2QFY2018 Result Update | Pharmaceutical

November 24, 2017

Dr. Reddy’s Laboratories

REDUCE

CMP

`2,361

Performance Highlights

Target Price

`2,040

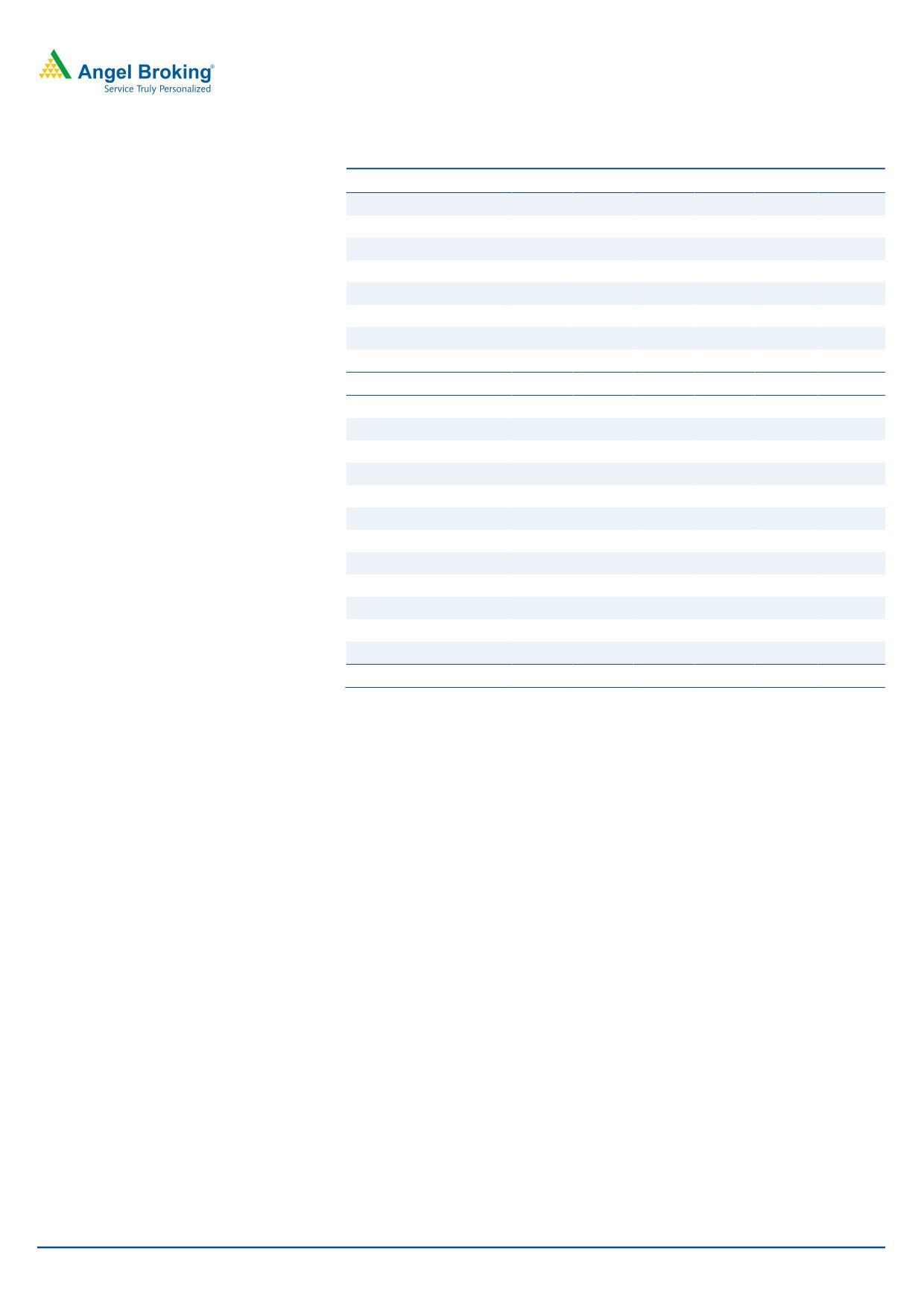

Y/E March (` cr)

2QFY2018 1QFY2018 % chg (qoq) 2QFY2017

% chg (yoy)

Investment Period

12 months

Net sales

3,546

3,316

6.9

3,586

(1.1)

Gross profit

2,170

1,990

9.1

2,278

(4.7)

Operating profit

649

306

112.3

579

12.1

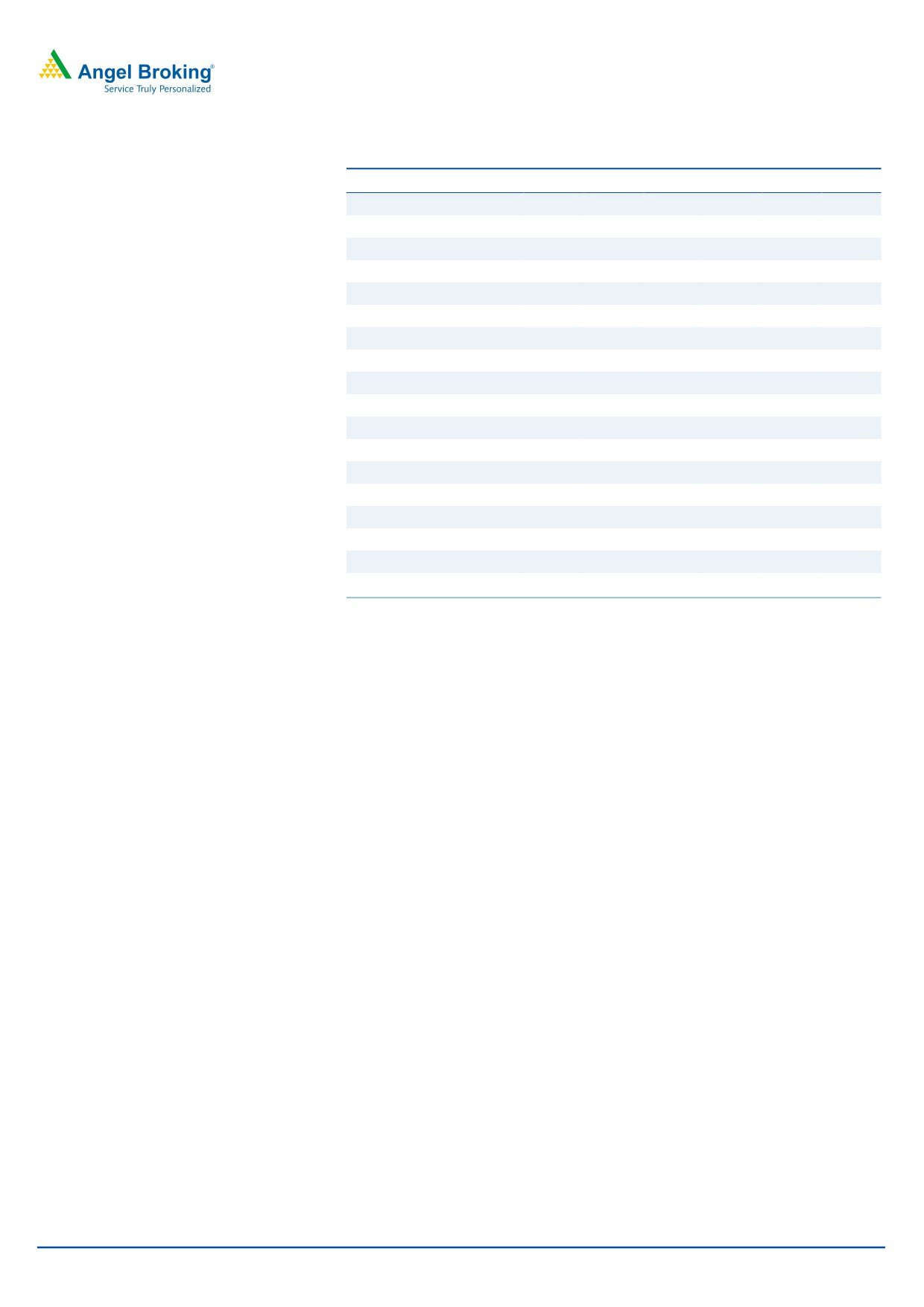

Stock Info

Adj. net profit

285

59

382.1

295

(3.3)

Sector

Pharmaceutical

Source: Company, Angel Research

Market Cap (` cr)

39,172

Net Debt (` cr)

2,839

Dr Reddy’s Labs (DRL) posted poor results for 2QFY2018, which were much lower

Beta

0.4

than expectations. The sales came in at `3,546cr (`3,700cr expected) v/s. `3,586cr,

52 Week High / Low

3,247/1902

a yoy de-growth of 1.1%. Global Generics at `2,862cr, posted a yoy de-growth of

Avg. Daily Volume

48,076

1.0%, while PSAI at `119cr, registering a yoy de-growth of 2.0%. On operating front,

Face Value (`)

5

the EBDITA came in at 18.3% (19.7% expected) v/s. 16.2% in 2QFY2017. R&D

BSE Sensex

33,562

expenses were at 11.8% of sales in 2QFY2018 v/s. 14.5% of sales in 2QFY2017.

