4QFY2016 Result Update | Pharmaceutical

June 10, 2016

Aurobindo Pharma

ACCUMULATE

CMP

`773

Performance Highlights

Target Price

`850

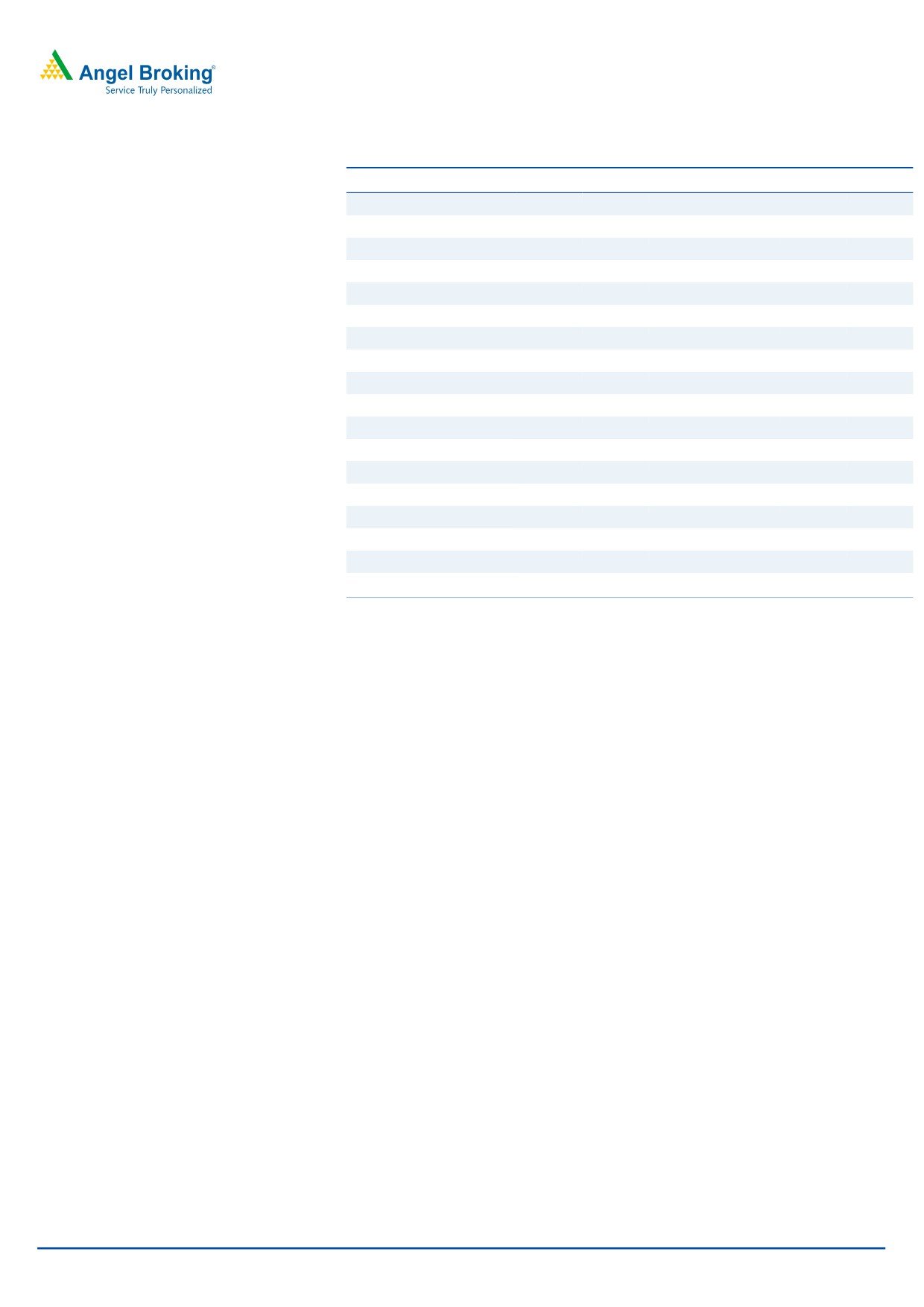

Y/E march (` cr)

4QFY16 3QFY16

% chg (QoQ) 4QFY15

% chg (yoy)

Investment Period

12 months

Net sales

3675

3432

7.1

3144

16.9

Other income

93

70

31.8

25

272.9

Stock Info

Operating profit

810

760

6.6

638

27.0

Sector

Pharmaceutical

Interest

21

23

(9.4)

23

(9.0)

Market Cap (` cr)

43,589

Adj. Net profit

562

525

7.0

403

39.2

Source: Company, Angel Research

Net debt (` cr)

3,265

Beta

1.1

Aurobindo Pharma (APL)’s results for 4QFY2016 have come in marginally lower

52 Week High / Low

892/582

than our expectations. Sales grew by 16.9% yoy to `3,675cr (vs `3,800cr

Avg. Daily Volume

166,432

expected), driven by formulations (which grew by 34.6% yoy; constitute ~79.5%

Face Value (`)

1

of sales). The key geographies in terms of formulations - US, Europe & ROW-

BSE Sensex

26,636

and the ARV segment posted a yoy growth of 24.3%, 32.2% and (-19.5%)

Nifty

8,170

respectively. The API on the other hand grew by 14.4% yoy. The OPM for the

Reuters Code

ARBN.BO

quarter stood at 22.1% (v/s 20.8% expected), ie a yoy expansion of 176bp. The Adj.

net profit came in at `562cr V/s `403cr in 4QFY2015, a yoy growth of 39.2%. We

Bloomberg Code

ARBP@IN

recommend an Accumulate rating on the stock.

Marginally lower than expected numbers: The company posted a revenue of

Shareholding Pattern (%)

`3,675cr for the quarter (v/s `3,800cr expected), ie a growth of 16.9% yoy. Sales

Promoters

53.8

grew by 16.9% yoy to `3,675cr (vs `3,800cr expected), driven by formulations

MF / Banks / Indian Fls

9.2

(which grew by 34.6% yoy; constitute ~79.5% of sales). The key geographies in

FII / NRIs / OCBs

27.9

terms of formulations - US, Europe & ROW- and the ARV segment posted a yoy

Indian Public / Others

9.1

growth of 24.3%, 32.2% and (-19.5%) respectively. The API on the other hand

grew by 14.4% yoy. The OPM for the quarter stood at 22.1% (v/s 20.8% expected), ie

Abs. (%)

3m 1yr

3yr

a yoy expansion of 176bp. The Adj. net profit came in at `562cr V/s `403cr in

4QFY2015, a yoy growth of 39.2%.

