4QFY2016 Result Update | Pharmaceutical

May 23, 2016

Lupin

BUY

CMP

`1,505

Performance Highlights

Target Price

`1,809

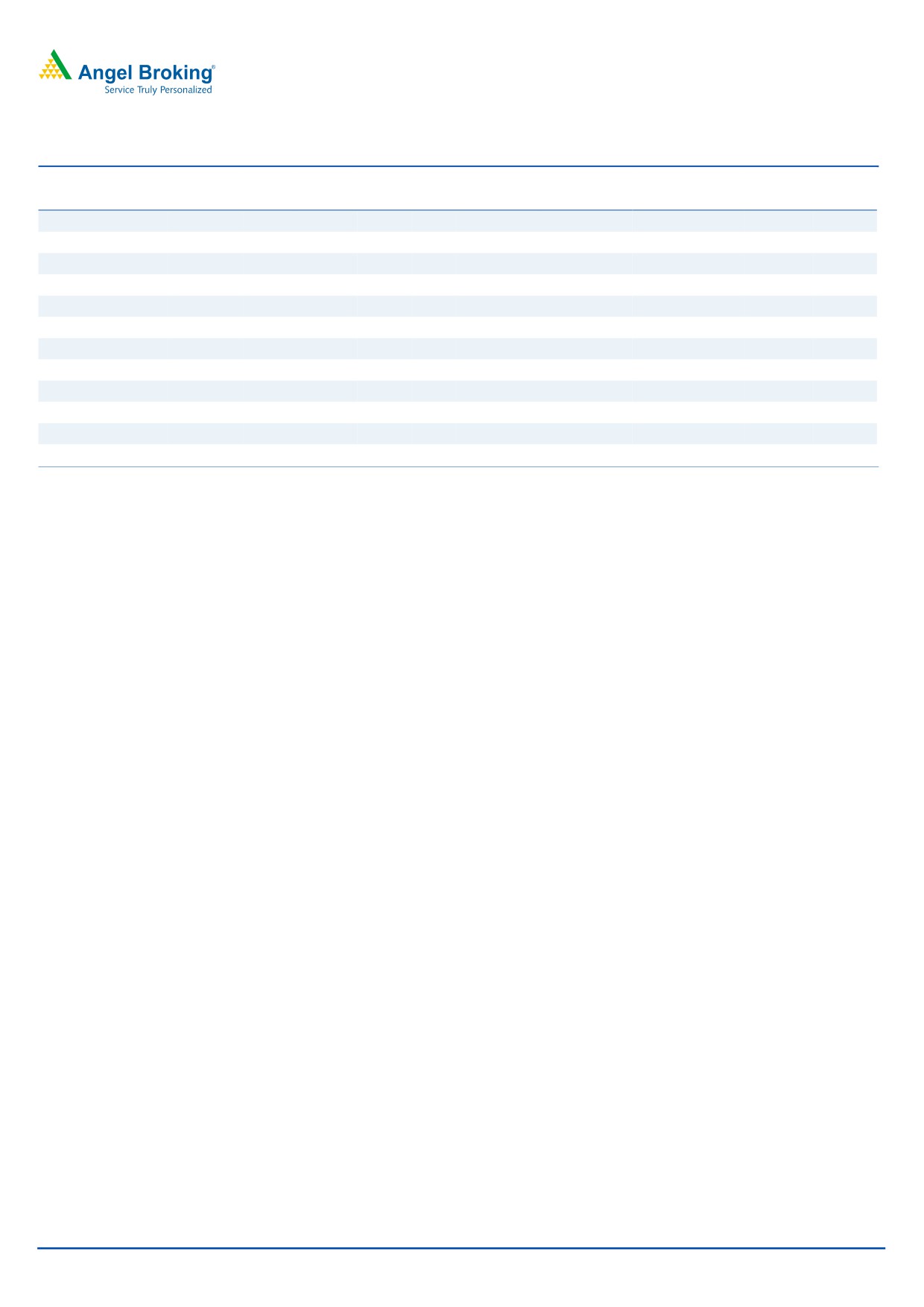

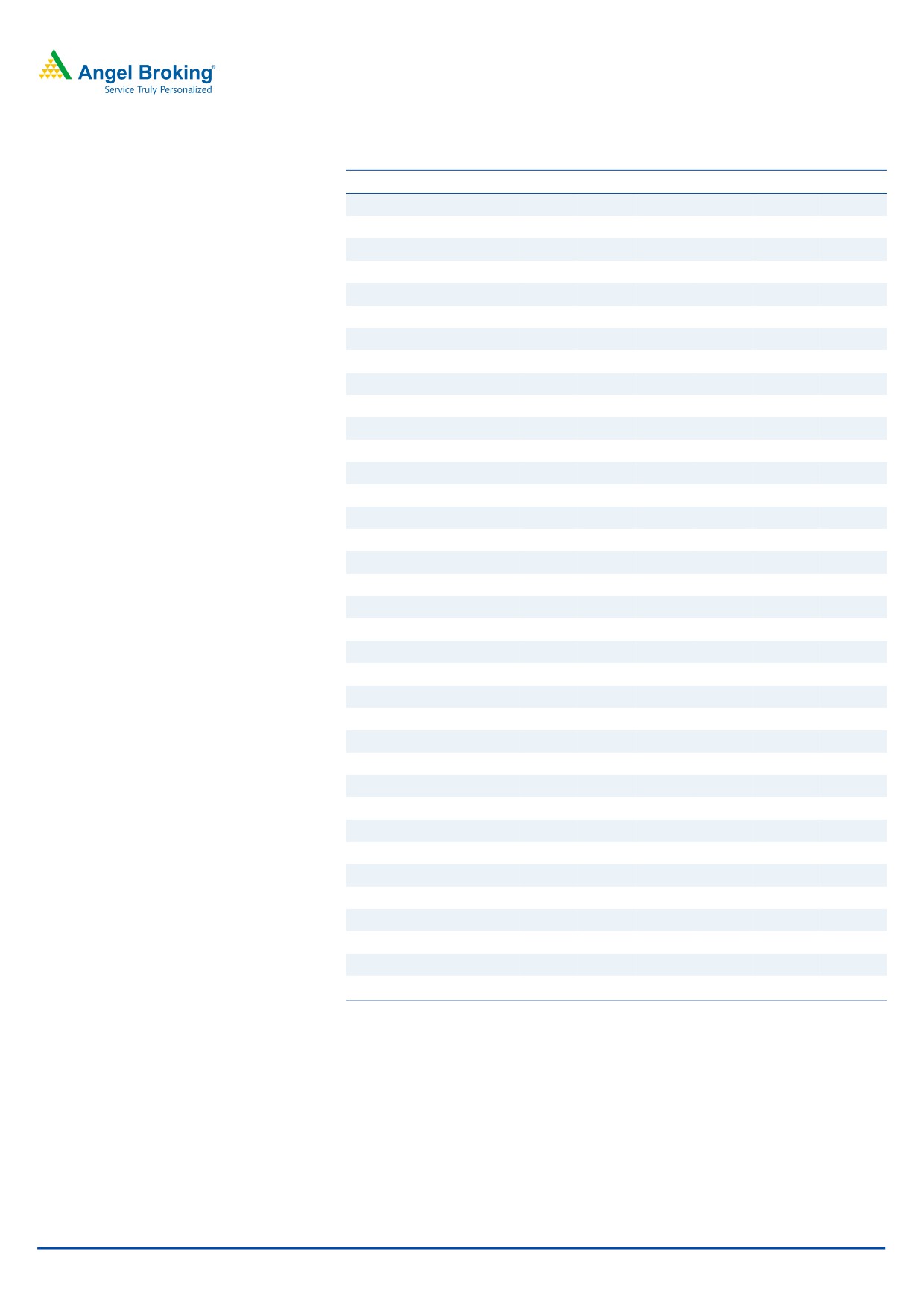

Y/E March (` cr)

4QFY2016 3QFY2016

% chg qoq 4QFY2015

% chg yoy

Investment Period

12 months

Net sales

4,091

3,358

21.8

3,054

34.0

Other income

115

263

(56.3)

41

178.9

Stock Info

Operating profit

1,277

679

88.1

766

66.9

Interest

23

9

149.2

3

815.2

Sector

Pharmaceutical

Net profit

807

530

52.3

547

47.5

Market Cap (` cr)

67,837

Source: Company, Angel Research

Net Debt (` cr)

6,737

Beta

0.7

For 4QFY2016, Lupin posted results above our expectations. Sales came in at

`4,091cr (V/s `3,665cr expected), up 34.0% yoy. Sales growth was driven by

52 Week High / Low

2,127 / 1,294

Formulations (`3,807.5cr) which rose by 38.6% yoy, while API (`283.8cr)

Avg. Daily Volume

157,745

witnessed a dip of 7.7% yoy. On the operating front, the EBDITA margin came in

Face Value (`)

2

at 31.2% V/s 25.1% in 4QFY2015 and V/s our expectation of 29.5%. The

BSE Sensex

23,382

expansion in the OPM was on the back of a firmer GPM which came in at 73.8%

Nifty

7,108

