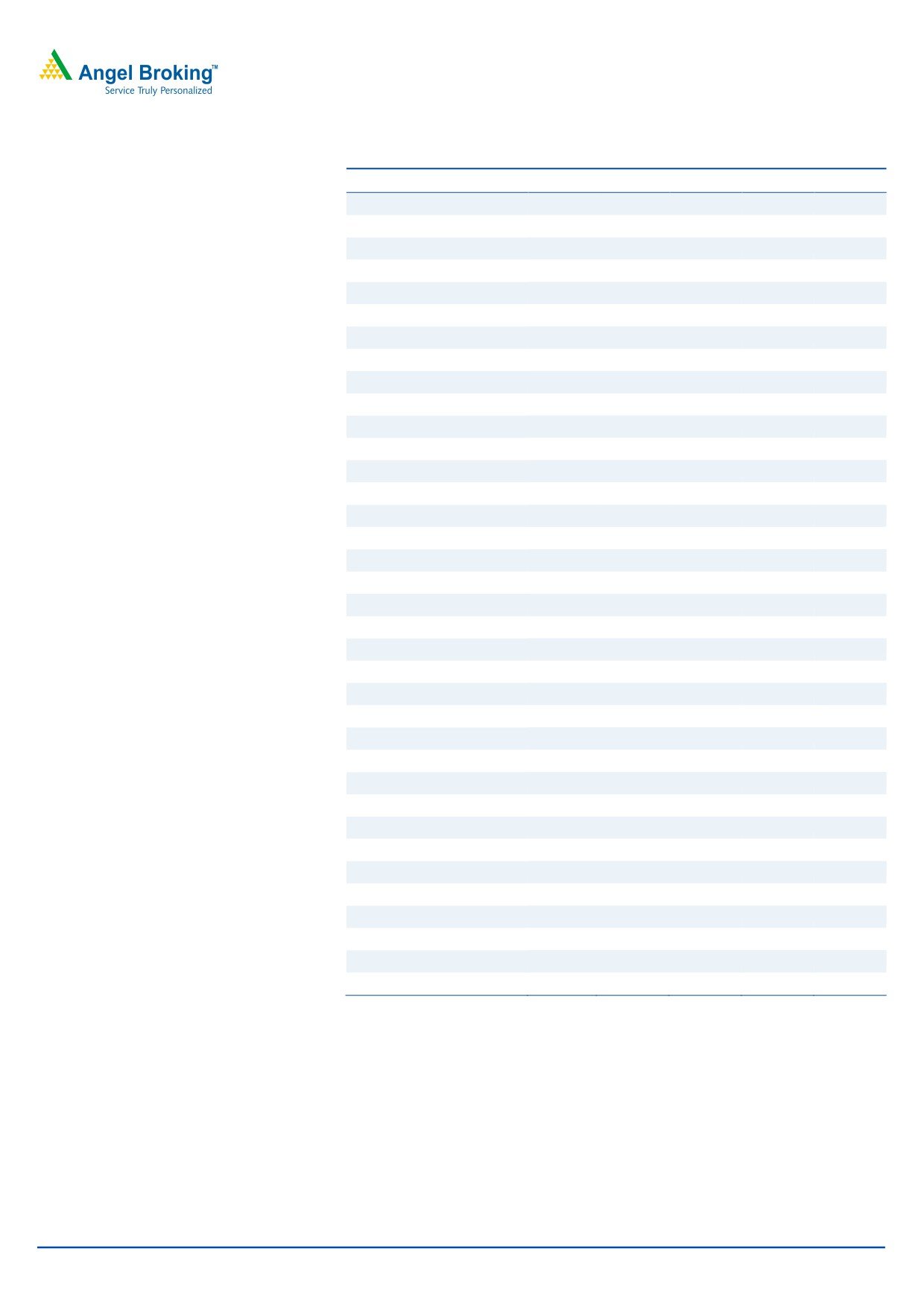

2QFY2018 Result Update | Pharmaceutical

November 24, 2017

Sun Pharma

BUY

CMP

`535

Performance Highlights

Target Price

`615

% chg

% chg

Investment Period

12 months

(` cr)

2QFY2018

1QFY2018

2QFY2017

(qoq)

(yoy)

6,590

6,167

6.9

7,764

(15.1)

Net sales

Stock Info

Other income

315

194

62.3

621

(49.2)

Sector

Pharm aceutical

4,713

4,489

5.0

5,924

(20.5)

Gross profit

Market Cap (` cr)

128,411

1,315

1,054

24.9

2,667

(50.7)

Net Debt (` cr)

(8,242)

Operating profit

Beta

0.7

Adj. Net profit

1,002

632

58.6

2,471

(59.5)

52 Week High / Low

731/433

Avg. D aily Volum e

477,916

Source: Company, Angel Research

Face Value (`)

1

For 2QFY2018, sales came in at `6,590cr (`7,118cr expected) v/s. `7,764cr in

BSE Sensex

33,562

2QFY2017, a yoy de-growth of 15.1%, following a decline in US sales (which was

Nifty

10,342

impacted on the back of pricing pressures and base effect). On operating front,

Reuters Code

SUN.BO

Bloom berg Code

SUNP@IN

the EBITDA margins came in at 20.0% as expected v/s. 34.3% in 2QFY2017, mainly

on the back of lower sales during the quarter and base effect. Thus, Adj. net profit

Shareholding Pattern (%)

came in at `1,002cr V/s `2,471cr in 2QFY2017, a yoy dip of 59.5%. The management

Prom oters

54.4

has maintained top-line guidance of high-single-digit decline in FY2018; EBITDA

MF / Banks / Indian Fls

18.5

margin guidance is also maintained at 20-22% for 2HFY18. We maintain our BUY.

FII / NRIs / OCBs

18.7

Indian Public / Others

8.4

US impact sales: Sales came in at `6,590cr (`7,118cr expected) v/s. `7,764cr in

2QFY2017, a yoy de-growth of 15.1%, following a decline in US sales (which was

Abs . (% )

3m

1 yr

3 yr

Sensex

6.3

29.3

17.8

impacted on the back of pricing pressures and base effect). US sales came in at

Sun Pharma

14.2

(22.4)

(36.1)

`1986cr, a yoy dip of 46.5%. Domestic Formulation sales were `2,221cr, a yoy growth

of 10.5%. On operating front, the EBITDA margins came in at 20.0% as expected v/s.