Nifty

10,342

Consequently, the PAT came in at `285cr (`594cr expected) v/s. `295cr in 2QFY2017,

Reuters Code

REDY.BO

a yoy de-growth of 3.3%. We maintain our Reduce.

Bloomberg Code

DRRD@IN

A subdued quarter: The sales came in at `3,546cr (`3,700cr expected) v/s. `3,586cr,

a yoy de-growth of 1.1%. Global Generics at `2,862cr, posted a yoy de-growth of

Shareholding Pattern (%)

1.0%, while PSAI at `119cr, registered a yoy de-growth of 2.0%. The Global Generics,

Promoters

26.8

which forms 81% of overall sales, saw dip in its key growth market USA (`1,432cr),

MF / Banks / Indian Fls

17.2

which posted a dip of 11.0% yoy, while Indian sales at `637cr posted a growth of

FII / NRIs / OCBs

45.7

2.0%. The USA market continued to reel under the pricing pressures, while Indian

Indian Public / Others

10.4

sales were under the pressure on the back of GST. On operating front, the EBDITA

came in at 18.3% (19.7% expected) v/s. 16.2% in 2QFY2017. R&D expenses were at

11.8% of sales in 2QFY2018 v/s. 14.5% of sales in 2QFY2017. Consequently, the PAT

Abs. (%)

3m 1yr

3yr

came in at `285cr (`594cr expected) v/s. `295cr in 2QFY2017, a yoy de-growth of

Sensex

6.3

29.3

17.8

3.3%.

Dr Reddy

16.4

(24.3)

(33.0)

Outlook & Valuation: We expect net sales to grow at a CAGR of 5.1% to

`15,548cr and adjusted EPS to post a CAGR of 18.5% to end the period at `102

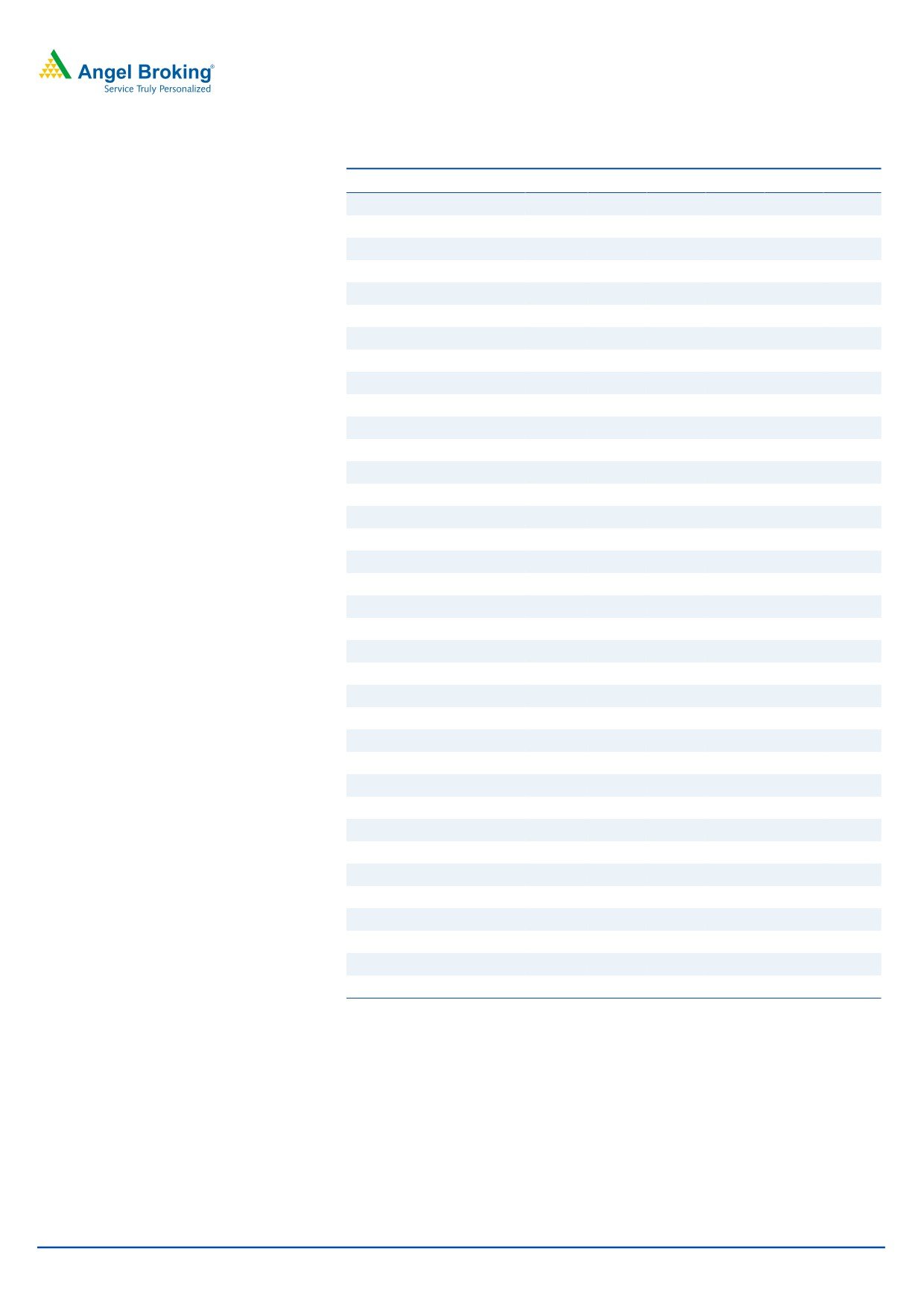

3-year Daily Price Chart

5,000

in FY2019E. We recommend a Reduce.

4,500

4,000

Key financials (IFRS Consolidated)

3,500

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

3,000

Net sales

15,471

14,081

13,734

15,548

2,500

% chg

4.4

(9.0)

(2.5)

13.2

2,000

Net profit

2,001

1,204

1,158

1,691

1,500

% chg

(9.8)

(39.8)

(3.8)

46.0

1,000

Adj net profit

2,357

1,204

1,158

1,691

% chg

6.3

(48.9)

(3.8)

46.0

Adj. EPS (`)

138.2

72.6

69.9

102.0

Source: Company, Angel Research

EBITDA margin (%)

24.6

16.1

17.7

20.2

P/E (x)

17.1

32.5

33.8

23.2

RoE (%)

19.7

9.6

9.2

12.4

Sarabjit Kour Nangra

RoCE (%)

18.7

7.5

7.7

10.3

+91 2 39357600 Ext: 6806

P/BV (x)

3.1

3.2

3.0

2.7

EV/Sales (x)

2.6

3.0

3.1

2.7

EV/EBITDA (x)

10.4

18.5

17.4

13.6

Source: Company, Angel Research; Note: CMP as of November 22, 2017

Please refer to important disclosures at the end of this report

1

Dr. Reddy’s Laboratories | 2QFY2018 Result Update

Exhibit 1: 2QFY2018 performance (IFRS, consolidated)

