Cadila Healthcare | Pharmaceuticals

March 27, 2019

Cadila Healthcare

HOLD

CMP

`338

Corrected but not ripe for investment

Target Price

‘370

Investment Period

12 Months

Cadila Healthcare (Cadila) is on the largest Pharmaceuticals player both in US & Indian

markets. However, over the last few years, the company has been going through tough

times both in USA & Indian markets. While the Indian formulation market has been

under pressure on back of the pricing norms & GST implementation, USA market has

witnessed tougher times by Cadila Healthcare, on back of its Moriya facility coming

Stock Info

Sector

Pharm aceuticals

under USFDA warning letter. However, since then the company has taken steps to

Market Cap (` cr)

34,341

mitigate the risk in its business. The stock has given a correction, to account for the

Net Debt (` cr)

4,017

high business risk; however, it still provides very little comfort for investors. We

Beta

1.0

52 Week High / Low

432/306

recommend a Hold rating on the stock.

Avg. D aily Volum e

45,560

Face Value (`)

1

Growth to be driven by Domestic Business: Cadila’s exports contributed

BSE Sensex

38,233

around 59% to its FY2018 sales. Company has established a formidable presence in

Nifty

11,483

the developed markets of US, Europe (France and Spain) and ROW. USA exports are

Reuters Code

CADI.BO

Bloomberg Code

CDH.IN

expected to post a CAGR of 1.4% over FY2018-21E, driven by new product launches

and more focused launches in injectable, Transdermal and Specialty segments. Overall,

Shareholding Pattern (%)

we have built in an export sales CAGR of 2.3% over FY2018-21E. In the domestic

Prom oters

74.8

market, it plans to perk-up its productivity levels, along with aggressively launching

MF / Banks / Indian Fls

10.6

FII / NRIs / OCBs

8.4

new products, which will keep the momentum steady. We have conservatively

Indian Public / Others

6.2

forecasted the formulation business to post a CAGR of 9.5% CAGR during the FY2018-

21E. Apart from Domestic formulation business, the company has a strong consumer

Abs .(%)

3m

1 yr

3 yr

division, which contributed ~4% of sales in FY2018. After the Heinz acquisition,

Sensex

6.8

15.6

53.1

company’s wellness segment will contribute around 12% by FY2020. Over FY2018-21E,

Cadila Healthcare

(1.0)

(13.9)

5.2

the segment is expected to post a CAGR of 62.0% during the period.

Valuations & Outlook: Over FY2018-21E, the company expects to post a sales

and net profit CAGR of 9.1% and a flat growth during FY2018-21E respectively.

Company’s stock has witnessed a correction & however given the challenges, at

3-Year Daily Price Chart

current valuations the stock provides very little upside. Hence, we have factored in

600

the same to recommend a Hold.

