4QFY2017 Result Update | Pharmaceutical

May 22, 2017

GlaxoSmithKline Pharmaceuticals

NEUTRAL

CMP

`2,428

Performance Highlights

Target Price

-

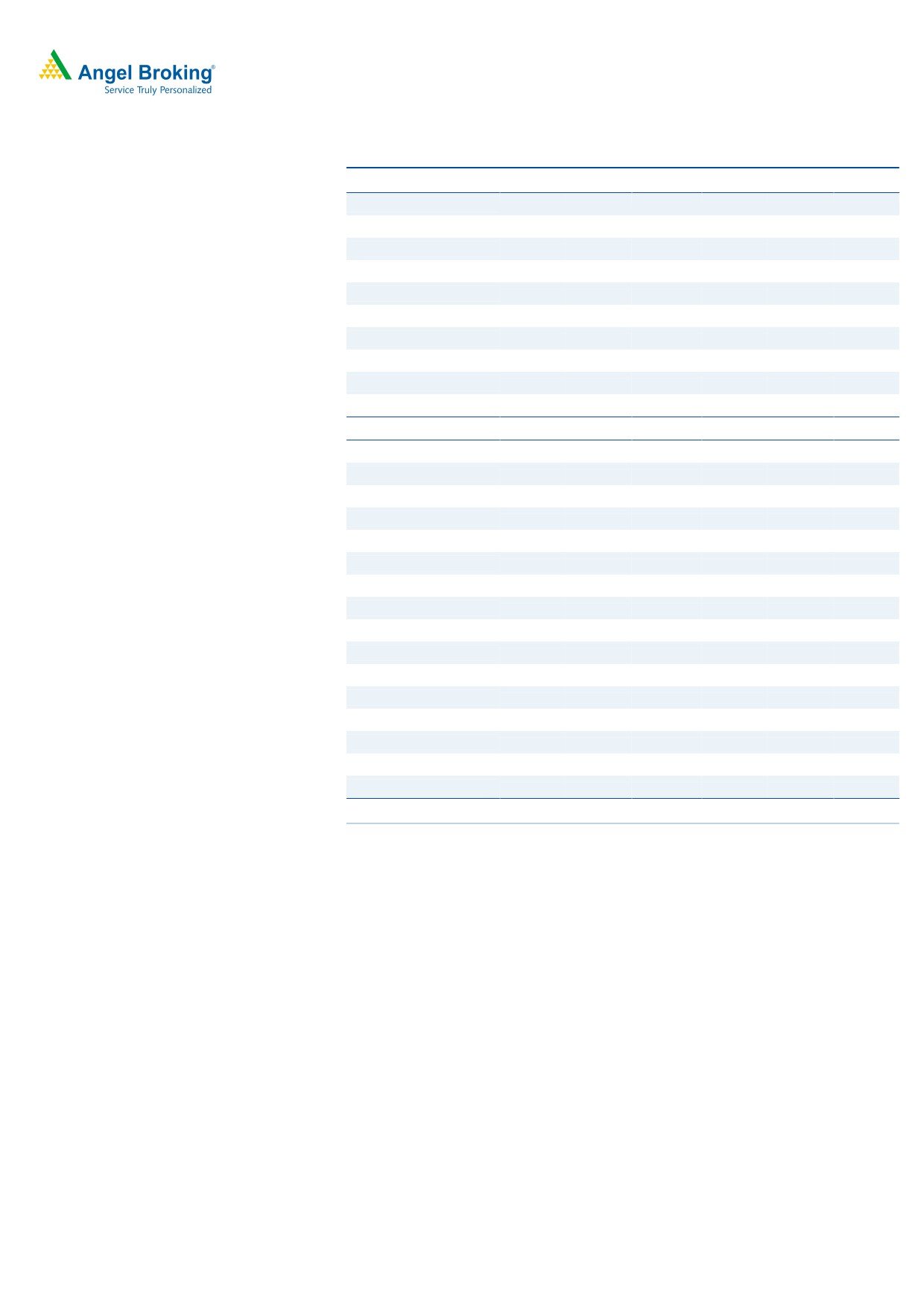

Y/E Mar (` cr)

4QFY2017

3QFY2017

% chg (QoQ)

4QFY2016

% chg (YoY)

Investment Period

-

Net Sales

763

689

10.8

688

10.9

Stock Info

Other income

35

38

(6.6)

58

(39.5)

Sector

Pharmaceutical

Gross profit

402

332

21.1

381

5.7

Market Cap (` cr)

20,566

Operating profit

116

35

232.2

111

5.0

Net Debt (` cr)

(936)

Adj. PAT

Beta

0.20

87

41

112.3

95

(9.2)

Source: Company, Angel Research

52 Week High / Low

3,850/2,397

Avg. Daily Volume

1,118

GlaxoSmithKline Pharmaceuticals (GSK) posted better than expected results on

sales and OPM fronts for 4QFY2017. The revenues came in at `763cr v/s

Face Value (`)

10

`690cr expected, registering a yoy growth of 10.9%. On the OPM front, the

BSE Sensex

30,465

EBDITA margins came in at 15.2% (v/s 11.3% expected) as compared to 16.1%

Nifty

9,428

in 4QFY2016. The Adj. PAT for the quarter came in at `86.7cr v/s `95.4cr in

Reuters Code

GLAX.BO

4QFY2016, a yoy dip of 9.2%. Given the valuations we maintain our Neutral.

Bloomberg Code

GLXO@IN

Results better than expectations: The revenues came in at `763cr v/s `690cr

Shareholding Pattern (%)

expected, registering a yoy growth of 10.9%. On the OPM front, the EBDITA margins

Promoters

75.0

came in at 15.2% (v/s 11.3% expected) as compared to 16.1% in 4QFY2016. The

MF / Banks / Indian Fls

10.8

expansion in margin was on the back of lower than expected employee and other

FII / NRIs / OCBs

2.1

expenses, which grew by 8.0% and 4.6% yoy respectively. The Adj. PAT during the

Indian Public / Others

12.1

quarter came in at `86.7cr v/s `95.4cr in 4QFY2016, a yoy dip of 9.2%.