3-year price chart

34.3% in 2QFY2017, mainly on the back of lower sales during the quarter and base

1,400

effect. Thus, Adj. net profit came in at `1,002cr V/s `2,471cr in 2QFY2017, a yoy dip

1,200

of 59.5%.

1,000

Outlook and valuation: We expect its net sales to post a CAGR of 2.5% to `31,826cr

800

600

and EPS to come in at `24.8 over FY2017-19E. %. The management has maintained

400

top-line guidance of high-single-digit decline in FY2018; EBITDA margin guidance is

200

also maintained at 20-22% for 2HFY18.We maintain a Buy rating.

0

Key financials (Consolidated)

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

Source: Company, Angel Research

Net sales

27,888

30,264

28,466

31,826

% chg

2.2

8.5

(5.9)

11.8

Adj. Net profit

6,248

7,846

5,101

5,949

% chg

31.7

25.6

(35.0)

16.6

EPS (`)

26.0

32.7

21.3

24.8

EBITDA margin (%)

24.6

29.0

20.8

22.4

P/E (x)

18.7

14.8

22.8

19.6

RoE (%)

21.0

22.2

13.0

15.2

RoCE (%)

15.6

18.8

11.5

12.3

P/BV (x)

Sarabjit Kour Nangra

3.5

3.2

2.9

2.6

+91 22 39357600 Ext: 6806

EV/Sales (x)

4.0

3.6

3.7

3.2

EV/EBITDA (x)

16.3

12.5

17.9

14.4

Source: Company, Angel Research; Note: CMP as of November 22, 2017

Please refer to important disclosures at the end of this report

1

Sun Pharma | 2QFY2018 Result Update

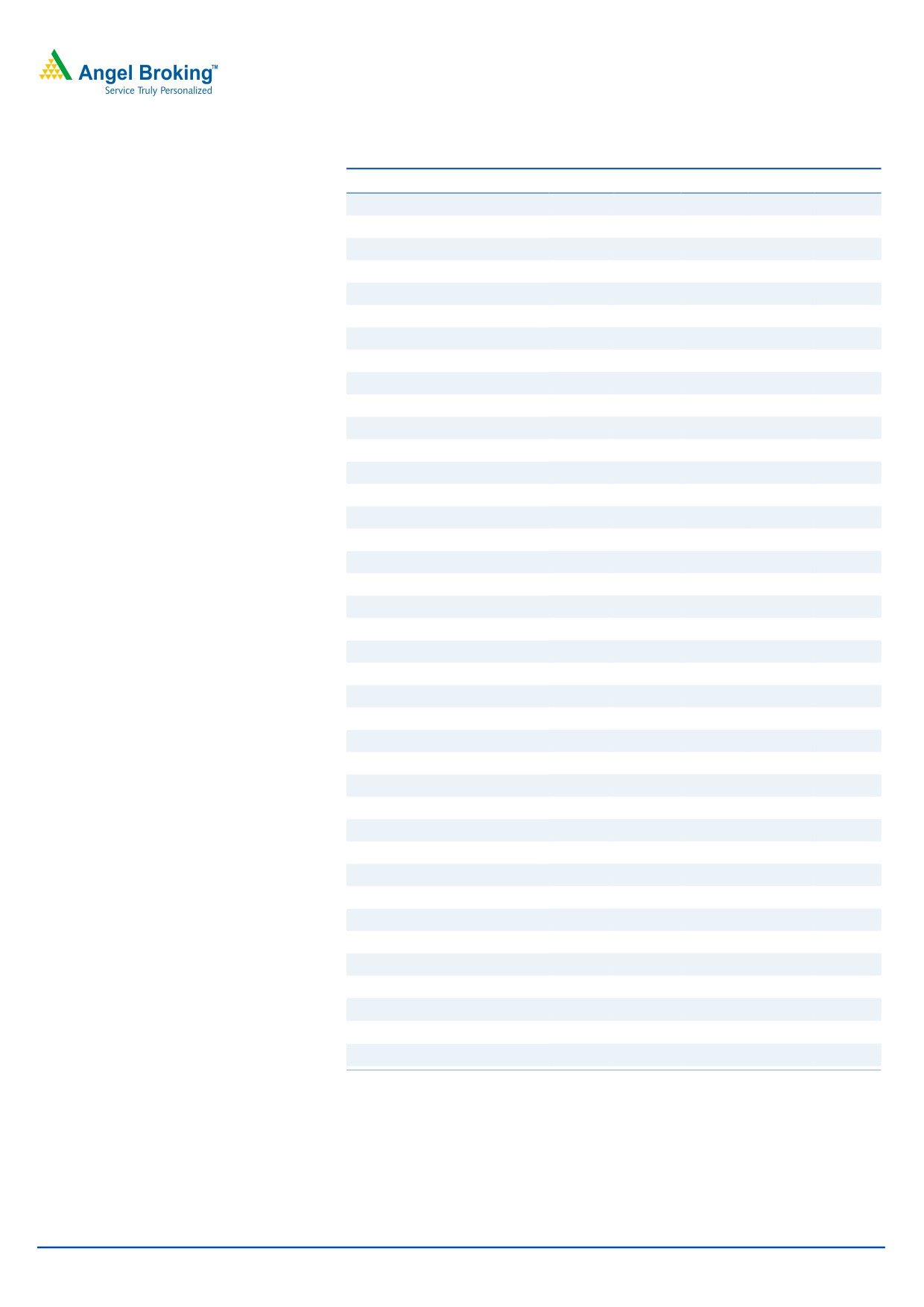

Exhibit 1: 2QFY2018 performance (Consolidated)

Y/E March (` cr)

2QFY2018

1QFY2018

% chg QoQ 2QFY2017

% chg yoy 1HFY2018 1HFY2017

% chg

Net sales

6,590

6,167

6.9

7,764

(15.1)

12,757

15,756

(19.0)

315.1

194.1

62.3

620.5

(49.2)

509

1,037

(50.9)

Other income

Total income

6,905

6,361

8.6

8,385

(17.6)

13,266

16,793

(21.0)

Gross profit

4,713

4,489

5.0

5,924

(20.5)

9,202

12,069

(23.8)

Gross margin (%)

71.5

72.8

76.3

72.1

76.6

Operating profit

1,315

1,054

24.9

2,667

(50.7)

2,369

5,328

(55.5)

20.0

17.1

34.3

18.6

33.8

Operating margin (%)