Y/E March (` cr)

2QFY2018

1QFY2018 % chg (qoq) 2QFY2017 % chg (yoy) 1HFY2018 1HFY2017

% chg

Net sales

3,546

3,316

6.9

3,586

(1.1)

6,862

6,714

2.2

Other income/(loss)

11

42

(72.5)

64

53

246

-

Total income

3,557

3,357

6.0

3,650

(2.5)

6,915

6,960

(0.6)

Gross profit

2,170

1,990

9.1

2,278

(4.7)

4,160

5,091

(18.3)

Gross margin (%)

61.2

60.0

63.5

60.6

75.8

SG&A expenses

1,103

1,176

(6.2)

1,177

(6.3)

2,280

2,303

(1.0)

R&D expenses

418

508

(17.7)

521

(19.9)

925

1,917

(51.7)

EBDITA

649

306

112.3

579

12.1

955

871

9.7

EBDITA (%)

18.3

9.2

-

16.2

13.9

13.0

-

Depreciation

280

280

0.0

268.2

4.4

559.8

505.8

10.7

Interest

2

-

-

-

-

-

PBT

381

67

465.0

375

1.5

448

611

(26.7)

Tax

103

18

470.6

89

16.0

121

148

(18.4)

Net Profit

278

49

463.0

287

(3.0)

328

462

(29.1)

Share of profit/ (loss) in associates

9

10

8.0

19.2

-

Reported net profit before exceptional

285

59

382.1

295

(3.3)

347

462

(25.0)

Exceptional items (loss) /profit

-

-

-

-

-

Reported PAT

285

59

382.1

295

(3.3)

347

462

(25.0)

Adj. Net Profit

285

59

382.1

295

(3.3)

347

462

(25.0)

EPS (`)

17.2

3.6

17.8

20.9

27.9

Source: Company, Angel Research

Exhibit 2: Actual Vs Estimates

(` cr)

Actual

Estimates

Variation (%)

Net sales

3,546

3,700

(4.2)

Other income

11

64

(82.2)

Operating profit

649

731

(11.1)

Tax

103

191

(46.2)

Adj. Net profit

285

594

(52.0)

Source: Company, Angel Research

Revenue lower than expectations: The sales came in at `3,546cr (`3,700cr

expected) v/s. `3,586cr, a yoy de-growth of 1.1%. Global Generics at `2,862cr, posted

a yoy de-growth of 1.0%, while PSAI at `119cr, registered a yoy de-growth of 2.0%.

The Global Generics, which forms 81% of overall sales, saw dip in its key growth

market USA (`1,432cr), which posted a dip of 11.0% yoy, while Indian sales at `637cr

posted a growth of 2.0%. The USA market continued to reel under the pricing

pressures, while Indian sales were under the pressure on the back of GST.

The global generic market had sales of `2,862cr (down 1.0% yoy). Europe posted

a yoy growth of 36.0% to end the period at `242cr. Growth was driven by the

new product launches and volume growth. Apart from this, the Emerging

markets (`551cr, up 14% yoy) posted robust growth on the back of Russia

(~`320cr), which posted a growth of 20% in the reported currency, while on

constant currency terms the region posted a yoy growth of 13%. Its key growth

market USA (`1,432cr), posted a dip of 11.0% yoy, while India (`637cr), posted a

growth of 2.0%.

November 24, 2017

2

Dr. Reddy’s Laboratories | 2QFY2018 Result Update

US posted a dip, primarily on account of higher price erosion, increased

competition in the key products. This was partially offset by contribution from

new launches. During the quarter, the company launched 4 new products.

The PSAI segment posted sales of `565cr, up 22.0% yoy. The growth came in on

the back of Europe (`194cr, a yoy growth of 4%) and ROW (`232cr, a yoy growth

of 35.0%). However, growth was registered in Indian market (sales of `44cr, a yoy

growth of 51%) and USA (`96cr, a yoy growth of 23%).

As of September 30, 2017, cumulatively 103 generic filings are pending for

approvals with the USFDA (100 ANDAs and 3 NDAs under 505(b)(2) route). Of

these 100 ANDAs, 60 are Para IVs, out of which we believe 28 have ‘First to File’

status.

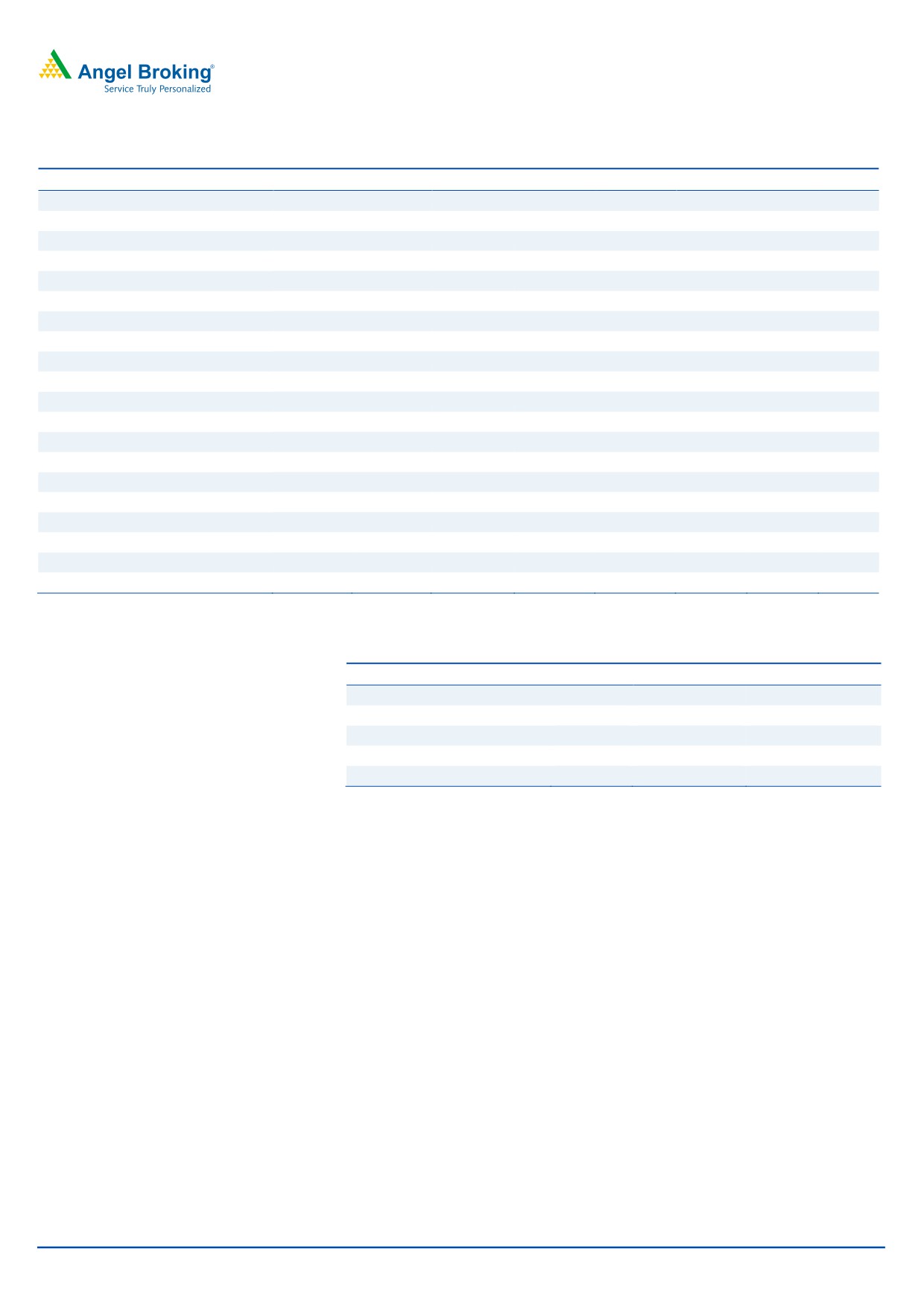

Exhibit 3: Trend in Global generics

3500

3000

2500

123

123

123

140

140

595

625

2000

571

637

469

215

177

207

208

1500

242

1000

1,613

1,659

1,535

1,496

1,432

500

0

2QFY2017

3QFY2017

4QFY2017

1QFY2018

2QFY2018

Others

Russia & CIS

India

Europe

North America

Source: Company, Angel Research

In the PSAI segment (16% of sales), the US grew by 23% yoy, while, ROW, Europe

and India grew by 35%, 4% & 51% yoy respectively during the quarter. Proprietary

Products & Others at `119cr posted a yoy growth of 13.0%.