Sensex

8.2

(0.8)

37.0

Aurobindo

2.9

14.5

746.7

Outlook and valuation: We estimate the company’s net sales to log a 15.1%

CAGR over FY2016-18E to `18,078cr on back of US formulations, which will be

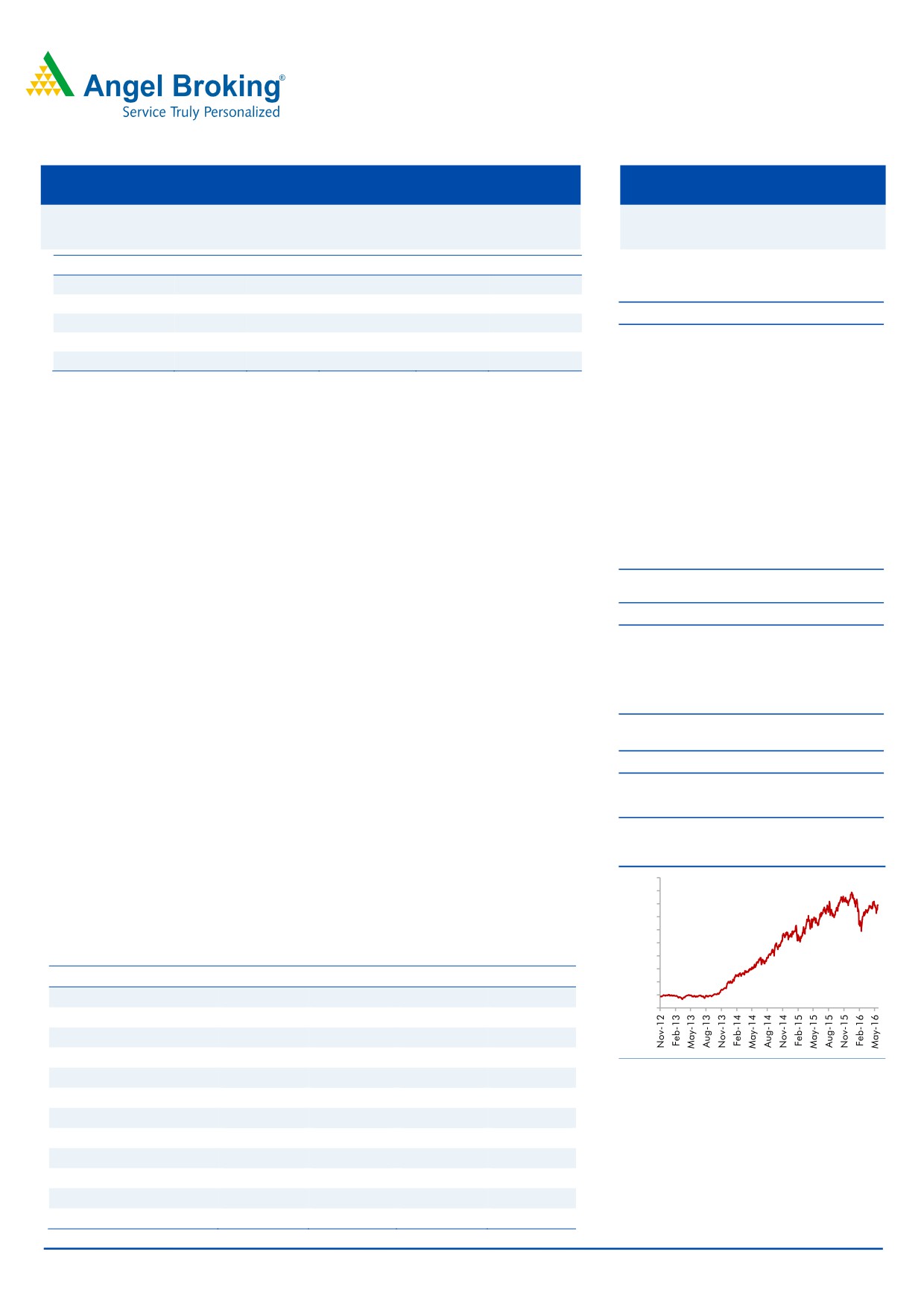

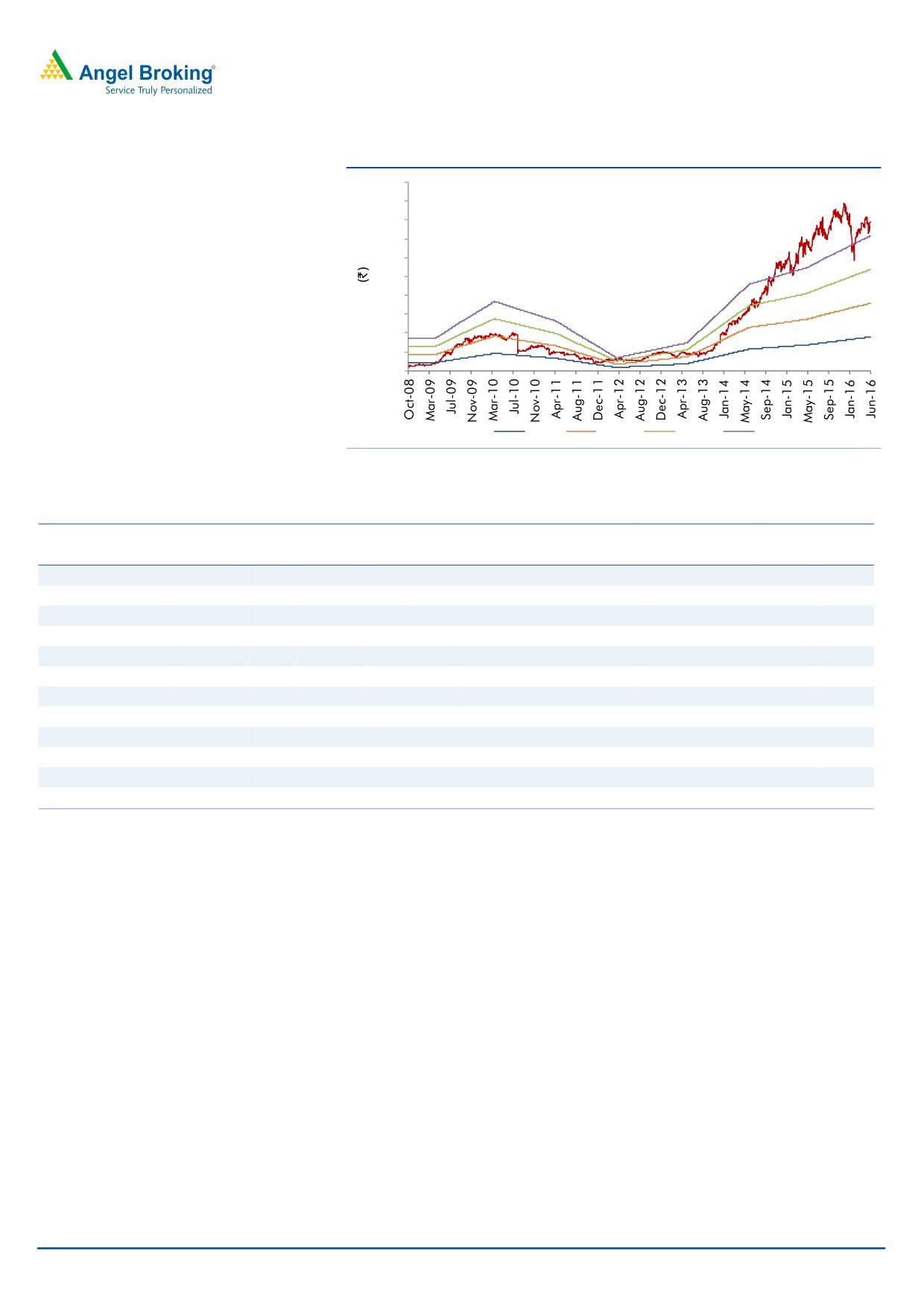

3-year daily price chart

supplemented through the recent acquisitions of the Western European

1,000

formulation businesses of Actavis and US’ Natrol. The acquisitions have also led

900

APL to become a

>~US$2bn sales company, with ~80% of sales being

800

700

accounted by formulations. We recommend an Accumulate on the stock.