Interest

157

109

43.9

54

193.1

267

188

41.7

Depreciation

359

347

3.5

304

18.0

705

620

13.8

Extraordinary item loss/ ( gain)

0

951

0

951

0

PBT

1,114

792

40.8

2,930

(62.0)

1,906

5,557

(65.7)

111

161.8

(31.1)

441.7

(74.8)

273

794

(65.6)

Provision for taxation

PAT before extra-ordinary item

1,003

630

59.3

2,488

(59.7)

1,633

4,763

(65.7)

Minority interest(MI)

(1)

(2)

(38.4)

17

(3)

(24)

Reported PAT

1,002

632

58.6

2,471

(59.5)

1,636

4,739

(65.5)

Adj. PAT/(Loss)

1,002

(323)

-

2,471

(59.5)

679

4,739

(85.7)

4.2

2.6

9.3

6.8

17.7

Adj. EPS (`)

Source: Company, Angel Research

Exhibit 2: 2QFY2018 - Actual V/s Angel estimates

(` cr)

Actual

Estimates

Variance (%)

Net sales

6,590

7,118

(7.4)

Other income

315

200

57.6

1,315

1,422

(7.5)

Operating profit

Tax

111

162

(31.1)

Adj. Net profit

1,002

752

33.3

Source: Company, Angel Research

Sales lower than expectations: Sales came in at `6,590cr (`7,118cr expected)

v/s. `7,764cr in 2QFY2017, a yoy de-growth of 15.1%, following a decline in the

US (which was impacted on back of pricing pressures and base effect). India

sales at `1,761cr (which accounted for 33.7% of sales) were up by 10.5% yoy,

while Exports (`3,956cr) were down 26% yoy, following a 46.5% yoy dip in the US

sales during the quarter.

Sales in the US were US$309mn for the quarter, a de-growth of 44% yoy over

same period last year and accounted for 30% of total sales. Taro posted

2QFY2018 sales of US$170mn, down 26% over 2QFY2017. For the first half, sales

were US$331mn, down 28% over first half last year. Taro’s net profit for 2QFY2018

was US$ 52mn, down by 58% over 2QFY2017. Net profit for 1HFY2018 was

US$107mn, down by 54% over first half last year.

Sales in emerging markets were at US$196mn for 2QFY2018, a growth of 16% yoy

and accounted for 19% of total sales. The growth was partly boosted by the

consolidation of the Biosintez acquisition in Russia.

November 24, 2017

2

Sun Pharma | 2QFY2018 Result Update

Formulation sales in Rest of World (ROW) markets excluding US and Emerging

Markets were US$111mn in 2QFY2018, a growth of 37% from 2QFY2017 and

accounting for 11% of revenues. The growth was partly boosted by the

consolidation of revenues from the acquisition of 14 brands from Novartis.

The company had a total of 422 ANDAs filed with the USFDA. Currently, ANDAs

for 136 products await USFDA approval, including 15 tentative approvals. For

the quarter, 4 ANDAs were filed and 3 approvals were received. Additionally,

the pipeline includes 37 approved NDAs while 4 NDAs await USFDA approval.