November 24, 2017

3

Dr. Reddy’s Laboratories | 2QFY2018 Result Update

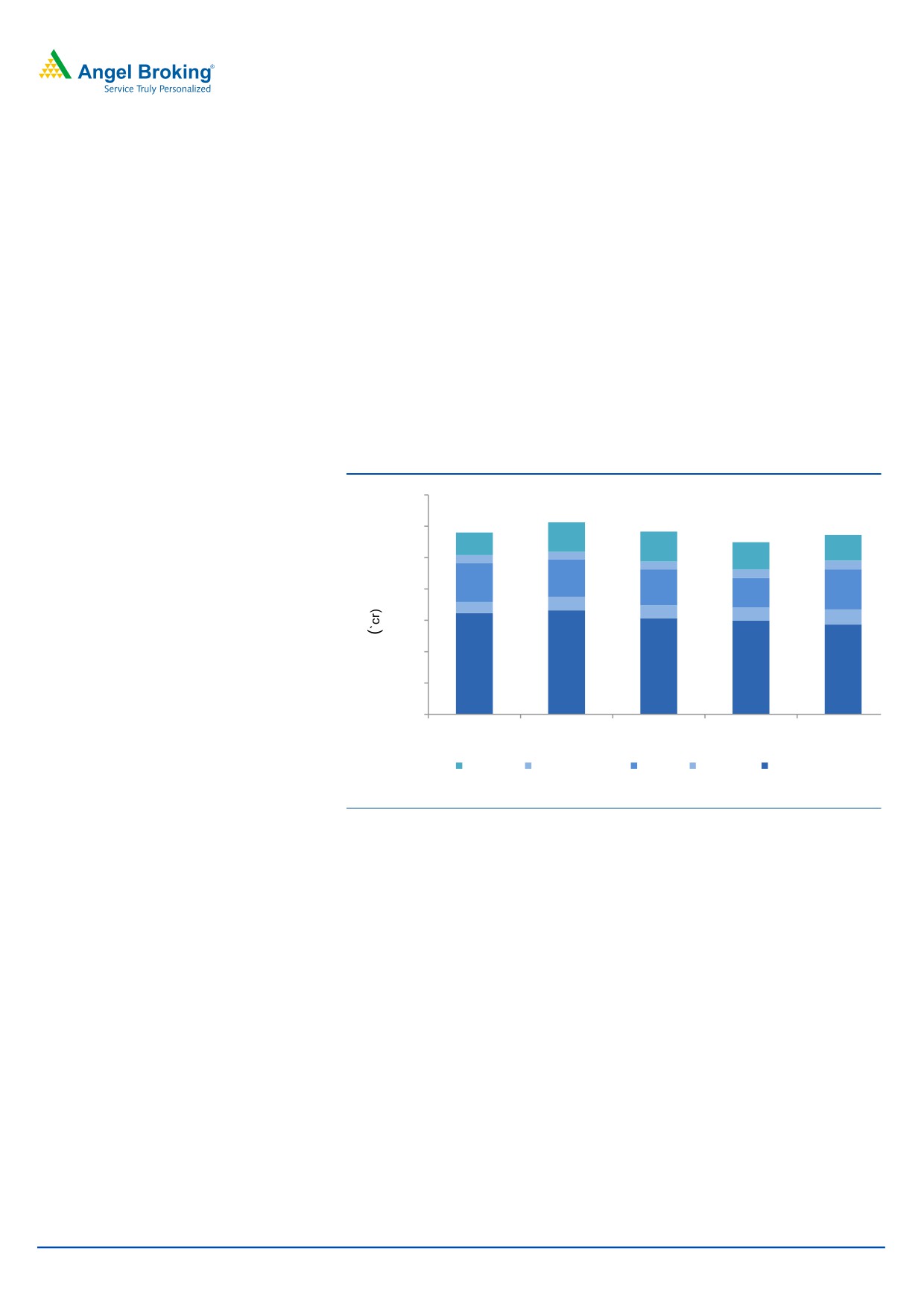

Exhibit 4: PSAI trend

700

600

500

198

190

194

232

400

156

58

41

40

300

44

139

210

183

200

194

254

91

100

114

126

96

53

80

0

2QFY2017

3QFY2017

4QFY2017

1QFY2018

2QFY2018

Others

India

Europe

North America

Source: Company, Angel Research

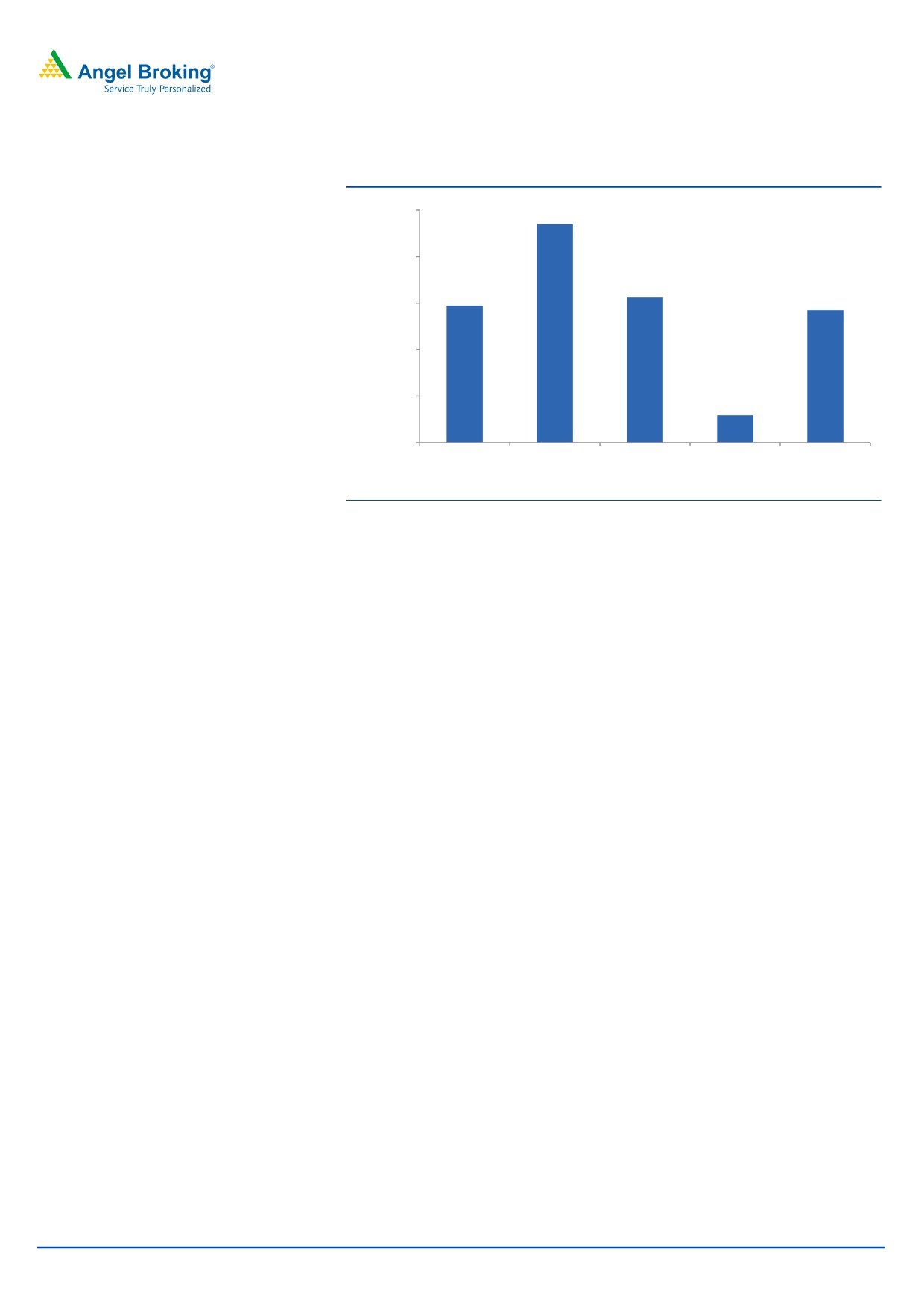

EBITDA margin expands yoy: On operating front, the EBDITA came in at 18.3%

(19.7% expected) in 2QFY2018 v/s. 16.2% in 2QFY2017. R&D expenses were at

11.8% of sales in 2QFY2018 v/s. 14.5% of sales in 2QFY2017. Gross margins during the

quarter were at 61.2% v/s. 63.5% in 2QFY2017. In spite of the same, 6.3% and

19.9% dip in the employee cost and R&D expenses respectively aided the

margin expansion.

