1QFY2018 Result Update | Pharmaceutical

August 3, 2017

Dr. Reddy’s Laboratories

NEUTRAL

CMP

`2,723

Performance Highlights

Target Price

-

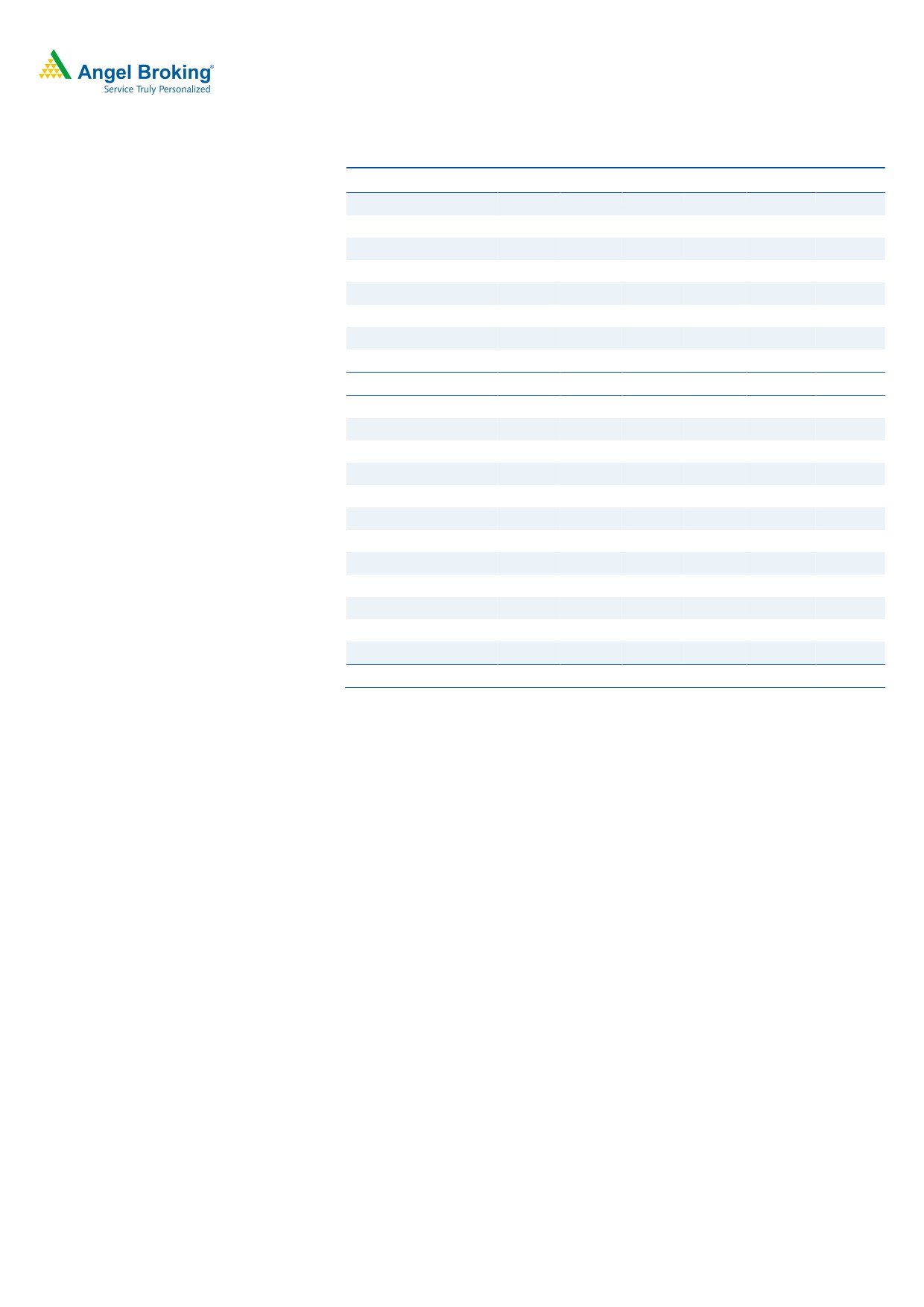

Y/E March (` cr)

1QFY2018

4QFY2017

% chg (qoq)

1QFY2017

% chg (yoy)

Investment Period

12 months

Net sales

3,316

3,554

(6.7)

3,235

2.5

Gross profit

1,990

2,111

(5.7)

2,086

(4.6)

Stock Info

Operating profit

306

555

(44.9)

377

(19.0)

Sector

Pharmaceutical

Adj. net profit

59

312

(81.1)

126

(53.2)

Market Cap (` cr)

40,241

Source: Company, Angel Research

Net Debt (` cr)

2,839

Dr Reddy’s Labs posted poor results for 1QFY2018, which were much lower than

Beta

0.4

expectations. The sales came in at `3,316cr (`3,636cr expected) v/s. `3,235cr, a yoy

52 Week High / Low

3,395/2,371

growth of 2.5%. Global Generics at `2,745.5cr, posted a yoy growth of 3.0%, while PSAI at

Avg. Daily Volume

33,208

`465.1cr, registered a yoy de-growth of 1.0%. On operating front, the EBDITA came in at

Face Value (`)

5

9.2% (16.1% expected) v/s. 11.7% in 1QFY2017. R&D expenses were at 15.3% of sales in

BSE Sensex

32,575

1QFY2018 v/s. 14.8% of sales in 1QFY2017. Consequently, the PAT came in at `59cr

Nifty

10,115

(`321cr expected) v/s. `126cr in 1QFY2017, a yoy de-growth of 53.2%. We maintain our

Reuters Code

REDY.BO

neutral.

Bloomberg Code

DRRD@IN

A subdued quarter: The sales came in at `3,316cr (`3,636cr expected) v/s. `3,235cr, a

yoy growth of 2.5%. Global Generics at `2,745.5cr, posted a yoy growth of 3.0%, while

Shareholding Pattern (%)

PSAI at `465.1cr, registered a yoy de-growth of 1.0%. The Global Generics, which forms

Promoters

26.8

83% of overall sales, saw dip in its key growth market USA (`1,494.6cr), which posted a

MF / Banks / Indian Fls

14.9

dip of 4.0% yoy, while Indian sales at `468.7cr posted a dip of 10.0%. The USA market

FII / NRIs / OCBs

49.0

continued to reel under the pricing pressures, while Indian sales were under the pressure on

Indian Public / Others

9.4

the back of GST. On operating front, the EBDITA came in at 9.2% (16.1% expected) v/s.

11.7% in 1QFY2017. R&D expenses were at 15.3% of sales in 1QFY2018 v/s. 14.8% of

sales in 1QFY2017. Consequently, the PAT came in at `59cr (`321cr expected) v/s. `126cr

Abs. (%)

3m 1yr

3yr

in 1QFY2017, a yoy de-growth of 53.2%.

Sensex

8.9

16.3

27.8

Outlook & Valuation: We expect net sales to grow at a CAGR of 13.0% to `17,973cr

Dr Reddy

(11.6)

(18.4)

(12.0)

and adjusted EPS to post a CAGR of 23.6% to end the period at `111 in FY2019E. We

recommend a Neutral.