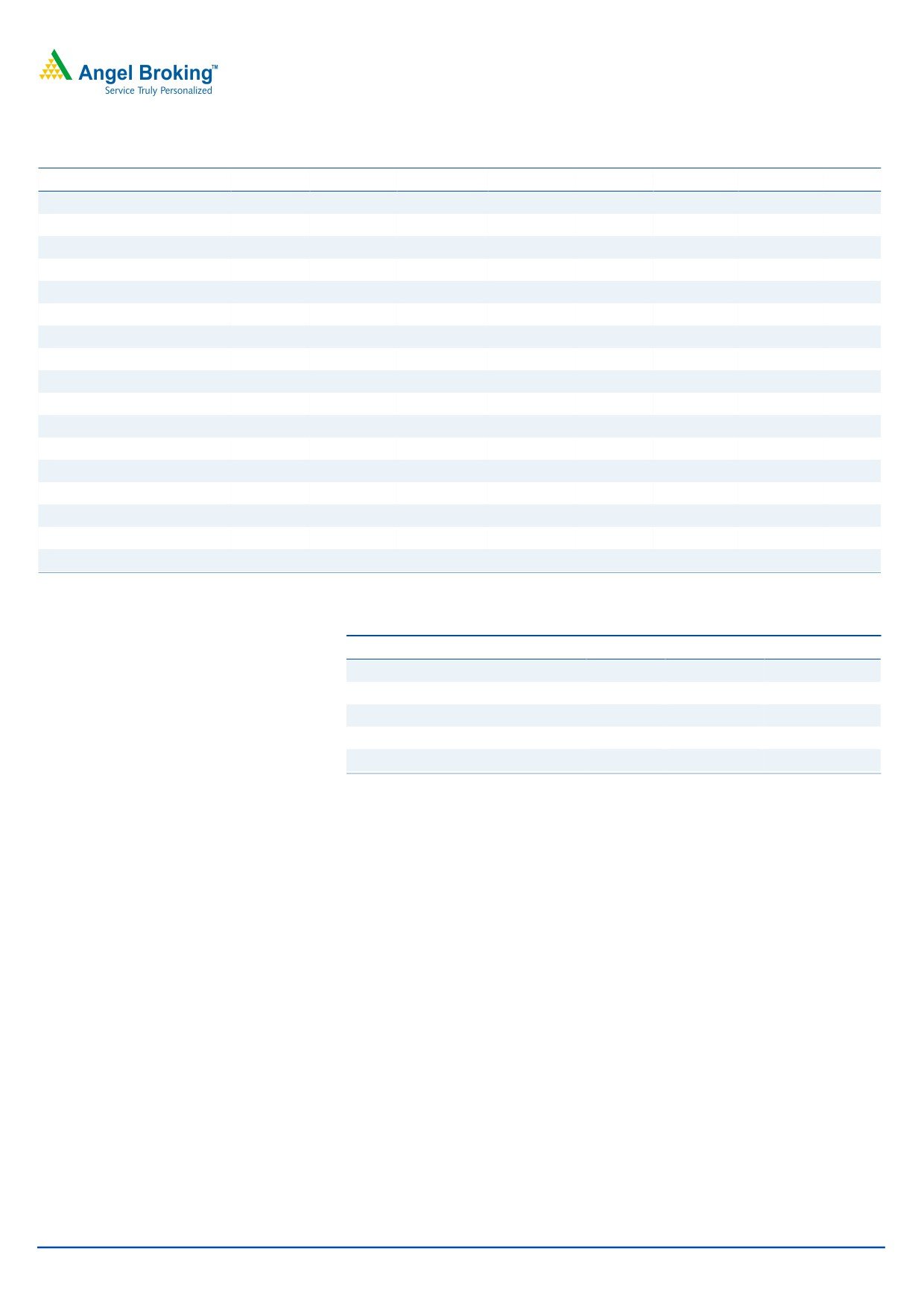

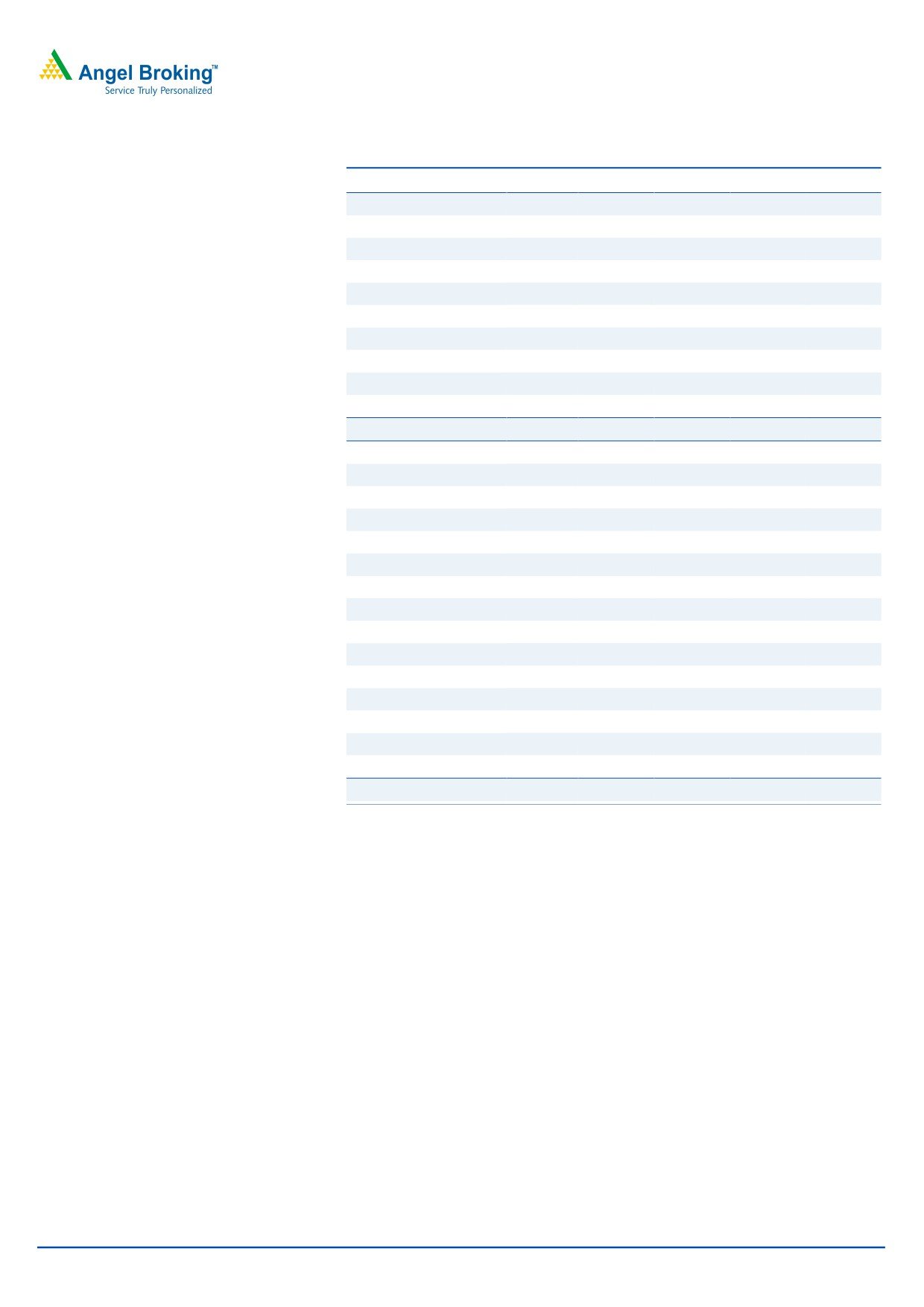

Exhibit 3: Sales trend

7000

5755

5714

6000

4909

5000

4406

4369

4000

3000

2221

2010

1969

1916

1761

2000

1000

0

2QFY2017

3QFY2017

4QFY2017

1QFY2018

2QFY2018

Domestic Formulation

Export Formulation, Bulk and others

Source: Company, Angel Research

OPM at 20.0%, lower than expected: On operating front, the EBITDA margins

came in at 20.0% as expected v/s. 34.3% in 2QFY2017, mainly on the back of

lower sales during the quarter and base effect. Gross margins came in at 71.5%

v/s. 76.3% in 2QFY2017, while R&D expenses were at 8.5% of sales v/s 7.3% of

sales during the last corresponding period.

Exhibit 4: OPM trend (%)