600

500

Key financials (Consolidated)

400

300

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

200

100

Net sales

12,043

13,651

15,720

18,078

0

% chg

49.8

13.3

15.2

15.0

Adj. Net profit

1,619

1,982

2,418

2,763

% chg

21.5

22.4

22.0

14.2

Source: Company, Angel Research

EPS (`)

27.7

33.9

41.4

47.3

EBITDA margin (%)

20.6

21.7

23.7

23.7

P/E (x)

27.9

22.8

18.7

16.3

RoE (%)

36.4

32.5

29.6

26.1

RoCE (%)

25.3

24.8

24.0

22.5

P/BV (x)

4.4

6.4

4.9

3.8

Sarabjit Kour Nangra

EV/Sales (x)

2.2

3.5

3.1

2.7

+91 22 3935 7800 Ext: 6806

EV/EBITDA (x)

10.5

16.4

13.1

11.3

Source: Company, Angel Research; Note: CMP as of June 7, 2016

Please refer to important disclosures at the end of this report

1

Aurobindo Pharma | 4QFY2016 Result Update

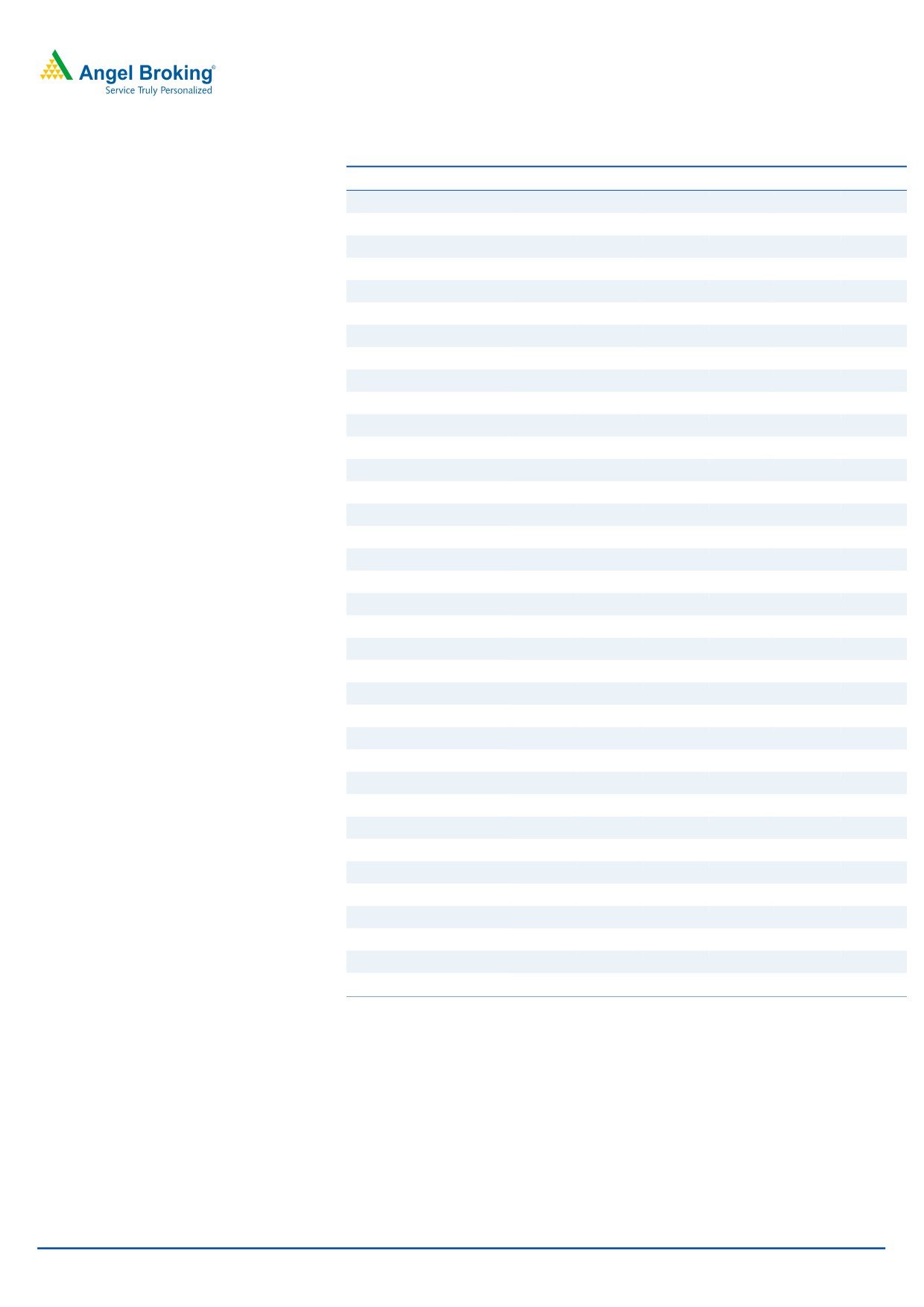

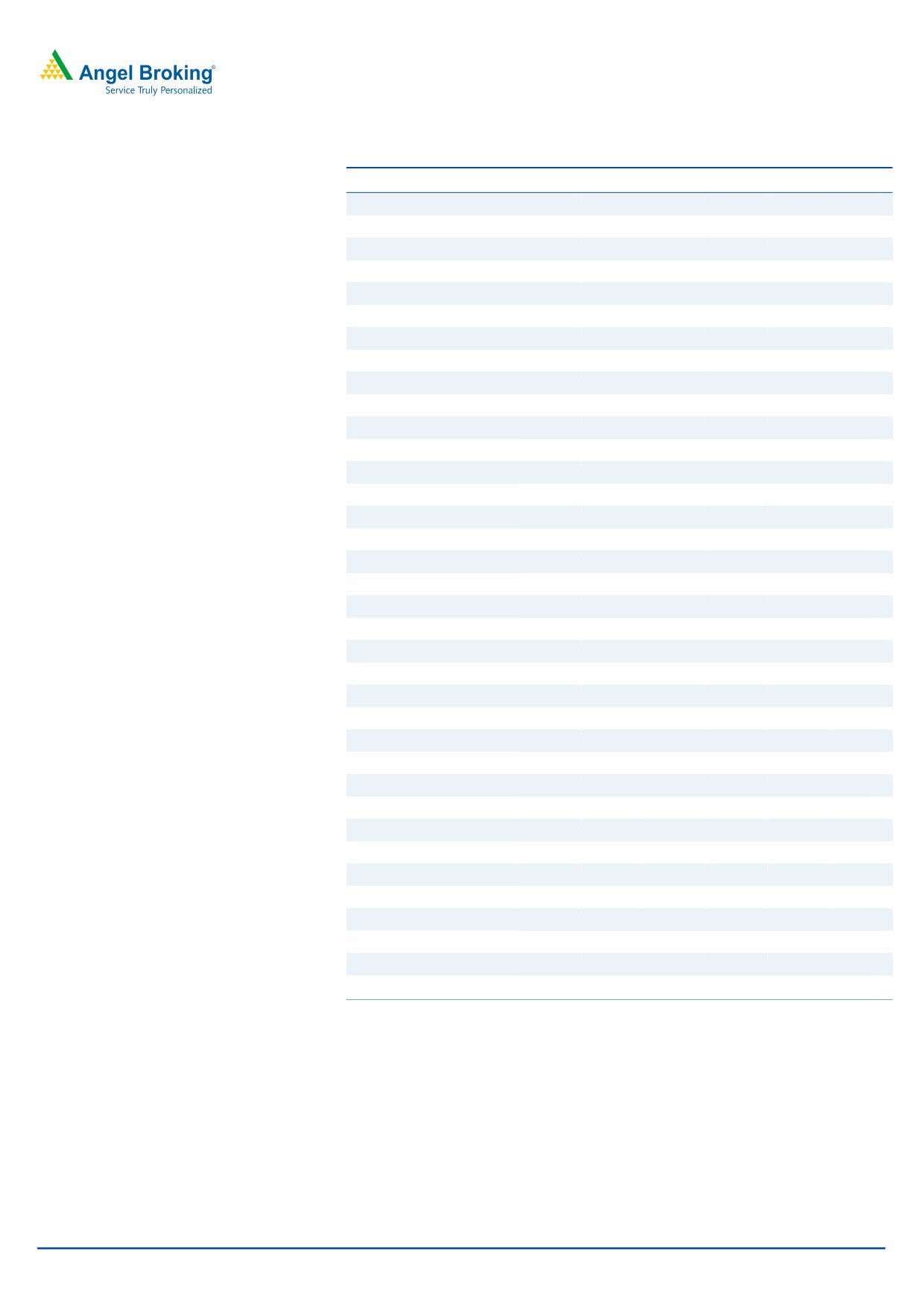

Exhibit 1: 4QFY2016 performance (Consolidated)

Y/E March (` cr)

4QFY2016

3QFY2016

% chg (qoq) 4QFY2015

% chg (yoy)

FY2016 FY2015

% chg (yoy)

Net sales

3,675

3,432

7.1

3,144

16.9

13,651

12,043

13.3

Other income

93

70

31.8

25

272.9

314

158

98.5

Total income

3,767

3,502

7.6

3,169

18.9

13,964

12,201

14.5

Gross profit

2,048

1,879

9.0

1,770

15.7

7,493

6,538

14.6

Gross margins

55.7

54.7

56.3

54.9

54.3

1.1

Operating profit

810

760

6.6

638

27.0

2,960

2,486

19.1

OPM (%)

22.1

22.1

20.3

21.7

20.6

Interest

21

23

(9.4)

23

(9.0)

159

84

89.0

Dep & amortisation

111

99

11.9

85

31.4

393

333

17.9

PBT

771

708

8.9

556

38.8

2,722

2,227

22.2

Provision for taxation

210

186

12.7

153

36.7

744

597

24.7

Net profit

561

522

7.6

402

39.6

1,978

1,630

21.4

Less : Exceptional items (gains)/loss

(1)

(13)

(0)

(4)

60

-

MI & share in associates

-

-

-

-

-

(5)

-

PAT after Exceptional items

563

535

5.2

404

39.4

1,982

1,576

25.8

Adjusted PAT

562

525

7.0

403

39.2

1,979

1,620

22.2

EPS (`)

9.6

9.0

6.9

33.9

27.7

Source: Company, Angel Research

Exhibit 2: Actual v/s Estimate