3-year Daily Price Chart

5,000

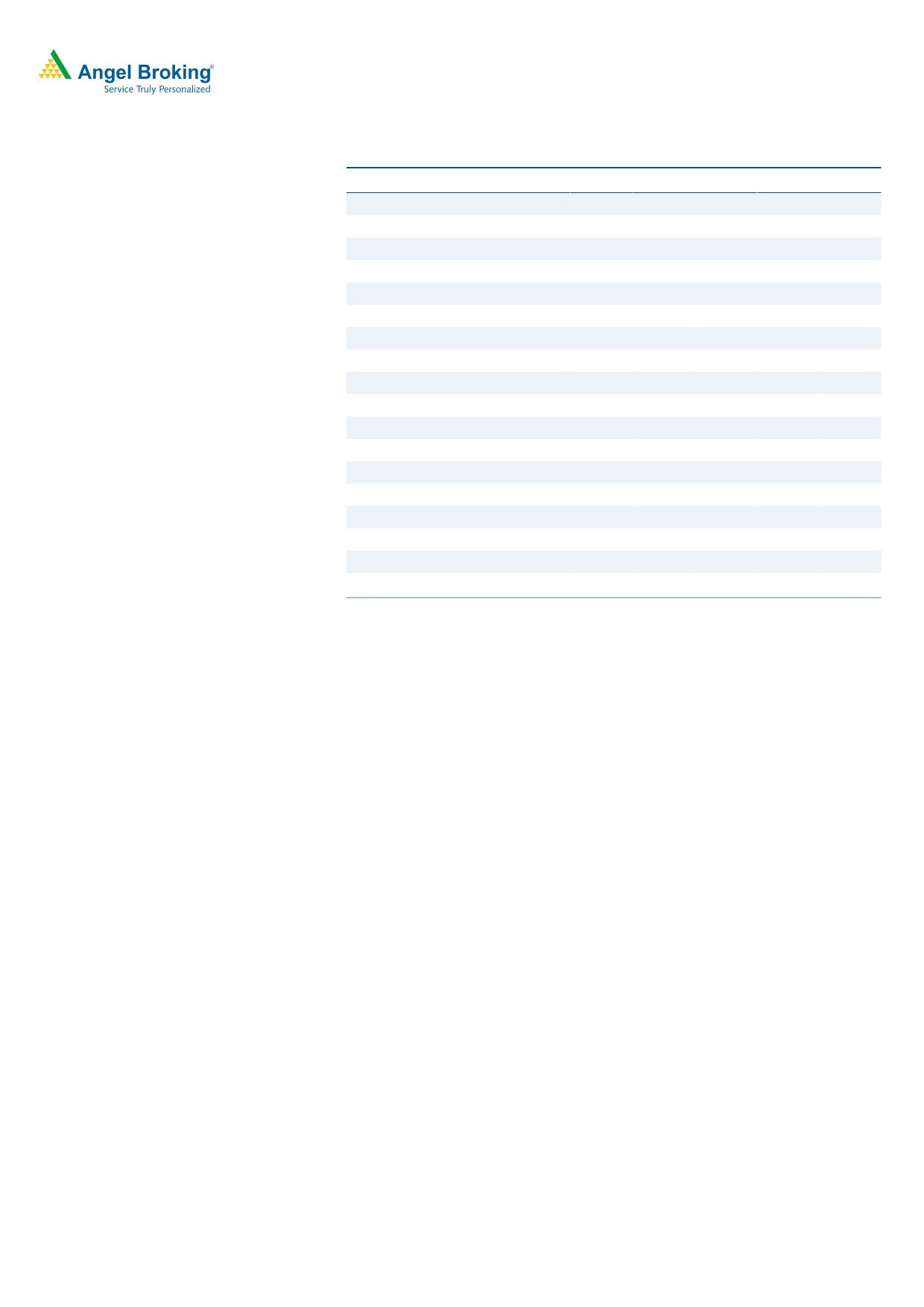

Key financials (IFRS Consolidated)

4,500

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

4,000

Net sales

15,471

14,081

15,844

17,973

3,500

% chg

4.4

-9.0

12.5

13.4

3,000

2,500

Net profit

2,001

1,204

1,521

1,840

2,000

% chg

(9.8)

(39.8)

26.3

21.0

1,500

Adj net profit

2,357

1,204

1,521

1,840

1,000

% chg

6.3

(48.9)

26.3

21.0

Adj. EPS (`)

138.2

72.6

91.7

111.0

EBITDA margin (%)

24.6

16.1

17.6

18.2

Source: Company, Angel Research

P/E (x)

17.6

33.4

26.5

21.9

RoE (%)

19.7

9.6

11.9

13.0

RoCE (%)

18.7

7.5

9.8

11.2

P/BV (x)

3.2

3.3

3.0

2.7

EV/Sales (x)

2.6

3.1

2.7

2.4

Sarabjit Kour Nangra

EV/EBITDA (x)

10.7

19.0

15.6

13.4

+91 2 39357600 Ext: 6806

Source: Company, Angel Research; Note: CMP as of August 1, 2017

Please refer to important disclosures at the end of this report

1

Dr. Reddy’s Laboratories | 1QFY2018 Result Update

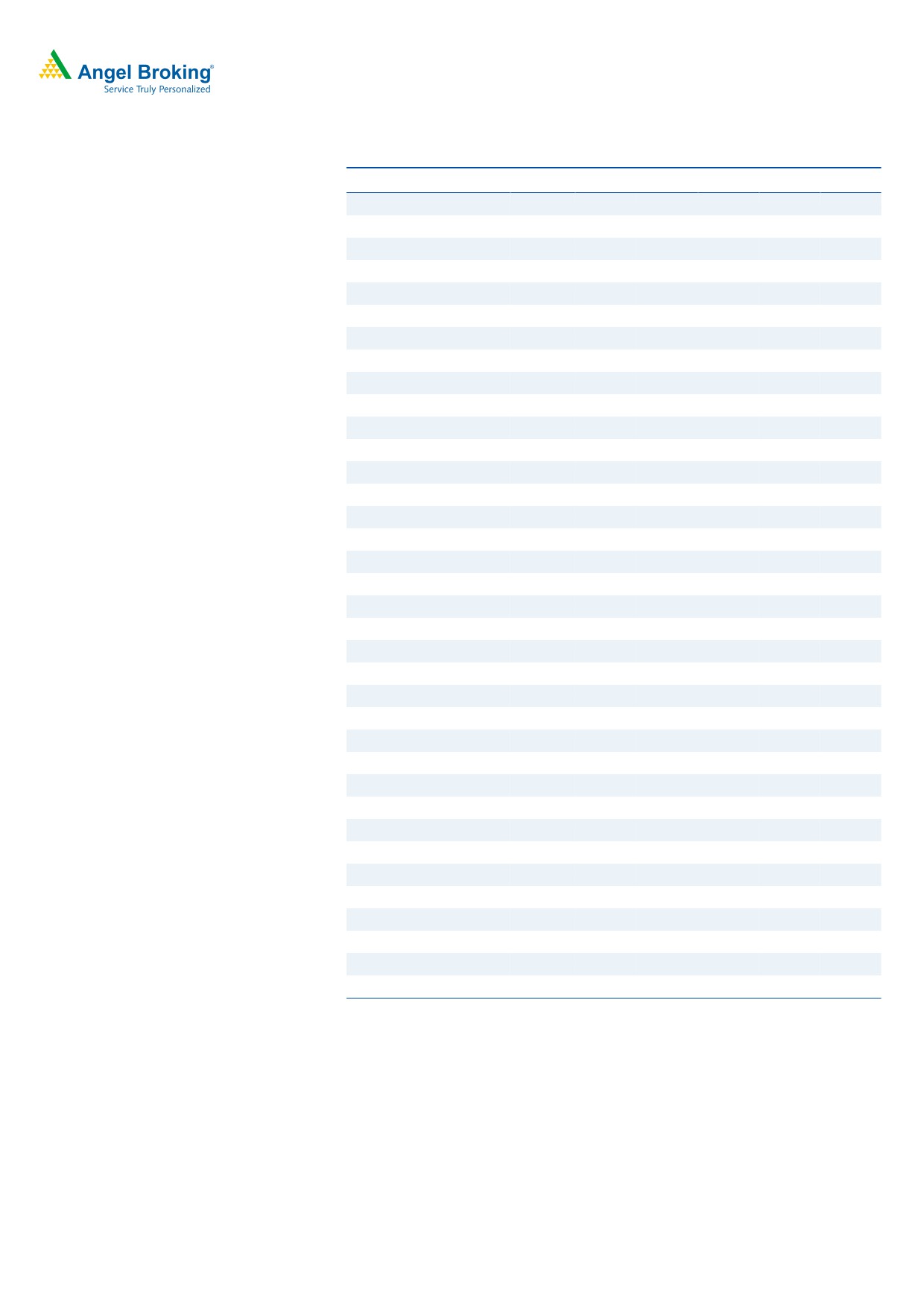

Exhibit 1: 1QFY2018 performance (IFRS, consolidated)

Y/E March (` cr)

1QFY2018

4QFY2017

% chg (qoq) 1QFY2017

% chg (yoy)

FY2017

FY2016

% chg

Net sales

3,316

3,554

(6.7)

3,235

2.5

14,081

15,471

(9.0)

Other income/(loss)

42

56

(25.8)

61

222

(161)

-

Total income

3,357

3,610

(7.0)

3,296

1.9

14,303

15,310

(6.6)

Gross profit

1,990

2,111

(5.7)

2,086

(4.6)

8,621

9,970

(13.5)

Gross margin (%)

60.0

59.4

64.5

61.2

64.4

SG&A expenses

1,176

1,097

7.2

1,228

(4.2)

4,637

4,570

1.5

R&D expenses

508

458

10.8

480

5.7

1,955

1,783

9.6

EBDITA

306

555

(44.9)