40.0

34.3

28.9

30.0

20.0

18.1

20.0

17.7

10.0

2QFY2017

3QFY2017

4QFY2017

1QFY2018

2QFY2018

Source: Company, Angel Research,

November 24, 2017

3

Sun Pharma | 2QFY2018 Result Update

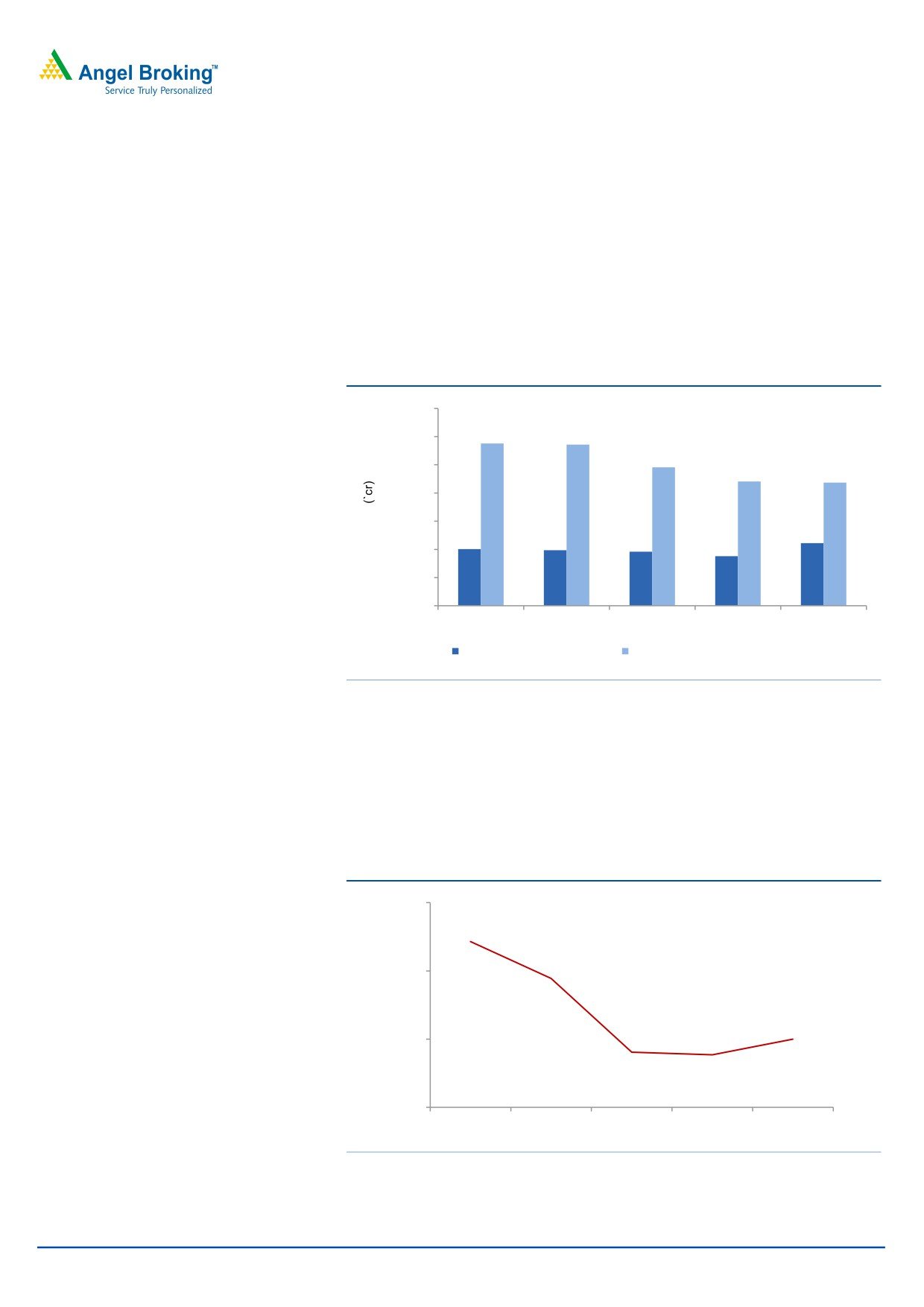

Net profit above expectations; mainly driven by other income:

Thus, Adj. net profit came in at `1,002cr V/s `2,471cr in 2QFY2017, a yoy dip of 59.5%,

but higher compared to `752cr expected, mainly on back of better than expected

other income. The yoy dip was mainly on back of lower sales and base effect, further

augmented by the 193.1% yoy rise in interest expenses.

Exhibit 5: Adjusted Net profit trend (` cr)

3,000

2,471

2,500

2,000

1,472

1,386

1,500

1,002

1,000

632

500

0

2QFY2017

3QFY2017

4QFY2017

1QFY2018

2QFY2018

Source: Company, Angel Research

Concall takeaways

The management has maintained top-line guidance of high-single-digit

decline in FY2018.

Company expects US FDA inspection at Halol before CY2017-end

2HFY2018E EBITDA margin to be ~20-22%.

MK-3222- EU approval deferred to CY2018-end/CY2019- beginning; US

approval expected in 2018.

Investment arguments

Strongest ANDA pipeline: Sun Pharma, with the recent acquisitions of DUSA,

URL Pharma and Ranbaxy Laboratories, has now become strong in the US

region, which accounted for 37% of its sales in FY2017. In terms of ANDAs,

the company cumulatively has 422 products, out of which 136 products

now await USFDA approval, including 15 tentative approvals. With the

merger of Ranbaxy Laboratories, the company is now the fifth-largest

specialty generics company in the world (behind Teva, Sandoz, Activas and

Mylan). However, the near term performance of the company has been

impacted on the back of supply constraints at the Halol facility; although

the company has taken redemption measures including site transfers. Also,

during FY2018, the company like other generic players in the US is expecting

a pricing dip on back of the consolidation in the buyers chain (4 players

hold now 90% market share). Overall, we expect the region to post a CAGR

of -10.5% in sales over FY2017-19E, accounting for almost 34% of the overall

sales in FY2019E.

November 24, 2017

4

Sun Pharma | 2QFY2018 Result Update

Domestic business: Sun Pharma’s domestic formulation business is among

the fastest growing in the Indian pharmaceutical industry. It contributed 23%

to the company’s total turnover in FY2014. Sun Pharma, with Ranbaxy

Laboratories’ merger, is now the segment leader with a market share of 8.7%

in the domestic formulation market, followed by Abbott India, which has a

market share of 6.5%. This is a significant gap considering that the segment

is highly fragmented. We expect the domestic formulation business to post

a CAGR of 15.0% over FY2017-19E, contributing

32% to the overall

formulation sales of the company in FY2019.

Healthy balance sheet: Sun Pharma has one of the strongest balance sheets

in the sector with cash of ~`15,000cr. The same can continue to support the

Management in inorganic growth and in scouting for acquisitions,

especially in the US and in emerging markets.

Outlook and valuation: Sun Pharma is one of the largest and fastest growing

Indian pharmaceutical companies. We expect its net sales to post a CAGR

of 2.5% (including Ranbaxy Laboratories) to `31,826cr and EPS to post a

CAGR of 8.0% to `24.8 over FY2017-19E. We recommend a Buy.