V/s 67.9% in 4QFY2015 and V/s 72.7% expected. This along with high other

Reuters Code

LUPN.BO

income at `115cr (V/s `41cr in 4QFY2015) led the net profit to come in at

Bloomberg Code

LPC@IN

`807cr V/s `547cr in 4QFY2015 and V/s `829cr expected. We recommend a

Buy on the stock with a price target of `1,809.

Shareholding Pattern (%)

Numbers outperform our expectations: Sales for the quarter came in at `4,091cr

Promoters

46.5

(V/s `3,665cr expected), up 34.0% yoy. Sales growth was driven by Formulations

MF / Banks / Indian Fls

8.3

(`3,807.5cr) which rose by 38.6% yoy, while API (`283.8cr) witnessed a dip of

FII / NRIs / OCBs

35.8

7.7% yoy. Formulation sales were driven by USA (`2,187.1cr, +58.7% yoy),

Indian Public / Others

9.4

Europe (`125.4cr, +40.7% yoy), India (`761.5cr, +14.7% yoy, Japan (`344.2cr,

+17.0% yoy) and ROW (`275.8cr, +38.3% yoy). On the operating front, the

EBDITA margin came in at 31.2% V/s 25.1% in 4QFY2015 and V/s our

Abs. (%)

3m 1yr 3yr

expectation of 29.5%. This along with high other income at `115cr (V/s `41cr in

Sensex

6.7

(8.5)

25.1

4QFY2015) led the net profit to come in at `807cr V/s `547cr in 4QFY2015 and

Lupin

(15.6)

(12.8)

96.0

V/s `829cr expected.