(` cr)

Actual

Estimate

Variation %

Net sales

3675

3800

(3.3)

Other operating income

92.6

60

55.4

Operating profit

810

887

(8.7)

Tax

210

162

29.3

Adj. Net profit

562

613

(8.4)

Source: Company, Angel Research

Revenue up 16.9% yoy; marginally lower than our expectation: The company

posted a sale of `3,675cr (V/s `3,800cr expected), a growth of 16.9% yoy. Sales

grew by 16.9% yoy to `3,675cr (V/s `3,800cr expected), driven by formulations

(which grew by 34.6% yoy; constitute ~79.5% of sales). The key geographies in

terms of formulations - US, Europe & ROW- and the ARV segment posted a yoy

growth of 24.3%, 32.2% and (19.5%) respectively. The API on the other hand grew

by 14.4% yoy.

In the formulation segment, the US (`1,666cr) posted a yoy growth of 24.3%,

while Europe & ROW (`1,016cr) posted a yoy growth of 32.2%. ARV (`328cr)

posted a yoy de-growth of 19.5%. Overall, formulations now contribute around

79.5% of sales, while APIs contribute the balance around 20.5%. As of end-March

2016, the company has 251 approved ANDAs including 36 tentative approvals.

June 13, 2016

2

Aurobindo Pharma | 4QFY2016 Result Update

Exhibit 3: Sales break-up (Consolidated)

(` cr)

4QFY2016

3QFY2016

% chg (qoq)

4QFY2015

% chg (yoy)

FY2016

FY2015

% chg

Formulations

3,011

2,681

12.3

2237

34.6

11,166

9,559

16.8

US

1,666

1,478

12.8

1341

24.3

6144

4832

27.2

Europe & ROW

1,016

932

9.0

769

32.2

3822

3763

1.6

ARV

328

271

21.3

408

(19.5)

1200

964

24.5

API

775

691

12.1

677

14.4

2,884

2,706

6.6

SSP

273

198

37.6

205

33.0

1366

864

58.1

Cephs

229

229

0.0

236

(2.8)

491

930

(47.2)

NPNC

273

264

3.4

236

15.5

1027

912

12.6

Source: Company, Angel Research

OPM expands to 22.1%: The OPM for the quarter stood at 22.1% (V/s 20.8%

expected), a yoy expansion of 176bp. The gross margin came in at 55.7% V/s

56.3% in 4QFY2015; however, on back of lower rise in employee costs

(+9.5% yoy) and other expenses (+9.1% yoy), the operating margin underwent an

expansion.