377

(19.0)

2,029

3,617

(43.9)

EBDITA (%)

9.2

15.6

-

11.7

14.4

23.4

-

Depreciation

280

292

(4.3)

268.2

4.4

785.7

742.0

5.9

Interest

-

-

-

-

-

PBT

67

319

(78.9)

170

(60.5)

1,465

2,714

(46.0)

Tax

18

6

200.0

44

261

713

(63.3)

Net Profit

49

313

(84.2)

126

(60.8)

1,204

2,001

(39.9)

Share of profit/ (loss) in associates

10

-

-

-

-

Reported net profit before exceptional

59

312

(81.1)

126

(53.2)

1,204

2,001

(39.9)

Exceptional items (loss) /profit

-

-

-

-

-

Reported PAT

59

312

(81.1)

126

(53.2)

1,204

2,001

(39.8)

Adj. Net Profit

59

312

(81.1)

126

(53.2)

1,204

2,357

(48.9)

EPS (`)

3.6

18.8

7.6

72.6

138.2

Source: Company, Angel Research

Exhibit 2: Actual Vs Estimates

(` cr)

Actual

Estimates

Variation (%)

Net sales

3,316

3,636

(8.8)

Other income

42

56

(25.9)

Operating profit

306

596

(48.7)

Tax

18

186

(90.3)

Adj. Net profit

59

321

(81.6)

Source: Company, Angel Research

Revenue lower than expectations: The sales came in at `3,316cr (`3,636cr expected)

in 1QFY2018 v/s. `3,235cr, a yoy growth of 2.5%. Global Generics at `2,745.5cr,

posted a yoy growth of 3.0%, while PSAI at `465.1cr, registered a yoy de-growth of

1.0%. The Global Generics, which constitutes 83% of overall sales, saw dip in its key

growth market USA (`1,494.6cr), which posted a dip of 4.0% yoy, while India (

`468.7cr), posted a dip of 10.0%. The USA market continued to reel under the pricing

pressures, while Indian sales were under the pressure on the back of GST.

The global generic market with sales at`2,746cr (up 3.0% yoy), was mainly lead by the

Europe performance, which posted a yoy growth of 28.0% to end the period at

`207.5cr. On constant currency basis, the growth in the region was 37.0% yoy. Growth

in the region was driven primarily on account of new launches and improvement in

base business.

Apart from this the Emerging markets (`575cr, up 34% yoy) posted robust growth on

the back of Russia (~`350cr) posted a growth of 48% in the reported currency, while

on constant currency terms the region posted a yoy growth of 31%. Its key growth

market USA (`1,494.6cr), posted a dip of 4.0% yoy, while India (`468.7cr), posted a

dip of 10.0%.

August 3, 2017

2

Dr. Reddy’s Laboratories | 1QFY2018 Result Update

US posted a dip, primarily on account of higher price erosion, increased competition in

the key products namely Valganciclovir, Decitabine, Azacitidine, etc., and

discontinuation of the McNeil business. This was partially offset by contribution from

new launches. During the quarter the company launched

4 new products

-

Ezetimibe+Simvastatin, Liposomal Doxorubicin, Progesterone, and Bivalirudin injection.

The PSAI segment posted sales of `465cr, down 1.0% yoy. The de-growth came in on

the back of Europe (`91.1cr, a yoy de-growth of 53%) and ROW (`156cr, a yoy dip of

10.0%). However, growth was registered in the sales of India (`139cr, a yoy growth of

273%) and USA (`80cr, a yoy growth of 24%).

As of June 30, 2017, cumulatively 99 generic filings are pending for approvals with the

USFDA (97 ANDAs and 2 NDAs under 505(b)(2) route). Of these 97 ANDAs, 59 are

Para IVs, out of which we believe 26 have ‘First to File’ status.

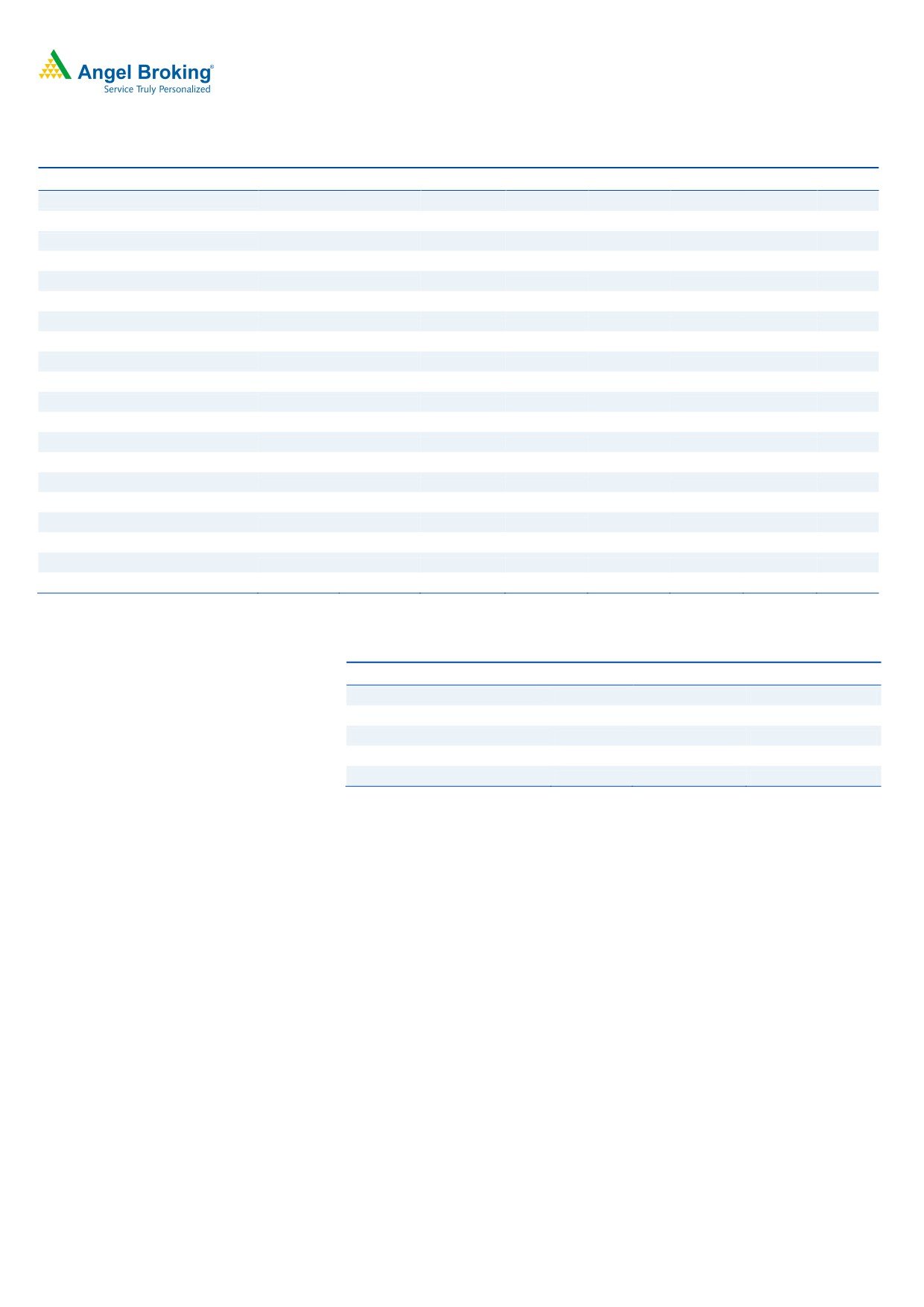

Exhibit 3: Trend in Global generics

3500

3000

2500

123

428

123

123

140

625

595

2000

571

522

469

215

177

162

207

208

1500

1000

1,613

1,659

1,552

1,535

1,496

500

0

1QFY2017

2QFY2017

3QFY2017

4QFY2017

1QFY2018

Others

Russia & CIS

India

Europe

North America

Source: Company, Angel Research

In the PSAI segment (14% of sales), the US grew by 24% yoy, while, ROW, Europe and

India grew by (10)%, (53)% & 273% yoy respectively during the quarter. Proprietary

Products & Others at `105.3cr posted a yoy growth of 4.0%.