Outlook and valuation: We expect Lupin to post a net sales CAGR of 16.7% to

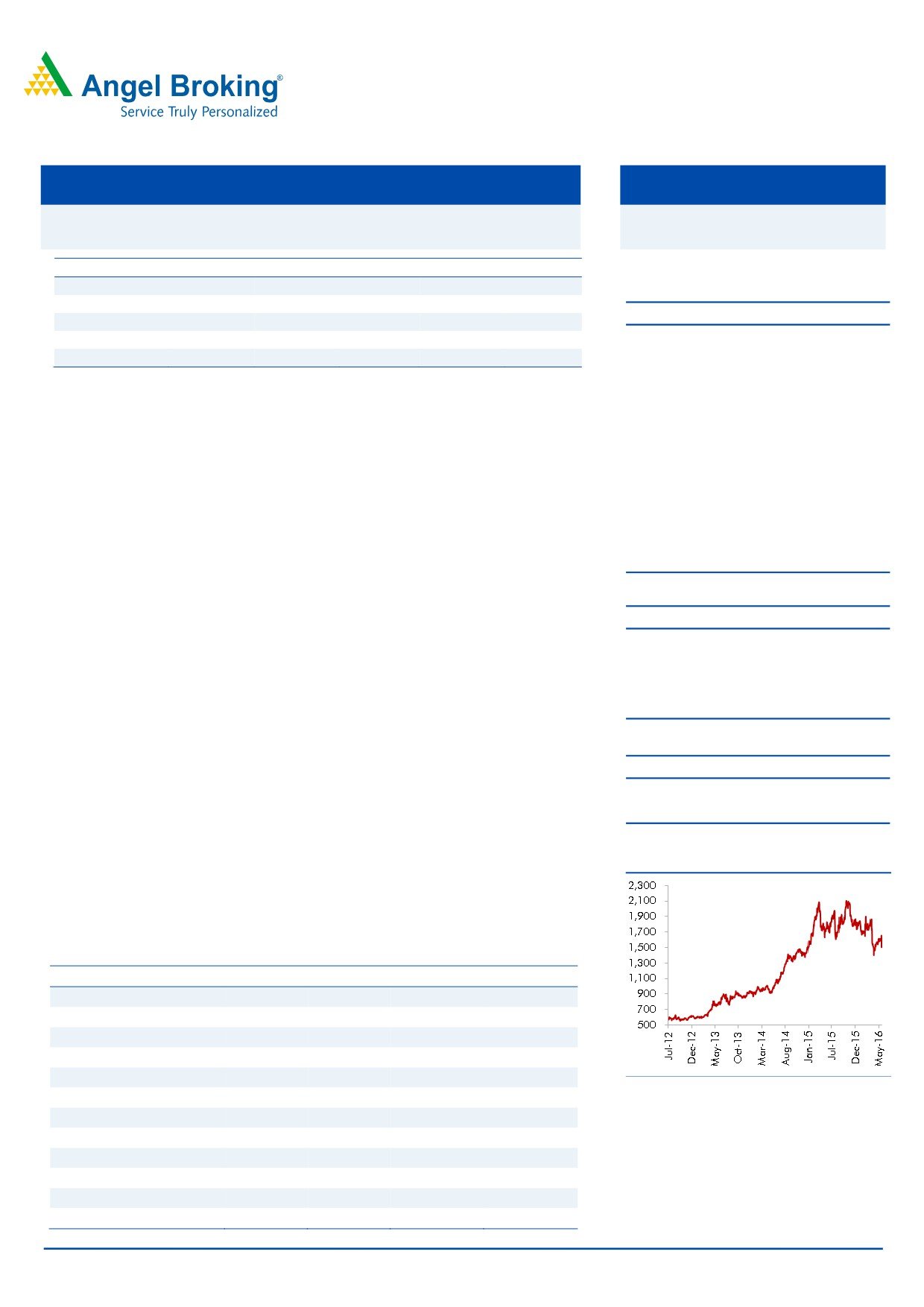

3-year price chart

`18,644cr and earnings CAGR of 17.2% to `69.3/share over FY2016-18E.

Currently, the stock is trading at 25.9x and 21.7x its FY2017E and FY2018E

earnings, respectively. We recommend a Buy on the stock.

Key financials (Consolidated)

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

Net sales

12,600

13,702

15,912

18,644

% chg

13.6

8.7

16.1

17.2

Net profit

2,403

2,271

2,611

3,117

% chg

30.9

(5.5)

15.0

19.4

EPS (`)

53.7

50.6

58.1

69.3

Source: Company, Angel Research

EBITDA margin (%)

27.4

23.7

26.4

26.7

P/E (x)

28.2

29.8

25.9

21.7

RoE (%)

30.4

22.9

21.4

20.9

RoCE (%)

34.3

19.6

19.3

24.4

P/BV (x)

7.6

6.2

5.0

4.1

Sarabjit Kour Nangra

EV/sales (x)

5.3

5.4

4.3

3.5

+91 22 3935 7600 Ext: 6806

EV/EBITDA (x)