550

500

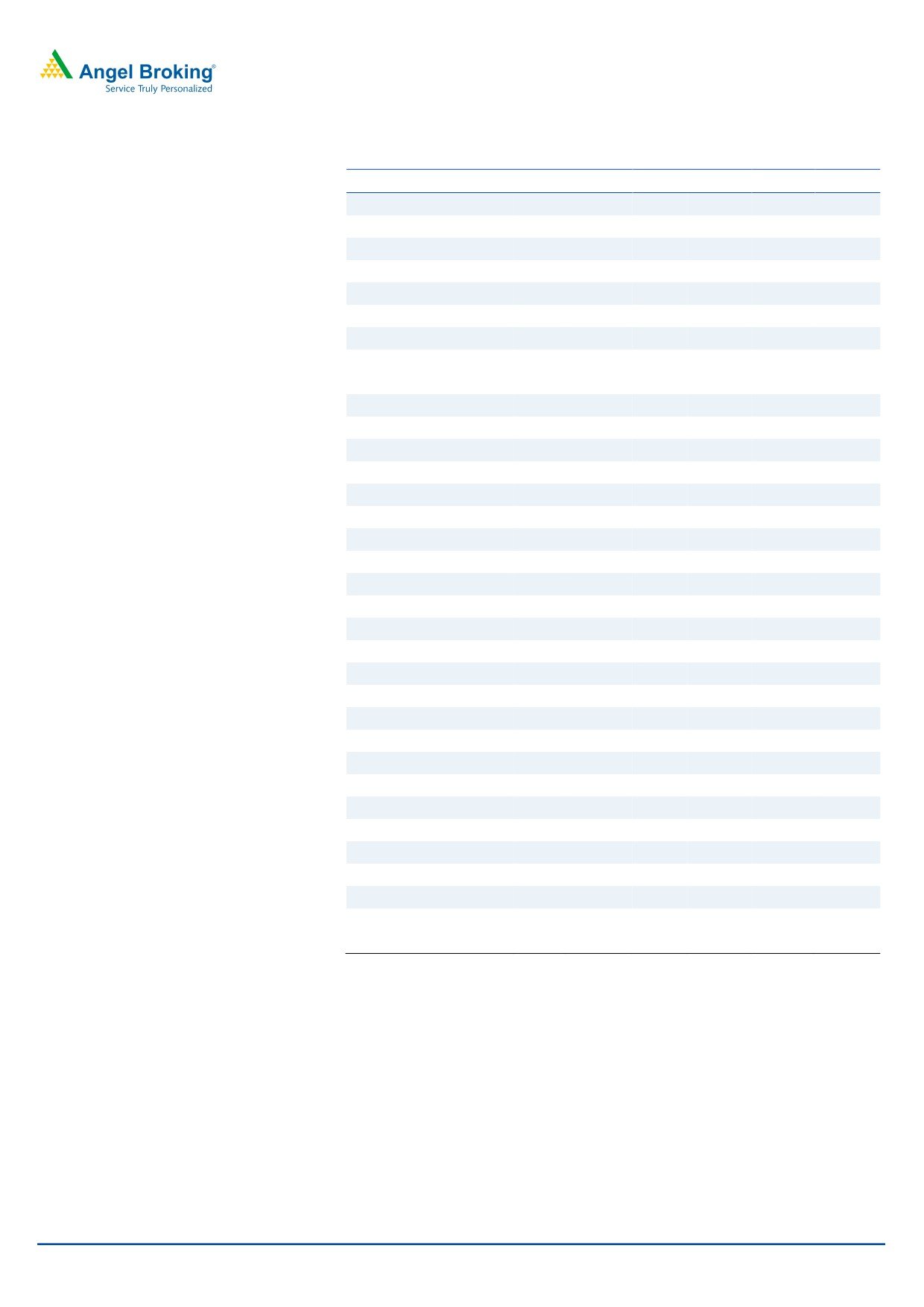

Key financials (Consolidated)

450

Y/E March (` cr)

FY2018

FY2019E

FY2020E

FY2021E

400

Net sales

11,599

12,624

14,063

15,055

350

% chg

25.8

8.8

11.4

7.0

300

Net profit

1,776

1,773

1,708

1,653

250

200

% chg

19.4

(0.2)

(3.6)

(3.3)

EBITDA margin (%)

21.8

20.4

19.1

17.9

EPS (`)

17.3

17.3

16.7

16.1

Source: Company, Angel Research

P/E (x)

19.5

19.5

20.2

20.9

P/BV (x)

4.0

3.5

3.1

2.8

RoE (%)

22.6

18.9

16.1

14.0

RoCE (%)

15.6

12.9

11.7

10.6

Sarabjit kour Nangra

EV/Sales (x)

3.3

3.2

2.9

2.6

+91 22 3935 7800 Ext: 6806

EV/EBITDA (x)

15.1

15.6

15.0

14.3

sarabjit @angelbroking.com

Source: Company, Angel Research; Note: CMP as of March 26, 2019

Please refer to important disclosures at the end of this report

1

Cadila Healthcare | Pharmaceuticals

Exports; expected to be lackluster

Cadila has a two-fold focus on exports (which contributed around 59% to its FY2018

top-line), wherein it is targeting developed as well as emerging markets. The company

has established a formidable presence in the developed markets of US, Europe (France

and Spain) and Japan. In the US, the company achieved critical scale of `5,834cr

(US$900mn) on the sales front in FY2018. The growth in exports to the USA along with

other regions like ROW would be driven by new product launches, going forward.

USA sales visibility better than earlier; but product concentration still high

USA is the key export market for the company, contributing 50% of overall sales. The

company registered a CAGR growth of 28% during FY2014-2018 in the region. It is the

8 th largest generic pharmaceutical company in US by Prescription Share & company’s

65% of portfolio occupy Top 3 position in the US generic prescription market (IQVIA

SMART NPA Generic TRx MAT October 2018). In addition, the company is amongst the

company with largest and diversify product pipeline for the USA market. As on 31st

Dec’2018, the company had overall 352 ANDA’s with around 215 ANDA is pending

approval. With around 15-20 ANDA’s expected to be approved annually, implies the

region can grow easily at 15-20% CAGR for next 4-5 years.