Exhibit 6: Key assumptions

FY2018E

FY2019E

Domestic Formulation sales growth (%)

10.0

20.0

Export Formulation sales growth (%)

(11.8)

9.9

Growth in employee expenses (%)

15.0

15.0

Operating margins (%)

20.7

22.4

Tax as % of PBT

15.0

15.0

Source: Company, Angel Research

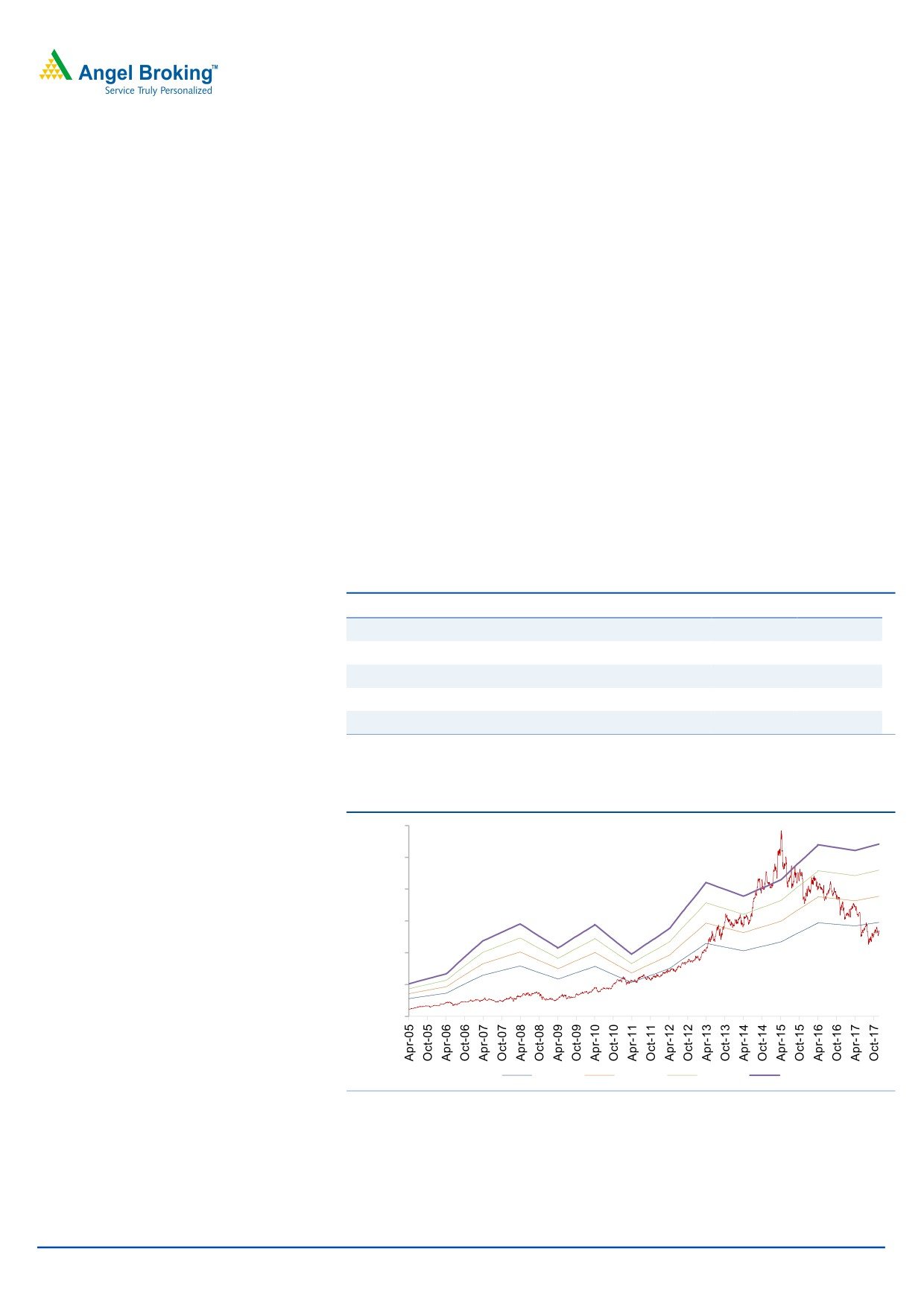

Exhibit 7: One-year forward PE band

1,200

1,000

800

600

400

200

-

10x

15x

20x

25x

Source: Company, Angel Research

November 24, 2017

5

Sun Pharma | 2QFY2018 Result Update

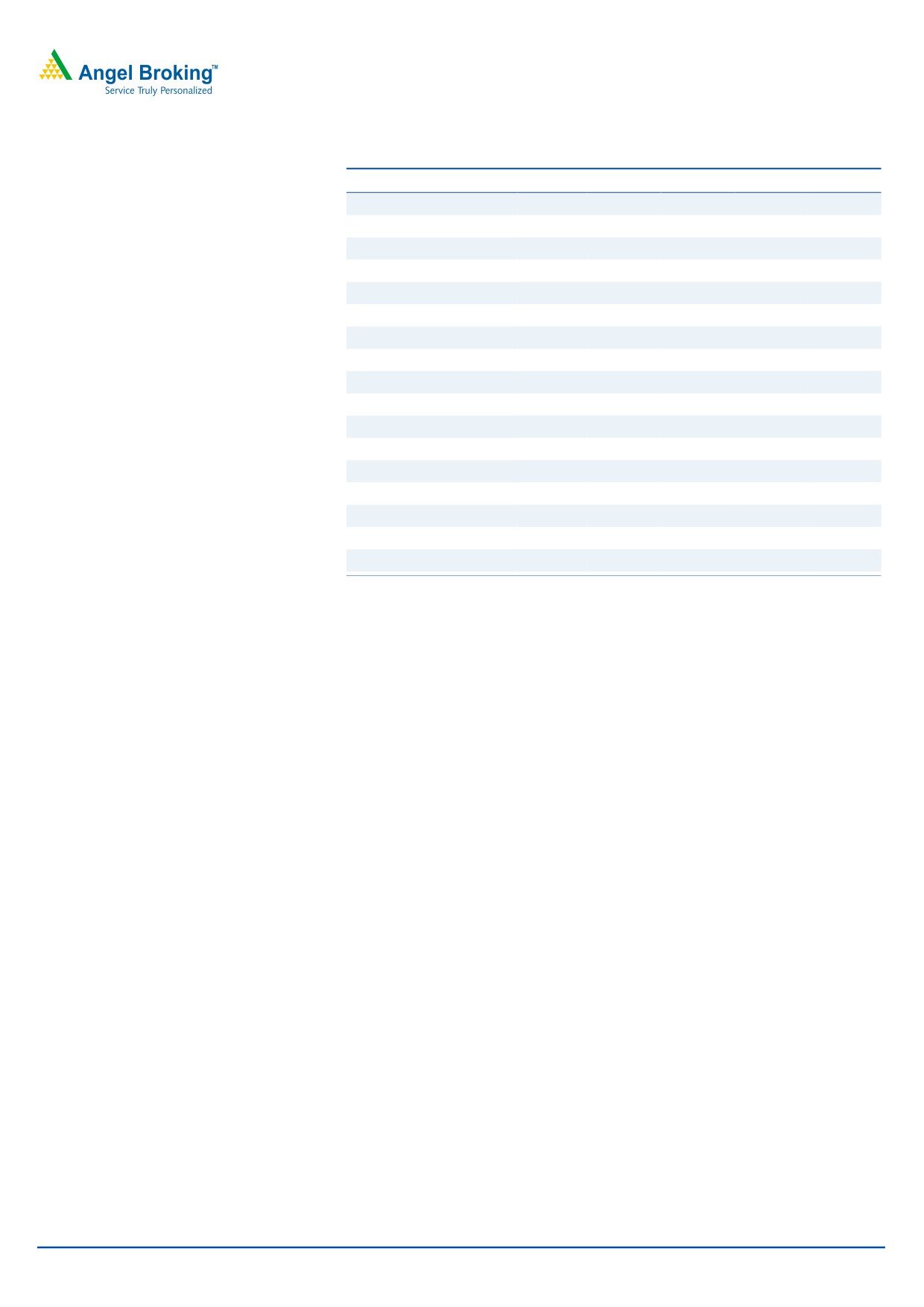

Exhibit 8: Valuation summary

Company

Reco

CMP Tgt. Price Upside

FY2019E

FY17-19E

FY2019E

PE

EV/Sales

EV/EBITDA

CAGR in EPS

RoCE

RoE

(`)

(`)

%

(x)

(x)

(x)

(%)

(%)

(%)

Alembic Pharma

Buy

511

600

17.3

21.4

2.9

13.0

5.7

20.6

18.4

Aurobindo Pharma Buy

699

823

17.8

13.6

2.5

9.9

14.2

25.3

22.7

Cadila Healthcare Reduce

443

411

(7.2)

21.6

4.1

17.6

18.9

16.5

22.2

Cipla

Sell

619

462

(25.3)

25.5

3.2

16.2

39.3

10.9

13.1

Dr Reddy's

Reduce

2,361

2,040

(13.6)

23.2

3.1

13.3

18.5

10.3

12.4

Dishman Pharma

Under Review

301

-

-

19.3

2.7

10.1

23.3

4.5

4.4

GSK Pharma

Sell

2,496

2,000

(19.9)

53.9

6.9

39.3

19.3

25.8

23.5

Indoco Remedies Sell

280

136

(49.0)

23.5

2.1

14.9

16.2

10.1

14.5

Ipca labs

Neutral

535

-

-

21.2

1.9

13.5

24.7

12.4

11.0

Lupin

Buy

828

1,091

31.8

16.7

2.4

9.3

(6.6)

13.7

13.7

Sanofi India*

Neutral

4,434

-

-

27.1

3.8

17.0

12.8

25.8

27.5

Sun Pharma

Buy

535

615

15.0

24.0

3.7

16.3

(17.5)

11.3

14.0

Source: Company, Angel Research; Note: * December year ending

Company background

Sun Pharma is an international specialty pharma company, with a large

presence in the US and India, and a footprint across 40 other markets. In India

and rest of the world markets, the key chronic therapy areas for the company