19.4

22.6

16.1

13.1

Source: Company, Angel Research; Note: CMP as of May 20, 2016

Please refer to important disclosures at the end of this report

1

Lupin | 4QFY2016 Result Update

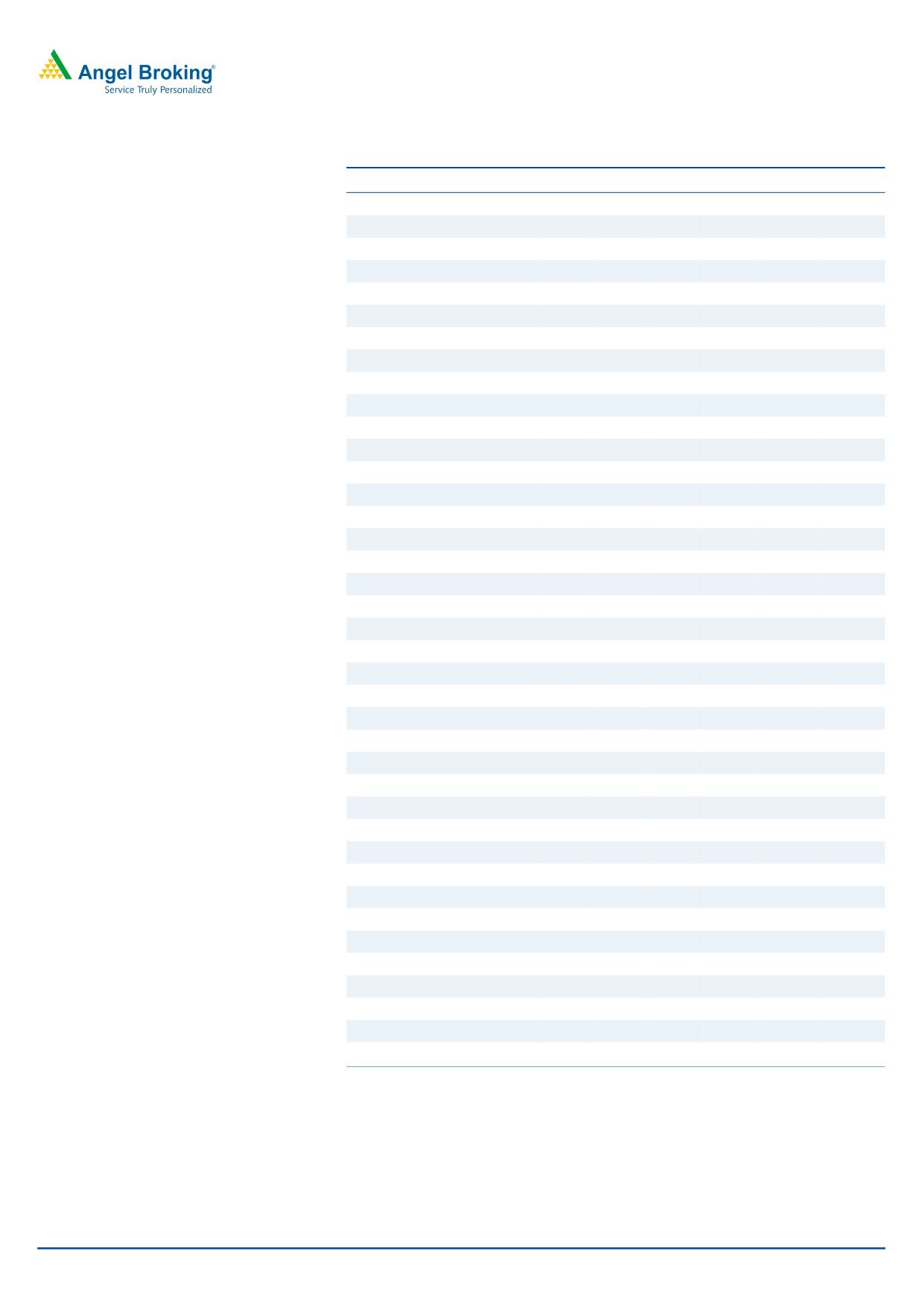

Exhibit 1: 4QFY2016 - Consolidated performance

Y/E March (` cr)

4QFY2016

3QFY2016

% chg (qoq)

4QFY2015

% chg (yoy) FY2016 FY2015

% chg (yoy)

Net sales

4,091

3,358

21.8

3,054

34.0

13,701

12,600

8.7

Other income

115

263

(56.3)

41

178.9

695

409

69.8

Total income

4,206

3,621

16.2

3,096

35.9

14,396

13,009

10.7

Gross profit

3,018

2,235

35.0

2,074

9,392

8,443

11.2

Gross margin

73.8

66.6

67.9

68.5

67.0

Operating profit

1,277.5

679.1

88.1

766

66.9

3,246

3,450.0

(5.9)

OPM (%)

31.2

20.2

25.1

23.7

27.4

Interest

23

9

149.2

3

815.2

45

10

346.2

Dep. & amortization

145

114

26.9

107

35.0

464

435

6.6

PBT

1,225

819

49.5

697

75.7

3,433

3,414

0.6

Provision for taxation

413

290

42.4

136

203.1

1,154

970

18.9

Reported net profit

812

529

53.4

561

44.8

2,279

2,444

(6.7)

Less : exceptional items

-

-

-

-

-

MI & share in associates

5

1

310.4

14

(62.6)

9

41

(78.6)

PAT after exceptional items

807

530

52.3

547

47.5

2,271

2,403

(5.5)

EPS (`)