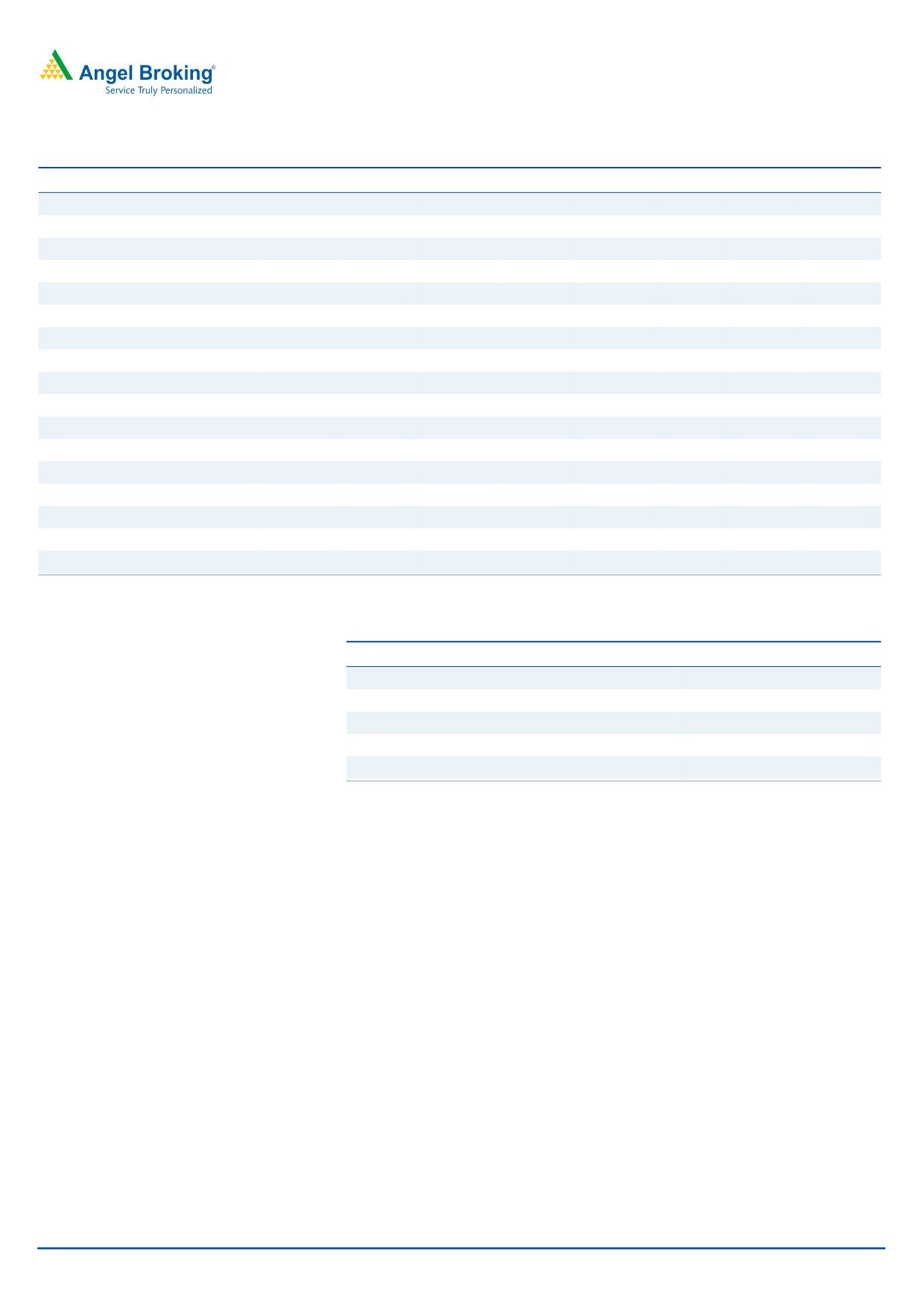

Exhibit 4: OPM Trend

23

22.1

22.1

22

22.0

21.8

21

20.3

20

4QFY2015

1QFY2016

2QFY2016

3QFY2016

4QFY2016

Source: Company, Angel Research

Net profit marginally lower than estimate: On the reported net profit front, the

company posted a net profit of `563cr, a yoy growth of 39.4%. The Adj. Net profit

came in at `562cr V/s `403cr in 4QFY2015, a yoy growth of 39.2%.

June 13, 2016

3

Aurobindo Pharma | 4QFY2016 Result Update

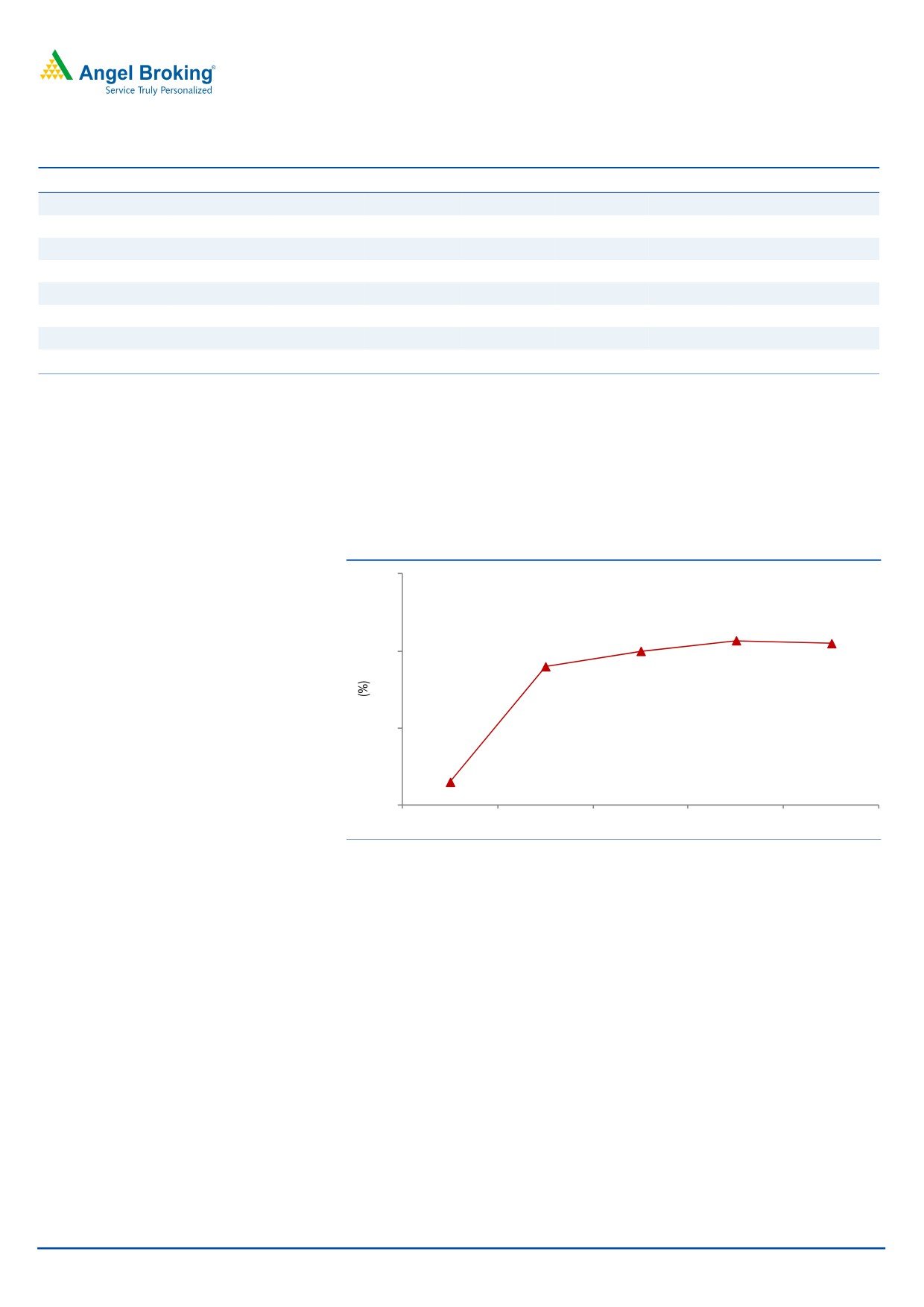

Exhibit 5: Adj. net profit

600

562

525

500

451

432

403

400

300

200

100

0

4QFY2015

1QFY2016

2QFY2016

3QFY2016

4QFY2016

Source: Company, Angel Research

Management takeaways

As of 4QFY2016 the company has filed 398 ANDAs, with 215 final approvals,

and 36 tentative approvals.

The company launched 28 products in the US during FY2016. It expects 30-

40 launches in FY2017.

The company plans to start filing oncology and hormonal products in the US

in the next four quarters while injectable filings are expected to be same as

FY2016.

For the Natrol business, the company guided for 15% yoy revenue growth with

margin expansion. Natrol’s current margins are higher than the company’s

consolidated margins. Natrol recorded revenue growth of ~15% in FY2016 to

US$110mn.