are cardiology, psychiatry, neurology, gastroenterology, diabetology, etc. The

company is a market leader in specialty therapy areas in India. In India, the

company has emerged as a leading pharma company, where it is the third

largest player. Also, in the US, a key geography, the company has expanded

significantly through both in-organic and organic routes.

November 24, 2017

6

Sun Pharma | 2QFY2018 Result Update

Profit & Loss statement (Consolidated)

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018E FY2019E

27,652

28,254

30,536

28,569

32,115

Gross sales

Less: Excise duty

366

366

272

257

289

Net sales

27,287

27,888

30,264

28,312

31,826

147

599

1,314

599

599

Other operating income

Total operating income

27,433

28,487

31,578

28,911

32,425

70.6

3.8

10.9

-8.4

12.2

% chg

Total expenditure

19,470

21,014

21,489

22,446

24,699

Net raw materials

6,739

6,330

8,131

7,644

8,550

1,192

1,218

1,322

1,237

1,390

Other mfg costs

Personnel

4,430

4,772

4,902

5,638

6,483

7,109

8,693

7,134

7,927

8,275

Other

EBITDA

7,817

6,874

8,775

5,866

7,127

% chg

12.9

(12.1)

(27.5)

(56.5)

3.7

28.6

24.6

29.0

20.7

22.4

(% of Net Sales)

Depreciation & amort.

1,195

1,038

1,265

1,465

1,665

6,622

6,436

8,825

5,000

6,061

EBIT

% chg

1.7

(2.8)

(18.7)

(43.3)

21.2

(% of Net Sales)

24.3

23.1

29.2

17.7

19.0

579

523

400

400

400

Interest & other charges

Other income

451

1,248

623

623

623

6.8

17.4

6.9

11.9

9.9

(% of PBT)

Share in profit of Asso.

-

-

-

1.0

Recurring PBT

6,641

7,161

9,048

5,223

6,285

(6.4)

7.8

(16.8)

0.0

0.1

% chg

Extraordinary expense/(inc.)

237.8

589.9

-

951

-

6,641

7,161

9,048

4,272

6,285

PBT (reported)

Tax

914.7

913.8

1,211.6

640.9

942.7

(% of PBT)

13.8

12.8

13.4

15.0

15.0

5,726

6,247

7,836

3,632

5,342

PAT (reported)

Add: Share of earnings of asso.