Exhibit 5: EBITDA margin trend (%)

28.0

23.0

24.0

20.0

18.3

16.2

15.6

16.0

12.0

9.2

8.0

4.0

0.0

2QFY2017

3QFY2017

4QFY2017

1QFY2018

2QFY2018

Source: Company, Angel Research

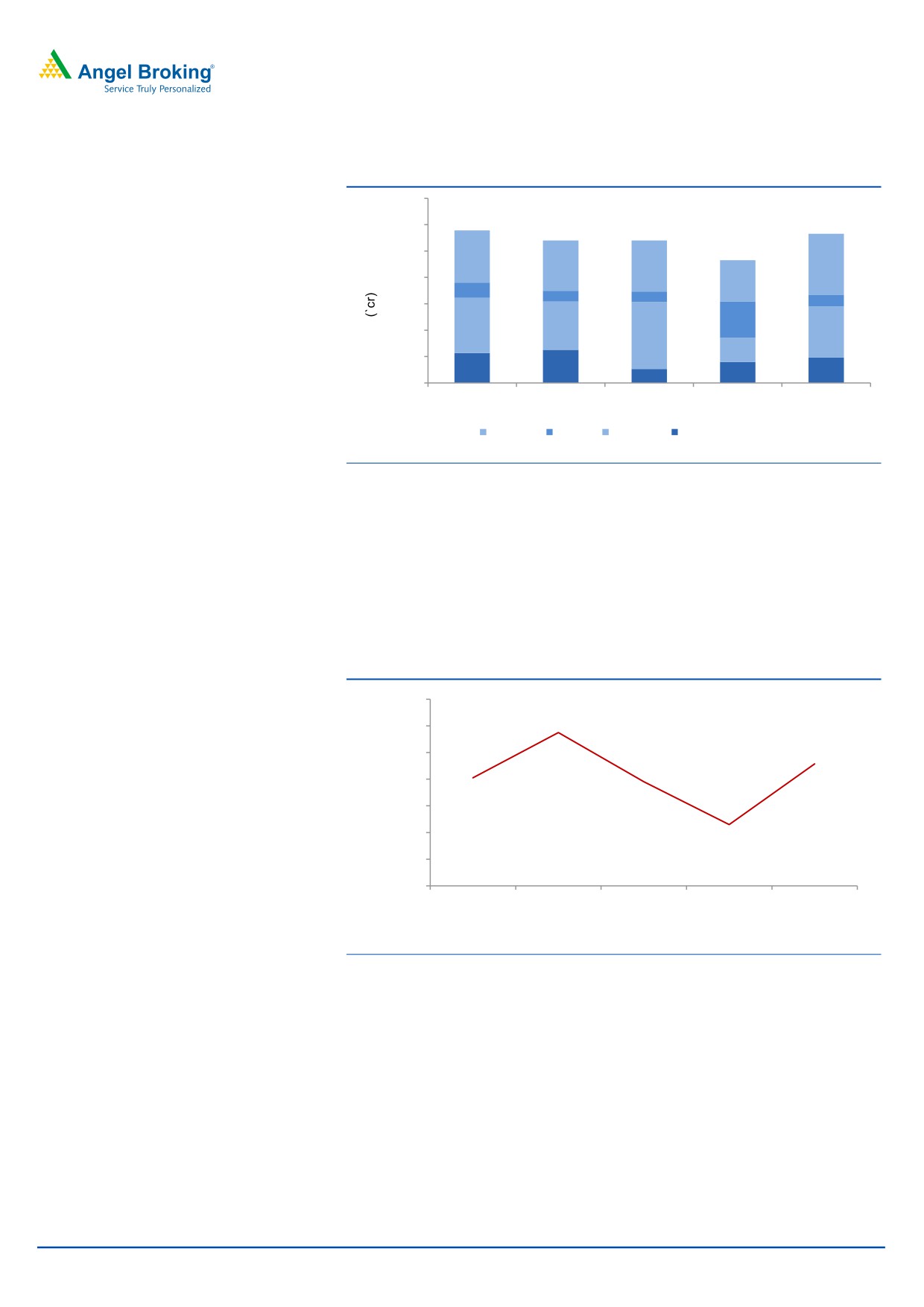

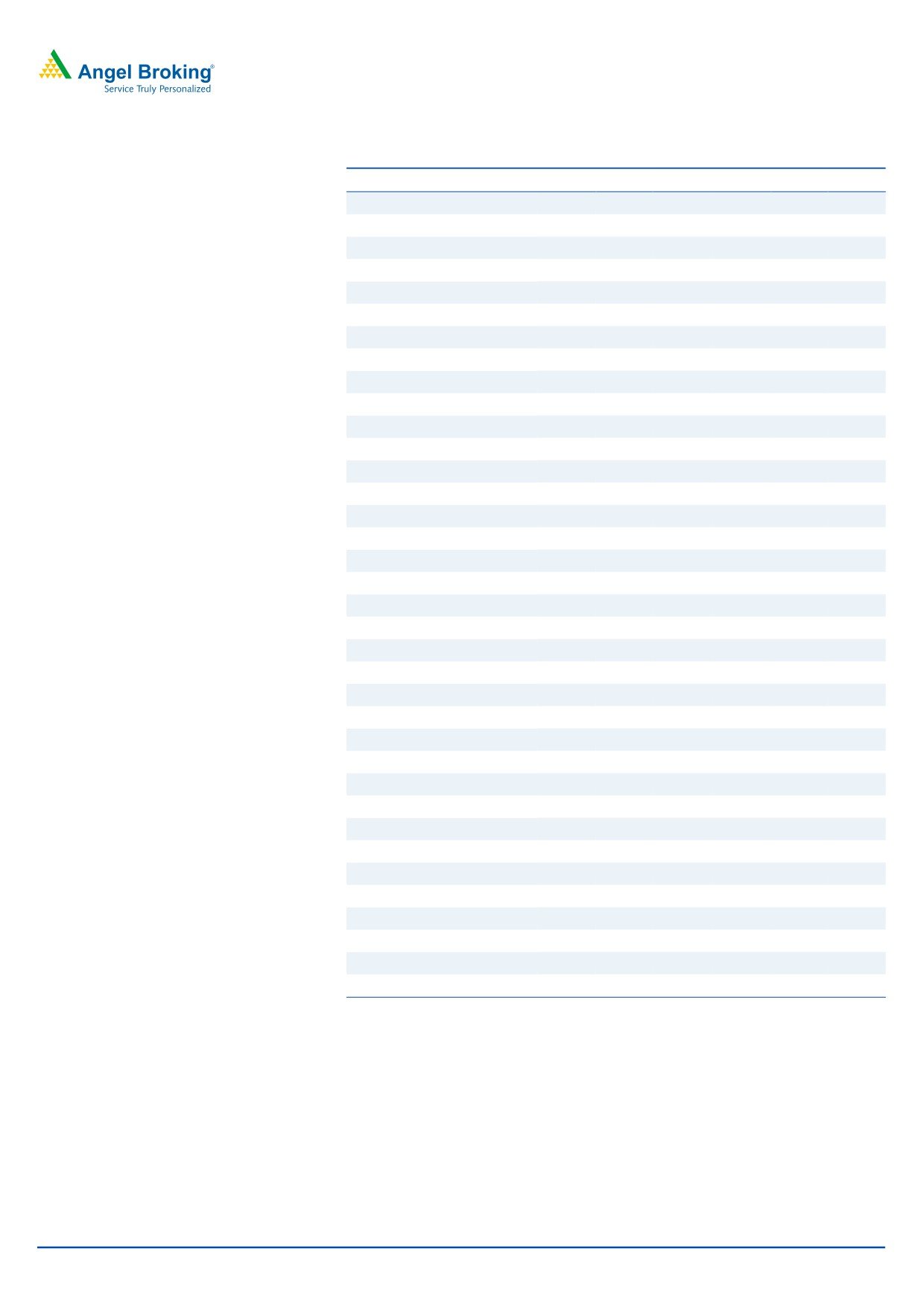

Net profit lower than expected: Consequently, the PAT came in at `285cr

(`594cr expected) in 2QFY2018 v/s. `295cr in 2QFY2017, a yoy de-growth of 3.3%.