August 3, 2017

3

Dr. Reddy’s Laboratories | 1QFY2018 Result Update

Exhibit 4: PSAI trend

700

600

500

198

190

194

400

173

156

58

41

40

300

64

139

210

183

200

254

195

91

100

114

126

53

80

0

37

1QFY2017 2QFY2017 3QFY2017 4QFY2017 1QFY2018

Others

India

Europe

North America

Source: Company, Angel Research

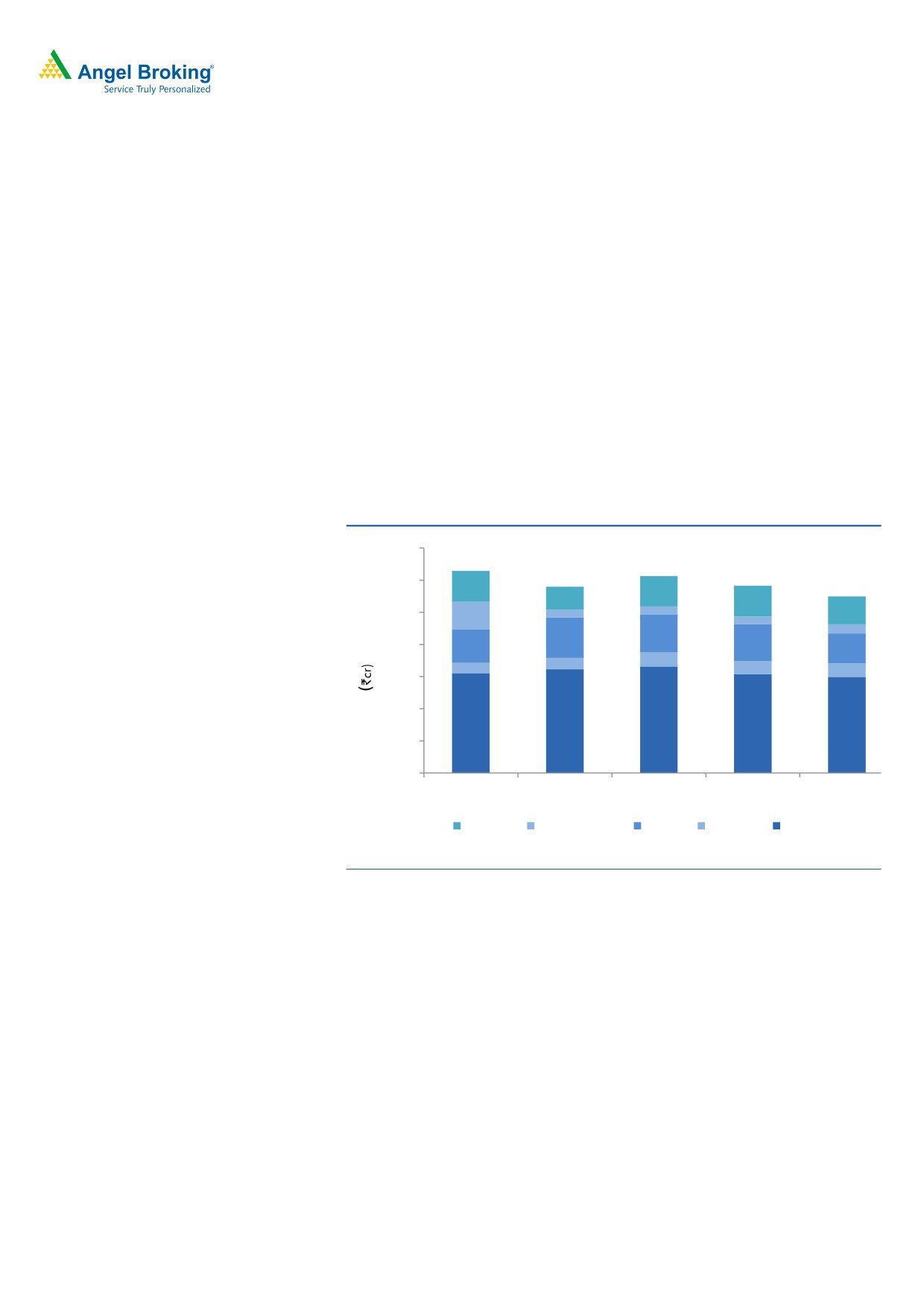

EBITDA margin dips yoy: On operating front, the EBDITA came in at 9.2% (16.1%

expected) in 1QFY2018 v/s. 11.7% in 1QFY2017. R&D expenses were at 15.3% of

sales in 1QFY2018 v/s. 14.8% of sales in 1QFY2017. Gross margins during the

quarter were at 60.0% v/s. 64.5% in 1QFY2017.

Exhibit 5: EBITDA margin trend (%)

28.0

23.0

24.0

20.0

16.6

15.6

16.0

11.7

12.0

9.2

8.0

4.0

0.0

1QFY2017 2QFY2017 3QFY2017 4QFY2017 1QFY2018

Source: Company, Angel Research

Net profit lower than expected: Consequently, the PAT came in at `59.1cr (`321cr

expected) in 1QFY2018 v/s. `126cr in 1QFY2017, a yoy de-growth of 53.2%.

August 3, 2017

4

Dr. Reddy’s Laboratories | 1QFY2018 Result Update

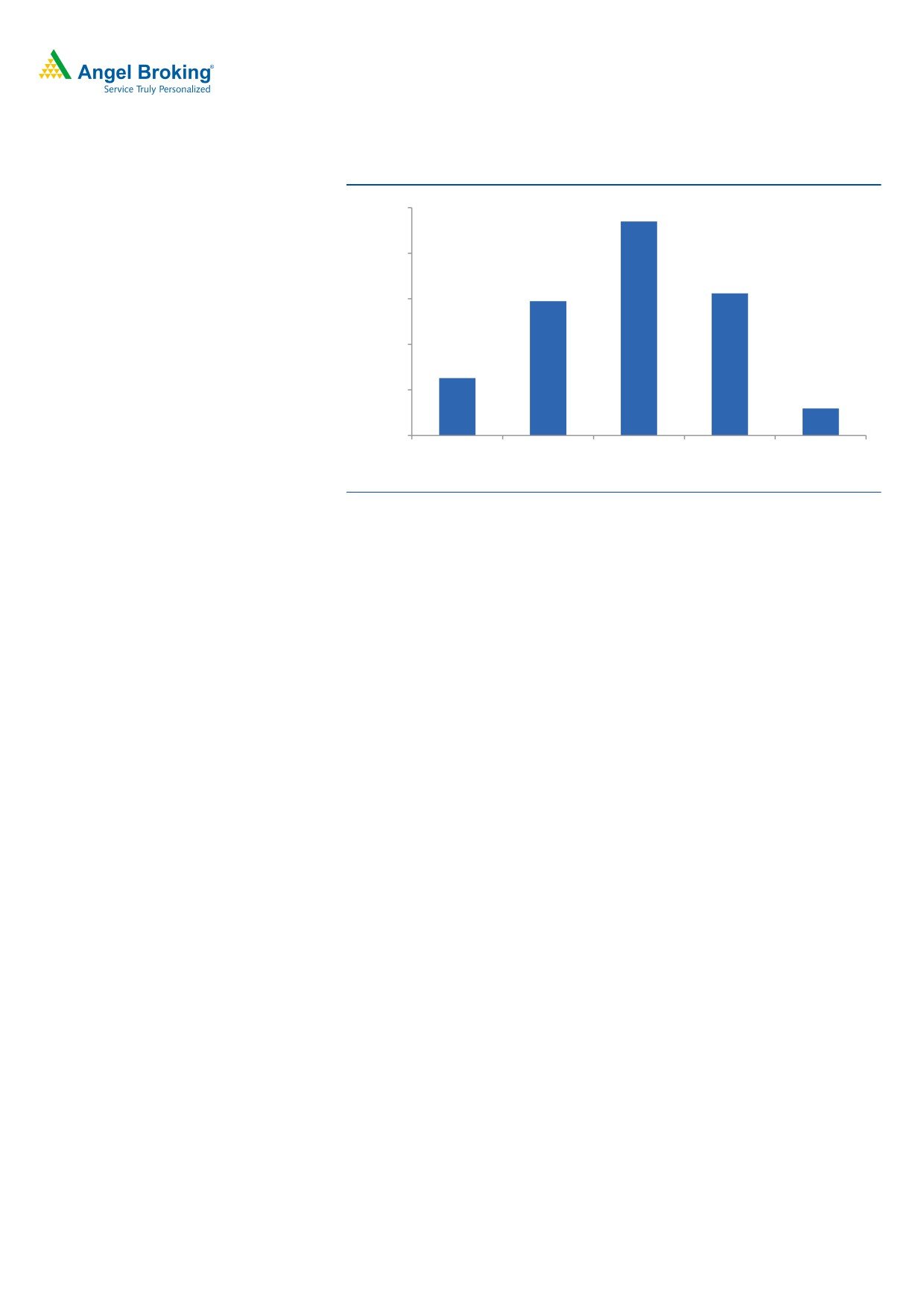

Exhibit 6: Adjusted net profit trend

470

500

400

312

295

300

200

126

59

100

0

1QFY2017

2QFY2017

3QFY2017

4QFY2017

1QFY2018

Source: Company, Angel Research

Concall takeaways

Duvvada will require re-inspection (expected by Dec’2017 end).