(13)

1

10

-

-

936

-

-

-

-

Less: Minority interest (MI)

Prior period items

-

-

-

-

4,539

5,658

7,846

3,632

5,342

PAT after MI (reported)

4,743

6,248

7,846

4,440

5,342

ADJ. PAT

% chg

(10.0)

31.7

65.4

(53.7)

47.1

16.6

0.0

1.0

2.0

3.0

(% of Net Sales)

Basic EPS (`)

22.9

26.0

32.7

18.5

22.3

22.9

26.0

32.7

18.5

22.3

Fully Diluted EPS (`)

(10.0)

13.4

42.8

(43.4)

20.3

% chg

November 24, 2017

7

Sun Pharma | 2QFY2018 Result Update

Balance Sheet (Consolidated)

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018E

FY2019E

SOURCES OF FUNDS

207

241

240

240

240

Equity share capital

Preference capital

26,300

32,742

36,400

38,908

43,127

Reserves & surplus

Shareholders’ funds

26,507

32,982

36,640

39,148

43,367

2,851

4,085

3,791

3,791

3,791

Minority interest

Total loans

7,596

8,316

8,091

8,091

8,091

Deferred tax liability

(1,752)

(3,046)

(2,178)

(2,178)

(2,178)

Other Long Term Liabilities

9

-

-

-

-

Long Term Provisions

2,710

2,106

1,342

2,355

2,591

Total liabilities

37,922

44,443

47,685

51,207

55,663

APPLICATION OF FUNDS

15,041

15,084

18,162

19,162

20,162

Gross block

Less: Acc. depreciation

4,863

7,139

8,404

9,869

11,534

10,179

7,945

9,758

9,293

8,628

Net block

Capital work-in-progress

842

842

303

303

303

3,701

9,261

10,417

10,417

10,417

Goodwill

Investments

2,716

1,830

1,192

1,388

1,389

Long term long & adv.

2,736

3,276

4,526

3,956

4,425

27,005

29,227

32,723

34,330

39,831

Current assets

Cash

10,998

13,182

15,141

17,745

21,201

2,193

2,006

2,480

2,332

2,608

Loans & advances

Other

13,813

14,040

15,102

14,253

16,022

9,256

7,938

11,232

8,479

9,330

Current liabilities

Net current assets

17,748

21,290

21,491

25,851

30,501

Others

-

-

-

-

-

Total assets

37,922

44,443

47,685

51,207

55,663

November 24, 2017

8

Sun Pharma | 2QFY2018 Result Update

Cash Flow Statement (Consolidated)

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018E

FY2019E

Profit before tax

6,641

7,161

9,048

5,223

6,285

Depreciation

1,195

1,038

1,265

1,465

1,665

(Inc)/Dec in working capital

(4,322)

(1,898)

(2,505)

(12,062)

(2,341)

Direct taxes paid

915

914

1,212

641

943

2,598

5,386

6,596

(6,015)

4,665

Cash Flow from Operations

(Inc.)/Dec.in Fixed Assets

(8,653)

(43)

(1,682)

(1,000)

(1,000)

(Inc.)/Dec. in Investments

70

886

1,524

(196)

(1)

Other income

-

-

-

-

-

Cash Flow from Investing

(8,583)

843

(157)

(1,196)

(1,001)

Issue of Equity

-

-

-

-

-

(4,928)

(1,333)

(1,873)

1,013

236

Inc./(Dec.) in loans

Dividend Paid (Incl. Tax)

-

(282)

(1,123)

(1,123)

(1,123)

Others

14,320

(2,431)

(1,485)

9,925

678

9,392

(4,046)

(4,480)

9,815

(209)

Cash Flow from Financing

Inc./(Dec.) in Cash

3,408

2,184

1,959

2,604

3,456

Opening Cash balances

7,590

10,998

13,182

15,141

17,745

10,998

13,182

15,141

17,745

21,201

Closing Cash balances

November 24, 2017

9

Sun Pharma | 2QFY2018 Result Update

Key Ratios

Y/E March

FY2015

FY2016

FY2017

FY2018E

FY2019E

Valuation Ratio (x)

23.4

20.6

16.4

28.9

24.0

P/E (on FDEPS)

P/CEPS

19.3

19.2

14.1

25.2

18.3

P/BV

4.9

3.9

3.5

3.3

3.0

0.6

0.2

0.2

0.2

0.2

Dividend yield (%)

EV/Sales

3.9

4.5

4.0

4.2

3.7

EV/EBITDA

13.7

18.1

13.8

20.4

16.3

2.8

2.8

2.5

2.3

2.1

EV / Total Assets

Per Share Data (`)

EPS (Basic)

22.9

26.0

32.7

18.5

22.3

22.9

26.0

32.7

18.5

22.3

EPS (fully diluted)

Cash EPS

27.7

27.8

38.0

21.2

29.2

3.0

1.0

1.0

1.0

1.0

DPS

110.2

137.1

152.3

162.7

180.2

Book Value

Dupont Analysis

24.3

23.1

29.2

17.7

19.0

EBIT margin

86.2

87.2

86.6

85.0

85.0

Tax retention ratio

Asset turnover (x)

1.2

1.0

1.1

0.9

1.0

26.1

19.7

27.5

13.2

15.5

ROIC (Post-tax)

Cost of Debt (Post Tax)

9.8

5.7

4.4

8.4

4.1

Leverage (x)

0.0

0.0

0.0

0.0

0.0

26.1

19.7

27.5

13.2

15.5

Operating ROE

Returns (%)

ROCE (Pre-tax)

21.1

15.6

18.8

10.1

11.3

38.3

29.6

41.3

22.4

26.1

Angel ROIC (Pre-tax)

ROE

21.1

21.0

22.2

11.5

14.0

Turnover ratios (x)

2.6

1.9

1.9

1.5

1.6

Asset Turnover (Gross Block)

Inventory / Sales (days)

58

77

76

87

90

Receivables (days)

50

76

76

87

90

61

91

95

69

69

Payables (days)

WC cycle (ex-cash) (days)

82

95

71

51

98

Solvency ratios (x)

(0.1)

(0.1)

(0.2)

(0.2)

(0.3)

Net debt to equity

Net debt to EBITDA

(0.4)

(0.7)

(0.8)

(1.6)

(1.8)

Interest Coverage (EBIT/Int.)

-

-

-

-

-

November 24, 2017

10

Sun Pharma | 2QFY2018 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of

India Limited, Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a

Depository Participant with CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund

Distributor. Angel Broking Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research

Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been debarred/

suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the

company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any

investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this

document should make such investigations as they deem necessary to arrive at an independent evaluation of an

investment in the securities of the companies referred to in this document (including the merits and risks involved), and

should consult their own advisors to determine the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding

positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a

report on a company's fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports

available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other

reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on

as such, as this document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies

shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the

information contained in this report. Angel Broking Pvt. Limited has not independently verified all the information contained

within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the

accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited endeavors to update on a

reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that

prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be

reproduced, redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may

Disclosure of Interest Statement

Sun Pharma

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

Yes

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 24, 2017

11