The net profit was lower than expected mainly on the back of the lower than

expected OPM and other income.

November 24, 2017

4

Dr. Reddy’s Laboratories | 2QFY2018 Result Update

Exhibit 6: Adjusted net profit trend

470

500

400

295

312

285

300

200

59

100

0

2QFY2017

3QFY2017

4QFY2017

1QFY2018

2QFY2018

Source: Company, Angel Research

Concall takeaways

Company guided for 2-3 new launches/quarter in USA.

Duvvada USFDA re-inspection in 4QFY2018.

DRL expects 15 ANDA launches in FY2018 (including 4-5 meaningful

launches.

Tax rate in FY2018 to stay at ~23-25% of PBT.

2nd Copaxone DMF filing will happen in two months (apart from

Srikakulam facility).

R&D expense is expected to remain at higher levels due to strong

product pipeline of complex generics, Biosimilars and differentiated

products. R&D expenses during the quarter are expected to be

~`2000cr in FY2018.

Investment arguments

Robust pipeline for US going ahead: After attaining a critical mass

(US$981mn in FY2017), DRL aims to scale up its business to the next orbit in

the US market on the back of a strong product pipeline (103 ANDAs are

pending approval, of which, 60 are Para IVs and 28 are FTFs). The

Management has guided for a robust growth in the US over the medium

term, driven by introduction of new products, some of which are also Para

IV opportunities. Owing to the import alert on the three facilities of the

company, we expect the ex-exclusivity US sales to be almost flat.

Domestic to be back in focus: DRL reported a 9.0% yoy growth in FY2017.

The management expects the company’s performance to rebound and

targets to achieve an above industry growth rate going ahead, driven by -

November 24, 2017

5

Dr. Reddy’s Laboratories | 2QFY2018 Result Update

(a) field force expansion and improvement in productivity; (b) new product

launches (including biosimilars); and (c) focus on brand building. In

4QFY2015, DRL had acquired UCB’s India portfolio and had completed the

integration process of these brands in 1QFY2016. UCB’s India business had

registered ~`150cr sales in CY2014 and has a branded portfolio of 21

products focusing on Allergy, Respiratory, Dermatology and Pediatric

space. The acquisition had been successfully integrated by 2QFY2016. Also,

in FY2017, the domestic formulation business posted a lower growth, on

account of NPPA pricing notifications and demonetization. In FY2018, the

Indian domestic sales have taken a hit on the back of GST implementation,

and hence, the year is expected to end with domestic formulation business

growing at single digit or low double digit growth. Thus, we expect sales in

India to post a CAGR of 8.9% over FY2017-19E.

Outlook & Valuation: We expect net sales to grow at a CAGR of 5.1% to

`15,548cr and adjusted EPS to post a CAGR of 18.5% over FY2017-19E to end

FY2019 at `102. The stock has been severely beaten down post the import

alert from the USFDA. However, considering the valuations, we recommend

a Reduce rating on the stock.

Exhibit 7: Key assumptions

FY2018E

FY2019E

PSAI segment growth (%)

3.5

3.8

Generics segment growth (%)

(4.3)

14.8

Operating margin (%)

17.7

20.2

Capex (` cr)

1200

1200

Source: Company, Angel Research

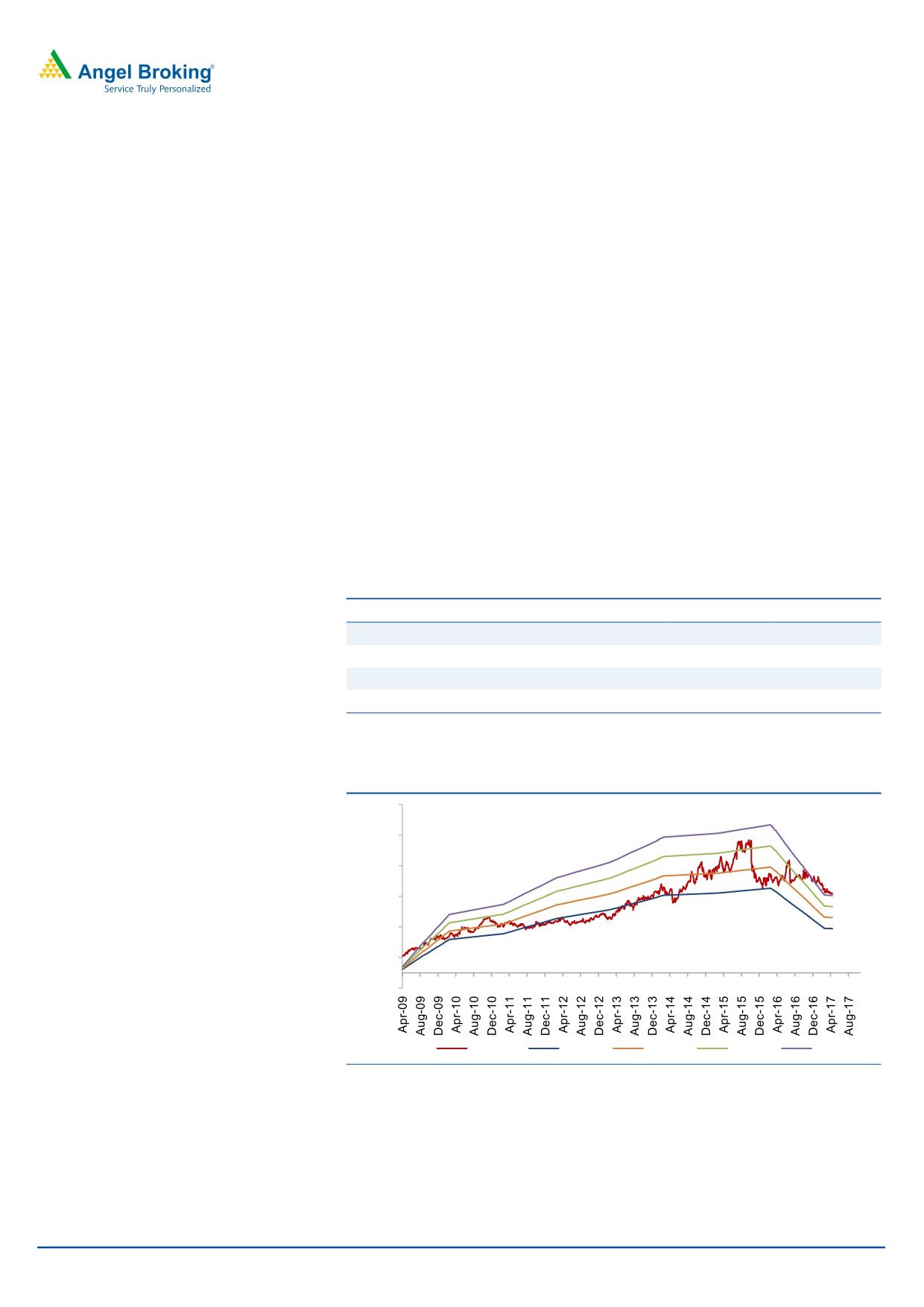

Exhibit 8: PE chart

5,500

4,500

3,500

2,500

1,500

500

(500)