Outlook and valuation: Company has a strong balance sheet with cash of ~`900cr,

which could be used for future acquisitions or higher dividend payouts. On the

Abs. (%)

3m 1yr

3yr

operational front, we expect the company’s net sales to post a CAGR of 12.2% to

Sensex

5.9

21.2

25.4

`3,685cr, while the EPS is expected to post a CAGR of 31.7% over FY2017-19E. We

Glaxo

(9.2)

(27.7)

(5.3)

remain Neutral on the stock.

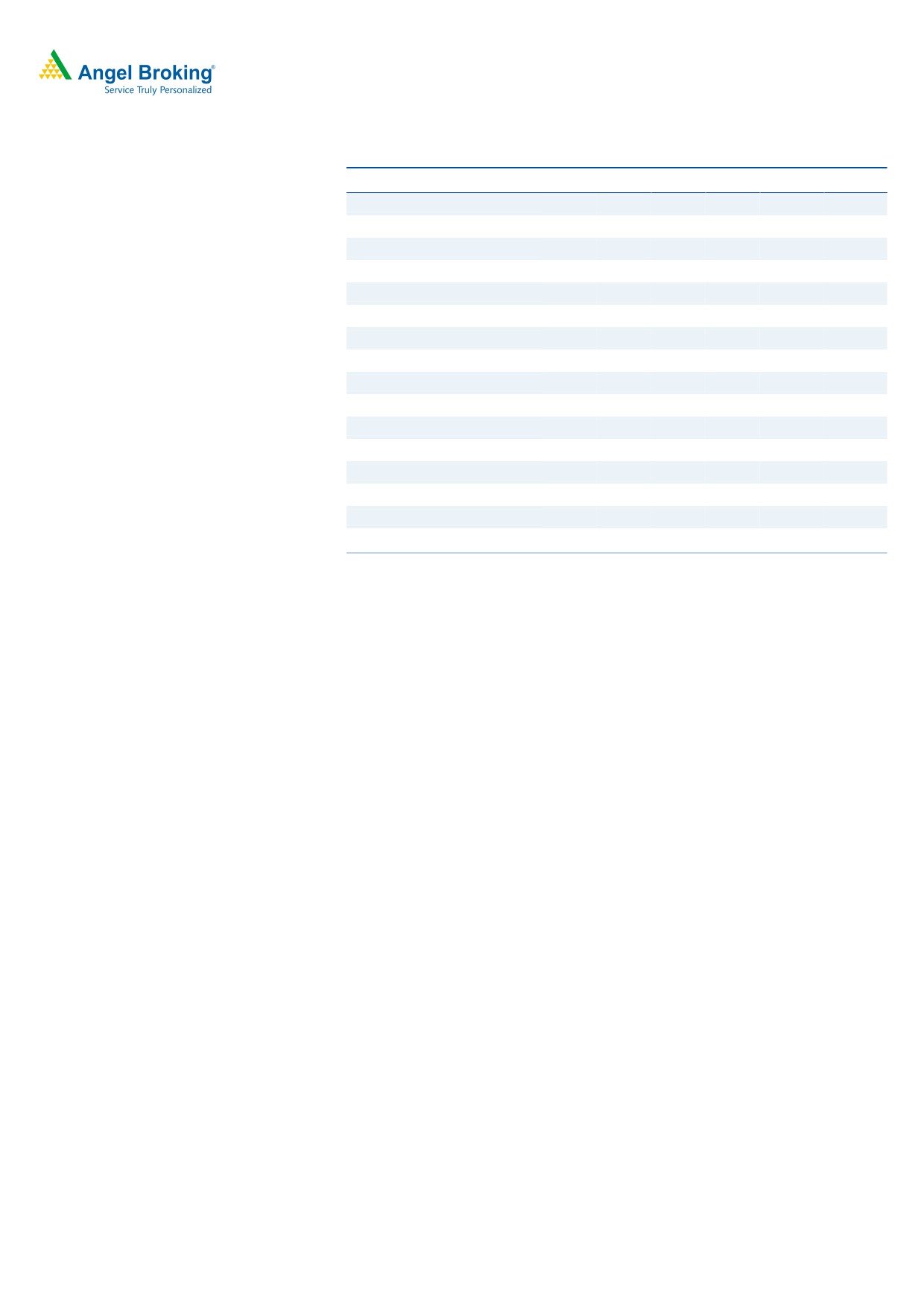

Key financials (Consolidated)

Y/E Mar (` cr)