18.0

11.8

12.2

50.6

53.7

Source: Company, Angel Research

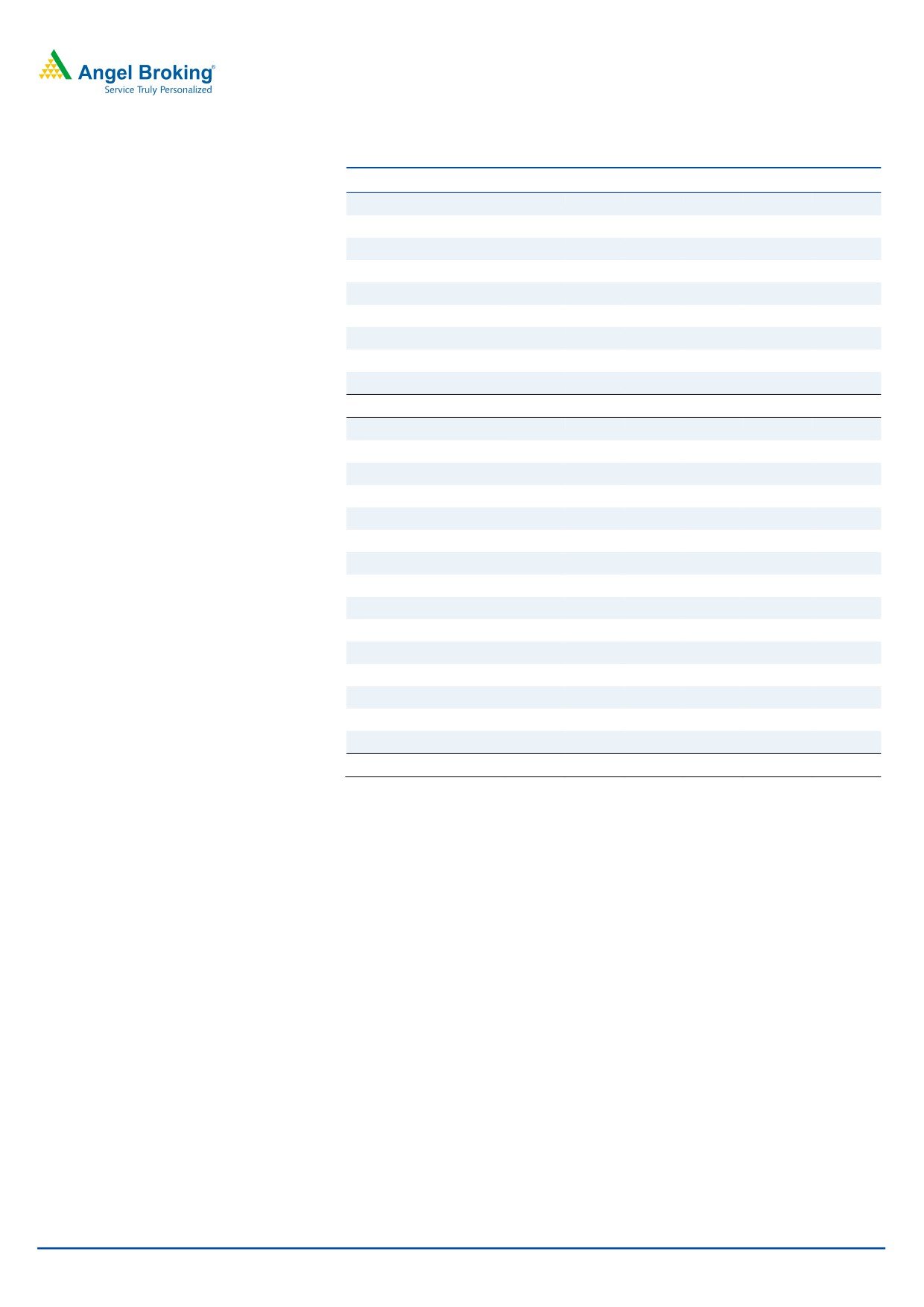

Exhibit 2: 4QFY2016 - Actual Vs Angel estimates

` cr

Actual

Estimates

Variation

Net Sales

4,091

3,665

11.6

Other Income

115

41

178.9

Operating Profit

1,277

1,080

18.3

Deprecation

145

113

28.0

Tax

413

207

99.1

Net Profit

807

829

(2.6)

Source: Company, Angel Research

Revenue grows 34.0% yoy: The company’s sales for the quarter came in at

`4,091cr (V/s `3,665cr expected), up 34.0% yoy. Sales growth was driven by

Formulations

(`3,807.5cr) which rose by

38.6% yoy, while API

(`283.8cr)

witnessed a dip of 7.7% yoy. Formulation sales were driven by USA (`2,312.5cr)

and Europe (`125.4cr), up a 57.6% yoy and 40.7% yoy respectively.

The growth in the US business (US$325mn) was led by strong sales of generic

Glumetza (in 180 days exclusivity) and by price hikes undertaken in generic

Fortamet in the previous quarters. The company completed the acquisition of

Gavis in March 2016, which resulted in the inclusion of Gavis sales (~US$10-

12mn) for 20 days in 4QFY2016.

India (`761.5cr) posted a 14.7% yoy growth, while Japan (`344.2cr) posted a

17.0% yoy growth. ROW (`275.8cr) posted a 38.3% yoy growth.

The company launched 9 products in the US during the period, taking the total

launches in FY2016 to 21. It has 79 products in the market. Lupin is the market

leader in 44 products marketed in the US generics market. The company is

amongst the top 3 by market share in 79 products.

Another export destination - Japan, posted a yoy growth of 17.0% to `344.2cr,

mainly on back of the currency impact. Sales in JPY terms grew 4.8% yoy to

May 23, 2016

2

Lupin | 4QFY2016 Result Update

JPY5,918mn during the quarter. Lupin’s sales in Europe (`125.4cr) and India

(`761.5cr) posted a yoy growth of 40.7% and 14.7% yoy, respectively. ROW

(`275.8cr) posted a strong growth of 38.3% yoy in 4QFY2016.

Pharma Dynamics clocked revenues of `113.5cr during 4QFY2016, a growth of

8.3% yoy, while it grew 13.2% in ZAR terms to ZAR228mn. The company remains

the fourth largest generic company in the South African market. On the regulatory

front, Lupin received 6 approvals from the USFDA during the quarter. Cumulative

ANDA filings with the USFDA as of March 31, 2016 stood at 343 (35 FTFs) with

the company having received 180 approvals to date.