The R&D cost for 4QFY2016 was 4.3% of turnover at `160cr while for FY2016

it was 3.4% of turnover at `477cr. The company guided for 4-4.5% of R&D

spending in FY2017E.

Recommendation rationale

US and ARV formulation segments - the key drivers for base business: APL’s

business would primarily be driven by the US and ARV segments on the

formulation front. The company has been an aggressive filer in the US market

with 398 ANDAs filed until 4QFY2016. Amongst peers, APL has emerged as

one of the top ANDA filers. The company has aggressively filed ANDAs in the

last few years and is now geared to reap benefits, even though most of the

filings are for highly competitive products. Going ahead, with US$70bn going

off-patent in the US over the next three years, we believe APL is well placed to

tap this opportunity and is one of the largest generic suppliers. The company

enjoys high market share as it is fully integrated in all its products apart from

having a larger product basket. Also, the company plans to launch

18

injectables in the next 2 years, which would drive its growth and profitability.

The US revenue has grown at a CAGR of 31% over FY2009-2015 to

June 13, 2016

4

Aurobindo Pharma | 4QFY2016 Result Update

`4,832cr. Going forward, the US business of the company is expected to post

a CAGR of 15% over FY2016-18E.

Acquisitions to augment growth and improve sales mix: APL announced the

signing of a binding offer to acquire commercial operations in seven Western

European countries from Actavis. The net sales for the acquired businesses

were around EUR320mn in 2013 with a growth rate of over 10% yoy. With

this, the European sales of the company would now be ~EUR400mn.

Although these businesses are currently loss-making (by around EUR20mn),

APL expects them to return to profitability in combination with its vertically

integrated platform and existing commercial infrastructure.

The acquisition will make APL one of the leading Indian pharmaceutical

companies in Europe with a position in the top 10 in several key markets,

which it plans to leverage to supply or widen its product portfolio through

introduction of its own products, especially high margin products like

injectiables.

Also, in December 2014, Aurobindo USA, spent US$132.5mn to acquire the

assets of Natrol with an agreement to take on certain liabilities. With this

acquisition, the company gets an entry into the nutraceutical markets.

Aurobindo USA believes that Natrol is an excellent strategic fit and provides

the right platform for creating a fully-integrated OTC platform in the USA and

in other international markets. Natrol, which manufactures and sells nutritional

supplements in USA and other international market, provides Aurobindo with-

strong brand reputation and presence in a variety of attractive supplement

markets. Natrol has a proven performance in the mass market, health food

and specialty channels, and has existing long term relationships with key

distribution and retail partners. It addresses a broad range of consumers and

has an effective growth strategy to expand market penetration.

Outlook and valuation

We estimate the company’s net sales to log a 15.1% CAGR over FY2016-18E to

`18,078cr on the back of US on back of the largest product pipeline. This along

with the recent acquisitions of the Western European formulation businesses of

Actavis and US’ Natrol, will led APL to become a >~US$2bn sales company, with

~ 80% of sales being accounted by formulations. We maintain our Accumulate

rating on the stock.

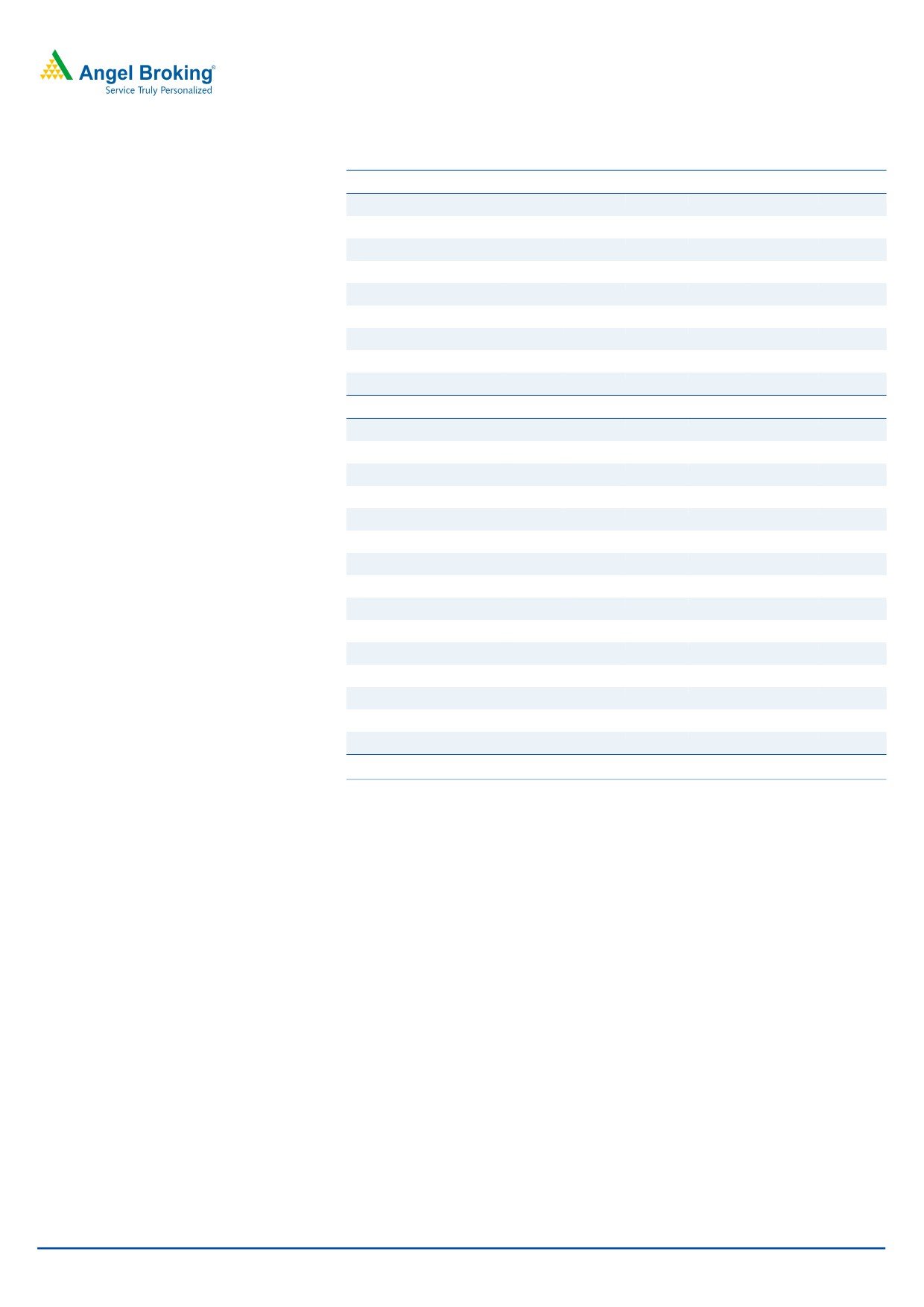

Exhibit 6: Key assumptions

FY2017E

FY2018E

Sales Growth (%)

15.2

15.0

Operating Margins (%)

23.7

23.7

Capex (` cr)