DRL expects 15 ANDA launches in FY2018 (including

4-5 meaningful

launches.

Tax rate in FY2018 to stay at ~23-25% of PBT.

R&D expense is expected to remain at higher levels due to strong product

pipeline of complex generics, Biosimilars and differentiated products. R&D

expenses during the quarter are expected to be ~`2000cr in FY2018.

Investment arguments

Robust pipeline for US going ahead: After attaining a critical mass (US$981mn in

FY2017), DRL aims to scale up its business to the next orbit in the US market on

the back of a strong product pipeline (99 ANDAs are pending approval, of which,

62 are Para IVs and 21 are FTFs). The Management has guided for a robust

growth in the US over the medium term, driven by introduction of new products,

some of which are also Para IV opportunities. Owing to the import alert on the

three facilities of the company, in a worst case scenario, we expect the ex-

exclusivity US sales to post a 14.3% growth over FY2017-19E.

Domestic to be back in focus: DRL reported a 9.0% yoy growth in FY2017. The

management expects the company’s performance to rebound and targets to

achieve an above industry growth rate going ahead, driven by - (a) field force

expansion and improvement in productivity; (b) new product launches (including

biosimilars); and (c) focus on brand building. In 4QFY2015, DRL had acquired

UCB’s India portfolio and had completed the integration process of these brands

in 1QFY2016. UCB’s India business had registered ~`150cr sales in CY2014 and

has a branded portfolio of

21 products focusing on Allergy, Respiratory,

Dermatology and Pediatric space. The acquisition had been successfully integrated

August 3, 2017

5

Dr. Reddy’s Laboratories | 1QFY2018 Result Update

by 2QFY2016. Also, in FY2017, the domestic formulation business posted a lower

growth, on account of NPPA pricing notifications and demonetization. In FY2018,

the Indian domestic sales have taken a hit on back of the GST implementation,

and hence, the year is expected to end with domestic formulation business growing

at single digit or low double digit growth. Thus, we expect sales in India to post a

CAGR of ~12.0% over FY2017-19E.

Outlook & Valuation: We expect net sales to grow at a CAGR of 13.0% to

`17,973cr and adjusted EPS to post a CAGR of 23.6% over FY2017-19E to end

FY2019 at `111.0. The stock has been severely beaten down post the import alert

from the USFDA. However, considering the valuations, we recommend a Neutral

rating on the stock.

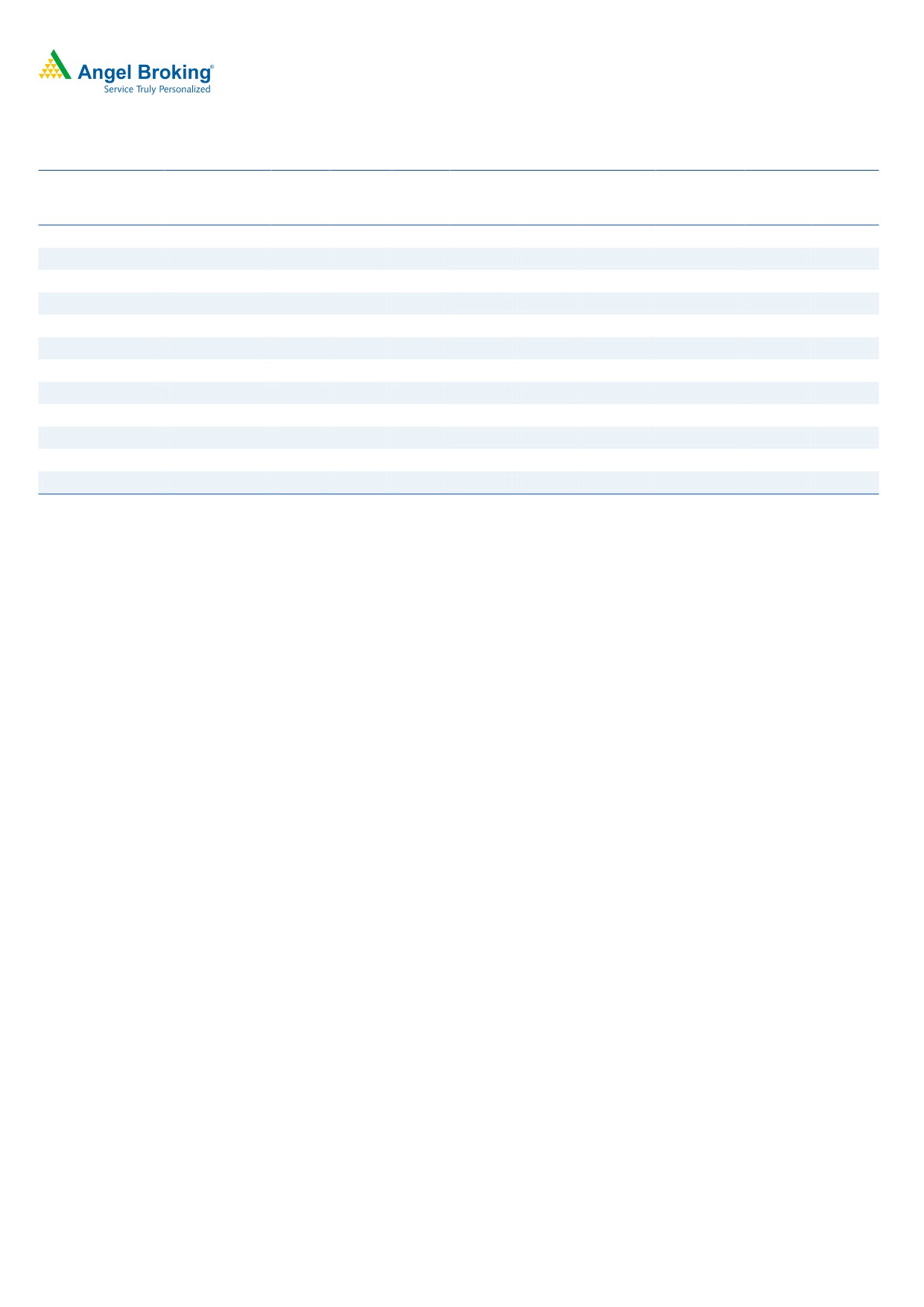

Exhibit 7: Key assumptions

FY2018E

FY2019E

PSAI segment growth (%)

3.5

3.8

Generics segment growth (%)

14.0

14.8

Operating margin (%)

17.6

18.2

Capex (` cr)