Cadila Healthcare in spite of being one of the top ANDA filer in the USA market (third,

after Sun Pharma & Aurobindo Pharma), had seen a rough patch in USA markets; when

its biggest facility Moriya plant went through USFDA inspection and import alert. The

sales from that plant contributed around 60% of its USA sales then. However, after

FY2017; the situation improved for the company as the plant got the clean chit. Thus,

since FY2018, USA sales of the company has improved on back of niche opportunities

and new product launches. Going into future, company in the near future i.e

FY2019/2020, should witness a slew of launches. For FY2019/2020, company is expected

to launch 50 and 40 products respectively. However, given that most of its niche

launches would face competitive pressures & new launches, overall the USA sales is

unlikely to witness significant growth. In terms of de-risking its filings and reducing the

USFDA event risk, the company since its experience with Moriya plant has built further

manufacturing facilities like Ahmedabad SEZ, Baddi & has acquired the Windlas facility.

As per Management now, Moriya accounts only for 18% of pending approvals.

In terms, of nature of fillings, the company has diversified filings across the therapeutic

segments. Key therapeutic segments which will drive its growth in USA over next 3-4

years, would be injectable, Transdermal and Specialty. While the company has products

being developed in-house for the former two categories, in specialty the company as

acquired Sentynl Therapeutics, which had sales of US$70mn in FY2018, contributing

10% of USA sales. The profitability of the company is very high with net margins of 37%.

As per Specialty segment, company plans to expand the same lead by acquisition

strategy. Overall USA exports are expected to post a CAGR of 1.4% over FY2018-21E.

This is mainly on back of the base effect of FY2018, where key niche opportunities like

gLiada, gAsacol HD and to some extent by gTamiflu capsules. These products according

to us would have contributed around ~40% of its sales in FY2018. This is the main

reason, that Cadila HealthCare’s USA business will report flat sales inspite of new

launches. Going forward, the growth In USA is highly dependent upon the new product

launches. Thus, while company has taken steps to diversify its fillings facility and

segment wise to arrest any major impact on USA sales. Excluding the niche

March 25, 2019

2

Cadila Healthcare | Pharmaceuticals

opportunities, the USA business is expected to register a growth of 10.0% during

FY2018-21E.

ROW exports to be driven by Vaccines & biologicals; Europe still to pickup

Apart from USA, company has good presence in Europe & ROW (Emerging Markets &

Brazil). Historically over FY2014-2017, the company saw European sales dip at a CAGR

of 12.4%, while Brazil & Emerging markets during the period posted a CAGR of 1.3%

and 11.2% respectively. Going forward, for ROW, the company has chalked out a

strategy to supply Biotech & Vaccines to the key growth drivers in the region. Company

expects these two product categories to register sales of US$ 200mn over next 4-5 years.

Going into FY2018-21E, we expect regions like Brazil & Emerging markets to grow at a

CAGR of 9.0% respectively. European region, we believe will remain lackluster. Overall,

we have built in an export sales CAGR of 2.3% over FY2018-21E.

Domestic portfolio; Focusing on growth levers

Cadila is the fourth largest player in the domestic market with sales of about `3,332cr in

FY2018; the domestic market contributed ~29% to its top-line. The company enjoys a

leadership position in the CVS, GI, women healthcare and respiratory segments, and has

a sales force of 6,000+ Field Force. Over FY2014-2018, Formulation sales grew by 7.8%

CAGR, which aided a 7.6% CAGR in overall domestic sales. Cadila Healthcare, historically

grown lower than the Indian Industry growth rate of 11-12% CAGR during the period.

One of prime reason behind the same has been high concentration of old mature

products, which still forms 22-25% of the domestic formulation business. This has also

kept the Cadila’s field productivity low at around 40-45lacs. Going forward, company

plans to perk-up its productivity levels and expects it to reach 60lacs in next few years.

Along with this company has been aggressively launching new products, which will keep

the momentum steady. We have conservatively forecasted the formulation business to

post a CAGR of 9.5% CAGR during the FY2018-21E.

Apart from Domestic formulation business, the company has a strong consumer division

through its stake in Zydus Wellness, which has premium brands such as Sugarfree,

Everyuth and Nutralite under its umbrella. This segment, which contributed ~4% of sales

in FY2018, registering a growth of 3.4% during FY2014-2018. However, after the Heinz

acquisition during 3QFY2019; company’s wellness segment will contribute around 12%

by FY2020.

With this Cadila gets Glucon-D, Nycil and Sampriti Ghee (Global rights), Complan (rights

for India, Bangladesh, Nepal and those countries where seller has IP rights). Amongst

the brands to be, acquired Glucon-D is the largest one and both Glucon-D and Nycil

have been growing faster than the market growth rate. Heinz India has sales of

`11,.500cr with EBITDA of `225cr for 12months of June’2018. This is largely domestic

sales with small exports. The company has been acquired at the cost of `4,595cr to be

funded in cash along with a combination of debt and equity. Overall, the management

indicated that transaction is likely to be funded 2/3rd by equity and the balance 1/3rd

by debt (has an interest cost of 9.4%). Company plans further infusion of around `1000-

`1200cr.