FY2016

FY2017

FY2018E

FY2019E

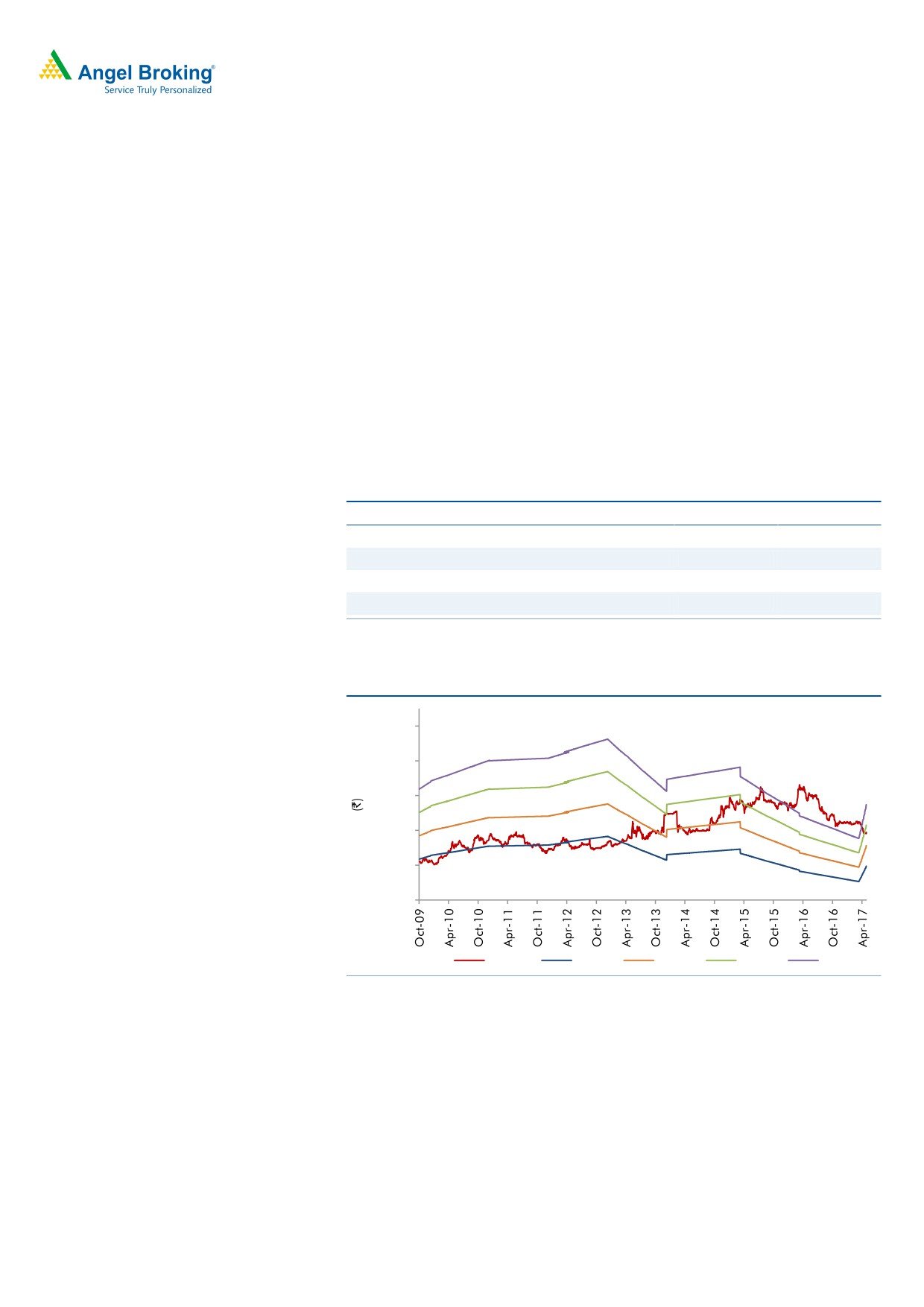

3-year price chart

Net sales

4,000

2,741

2,927

3,290

3,685

% chg

3,500

(16.2)

6.8

12.4

12.0

Net profit

374

291

420

505

3,000

% chg

(26.5)

(22.2)

44.4

20.1

2,500

EPS (`)

44.2

34.4

49.6

59.6

2,000

EBITDA (%)

16.5

11.8

16.2

18.1

1,500

P/E (x)

55.0

70.7

48.9

40.7

RoE (%)

18.7

13.9

21.3

26.5

RoCE (%)

Source: Company, Angel Research

19.4

14.0

22.3

29.1

P/BV (x)

9.4

10.2

10.6

10.9

EV/Sales (x)

7.0

6.7

6.1

5.5

Sarabjit Kour Nangra

EV/EBITDA (x)

42.5

56.8

37.3

30.4

+91 22 39357800 Ext: 6806

Source: Company, Angel Research; Note: CMP as of May 22, 2016;

Please refer to important disclosures at the end of this report

1

Glaxo Pharma | 4QFY2017 Result Update

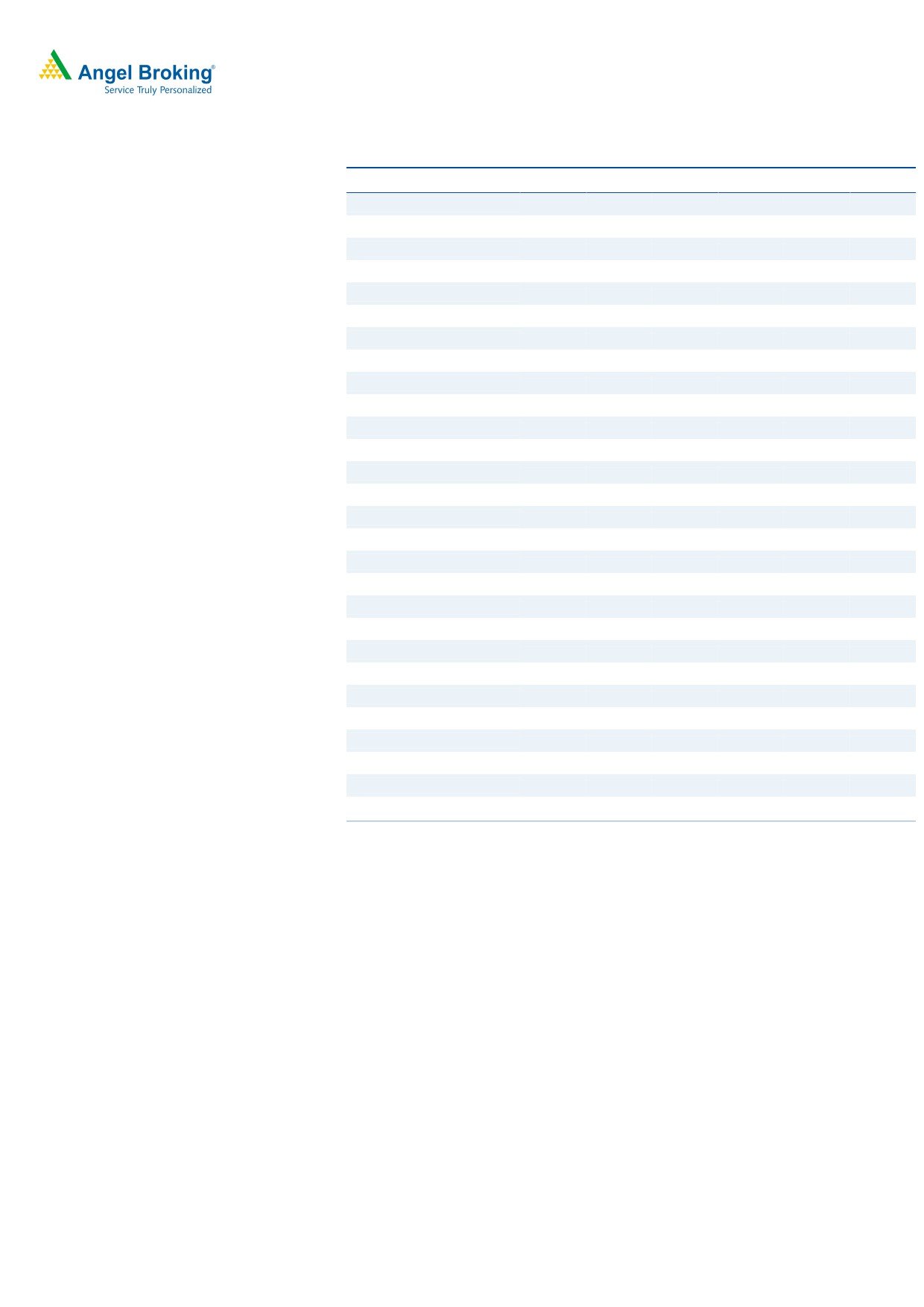

Exhibit 1: 4QFY2017 - Standalone performance

Y/E March (` cr)