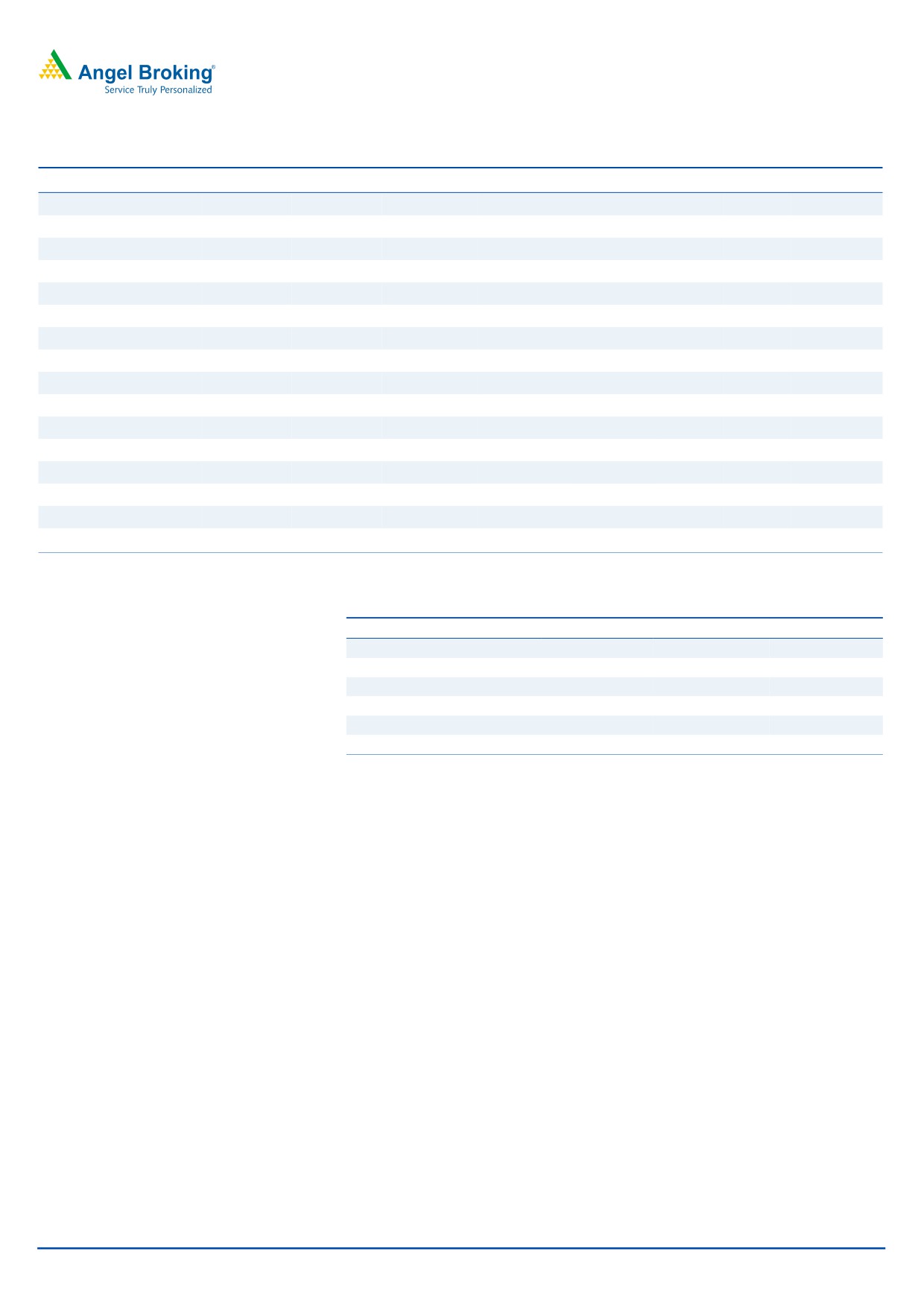

Exhibit 3: Advanced markets - Sales trend

3,000

2,531

2,500

1,880

2,000

1,761

1,599

1,594

1,500

1,000

500

0

4QFY2015

1QFY2016

2QFY2016

3QFY2016

4QFY2016

Source: Company, Angel Research

Exhibit 4: Domestic Formulation Market

1000

885

874

871

900

762

800

664

700

600

500

400

300

200

100

0

4QFY2015

1QFY2016

2QFY2016

3QFY2016

4QFY2016

Source: Company

OPM at 31.2%: On the operating front, the EBDITA margin came in at 31.2% V/s

25.1% in 4QFY2015 and V/s 29.5% expected. The expansion in the OPM was on

back of the GPM expansion which came in at 73.8% V/s 68.7% in 4QFY2015 and

V/s 72.7% expected. The R&D expenditure during the quarter was 16.7% of sales

V/s 10.1% of sales during 4QFY2015.