March 25, 2019

3

Cadila Healthcare | Pharmaceuticals

Over FY2018-21E, the segment is expected to post a CAGR of 62.0% during the period,

contributing 12% of overall sales by FY2020. Overall, FY2018-21E, we expect the

domestic segment to grow at a CAGR of 19.1%.

Valuations & Outlook

Cadila Healthcare has been one of the steady companies in the Indian Pharmaceutical

Industry; in spite of all the challenges. Over FY2011-18E, the company has witnessed a

sales growth of 14.6%; while net profit has registered a growth of 14.0%. EBDITA margins

of the company has been steady at around 18-19%.

Going forward, as company moves along with the iIndustry into the next leg of the

transition; where more complex and specialty products along with normal generic-

generic products will dominate the growth drivers of most of the companies. Thus M&A

along with investments in R&D could witness a pump-up. Hence, we are going selective

in the space; given these product categories are going to be complex. In addition, given

the regulatory risks involved in the business from both USA markets & domestic

markets, we expect few companies to cruise through the new challenges.

Cadila Healthcare has built in blocks to make that transition smooth, by putting a

strategy to diversifying its USA business in terms of both fillings (plant-wise) & product

launches. Hence, over FY2018-21E, the company expects to post a sales and net profit

CAGR of 9.1% and flattish growth during the FY2018-21E respectively. However, on

negative side the ROIC of the company is around 17%; with D/E of 0.6xFY2019E. Given

that, the generic pharmaceutical business is a price sensitive business & requires a lot

of discipline for the players to deliver consistently over a period. Cadila Healthcare has

been one of such players and future pharmaceuticals business will demand more R&D

expenses & strong balance sheets. While Cadila Healthcare, scores over its peers in

many factors like diversified big ANDA pipeline, disciplined approach to R&D

investments, strong control on expenses, its’ domestic business lacks its peers in terms

of growth and other key parameters. Further, its concentration in its key markets like

USA & Indian is a risk. This we have witnessed in the stock performance of the company.

Thus while, the dip has provided some relief, we believe at this juncture the stock given

the challenges, at current valuations provides very little upside. Hence, we have

factored in the same to recommend a Hold.

Company Background

Zydus Cadila, a leading Indian Pharmaceutical company is a fully integrated, global

healthcare provider. With in-depth domain expertise in the field of healthcare, it has

strong capabilities across the spectrum of the pharmaceutical value chain. From

formulations to active pharmaceutical ingredients and animal healthcare products to

wellness products, Zydus has earned a reputation amongst Indian pharmaceutical

companies for providing comprehensive and complete healthcare solutions. Having

already achieved the US$1bn sales mark in 2011, the company aims to be a research-

driven pharmaceutical company by 2020.