4QFY2017

3QFY2017

% chg (QoQ)

4QFY2016

% chg (YoY)

FY2017

FY2016

% chg

Net Sales

763

689

10.8

688

10.9

2,921

2,753

6.1

Other income

35

38

(6.6)

58

(39.5)

145

197

(26.3)

Total Income

799

727

9.9

746

7.0

3,066

2,950

3.9

Gross profit

402

332

21.1

381

5.7

1,527

1,525

0.1

Gross margin

52.7

48.2

55.3

52.3

55.4

Operating profit

116

35

232.2

111

5.0

346

404

(14.2)

Operating margin (%)

15.2

5.1

16.1

11.9

14.7

Interest

0

0

-

0

-

0

0

-

Depreciation & Amortization

8

7

17.9

7

15.9

26

25

5.6

PBT & Exceptional Items

144

66

117.6

162

(11.4)

465

576

(19.2)

Less : Exceptional Items

26

12

-

10

-

46

2

Profit before tax

170

78

116.9

173

(1.7)

511

577

(11.5)

Provision for taxation

57

25

126.1

56

1.1

174

201

(13.5)

Reported PAT

113

53

112.6

79

42.7

337

375

(10.1)

Adj. Net profit

87

41

112.3

95

(9.2)

291

373

(22.0)

EPS (`)

10.2

4.8

11.3

34.4

44.0

Source: Company, Angel Research,

Exhibit 2: 4QFY2017 - Actual Vs Angel estimates

(` cr)

Actual

Estimates

Variation (%)

Net sales

10.6

763

690

Other income

(29.4)

35

50

Operating profit

48.9

116

78

Tax

126.1

57

25

Adj. net profit

(9.8)

87

96

Source: Company, Angel Research

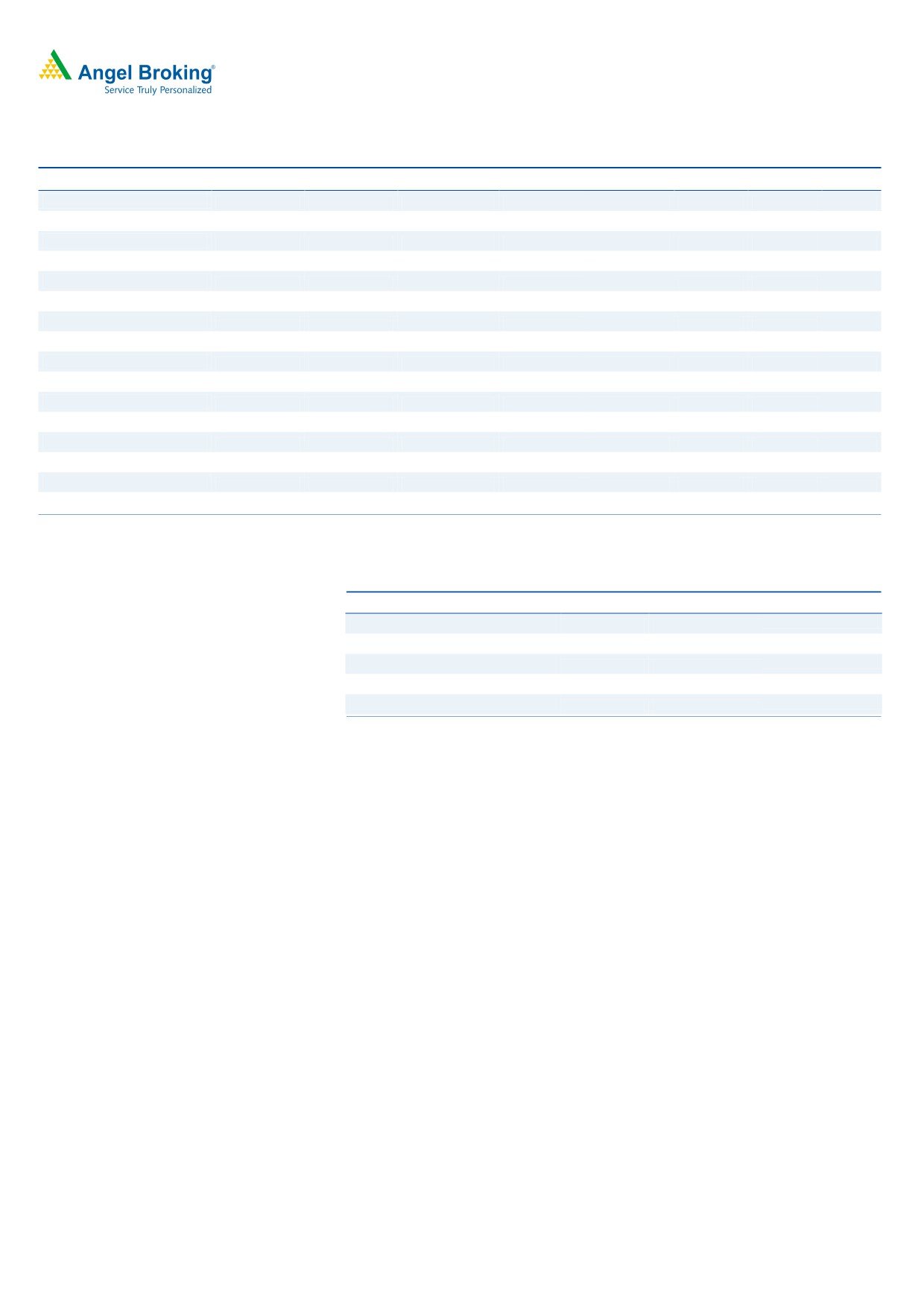

Revenue grew by 10.9% yoy

The revenues came in at `763cr v/s `690cr expected, registering a yoy growth of

10.9%. For FY’2017, the sales grew by 6.1% yoy to end the period at `2,921cr.