1200

1200

Source: Company, Angel Research

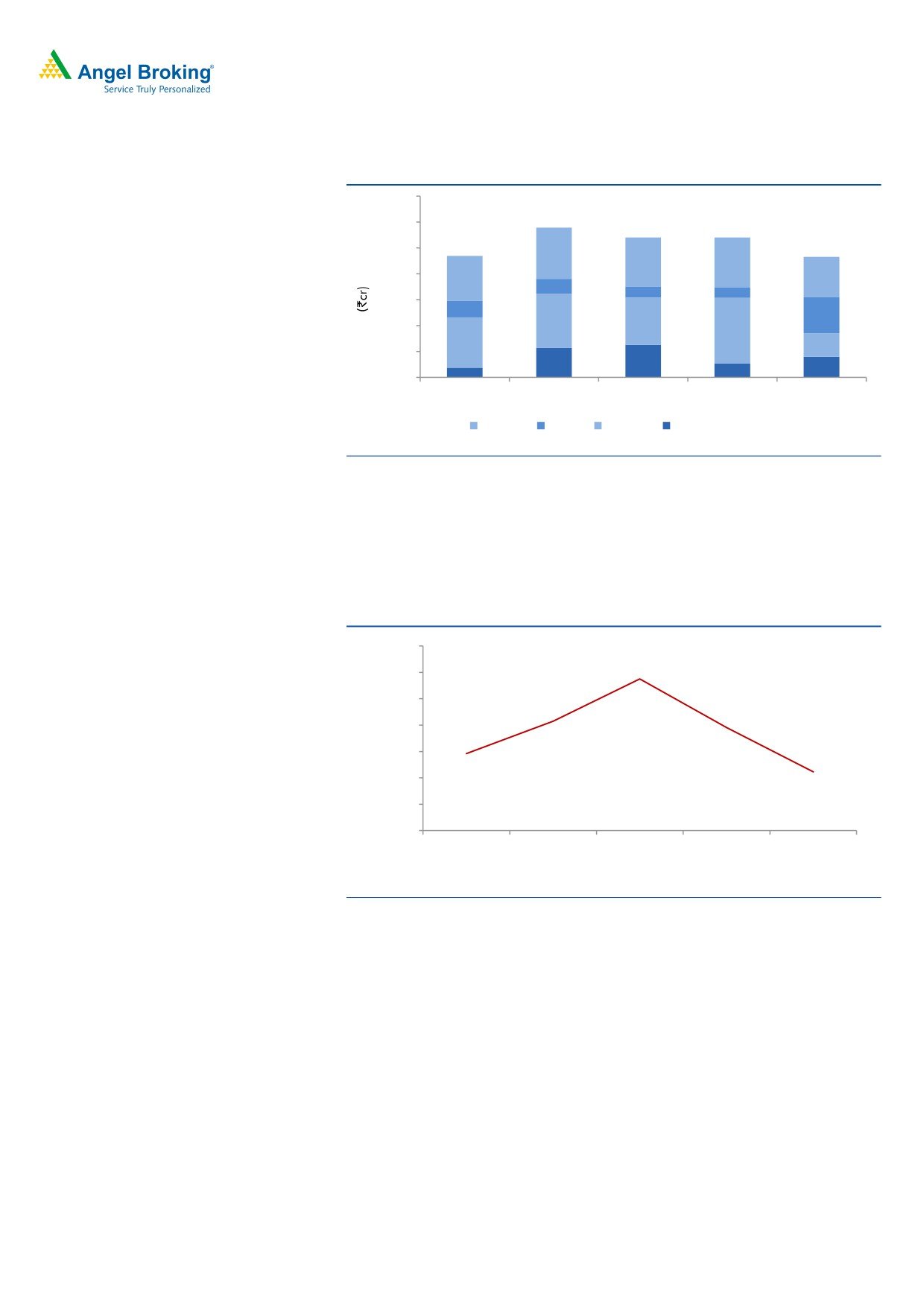

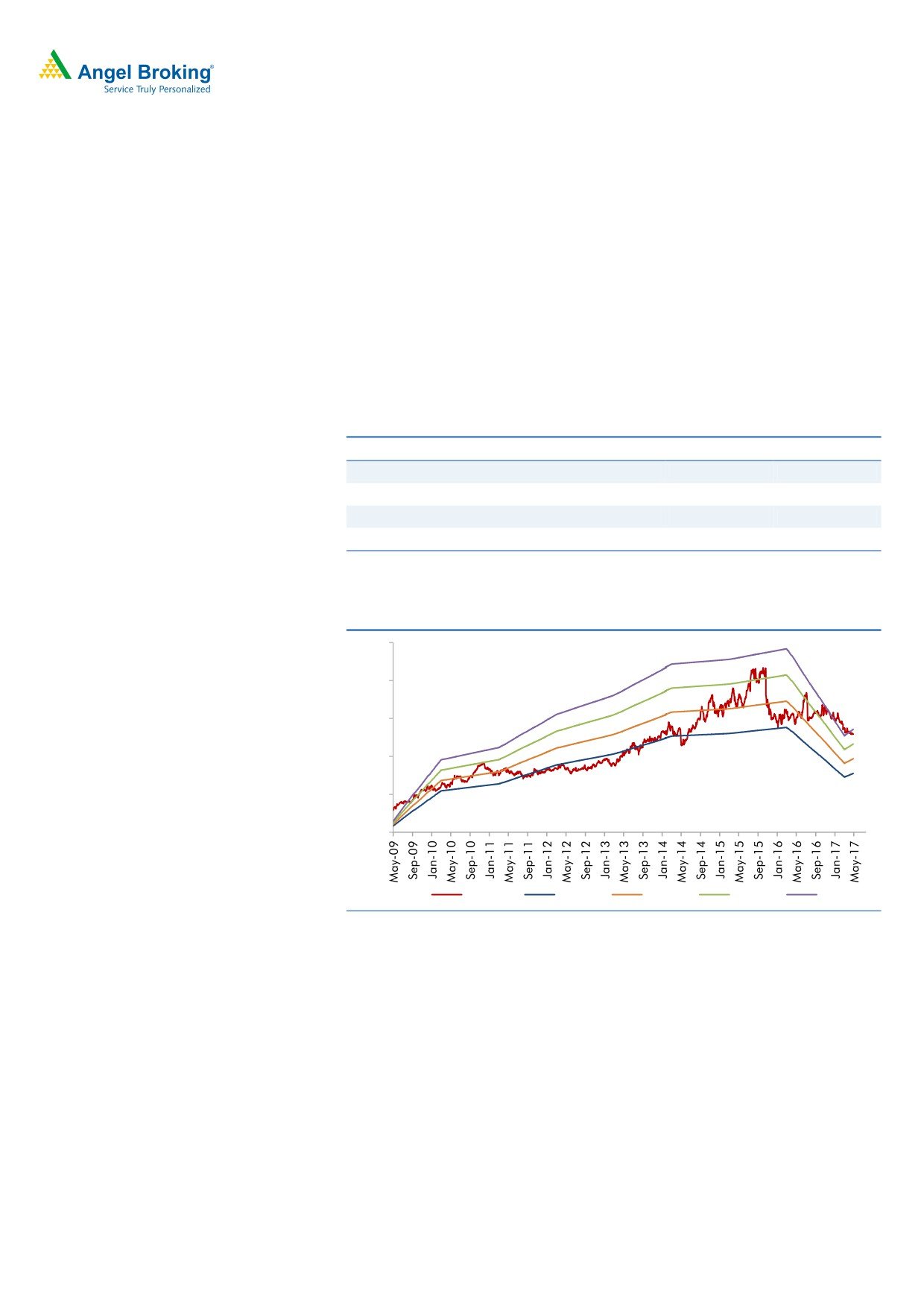

Exhibit 8: PE chart

5,000

4,000

3,000

2,000

1,000

0

Price

20x

25x

30x

35x

Source: Company, Angel Research

August 3, 2017

6

Dr. Reddy’s Laboratories | 1QFY2018 Result Update

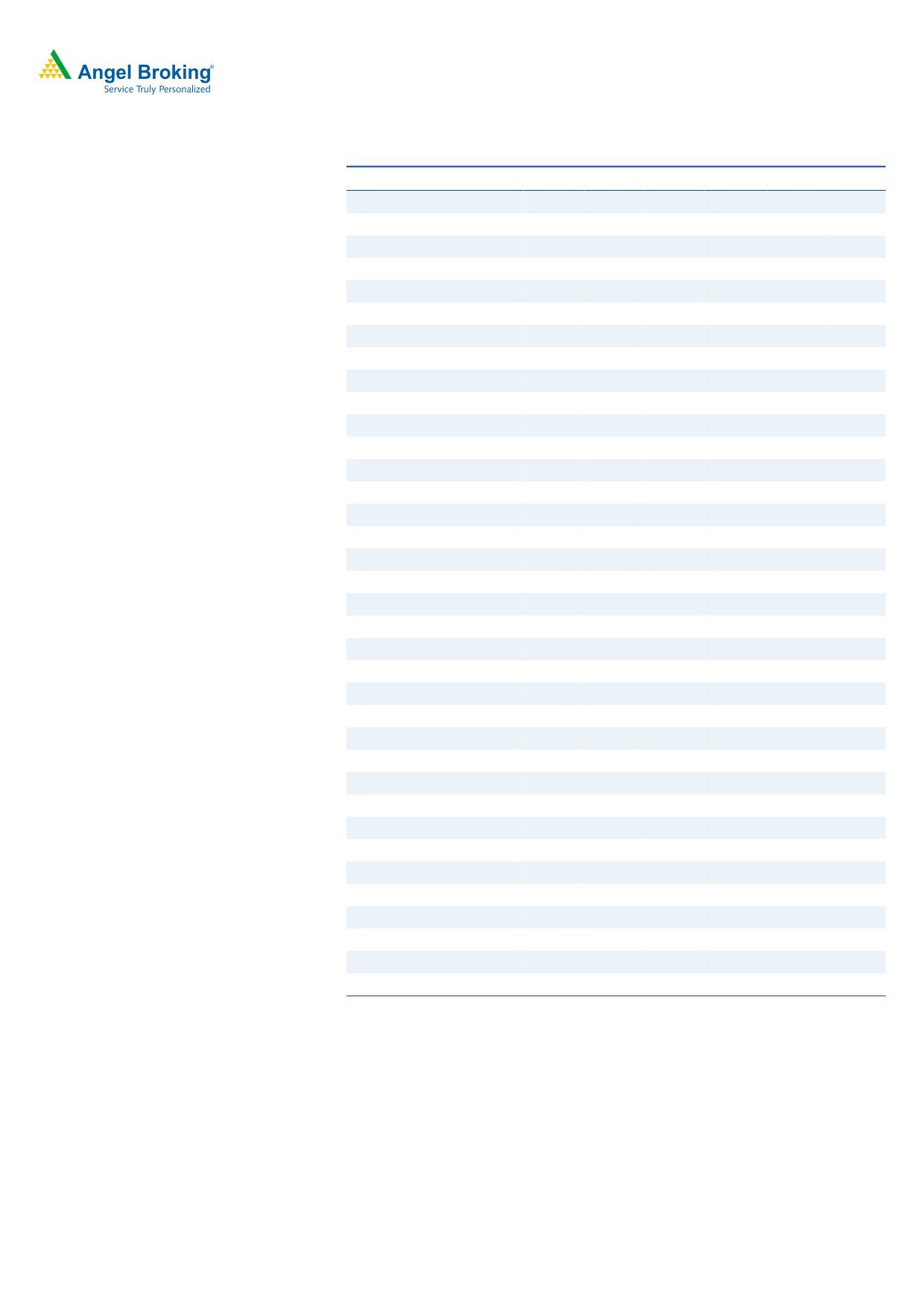

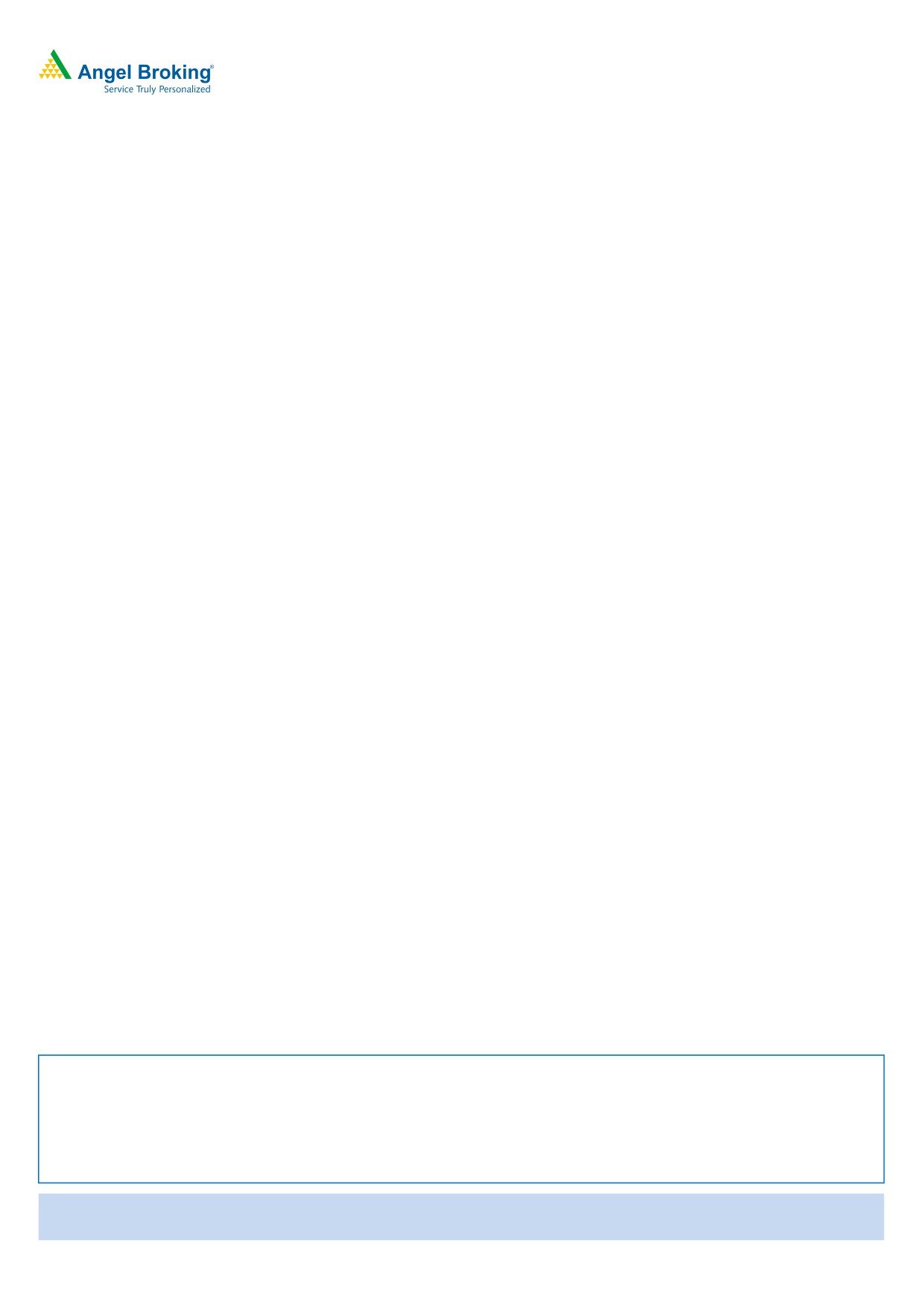

Exhibit 9: Recommendation summary

Company

Reco.

CMP

Tgt Price

Upside

FY2019E

FY17-19E

FY2019E

(`)

(`)

(%)

PE

EV/Sales

EV/EBITDA

CAGR in EPS

RoCE

RoE

(x)

(x)

(x)

(%)

(%)

(%)

Alembic Pharma

Accumulate

525

600

14.4

19.3

2.2

11.3

12.8

24.3

20.6

Aurobindo Pharma

Accumulate

735

877

12.0

14.3

2.2

10.0

14.2

25.3

22.7

Cadila Healthcare

Sell

542

450

(16.9)

25.5

4.1

20.2

21.0

17.3

22.9

Cipla

Sell

562

465

(18.0)

23.2

2.4

15.0

39.2

11.0

13.2

Dr Reddy's

Neutral

2,427

-

-

21.9

2.4

13.4

23.6

11.2

13.0

Dishman Pharma

Under Review

301

-

-

18.9

1.3

10.1

(6.8)

2.9

2.5

GSK Pharma

Neutral

2,377

-

-

40.6

5.5

30.4

30.6

28.9

26.5

Indoco Remedies

Sell

200

153

(23.5)

15.7

1.5

10.3

23.0

11.2

15.0

Ipca labs

Buy

483

613

28.5

7.9

0.6

4.1

27.9

12.8

11.2

Lupin

Buy

1,018

1,526

49.9

14.7

2.0

8.5

10.4

20.6

17.8

Sanofi India*

Neutral

4,286

-

-

27.9

2.9

17.2

9.2

23.9

25.8

Sun Pharma

Buy

535

712

33.2

16.5

3.1

12.2

1.2

15.1

18.8

Source: Company, Angel Research; Note: *December year ending

Company Background

Established in

1984, Dr. Reddy's Laboratories is an integrated global

pharmaceutical company, through its three businesses - Pharmaceutical Services &

Active Ingredients, Global Generics and Proprietary Products. The company’s key

therapeutic focus is on gastro-intestinal, cardiovascular, diabetology, oncology,

pain management, anti-infective and paediatrics. The company’s key markets

include India, USA, Russia & CIS and Germany.