March 25, 2019

4

Cadila Healthcare | Pharmaceuticals

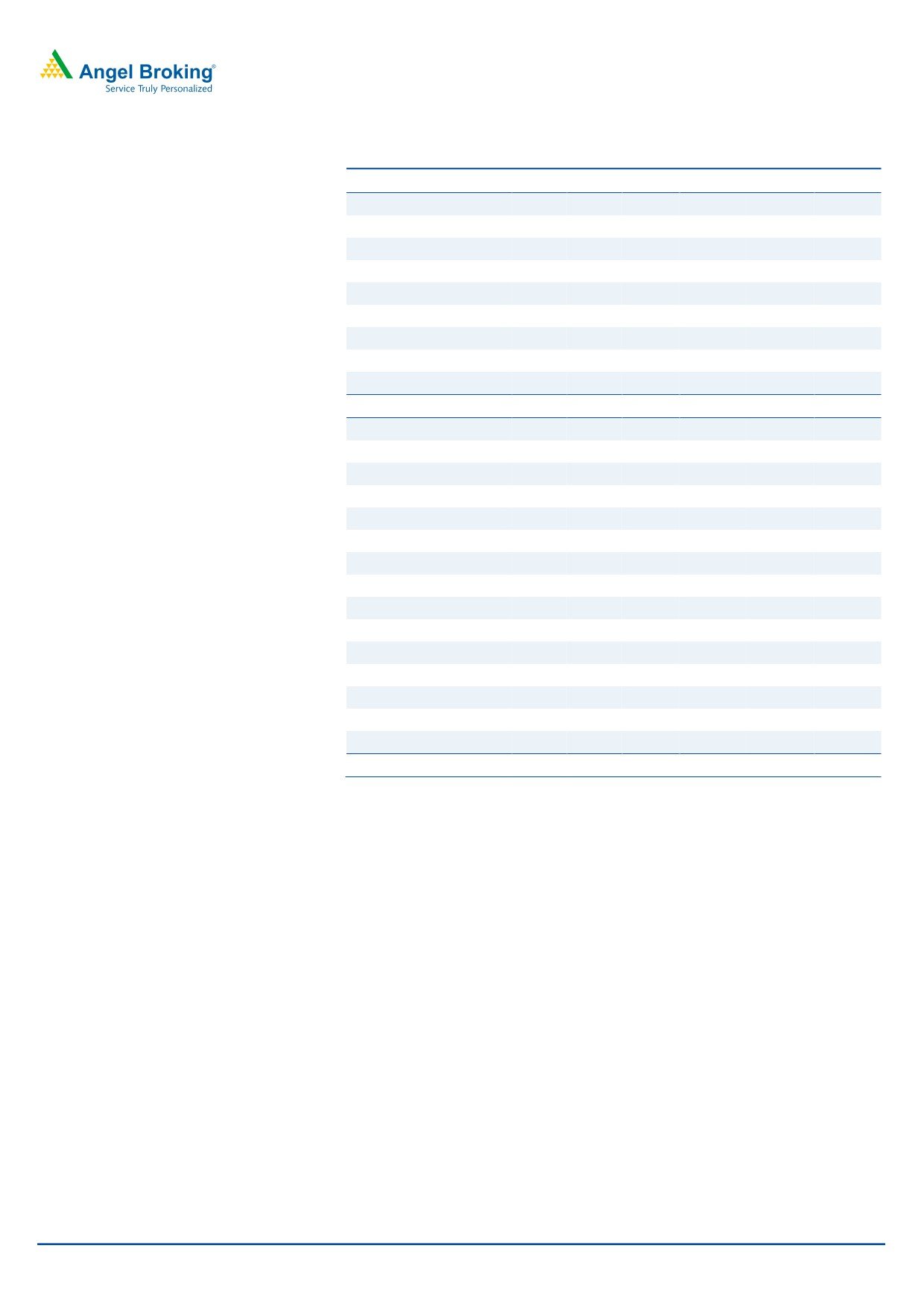

Profit & Loss statement (Consolidated)

Y/E March (` cr)

FY2016

FY2017

FY2018

FY2019E

FY2020E

FY2021E

Gross sales

9,262

9,416

11,631

12,658

14,109

15,105

Less: Excise duty

190

196

32

34

46

50

Net sales

9,072

9,220

11,599

12,624

14,063

15,055

Other operating income

355

210

306

406

406

406

Total operating income

9,427

9,430

11,905

13,030

14,469

15,460

% chg

9.0

0.0

26.3

9.5

11.0

6.8

Total expenditure

7,099

7,526

9,076

10,047

11,380

12,354

Net raw materials

3,096

3,445

4,437

4,829

5,379

5,721

Other mfg costs

570

579

729

631

703

753

Personnel

1,262

1,500

1,855

2,188

2,626

3,020

R&D Expenses

726

754

942

1,010

1,125

1,204

Other

1,446

1,248

1,114

1,389

1,547

1,656

EBITDA

1,973

1,694

2,523

2,577

2,683

2,701

% chg

23.2

(14.2)

49.0

2.2

4.1

0.7

(% of Net Sales)

21.7

18.4

21.8

20.4

19.1

17.9

Depreciation& amortization

292

375

539

690

770

850

EBIT

1,681

1,319

1,984

1,887

1,913

1,850

% chg

27.9

(21.5)

50.5

-4.9

1.4

-3.2

(% of Net Sales)

18.5

14.3

17.1

14.9

13.6

12.3

Interest & other charges

53

45

91

167

198

210

Other income

116

129

113

200

120

120

(% of PBT)

6

8

5

9

5

6

Recurring PBT

2,099

1,612

2,312

2,326

2,240

2,166

% chg

44.1

(23.2)

43.4

0.6

(3.7)

(3.3)

Extraordinary expense/(Inc.)

2

-

-

0

0

0

PBT (reported)

2,099

1,612

2,312

2,326

2,240

2,166

Tax

177.4

128.9

564.4

581.5

560.0

541.5

(% of PBT)

8.5

8.0

24.4

25.0

25.0

25.0

PAT (reported)

1,921

1,483

1,747

1,744

1,680

1,624

Less: Minority interest (MI)

30.0

29.1

(28.2)

(28.2)

(28.2)

(28.2)

PAT after MI (reported)

1,934

1,488

1,776

1,773

1,708

1,653

ADJ. PAT

1,936

1,488

1,776

1,773

1,708

1,653

% chg

67.0

(23.2)

19.4

(0.2)

(3.6)

(3.3)

Basic EPS (`)