The sales during the year were impacted on the back of the mandatory price cuts.

The current quarter saw a bit of bounce back, with company posting sales growth

in-line with the Industry.

May 23, 2017

2

Glaxo Pharma | 4QFY2017 Result Update

Exhibit 3: Sales trend

783

800

40.0

763

35.0

686

685

689

30.0

700

25.0

20.0

600

15.0

10.0

5.0

500

0.0

(5.0)

400

(10.0)

4QFY2016 1QFY2017 2QFY2017 3QFY2017 4QFY2017

Sales

Growth (YoY)

Source: Company, Angel Research

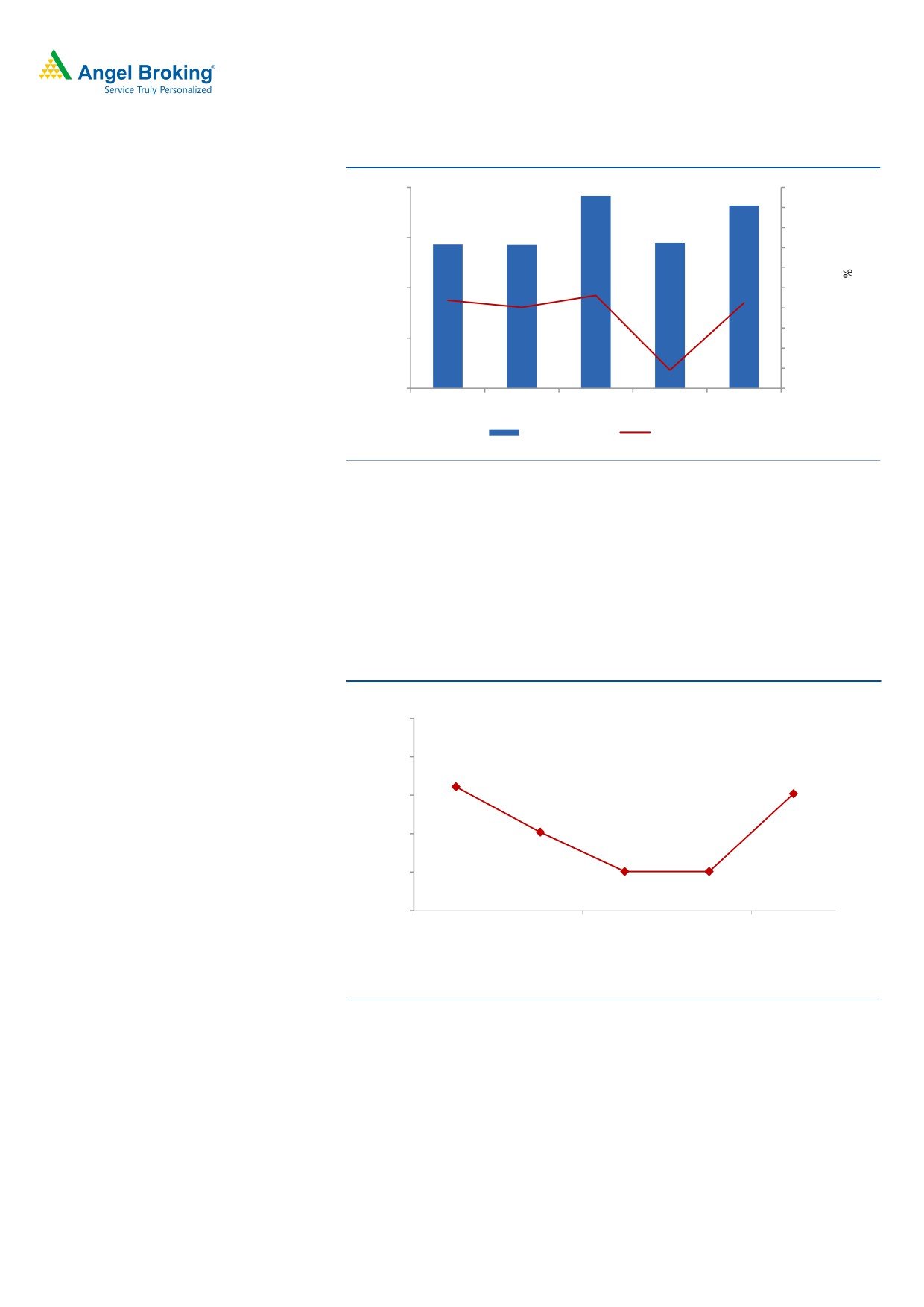

OPM comes higher than expected at 15.2%

On the OPM front, the EBDITA margins came in at 15.2% (v/s 11.3% expected) as

compared to 16.1% in 4QFY2016. The margin expansion happened on back of

lower than expected employee and other expenses, which grew by 8.0% and 4.6%

yoy respectively. The higher than expected margin expansion was on the back of

the low growth in other expenses and employee expenses.