800

800

Source: Company, Angel Research

June 13, 2016

5

Aurobindo Pharma | 4QFY2016 Result Update

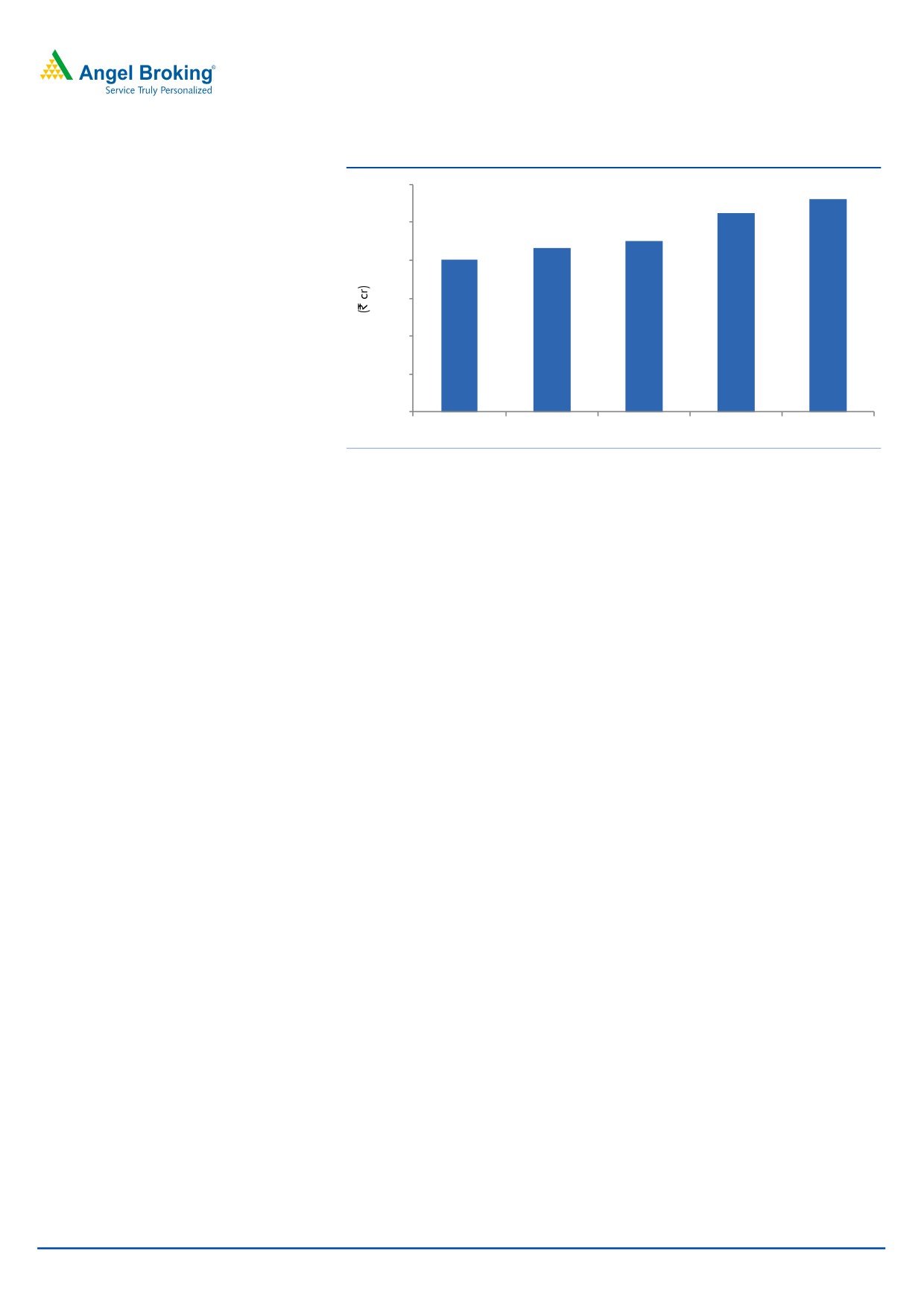

Exhibit 7: One-year forward PE

1,000

900

800

700

600

500

400

300

200

100

0

5x

10x

15x

20x

Source: Company, Angel Research

Exhibit 8: Recommendation summary

Company

Reco

CMP Tgt. price Upside

FY2017E

FY15-17E

FY2017E

(`)

(`)

% PE (x) EV/Sales (x) EV/EBITDA (x) CAGR in EPS (%) RoCE (%) RoE (%)

Alembic Pharma

Neutral

557

-

-

29.8

3.0

18.2

11.4

22.0

20.1

Aurobindo Pharma Accumulate

773

850

10.0

18.7

3.1

13.1

6.9

24.0

29.6

Cadila Healthcare

Buy

320

400

25.0

18.7

2.9

13.2

22.9

24.2

28.8

Cipla

Neutral

469

-

-

21.6

2.7

15.3

4.9

11.1

13.7

Dr Reddy's

Accumulate

3,158

3,476

10.1

20.7

3.0

12.3

6.8

19.2

18.7

Dishman Pharma

Neutral

152

-

-

15.2

1.6

7.7

15.9

9.4

11.0

GSK Pharma

Neutral

3,515

-

-

58.4

8.1

43.0

0.0

33.0

29.9

Indoco Remedies

Neutral

282

-

-

20.7

2.2

12.4

23.0

19.7

19.7

Ipca labs

Buy

431

750

74.0

15.4

1.6

8.8

17.9

11.8

14.9

Lupin

Buy

1,435

1,809

26.1

24.7

4.1

15.6

13.1

29.6

24.7

Sanofi India*

Accumulate

4,300

4,738

10.2

28.0

3.9

22.3

34.2

21.0

25.6

Sun Pharma

Buy

739

950

28.6

26.4

5.4

17.9

10.5

17.7

18.7

Source: Company, Angel Research; Note: *December year ending

June 13, 2016

6

Aurobindo Pharma | 4QFY2016 Result Update

Company background

Aurobindo Pharma manufactures generic pharmaceuticals and APIs. The

company’s manufacturing facilities are approved by several leading regulatory

agencies like the USFDA, UK MHRA, WHO, Health Canada, MCC South Africa

and ANVISA Brazil among others. The company’s robust product portfolio is

spread over six major therapeutic/product areas encompassing antibiotics,

antiretrovirals, CVS, CNS, gastroenterological, and anti-allergics. The company

has acquired the generic business of Actavis which has made it a US$2bn

company, and a leading company in Europe. With this acquisition, formulations

now contribute around 80% to the company’s sales (as in FY2015).

June 13, 2016

7

Aurobindo Pharma | 4QFY2016 Result Update

Profit & loss statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E

Gross sales

5,863

8,198

12,221

13,878

15,959

18,353

Less: Excise duty

80

159

178

227

239

275

Net Sales

5,783

8,038

12,043

13,651

15,720

18,078

Other operating income

72

61

77

245

245

245

Total operating income

5,855

8,100

12,121

13,896

15,965

18,323

% chg

26.5

38.3

49.6

14.6

14.9

14.8

Total Expenditure

4,966

5,968

9,557

10,691

12,001

13,802

Net Raw Materials

2,792

3,606

5,506

6,158

6,288

7,231

Other Mfg costs

578

804

1,204

1,365

1,572

1,808

Personnel

663

832

1,302

1,551

1,783

2,051

Other

932

726

1,545

1,617

2,358

2,712

EBITDA

817

2,071

2,486

2,960

3,718

4,276

% chg

53.2

153.5

20.1

19.1

25.6

15.0

(% of Net Sales)

14.1

25.8

20.6

21.7

23.7

23.7

Depreciation& Amortisation

249

313

333

393

532

588

EBIT

568

1,758

2,154

2,567

3,187

3,689

% chg

38.8

209.5

22.5

19.2

24.1

15.7

(% of Net Sales)

9.8

21.9

17.9

18.8

20.3

20.4

Interest & other Charges

131

108

84

159

192

220

Other Income

29

23

81

68

68

68

(% of PBT)

5.3

1.3

3.6

2.5

2.1

1.8

Share in profit of Associates

-

-

-

-

-

-

Recurring PBT

538

1,735

2,227

2,722

3,309

3,782

% chg

62.3

222.7

28.4

22.2

21.5

14.3

Extraordinary Expense/(Inc.)