18.9

14.5

17.3

17.3

16.7

16.1

March 25, 2019

5

Cadila Healthcare | Pharmaceuticals

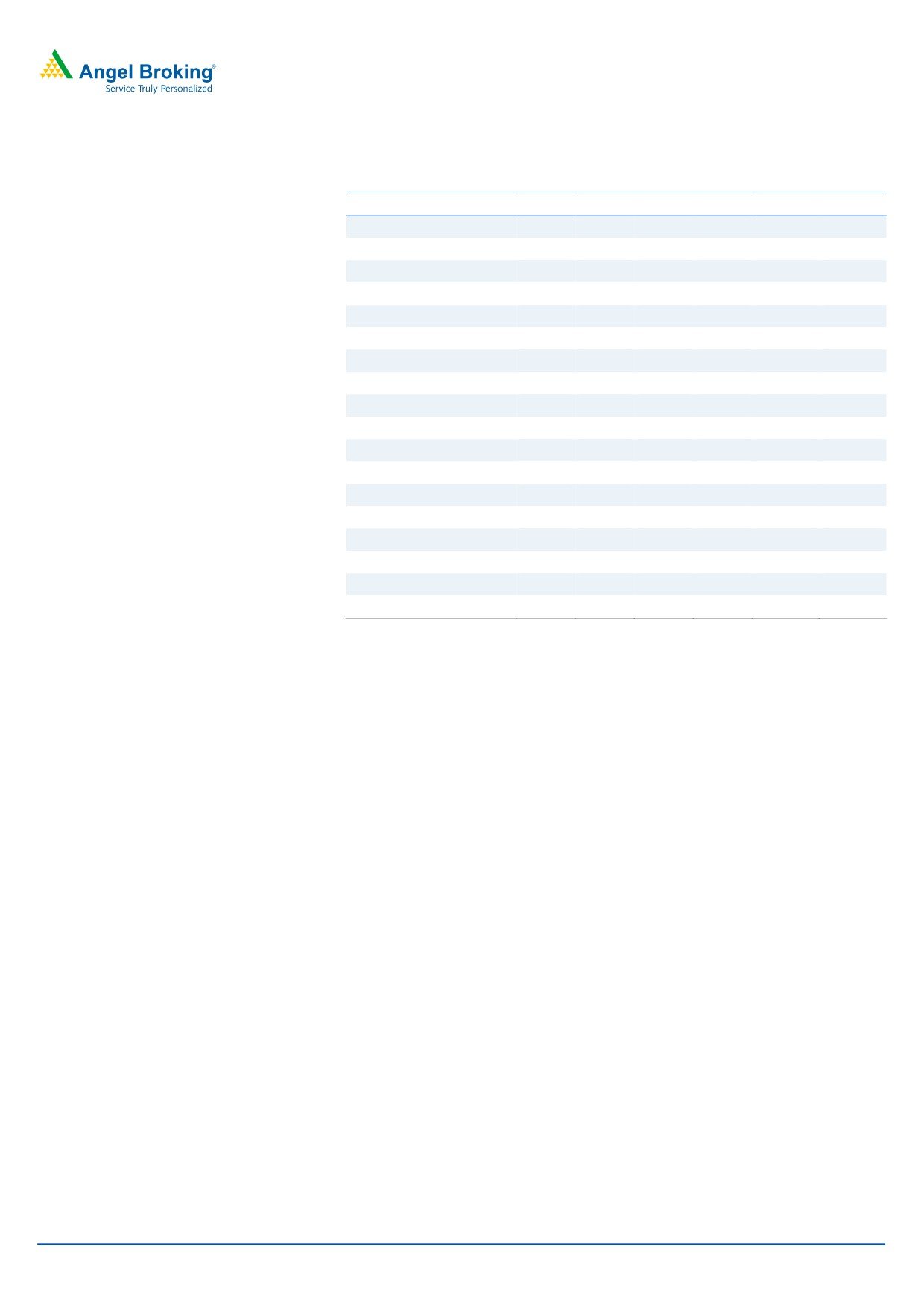

Balance Sheet (Consolidated)

Y/E March (` cr)

FY2016 FY2017 FY2018 FY2019E FY2020E FY2021E

SOURCES OF FUNDS

Equity share capital

102

102

102

102

102

102

Reserves & Surplus

5,597

6,858

8,642

9,896

11,105

12,274

Shareholders funds

5,699

6,960

8,746

10,001

11,210

12,381

Minority interest

135

156

191

163

135

106

Total loans

2,107

4,945

5,113

6,000

6,000

6,000

Other Long Term Liabilities

61

45

64

47

48

49

Long Term Provisions

97

169

156

156

156

156

Deferred tax liability

(318)

(401)

(643)

(643)

(643)

(643)

Total liabilities

7,782

11,875

13,626

15,724

16,906

18,049

APPLICATION OF FUNDS

Gross block

4,786

5,436

8,131

9,131

10,131

11,131

Less: Acc. depreciation

2,120

2,495

3,033

3,724

4,494

5,345

Net block

2,666

3,942

5,097

5,407

5,636

5,786

Capital Work-in-Progress

892

892

1,527

1,527

1,527

1,527

Goodwill

1,141

2,465

1,385

1,385

1,385

1,385

Investments

416

435

746

3,375

3,845

3,124

Long Term Loans and Adv.