Exhibit 4: OPM trend

25.0

20.0

16.1

15.0

10.2

15.2

10.0

5.1

5.1

5.0

0.0

4QFY2016 1QFY2017 2QFY2017 3QFY2017 4QFY2017

Source: Company, Angel Research

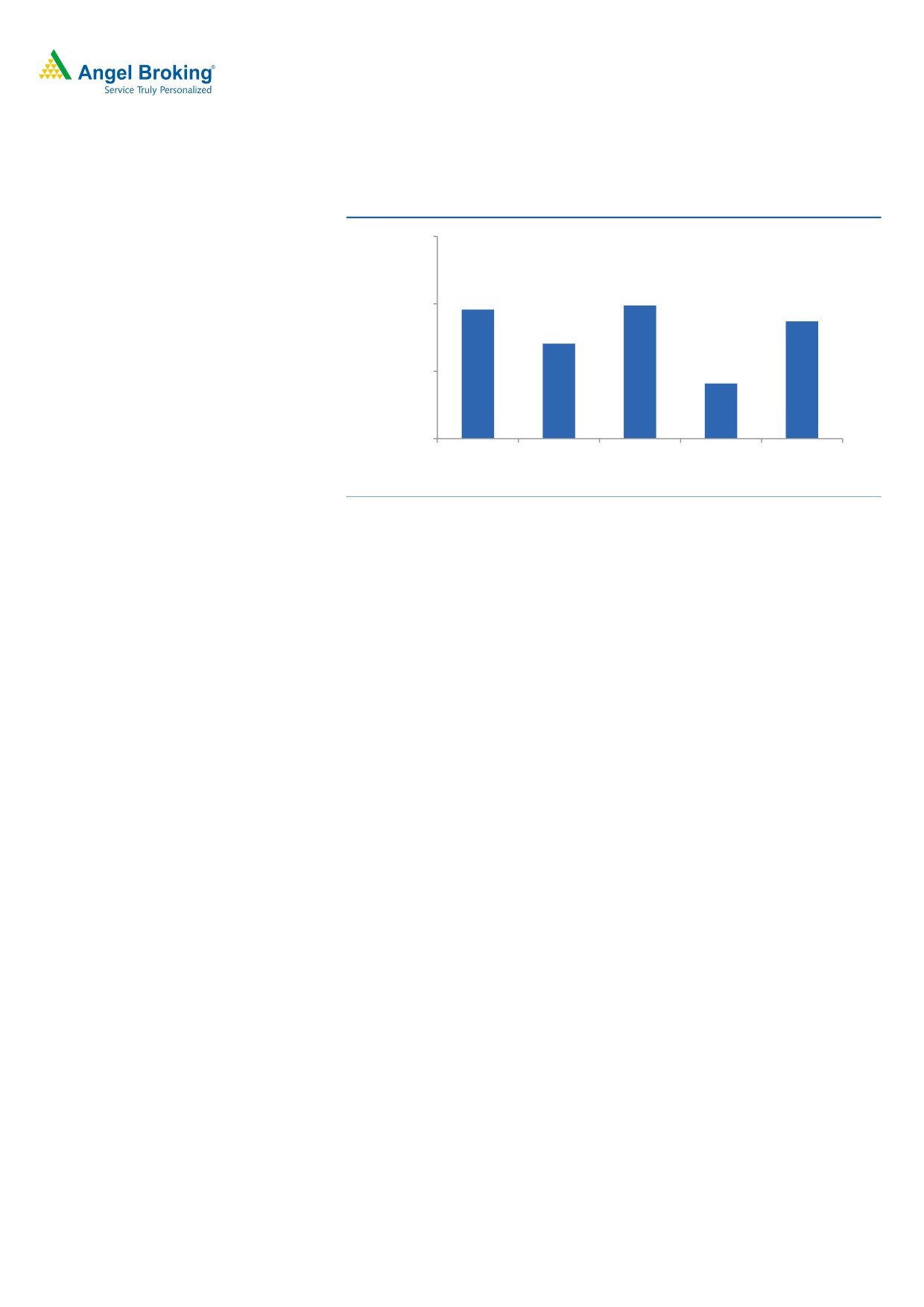

Net profit lower than estimated

The Adj. PAT during the quarter came in at `86.7cr v/s `95.4cr in 4QFY2016, a

yoy dip of 9.2%. The reported profit came in at `112.6cr v/s `105.8cr, a yoy

growth of 6.4%. Also, during the quarter the company posted an exceptional net

gain of `25.9cr, which was related to the sale of properties and proceeds from

sale of the non-core brands.

May 23, 2017

3

Glaxo Pharma | 4QFY2017 Result Update

Exhibit 5: Adjusted net profit trend

150

99

96

100

87

70

50

41

0

4QFY2016 1QFY2017 2QFY2017 3QFY2017 4QFY2017

Source: Company, Angel Research

May 23, 2017

4

Glaxo Pharma | 4QFY2017 Result Update

Recommendation rationale

Renewed focus on the Indian market: GSK is among the top ten players in the

Indian pharmaceutical market, having a market share of ~3.7%. Unlike other

MNCs, the company has been amongst the few which have taken initiatives to

grow their businesses in the Indian market with consistent launch of new products.

Over the last six years, the company has strategically decided to expand its

presence in the Specialty segment. The Specialty segment’s contribution to sales

has reached 23% (as of 2013). Another segment which is strong for the company

is the area of vaccines, where GSK Vaccines has become the leading company in

the private market for vaccines in India. The recently introduced vaccine for

pneumococcal conjugate disease, Synflorix, has become the biggest brand in the

vaccine portfolio of the company in the second year of its launch. The efforts of the

company in raising awareness about vaccines and preventable diseases continue

with increasing fervor. Also, in FY2015, GlaxoSmithKline Plc (Glaxo), London, UK,

entered into three inter-conditional agreements with Novartis AG (Novartis), Basel,

Switzerland. In one such agreement, Glaxo agreed to acquire Novartis’ vaccines

business (excluding influenza vaccine) and its manufacturing capabilities and

facilities, and in the second agreement, Glaxo agreed to sell the rights of its

Marketed Oncology Portfolio, related R&D activities and AKT Inhibitors currently in

development to Novartis. Globally, these transactions with Novartis were

completed on March 2, 2015.

On the other hand, its other key segments like mass markets and mass specialty,

which contribute 60% of its sales, de-grew by 12% in CY2013. This was as a result

of a number of products of the company having come under the DPCO 2013

ruling, resulting in reduction in prices of its drugs, which impacted its sales in

CY2013. Along with this, the supply constraints, mainly from local supplies during

FY2015, have been impacting its performance. FY2017 was another year, where

the company’s, sales got impacted on back of the government’s pricing cuts.

Overall, for FY2017-19E, we expect the domestic formulation business of the

company to grow at a CAGR of 12.2%.