163.4

203.1

59.6

-

-

-

PBT (reported)

374

1,532

2,168

2,722

3,309

3,782

Tax

82.7

363.5

596.6

744.4

893.4

1,021.2

(% of PBT)

22.1

23.7

27.5

27.3

27.0

27.0

PAT (reported)

291

1,168

1,571

1,978

2,416

2,761

Less: Minority interest (MI)

(2)

(4)

(5)

(4)

(3)

(2)

PAT after MI (reported)

294

1,172

1,576

1,982

2,418

2,763

ADJ. PAT

432

1,333

1,619

1,982

2,418

2,763

% chg

118.5

208.6

21.5

22.4

22.0

14.2

(% of Net Sales)

5.1

14.6

13.1

14.5

15.4

15.3

Basic EPS (`)

7.4

22.8

27.7

33.9

41.4

47.3

% chg

8.9

208.6

21.5

22.4

22.0

14.2

June 13, 2016

8

Aurobindo Pharma | 4QFY2016 Result Update

Balance sheet (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

SOURCES OF FUNDS

Equity Share Capital

29

29

29

58

58

58

Share Application Money

-

-

-

-

-

-

Reserves & Surplus

2,577

3,721

5,127

6,998

9,246

11,838

Shareholders Funds

2,606

3,750

5,156

7,057

9,304

11,896

Minority Interest

11

26

26

60

57

55

Long-term provisions

9

9

24

24

24

24

Total Loans

3,384

3,769

3,864

4,076

5,500

5,500

Deferred Tax Liability

68

205

211

236

236

236

Total Liabilities

6,069

7,760

9,280

11,452

15,098

17,688

APPLICATION OF FUNDS

Gross Block

3,316

4,107

6,095

7,195

7,995

8,795

Less: Acc. Depreciation

1,140

1,461

1,794

2,187

2,718

3,306

Net Block

2,175

2,645

3,752

4,865

5,277

5,490

Capital Work-in-Progress

645

310

310

310

310

310

Goodwill

55

76

64

89

89

89

Investments

22

20

20

0

0

0

Long-term loans and adv.

243

789

486

434

434

436

Current Assets

4,128

5,631

8,279

10,001

12,249

15,113

Cash

208

179

469

834

2,089

2,275

Loans & Advances

332

789

692

784

409

1,625

Other

3,587

4,664

7,118

8,383

9,751

11,213

Current liabilities

1,200

1,730

3,634

4,247

3,261

3,750

Net Current Assets

2,928

3,901

4,645

5,755

8,988

11,363

Mis. Exp. not written off

-

18

5

-

-

-

Total Assets

6,069

7,760

9,280

11,452

15,098

17,688

June 13, 2016

9

Aurobindo Pharma | 4QFY2016 Result Update

Cash flow statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E

Profit before tax

374

1,532

2,168

2,722

3,309

3,782

Depreciation

249

313

333

393

532

588

(Inc)/Dec in Working Capital

(191)

(457)

(757)

(796)

(1,979)

(2,188)

Less: Other income

29

23

81

68

68

68

Direct taxes paid

(83)

(363)

(597)

(744)

(893)

(1,021)

Cash Flow from Operations

321

1,001

1,066

1,507

900

1,093

(Inc.)/Dec.in Fixed Assets

(283)

(455)

(1,989)

(1,100)

(800)

(800)

(Inc.)/Dec. in Investments

(16)

(2)

-

(20)

-

-

Other income

29

23

81

68

68

68

Cash Flow from Investing

(271)

(435)

(1,908)

(1,051)

(732)

(732)

Issue of Equity

-

-

-

-

-

-

Inc./(Dec.) in loans

288

385

94

213

1,424

-

Dividend Paid (Incl. Tax)

(17)

(102)

(171)

(171)

(171)

(171)

Others

(183)

(879)

1,209

(132)

(167)

(4)

Cash Flow from Financing

88

(596)

1,133

(90)

1,086

(175)

Inc./(Dec.) in Cash

138

(30)

291

365

1,255

186

Opening Cash balances

71

208

179

469

834

2,089

Closing Cash balances

208

179

469

834

2,089

2,275

June 13, 2016

10

Aurobindo Pharma | 4QFY2016 Result Update

Key ratios

Y/E March

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

104.5

33.9

27.9

22.8

18.7

16.3

P/CEPS

41.5

15.2

11.8

19.0

15.3

13.5

P/BV

8.6

6.0

4.4

6.4

4.9

3.8

Dividend yield (%)

0.1

0.1

0.1

0.1

0.1

0.1

EV/Sales

4.4

3.2

2.2

3.5

3.1

2.7

EV/EBITDA

31.5

12.6

10.5

16.4

13.1

11.3

EV / Total Assets

4.2

3.4

2.8

4.2

3.2

2.7

Per Share Data (`)

EPS (Basic)

7.4

22.8

27.7

33.9

41.4

47.3

EPS (fully diluted)

7.4

22.8

27.7

33.9

41.4

47.3

Cash EPS

18.6

51.0

65.4

40.7

50.5

57.4

DPS

0.5

0.5

0.5

0.5

0.5

0.5

Book Value

89.5

128.8

176.6

120.8

159.3

203.7

Dupont Analysis

EBIT margin

9.8

21.9

17.9

18.8

20.3

20.4

Tax retention ratio

77.9

76.3

72.5

72.7

73.0

73.0

Asset turnover (x)

1.0

1.2

1.5

1.4

1.4

1.3

ROIC (Post-tax)

8.0

20.1

19.2

19.5

20.0

19.2

Cost of Debt (Post Tax)

3.2

2.3

1.6

2.9

2.9

2.9

Leverage (x)

1.3

1.1

0.8

0.6

0.4

0.3

Operating ROE

14.0

39.5

33.4

28.9

27.1

24.4

Returns (%)

ROCE (Pre-tax)

9.9

25.4

25.3

24.8

24.0

22.5

Angel ROIC (Pre-tax)

11.5

28.5

27.6

27.5

27.9

26.7

ROE

17.5

41.9

36.4

32.5

29.6

26.1

Turnover ratios (x)

Asset Turnover (Gross Block)

1.8

2.2

2.4

2.1

2.1

2.2

Inventory / Sales (days)

98

49

90

95

101

108

Receivables (days)

129

95

93

95

63

63

Payables (days)

78

73

114

119

81

81

WC cycle (ex-cash) (days)

159

145

119

119

135

159

Solvency ratios (x)

Net debt to equity

1.2

1.0

0.7

0.5

0.4

0.3

Net debt to EBITDA

3.9

1.7

1.4

1.1

0.9

0.8

Interest Coverage (EBIT / Int.)

4.3

16.3

25.5

16.2

16.6

16.8

June 13, 2016

11

Aurobindo Pharma | 4QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Aurobindo Pharma

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

June 13, 2016

12