836

997

460

460

460

460

Current assets

4,081

5,973

7,926

7,395

8,314

10,329

Cash

639

1,544

1,315

160

129

1,607

Loans & advances

335

336

337

407

578

579

Other

3,108

4,094

6,274

6,828

7,607

8,143

Current liabilities

2,250

2,829

3,515

3,825

4,261

4,562

Net Current assets

1,831

3,144

4,411

3,570

4,052

5,767

Mis. Exp. not written off

-

-

-

-

-

Total assets

7,782

11,875

13,626

15,724

16,906

18,049

March 25, 2019

6

Cadila Healthcare | Pharmaceuticals

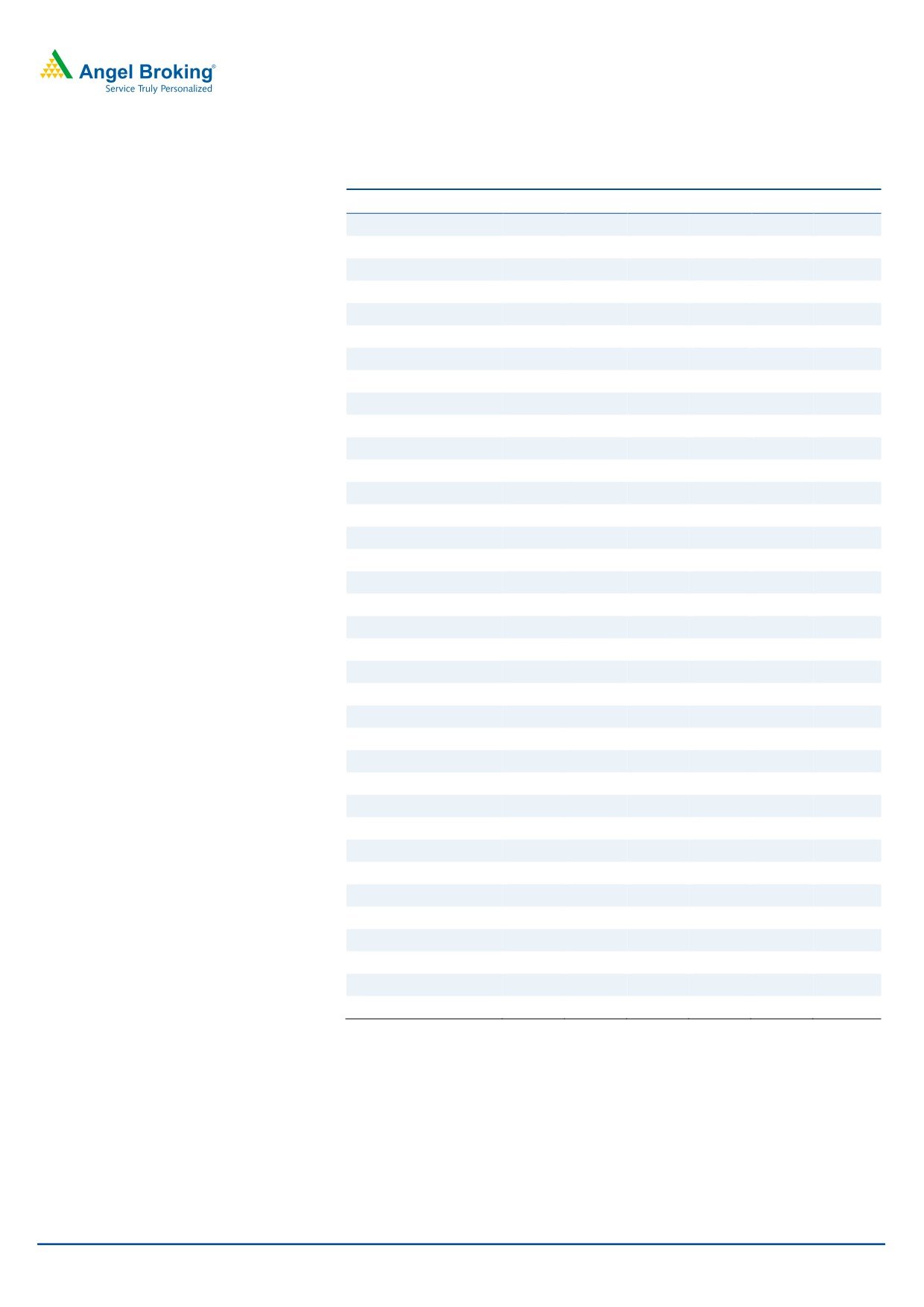

Cash Flow Statement (Consolidated)

Y/E March (` cr)

FY2016 FY2017 FY2018 FY2019 FY2020E FY2021E

Profit before tax

2,099

1,612

2,312

2,326

2,240

2,166

Depreciation

292

375

539

690

770

850

(Inc)/Dec in Working Cap.