May 23, 2016

3

Lupin | 4QFY2016 Result Update

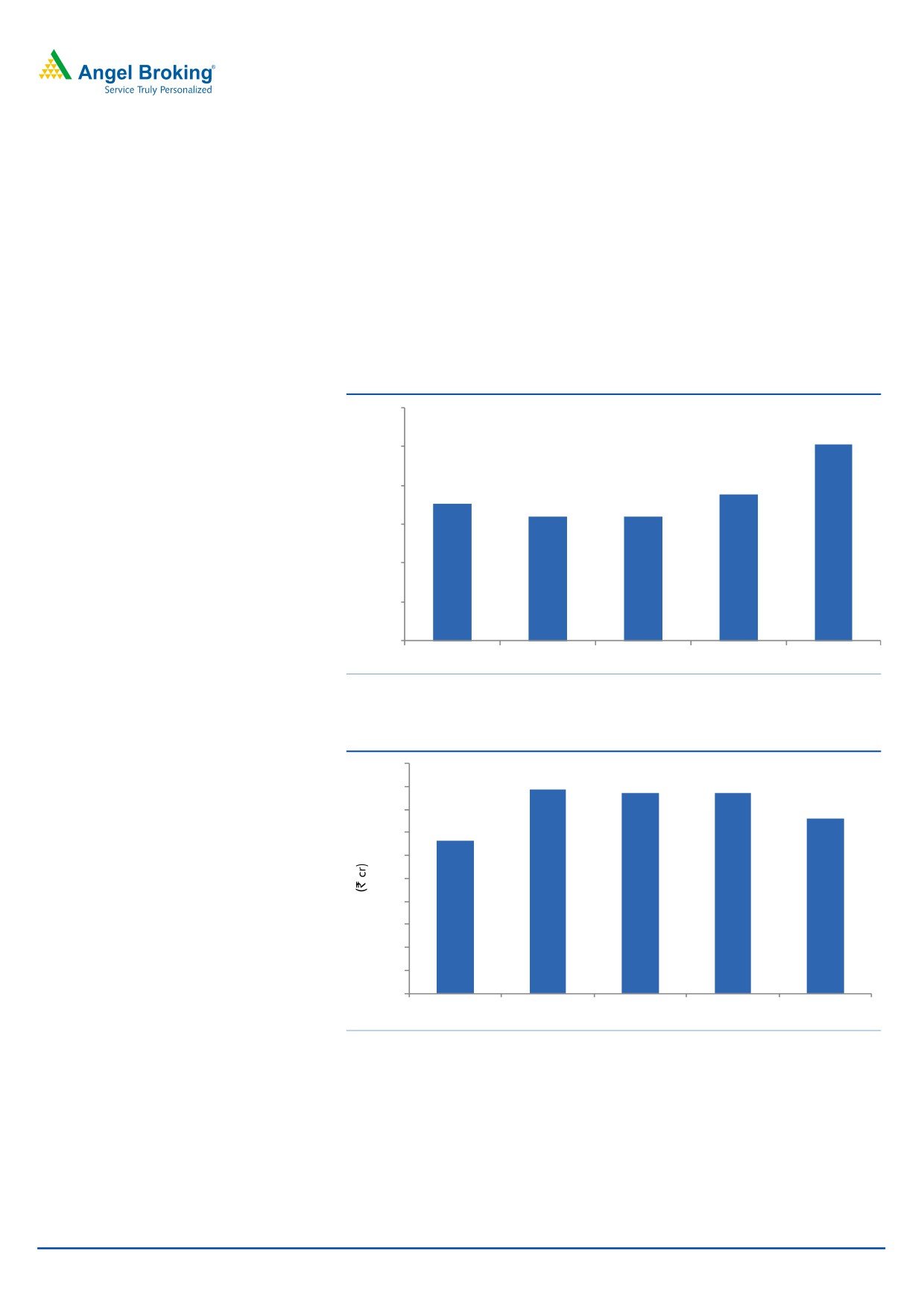

Exhibit 5: OPM trend

33.0

31.2

31.0

29.0

27.0

25.1

24.2

25.0

23.0

20.0

20.2

21.0

19.0

17.0

15.0

4QFY2015

1QFY2016

2QFY2016

3QFY2016

4QFY2016

Source: Company, Angel Research

Net profit growth lower than our estimate: Thus, the net profit came in at `807cr

V/s `829cr expected and V/s `547cr in 4QFY2015, a yoy growth of 47.5%.

Exhibit 6: Net profit trends

900

807

800

700

600

547

525

530

500

400

400

300

200

100

-

4QFY2015

1QFY2016

2QFY2016

3QFY2016

4QFY2016

Source: Company, Angel Research

Conference call takeaways

FY2018 revenue aspiration has been brought down to US$3.5bn (US$2.1bn

in FY2016) from US$5bn. Net profit margin for FY2018 to be 20%.

Fortamet and Glumetza should continue to drive growth in FY2017 as the

company does not expect more than 1-2 new players over the next one year.

ANDA approval guidance: 25-30 launches are expected in FY2017 out of

which 15 would be from Gavis and 15 would be from Lupin. Lupin expects 2

FTFs in FY2017.

R&D as % of sales to be 12-15% in FY2017. Biosimilars expense would be

~12-14% of total R&D cost. Around 1/6th of the expense would be towards the

NCE portfolio.

May 23, 2016

4

Lupin | 4QFY2016 Result Update

Currently, 24% of the portfolio is under NLEM (price control) and the company

has taken a price decline of ~2.7% on this portfolio (in line with WPI

deflation).

Tax rate guided to be between 28-30% of PBT.

Recommendation rationale

US market - the key driver: The high-margin branded generic business has

been the key differentiator for Lupin in the Indian pharmaceuticals space. On

the generic turf, Lupin is currently the fifth largest generic player in the US,

with 5.3% market share in prescription. Lupin is now the market leader in 44

products marketed in the US generics market and is amongst the top 3 by

market share in 79 products. Currently, the company’s cumulative filings stand

at 343, of which 180 have been approved, with 35 FTFs valued at more than

US$13bn. Lupin plans to launch 25-30 products in the US in FY2017. We

expect the region to post a CAGR of 22.9% during FY2016-18E, on back of

new product launches.