Significant capex plans ahead indicate revival in growth: Global pharmaceutical

major Glaxo announced

`864cr investment in India to set up a medicine

manufacturing unit. The new facility will substantially increase the company’s

manufacturing base. The drug maker is proactively building capacity in the country

as it delivers its portfolio of products in areas such as gastroenterology and anti-

inflammatory medicines. When complete, the factory will make pharmaceutical

products for the Indian market at a rate of up to 8bn tablets and 1bn capsules a

year. The facility, expected to be operational by 2017, will include a warehouse,

site infrastructure, and utilities to support the manufacturing and packing of

medicines. It showcases GSK's latest commitment to its manufacturing network in

India where the company has invested `1,017cr over the last decade. The

development is positive and comes after a long lull in terms of investments.

May 23, 2017

5

Glaxo Pharma | 4QFY2017 Result Update

Outlook and valuation

GSK has a strong balance sheet with cash of ~`900cr, which could be used for

future acquisitions or higher dividend payouts. The company’s parent company

Glaxo increased stake in it through a voluntary open offer, after which Glaxo holds

75% stake in the Indian subsidiary. The buy-back of shares is a strong indicator

from the Management towards the performance of its listed Indian entity,

especially as it comes after the recent `864cr investment plan announced by the

company to further its growth prospects in the Indian pharmaceuticals market. The

said investments are expected to fructify by 2017.

On the operational front, we expect the company’s net sales to post a CAGR of

12.2% to `3,685cr and EPS to register a CAGR of 31.7% to `59.6 over FY2017-

19E. At current level, the stock is trading at 48.9x and 40.7x its FY2018E and

FY2019E earnings respectively. We remain Neutral on the stock.

Exhibit 6: Key assumptions

FY2018E

FY2019E

Sales growth (%)

12.4

12.0

Growth in employee expenses (%)

12.4

8.6

Operating margin (%)

16.2

18.1

Capex (` cr)

200

200

Source: Company, Angel Research

Exhibit 7: One-year forward PE

5,500

4,500

3,500

2,500

1,500

500

Price

18x

30x

42x

54x

Source: Company, Angel Research

May 23, 2017

6

Glaxo Pharma | 4QFY2017 Result Update

Exhibit 8: Recommendation summary

Company

Reco

CMP

Tgt. price

Upside

FY2018E

FY16-18E

FY2018E

(`)

(`)

% PE (x) EV/Sales (x) EV/EBITDA (x) CAGR in EPS (%) RoCE (%) RoE (%)

Alembic Pharma

Accumulate

600

648

8.0

23.5

2.7

13.1

(10.8)

27.5

25.3

Aurobindo Pharma

Buy

576

877

52.2

12.2

2.0

8.6

18.1

22.5

26.1

Cadila Healthcare

Neutral

456

-

-

23.8

3.7

17.3

13.5

23.6

27.1

Cipla

Sell

561

465

(17.0)

22.9

2.6

15.4

14.2

12.2

13.9

Dr Reddy's

Neutral

2,608

-

-

21.8

2.8

12.5

(13.7)

10.8

13.6

Dishman Pharma

Sell

291

143

(50.9)

25.7

2.8

12.3

16.3

13.0

13.5

GSK Pharma*

Neutral

2,428

-

-

48.9

6.1

37.3

6.0

22.3

21.3

Indoco Remedies

Buy

203

240

18.2

12.7

1.5

8.2

33.2

19.1

20.1

Ipca labs

Buy

520

613

17.9

27.1

1.9

12.1

34.8

8.6

9.5

Lupin

Buy

1,263

1,809

43.2

18.2

3.0

11.2

17.2

24.4

20.9

Sanofi India

Neutral

4,102

-

-

29.3

3.4

20.1

16.8

22.5

26.4

Sun Pharma

Buy

640

847

32.3

18.1

3.8

11.5

26.5

18.9

20.1

Source: Company, Angel Research; Note: * December year ending;

May 23, 2017

7

Glaxo Pharma | 4QFY2017 Result Update

Company Background

GlaxoSmithKline Pharmaceuticals (GSK) is the sixth largest pharmaceutical player

in the Indian market with a market share of ~3.7%. The company’s product

portfolio includes both, prescription medicines and vaccines. GSK sells prescription

medicines across therapeutic areas such as anti-infectives, dermatology,

gynecology, diabetes, oncology, cardiovascular diseases and respiratory diseases.

A large portion of the company’s revenue comes from the acute therapeutic

portfolio. However, the company is now scouting for opportunities in high-growth

therapeutic areas such as CVS, CNS, diabetes and oncology. Further, with a strong

parentage, the company plans to increase its product portfolio through patented

launches and vaccines. To fructify the same, the company plans to enhance its

manufacturing assets with its parent company investing `864cr in it; the capacity

expansion is expected to fructify in 2017.

May 23, 2017

8

Glaxo Pharma | 4QFY2017 Result Update

Profit & loss statement

Y/E March (` cr)

CY2013

FY2015

FY2016

FY2017E FY2018E FY2019E

Gross sales

2,589

3,328

2,800

2,999

3,357

3,760

Less: Excise duty

51

56

59

72

67

75

Net sales

2,538

3,272

2,741

2,927

3,290

3,685

Other operating income

24

32

27

28

28

28

Total operating income

2,563

3,305

2,768

2,954

3,318

3,713

% chg

(3.3)

28.9

(16.2)

6.7

12.3

11.9

Total expenditure

2,034

2,690

2,289

2,581

2,757

3,016

Net raw materials

1,164

1,510

1,233

1,398

1,481

1,658

Other Mfg costs

89

115

99

107

111

115

Personnel

362

493

443

483

543

590

Other

420

572

514

593

623

654

EBITDA

504

582

452

346

533

669

% chg

(33.6)

15.5

(22.4)

(23.5)

54.3

25.4

(% of Net Sales)

19.9

17.8

16.5

11.8

16.2

18.1

Depreciation& amortization

20

25

25

26

52

60

EBIT

484

557

427

319

481

608

% chg

(34.7)

15.0

(23.3)

(25.2)

50.7

26.5

(% of Net Sales)

19.1

17.0

15.6

10.9

14.6

16.5

Interest & other charges

-

-

-

-

-

1

Other income

177

200

125

119

119

119

(% of PBT)

Share in profit of Associates

-

-

-

-

-

-

Recurring PBT

685

789

579

465

627

754

% chg

(27.5)

15.1

(26.5)

(19.7)

34.8

20.1

Extraordinary expense/(Inc.)