(37)

(570)

(957)

(314)

(513)

(237)

Less: Other income

116

129

113

200

120

120

Direct taxes paid

177

129

564

581

560

541

Cash Flow from Operations

2,061

1,160

1,216

1,921

1,817

2,118

(Inc.)/Dec.in Fixed Assets

(433)

(650)

(3,331)

(1,000)

(1,000)

(1,000)

(Inc.)/Dec. in Investments

(262)

(19)

(311)

(2,629)

(470)

721

Other income

116

129

113

200

120

120

Cash Flow from Investing

(579)

(540)

(3,529)

(3,429)

(1,350)

(159)

Issue of Equity

-

-

-

-

-

-

Inc./(Dec.) in loans

(222)

2,894

173

870

1

1

Dividend Paid (Incl. Tax)

(572)

(327)

(419)

(518)

(500)

(483)

Others

(589)

(2,431)

1,804

479

1

1

Cash Flow from Financing

(1,383)

136

1,557

831

(498)

(482)

Inc./(Dec.) in Cash

99

756

(756)

(677)

(31)

1,477

Opening Cash balances

738

837

1,593

837

160

129

Closing Cash balances

837

1,593

837

160

129

1,607

March 25, 2019

7

Cadila Healthcare | Pharmaceuticals

Key Ratios

Y/E March

FY2016 FY2017 FY2018 FY2019 FY2020E FY2021E

Valuation Ratio (x)

P/E (on FDEPS)

17.9

23.2

19.5

19.5

20.2

20.9

P/CEPS

15.5

18.5

14.9

14.0

13.9

13.8

P/BV

6.1

5.0

4.0

3.5

3.1

2.8

Dividend yield (%)

0.9

1.0

1.0

1.3

1.2

1.2

EV/Sales

3.9

4.0

3.3

3.2

2.9

2.6

EV/EBITDA

17.9

21.9

15.1

15.6

15.0

14.3

EV / Total Assets

4.5

3.1

2.8

2.5

2.4

2.1

Per Share Data (`)

EPS (Basic)

18.9

14.5

17.3

17.3

16.7

16.1

EPS (fully diluted)

18.9

14.5

17.3

17.3

16.7

16.1

Cash EPS

21.8

18.2

22.7

24.1

24.3

24.5

DPS

3.2

3.5

3.5

4.3

4.2

4.0

Book Value

55.7

68.0

85.4

97.7

109.5

120.9

Dupont Analysis

EBIT margin

18.5

14.3

17.1

14.9

13.6

12.3

Tax retention ratio

91.5

92.0

75.6

75.0

75.0

75.0

Asset turnover (x)

1.4

1.1

1.1

0.9

0.9

0.9

ROIC (Post-tax)

23.8

14.2

13.6

10.5

9.1

8.6

Cost of Debt (Post Tax)

2.2

1.2

1.4

2.3

2.5

2.6

Leverage (x)

0.3

0.4

0.5

0.5

0.6

0.4

Operating ROE

30.8

19.1

19.2

14.7

12.8

11.2

Returns (%)

ROCE (Pre-tax)

22.8

13.4

15.6

12.9

11.7

10.6

Angel ROIC (Pre-tax)

34.4

21.8

24.2

17.1

14.4

13.5

ROE

38.9

23.5

22.6

18.9

16.1

14.0

Turnover ratios (x)

Asset Turnover (Gr. Block)

2.1

1.8

1.8

1.5

1.5

1.5

Inventory / Sales (days)

56

61

64

54

55

63

Receivables (days)

65

78

84

71

72

84

Payables (days)

83

105

112

61

60

59

WC (ex-cash) (days)

49

54

72

91

92

95

Solvency ratios (x)

Net debt to equity

0.3

0.5

0.4

0.6

0.5

0.4

Net debt to EBITDA

0.7

2.0

1.5

2.3

2.2

1.6

Int. Coverage (EBIT / Int.)

31.8

29.3

21.8

11.3

9.7

8.8

March 25, 2019

8

Cadila Healthcare | Pharmaceuticals

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits

and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

Cadila Healthcare

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or

No

relatives

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

March 25, 2019

9