Price

20x

25x

30x

35x

Source: Company, Angel Research

November 24, 2017

6

Dr. Reddy’s Laboratories | 2QFY2018 Result Update

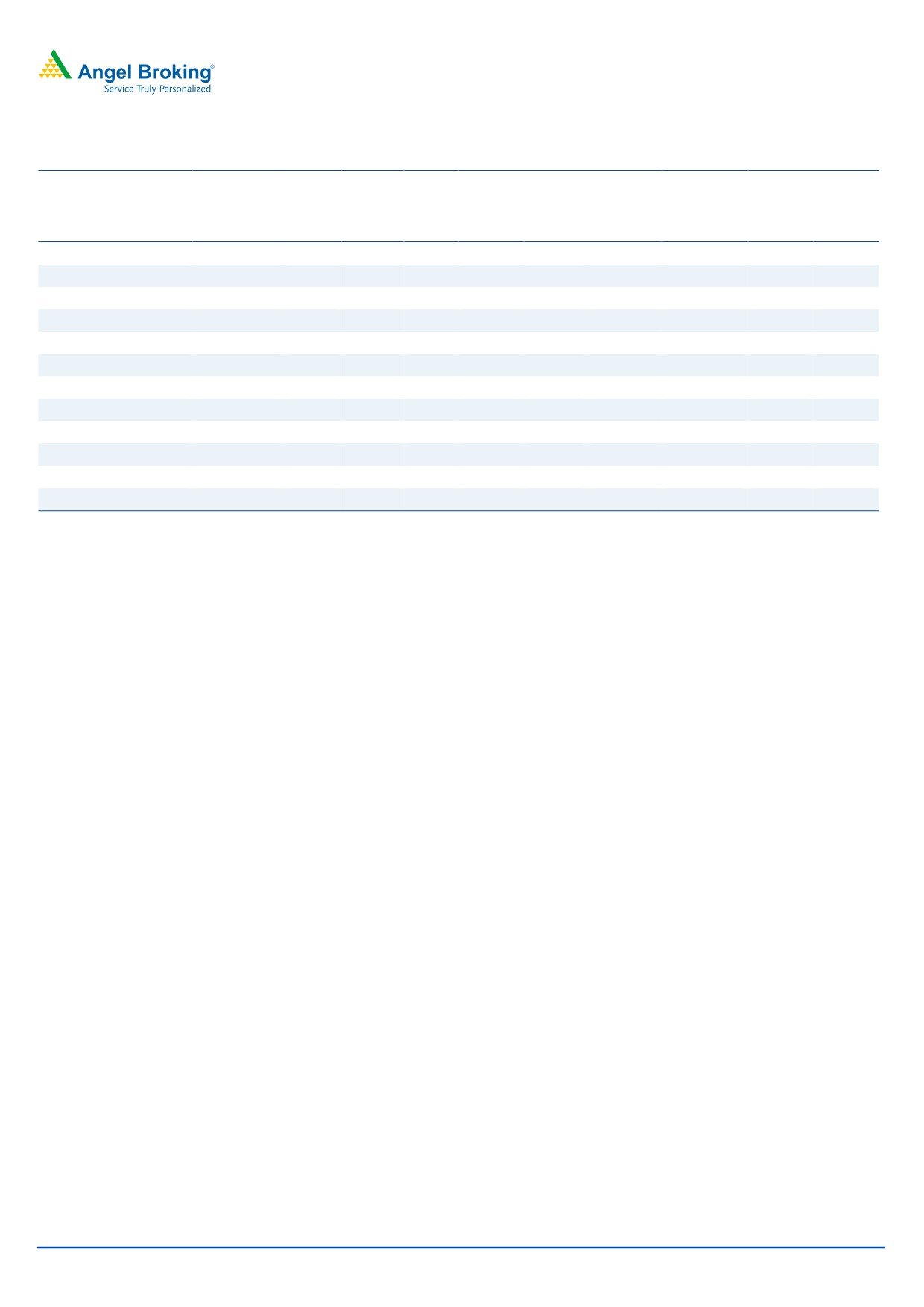

Exhibit 9: Recommendation summary

Company

Reco.

CMP Tgt Price Upside

FY2019E

FY17-19E

FY2019E

(%)

CAGR in

(`)

(`)

PE

EV/Sales

EV/EBITDA

RoCE

RoE

EPS

(x)

(x)

(x)

(%)

(%)

(%)

Alembic Pharma

Buy

511

600

17.3

21.4

2.9

13.0

5.7

20.6

18.4

Aurobindo Pharma

Buy

699

823

17.8

13.6

2.5

9.9

14.2

25.3

22.7

Cadila Healthcare

Reduce

443

411

(7.2)

21.6

4.1

17.6

18.9

16.5

22.2

Cipla

Sell

619

462

(25.3)

25.5

3.2

16.2

39.3

10.9

13.1

Dr Reddy's

Reduce

2,361

2,040

(13.6)

23.2

3.1

13.3

18.5

10.3

12.4

Dishman Pharma

Under Review

301

-

-

19.3

2.7

10.1

23.3

4.5

4.4

GSK Pharma

Sell

2,496

2,000

(19.9)

53.9

6.9

39.3

19.3

25.8

23.5

Indoco Remedies

Sell

280

136

(49.0)

23.5

2.1

14.9

16.2

10.1

14.5

Ipca labs

Neutral

535

-

-

21.2

1.9

13.5

24.7

12.4

11.0

Lupin

Buy

828

1,091

31.8

16.7

2.4

9.3

(6.6)

13.7

13.7

Sanofi India*

Neutral

4,434

-

-

27.1

3.8

17.0

12.8

25.8

27.5

Sun Pharma

Buy

535

615

15.0

24.0

3.7

16.3

(17.5)

11.3

14.0

Source: Company, Angel Research; Note: *December year ending

Company Background

Established in 1984, Dr. Reddy's Laboratories is an integrated global

pharmaceutical company, through its three businesses - Pharmaceutical

Services & Active Ingredients, Global Generics and Proprietary Products.

The company’s key therapeutic focus is on gastro-intestinal, cardiovascular,

diabetology, oncology, pain management, anti-infective and paediatrics.

The company’s key markets include India, USA, Russia & CIS and Germany.

November 24, 2017

7

Dr. Reddy’s Laboratories | 2QFY2018 Result Update

Profit & loss statement (IFRS Consolidated)

Y/E March

FY2014

FY2015

FY2016

FY2017 FY2018E FY2019E

13,217

14,819

15,471

14,081

13,734

15,548

Net sales

Other operating income

141.6

91.7

87.4

106.5

106.5

106.5

Total operating income

13,359

14,911

15,558

14,187

13,840

15,654

12.5

11.6

4.3

-8.8

-2.4

13.1

% chg

Total expenditure

10,096

11,535

11,669

11,811

11,308

12,411

4,977

5,531

5,315

5,219

5,402

5,725

Cost of revenues

SG&A expenses

3,878

4,259

4,570

4,637

3,983

4,509

R&D expenses

1,240

1,745

1,783

1,955

1,923

2,177

EBITDA

3,121

3,284

3,802

2,270

2,426

3,137

% chg

16.6

5.2

15.8

-40.3

6.9

29.3

23.6

22.2

24.6

16.1

17.7

20.2

(% of Net Sales)

Depreciation & amortisation

659.8

747.4

927.4

1,026.6

1,052.8

1,115.5

EBIT

2,462

2,537

2,875

1,243

1,373

2,021

% chg

27.4

3.1

13.3

-56.7

10.5

47.2

(% of Net Sales)

18.6

17.1

18.6

8.8

10.0

13.0

-

-

-

-

-

-

Interest & other charges

Other Income

40.0

168.2

(270.8)

80.6

80.6

80.6

(% of PBT)

1.5

6.0

(10.0)

5.5

5.1

3.6

Share in profit of associates

17.4

19.5

22.9

34.9

34.9

34.9

Recurring PBT

2,661

2,816

2,714

1,465

1,595

2,243

19.0

5.9

-3.6

-46.0

8.9

40.6

% chg

Extraordinary expense/(Inc.)