August 3, 2017

7

Dr. Reddy’s Laboratories | 1QFY2018 Result Update

Profit & loss statement (IFRS Consolidated)

Y/E March

FY2014

FY2015

FY2016

FY2017

FY2018E

FY2019E

Net sales

13,217

14,819

15,471

14,081

15,844

17,973

Other operating income

141.6

91.7

87.4

106.5

106.5

106.5

Total operating income

13,359

14,911

15,558

14,187

15,951

18,080

% chg

12.5

11.6

4.3

(8.8)

12.4

13.3

Total expenditure

10,096

11,535

11,669

11,811

13,049

14,701

Cost of revenues

4,977

5,531

5,315

5,219

6,236

6,793

SG&A expenses

3,878

4,259

4,570

4,637

4,595

5,212

R&D expenses

1,240

1,745

1,783

1,955

2,218

2,696

EBITDA

3,121

3,284

3,802

2,270

2,796

3,272

% chg

16.6

5.2

15.8

(40.3)

23.2

17.0

(% of Net Sales)

23.6

22.2

24.6

16.1

17.6

18.2

Depreciation & amortisation

659.8

747.4

927.4

1,026.6

1,052.8

1,115.5

EBIT

2,462

2,537

2,875

1,243

1,743

2,157

% chg

27.4

3.1

13.3

(56.7)

40.2

23.7

(% of Net Sales)

18.6

17.1

18.6

8.8

11.0

12.0

Interest & other charges

-

-

-

-

-

-

Other Income

40.0

168.2

(270.8)

80.6

80.6

80.6

(% of PBT)

1.5

6.0

(10.0)

5.5

4.1

3.4

Share in profit of associates

17.4

19.5

22.9

34.9

34.9

34.9

Recurring PBT

2,661

2,816

2,714

1,465

1,965

2,379

% chg

19.0

5.9

(3.6)

(46.0)

34.1

21.1

Extraordinary expense/(Inc.)

-

-

508.5

-

-

-

PBT (reported)

2,660.6

2,816.3

2,714.0

1,465.3

1,964.9

2,378.8

Tax

509.4

598.4

712.7

261.4

443.9

539.1

(% of PBT)

19.1

21.2

26.3

17.8

22.6

22.7

PAT (reported)

2,151.2

2,217.9

2,001.3

1,203.9

1,521.0

1,839.7

Add: Share of earnings of asso.

-

-

-

-

-

-

Less: Minority interest (MI)

-

-

-

-

-

-

Exceptional items

-

-

-

-

-

-

PAT after MI (reported)

2,151.2

2,217.9

2,001.3

1,203.9

1,521.0

1,839.7

ADJ. PAT

2,151.2

2,217.9

2,357.0

1,203.9

1,521.0

1,839.7

% chg

22.9

3.1

6.3

(48.9)

26.3

21.0

(% of Net Sales)

16.3

15.0

12.9

8.5

9.6

10.2

Basic EPS (`)

126.7

130.2

138.2

72.6

91.7

111.0

Fully Diluted EPS (`)

126.7

130.2

138.2

72.6

91.7

111.0

% chg

22.9

2.7

6.1

(47.4)

26.3

21.0

August 3, 2017

8

Dr. Reddy’s Laboratories | 1QFY2018 Result Update

Balance sheet (IFRS Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017

FY2018E FY2019E

SOURCES OF FUNDS

Equity share capital

84.9

85.2

85.3

82.9

82.9

82.9

Preference Capital

-

-

-

-

-

-

Reserves & surplus

8,995

11,045

12,748

12,179

13,301

14,741

Shareholders funds

9,080

11,130

12,834

12,262

13,384

14,824

Minority Interest

Total loans

4,474.2

3,954.3

3,661.9

5,335.1

5,700.0

5,800.0

Deferred tax liability

(192.9)

(401.3)

(423.0)

(516.4)

(516.4)

(516.4)

Total liabilities

13,361

14,683

16,073

17,081

18,567

20,108

APPLICATION OF FUNDS

Net fixed assets

3,945

4,314

5,396

5,142

6,342

7,542

Goodwill /other intangibles

1,470

1,643

1,969

4,618

4,618

4,618

Capital Work-in-Progress

495.2

495.2

495.2

495.2

495.2

495.2

Investments

2,589

3,811

3,833

2,110

2,110

2,110

Current Assets

7,866

8,558

8,465

8,257

8,857

9,780

Cash

845

539

492

387

299

80

Loans & Advances

793.0

889.1

928.2

844.9

950.7

1,078.4

Other

6,228

7,129

7,045

7,025

7,607

8,622

Current liabilities

3,006

4,214

4,193

4,057

4,371

4,954

Net Current Assets

4,860

4,344

4,273

4,199

4,486

4,826

Other Assets

76

106

517

517

517

Total Assets

13,361

14,683

16,073

17,081

18,567

20,108

August 3, 2017

9

Dr. Reddy’s Laboratories | 1QFY2018 Result Update

Cash flow statement (IFRS Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017

FY2018E FY2019E

Profit before tax

2,661

2,816

2,714

1,465

1,965

2,379

Depreciation

660

747

927

1,027

1,053

1,116

(Inc)/Dec in Working Capital

(906)

211

24

(32)

(374)

(560)

Less: Other income

40

168

(271)

81

81

81

Direct taxes paid

509

598

713

261

444

539

Cash Flow from Operations

1,865

3,008

3,224

2,118

2,119

2,315

(Inc.)/Dec.in Fixed Assets

(164)

(369)

(1,082)

254

(1,200)

(1,200)

(Inc.)/Dec. in Investments

824

1,222

22

(1,723)

-

-

Other income

40

168

(271)

81

81

81

Cash Flow from Investing

701

1,021

(1,331)

(1,389)

(1,119)

(1,119)

Issue of Equity

-

0

0

(2)

-

-

Inc./(Dec.) in loans

798

(520)

(292)

1,673

365

100

Dividend Paid (Incl. Tax)

358

399

399

399

399

399

Others

(3,390)

(4,214)

(2,047)

(2,904)

(1,851)

(1,914)

Cash Flow from Financing

(2,234)

(4,335)

(1,940)

(834)

(1,087)

(1,415)

Inc./(Dec.) in Cash

331

(306)

(47)

(106)

(88)

(219)

Opening Cash balances

514

845

539

492

387

299

Closing Cash balances

845

539

492

387

299

80

August 3, 2017

10

Dr. Reddy’s Laboratories | 1QFY2018 Result Update

Key ratios

Y/E March

FY2014

FY2015

FY2016

FY2017

FY2018E

FY2019E

Valuation Ratio (x)

P/E (on FDEPS)

19.2

18.6

17.6

33.4

26.5

21.9

P/CEPS

14.7

13.9

14.1

18.0

15.6

13.6

P/BV

4.5

3.7

3.2

3.3

3.0

2.7

Dividend yield (%)

0.6

0.6

0.6

0.6

0.6

0.6

EV/Sales

3.2

2.8

2.6

3.1

2.7

2.4

EV/EBITDA

13.5

12.5

10.7

19.0

15.6

13.4

EV / Total Assets

3.2

2.8

2.5

2.5

2.3

2.2

Per Share Data (`)

EPS (Basic)

126.7

130.2

138.2

72.6

91.7

111.0

EPS (fully diluted)

126.7

130.2

138.2

72.6

91.7

111.0

Cash EPS

165.5

174.0

171.7

134.5

155.2

178.2

DPS

15.0

15.0

15.0

15.0

15.0

15.0

Book Value

534.7

653.3

752.3

739.6

807.2

894.1

Dupont Analysis

EBIT margin

18.6

17.1

18.6

8.8

11.0

12.0

Tax retention ratio

80.9

78.8

73.7

82.2

77.4

77.3

Asset turnover (x)

1.2

1.1

1.0

0.9

0.9

0.9

ROIC (Post-tax)

17.4

15.1

14.3

6.4

7.8

8.8

Cost of Debt (Post Tax)

0.0

0.0

0.0

0.0

0.0

0.0

Leverage (x)

0.4

0.4

0.3

0.3

0.4

0.4

Operating ROE

24.7

20.4

18.3

8.5

10.9

12.2

Returns (%)

ROCE (Pre-tax)

20.2

18.1

18.7

7.5

9.8

11.2

Angel ROIC (Pre-tax)

25.6

22.5

22.9

10.1

14.1

15.4

ROE

26.3

21.9

19.7

9.6

11.9

13.0

Turnover ratios (x)

Asset Turnover (Gross Block)

3.5

3.6

3.2

2.7

2.8

2.6

Inventory / Sales (days)

62

61

60

62

59

57

Receivables (days)

89

90

96

89

85

83

Payables (days)

40

43

59

40

39

39

WC cycle (ex-cash) (days)

97

96

89

98

92

90

Solvency ratios (x)

Net debt to equity

0.4

0.3

0.2

0.4

0.4

0.4

Net debt to EBITDA

1.2

1.0

0.8

2.2

1.9

1.7

Interest Coverage (EBIT / Int.)

-

-

-

-

-

1.0

August 3, 2017

11

Dr. Reddy’s Laboratories | 1QFY2018 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Dr. Reddy’s Laboratories

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

August 3, 2017

12