(26)

33

(3)

(46)

-

-

PBT (reported)

711

756

582

511

627

754

Tax

230

279

203

174

207

249

(% of PBT)

32.3

36.9

34.8

31.3

33.0

33.0

PAT (reported)

482

477

377

337

420

505

Add: Share of earnings

of asso.

-

-

-

-

-

-

Less: Minority interest (MI)

-

-

-

-

-

-

Prior period items

-

-

-

-

-

-

Exceptional items

PAT after MI (reported)

482

477

377

337

420

505

ADJ. PAT

464

509

374

291

420

505

% chg

(29.4)

9.8

(26.5)

(22.2)

44.4

20.1

(% of Net Sales)

18.3

15.6

13.7

9.9

12.8

13.7

Basic EPS (`)

55

60

44

34

50

60

Fully diluted EPS (`)

55

60

44

34

50

60

% chg

(29.4)

9.8

(26.5)

(22.2)

44.4

20.1

May 23, 2017

9

Glaxo Pharma | 4QFY2017 Result Update

Balance Sheet

Y/E March (` cr)

CY2013

FY2015

FY2016

FY2017E

FY2018E

FY2019E

SOURCES OF FUNDS

Equity share capital

85

85

85

85

85

85

Preference Capital

-

-

-

-

-

-

Reserves& surplus

1,905

1,744

2,099

1,922

1,847

1,797

Shareholders funds

1,990

1,829

2,183

2,007

1,932

1,881

Minority Interest

Total loans

4

3

1

2

2

3

Other long-term liabilities

5

5

-

-

-

-

Long-term provisions

242

273

291

276

276

276

Deferred tax liability

(92)

(83)

(101)

(92)

(92)

(92)

Total liabilities

2,148

2,026

2,374

2,193

2,118

2,069

APPLICATION OF FUNDS

Gross block

323

467

725

1,105

1,305

1,505

Less: Acc. Depreciation

247

272

297

323

375

436

Net block

76

195

428

782

930

1,070

Capital work-in-progress

44

44

44

44

44

44

Goodwill

42

-

-

32

32

32

Other non-current assets

14

-

-

-

-

-

Long-term loans and adv.

238

307

302

374

428

479

Investments

10

0

5

6

6

6

Current assets

2,614

2,587

2,174

1,674

1,489

1,345

Cash

2,042

1,911

1,392

932

655

240

Loans & advances

238

122

123

132

148

166

Other

335

554

658

610

686

940

Current liabilities

889

1,107

579

720

811

908

Net current assets

1,725

1,480

1,595

954

678

438

Mis. Exp. not written off

-

-

-

-

-

-

Total Assets

2,148

2,026

2,374

2,193

2,118

2,068

May 23, 2017

10

Glaxo Pharma | 4QFY2017 Result Update

Cash flow statement

Y/E March (` cr)

CY2013 FY2015 FY2016 FY2017E FY2018E FY2019E

Profit before tax and exceptional

711

756

582

557

627

754

Depreciation

20

25

25

26

52

60

(Inc)/Dec in working capital

15

114

(633)

181

(2)

(174)

Direct taxes paid

230

279

203

174

207

249

Cash Flow from Operations

517

616

(229)

590

471

391

(Inc.)/Dec.in fixed assets

(49)

(144)

(258)

(381)

(200)

(200)

(Inc.)/Dec. in investments

(45)

(10)

5

1

-

-

Cash Flow from Investing

(93)

(154)

(253)

(380)

(200)

(200)

Issue of equity

-

-

-

-

-

-

Inc./(Dec.) in loans

-

-

-

-

-

-

Dividend paid (Incl. Tax)

(495)

(624)

(495)

(297)

(495)

(555)

Others

47

32

459

-

-

-

Cash Flow from Financing

(448)

(593)

(37)

(297)

(495)

(555)

Inc./(Dec.) in cash

(25)

(131)

(519)

(460)

(277)

(415)

Opening cash balances

2,067

2,042

1,911

1,392

932

655

Closing cash balances

2,042

1,911

1,392

932

655

240

May 23, 2017

11

Glaxo Pharma | 4QFY2017 Result Update

Key ratio

Y/E March

CY2013

FY2015

FY2016

FY2017E

FY2018E

FY2019E

Valuation Ratio (x)

P/E (on FDEPS)

44.3

40.4

55.0

70.7

48.9

40.7

P/CEPS

41.0

41.0

51.2

50.3

43.5

36.4

P/BV

10.3

11.2

9.4

10.2

10.6

10.9

Dividend yield (%)

2.1

2.1

2.1

1.2

2.1

2.3

EV/Sales

7.3

5.7

7.0

6.7

6.1

5.5

EV/EBITDA

36.8

32.1

42.5

56.8

37.3

30.4

EV / Total Assets

8.6

9.2

8.1

9.0

9.4

9.8

Per Share Data (`)

EPS (Basic)

54.8

60.1

44.2

34.4

49.6

59.6

EPS (fully diluted)

54.8

60.1

44.2

34.4

49.6

59.6

Cash EPS

59.2

59.3

47.4

48.3

55.8

66.7

DPS

50.0

50.0

50.0

30.0

50.8

56.8

Book Value

234.9

215.9

257.8

236.9

228.0

222.1

Returns (%)

RoCE (Pre-tax)

22.4

26.7

19.4

14.0

22.3

29.1

Angel ROIC (Pre-tax)

22.4

26.7

19.4

14.0

22.3

29.1

RoE

23.2

26.7

18.7

13.9

21.3

26.5

Turnover ratios (x)

Asset Turnover (Gross Block)

8.6

8.4

4.6

3.2

2.8

2.6

Inventory / Sales (days)

48

40

59

52

38

31

Receivables (days)

15

11

15

14

10

8

Payables (days)

54

55

77

43

48

49

WC cycle (ex-cash) (days)

79

69

96

94

87

95

Solvency ratios (x)

Net debt to equity

(1.0)

(1.0)

(0.6)

(0.5)

(0.3)

(0.1)

Net debt to EBITDA

(4.0)

(3.3)

(3.1)

(2.7)

(1.2)

(0.4)

Interest Coverage (EBIT / Int.)

-

-

-

-

-

-

May 23, 2017

12

Glaxo Pharma | 4QFY2017 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Glaxo Pharma

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

May 23, 2017

13