-

-

508.5

-

-

-

PBT (reported)

2,660.6

2,816.3

2,714.0

1,465.3

1,595.4

2,243.2

Tax

509.4

598.4

712.7

261.4

436.9

552.1

(% of PBT)

19.1

21.2

26.3

17.8

27.4

24.6

2,151.2

2,217.9

2,001.3

1,203.9

1,158.5

1,691.1

PAT (reported)

Add: Share of earnings of asso.

-

-

-

-

-

-

Less: Minority interest (MI)

-

-

-

-

-

-

Exceptional items

-

-

-

-

-

-

PAT after MI (reported)

2,151.2

2,217.9

2,001.3

1,203.9

1,158.5

1,691.1

2,151.2

2,217.9

2,357.0

1,203.9

1,158.5

1,691.1

ADJ. PAT

% chg

22.9

3.1

6.3

(48.9)

(3.8)

46.0

(% of Net Sales)

16.3

15.0

12.9

8.5

8.4

10.9

Basic EPS (`)

126.7

130.2

138.2

72.6

69.9

102.0

Fully Diluted EPS (`)

126.7

130.2

138.2

72.6

69.9

102.0

22.9

2.7

6.1

(47.4)

(3.8)

46.0

% chg

November 24, 2017

8

Dr. Reddy’s Laboratories | 2QFY2018 Result Update

Balance sheet (IFRS Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017

FY2018E FY2019E

SOURCES OF FUNDS

84.9

85.2

85.3

82.9

82.9

82.9

Equity share capital

Preference Capital

-

-

-

-

-

-

Reserves & surplus

8,995

11,045

12,748

12,179

12,938

14,230

9,080

11,130

12,834

12,262

13,021

14,313

Shareholders’ funds

Minority Interest

4,474.2

3,954.3

3,661.9

5,335.1

6,000.0

6,800.0

Total loans

Deferred tax liability

(192.9)

(401.3)

(423.0)

(516.4)

(516.4)

(516.4)

Total liabilities

13,361

14,683

16,073

17,081

18,505

20,597

APPLICATION OF FUNDS

Net fixed assets

3,945

4,314

5,396

5,142

6,342

7,542

1,470

1,643

1,969

4,618

4,618

4,618

Goodwill /other intangibles

Capital Work-in-Progress

495.2

495.2

495.2

495.2

495.2

495.2

Investments

2,589

3,811

3,833

2,110

2,110

2,110

7,866

8,558

8,465

8,257

8,216

9,605

Current Assets

Cash

845

539

492

387

791

1,206

793.0

889.1

928.2

844.9

824.0

932.9

Loans & Advances

Other

6,228

7,129

7,045

7,025

6,600

7,465

Current liabilities

3,006

4,214

4,193

4,057

3,792

4,289

4,860

4,344

4,273

4,199

4,423

5,315

Net Current Assets

Other Assets

76

106

517

517

517

Total Assets

13,361

14,683

16,073

17,081

18,505

20,597

November 24, 2017

9

Dr. Reddy’s Laboratories | 2QFY2018 Result Update

Cash flow statement (IFRS Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017

FY2018E FY2019E

Profit before tax

2,661

2,816

2,714

1,465

1,595

2,243

660

747

927

1,027

1,053

1,116

Depreciation

(Inc)/Dec in Working Capital

(906)

211

24

(32)

181

(477)

Less: Other income

40

168

(271)

81

81

81

509

598

713

261

437

552

Direct taxes paid

Cash Flow from Operations

1,865

3,008

3,224

2,118

2,311

2,249

(164)

(369)

(1,082)

254

(1,200)

(1,200)

(Inc.)/Dec.in Fixed Assets

(Inc.)/Dec. in Investments

824

1,222

22

(1,723)

-

-

Other income

40

168

(271)

81

81

81

Cash Flow from Investing

701

1,021

(1,331)

(1,389)

(1,119)

(1,119)

Issue of Equity

-

0

0

(2)

-

-

798

(520)

(292)

1,673

665

800

Inc./(Dec.) in loans

Dividend Paid (Incl. Tax)

358

399

399

399

399

399

Others

(3,390)

(4,214)

(2,047)

(2,904)

(1,851)

(1,914)

Cash Flow from Financing

(2,234)

(4,335)

(1,940)

(834)

(787)

(715)

Inc./(Dec.) in Cash

331

(306)

(47)

(106)

405

415

514

845

539

492

387

791

Opening Cash balances

Closing Cash balances

845

539

492

387

791

1,206

November 24, 2017

10

Dr. Reddy’s Laboratories | 2QFY2018 Result Update

Key ratios

Y/E March

FY2014

FY2015

FY2016

FY2017

FY2018E FY2019E

Valuation Ratio (x)

18.6

18.1

17.1

32.5

33.8

23.2

P/E (on FDEPS)

P/CEPS

14.3

13.6

13.8

17.6

17.7

13.9

P/BV

4.4

3.6

3.1

3.2

3.0

2.7

0.6

0.6

0.6

0.6

0.6

0.6

Dividend yield (%)

EV/Sales

3.1

2.7

2.6

3.0

3.1

2.7

13.2

12.1

10.4

18.5

17.4

13.6

EV/EBITDA

EV / Total Assets

3.1

2.7

2.5

2.5

2.3

2.1

Per Share Data (`)

EPS (Basic)

126.7

130.2

138.2

72.6

69.9

102.0

EPS (fully diluted)

126.7

130.2

138.2

72.6

69.9

102.0

165.5

174.0

171.7

134.5

133.4

169.3

Cash EPS

DPS

15.0

15.0

15.0

15.0

15.0

15.0

Book Value

534.7

653.3

752.3

739.6

785.4

863.3

Dupont Analysis

EBIT margin

18.6

17.1

18.6

8.8

10.0

13.0

80.9

78.8

73.7

82.2

72.6

75.4

Tax retention ratio

Asset turnover (x)

1.2

1.1

1.0

0.9

0.8

0.8

ROIC (Post-tax)

17.4

15.1

14.3

6.4

5.8

8.3

Cost of Debt (Post Tax)

0.0

0.0

0.0

0.0

0.0

0.0

Leverage (x)

0.4

0.4

0.3

0.3

0.4

0.4

24.7

20.4

18.3

8.5

8.2

11.5

Operating ROE

Returns (%)

ROCE (Pre-tax)

20.2

18.1

18.7

7.5

7.7

10.3

Angel ROIC (Pre-tax)

25.6

22.5

22.9

10.1

11.4

15.0

ROE

26.3

21.9

19.7

9.6

9.2

12.4

Turnover ratios (x)

Asset Turnover (Gross Block)

3.5

3.6

3.2

2.7

2.4

2.3

Inventory / Sales (days)

62

61

60

62

63

65

Receivables (days)

89

90

96

89

91

94

Payables (days)

40

43

59

40

39

40

97

96

89

98

98

90

WC cycle (ex-cash) (days)

Solvency ratios (x)

Net debt to equity

0.4

0.3

0.2

0.4

0.4

0.4

Net debt to EBITDA

1.2

1.0

0.8

2.2

2.1

1.8

Interest Coverage (EBIT / Int.)

-

-

-

-

-

1.0

November 24, 2017

11

Dr. Reddy’s Laboratories | 2QFY2018 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of

India Limited, Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a

Depository Participant with CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund

Distributor. Angel Broking Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research

Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been debarred/

suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the

company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any

investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this

document should make such investigations as they deem necessary to arrive at an independent evaluation of an

investment in the securities of the companies referred to in this document (including the merits and risks involved), and

should consult their own advisors to determine the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding

positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a

report on a company's fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports

available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other

reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on

as such, as this document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies

shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the

information contained in this report. Angel Broking Pvt. Limited has not independently verified all the information contained

within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the

accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited endeavors to update on a

reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that

prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be

reproduced, redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may

Disclosure of Interest Statement

Dr. Reddy’s Laboratories

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 24, 2017

12