Domestic formulations on a strong footing: Lupin continues to make strides in

the Indian market. Currently, Lupin ranks No 3, and is the fastest growing

company among the top five companies in the domestic formulation space,

registering a strong CAGR of 20.0% over the last few years. Six of Lupin's

products are among the top 300 brands in the country. Lupin has a strong

field force of ~6,000MRs (as of FY2016). We expect the domestic formulation

market to grow at a CAGR of 15.0% over FY2016-18E.

First-mover advantage in Japan: Lupin figures among the few Indian

companies with a formidable presence in Japan, the world’s second largest

pharma market (ranked as the 8th largest as per IMS MAT March 2014). The

Management believes there will be patent expiries (US$14-16bn) in the next

two years in the Japanese market, which along with increased generic

penetration would drive growth in the market. The Management expects

improvement in growth in the next 3-4 years. On a conservative basis, we

expect the market to post a CAGR of 10.0% over FY2016-18E.

May 23, 2016

5

Lupin | 4QFY2016 Result Update

Valuation

We expect Lupin to post a net sales CAGR of 16.7% to `18,644cr and earnings

CAGR of 17.2% to `69.3/share over FY2016-18E. Currently, the stock is trading

at

25.9x and

21.7x its FY2017E and FY2018E earnings, respectively. We

recommend a Buy on the stock.

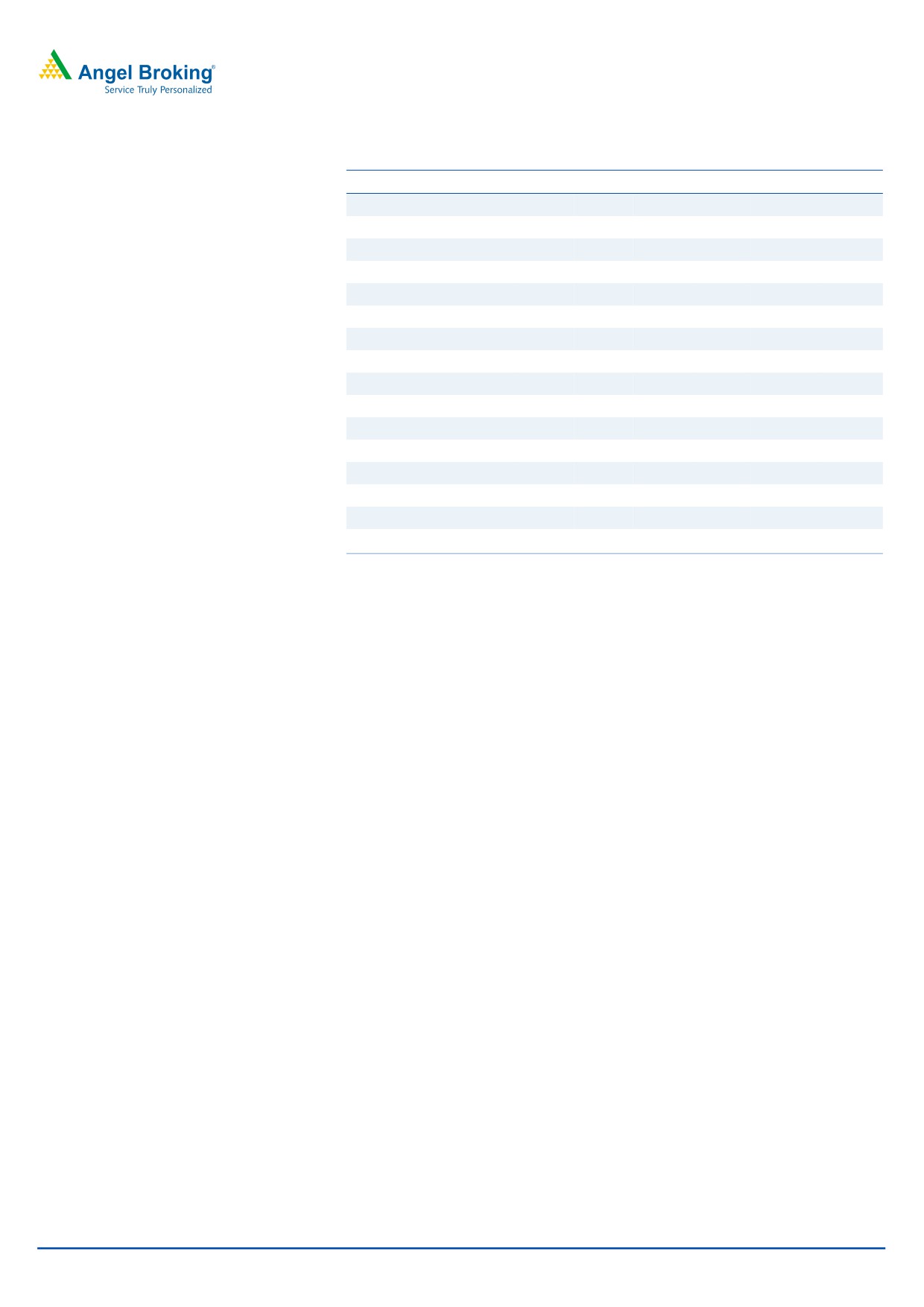

Exhibit 7: Key Assumptions

FY2017E

FY2018E

Sales growth (%)

16.1

17.2

Domestic growth (%)

14.0

16.0

Exports growth (%)

17.8

17.5

Operating margins (%)

26.4

26.7

R&D Exp ( % of sales)

12.0

12.0

Capex (` cr)

1000

1000

Source: Company, Angel Research

Exhibit 8: One-year forward PE

3,000

2,500

2,000

1,500

1,000

500

-

20x

25x

30x

35x

Source: Company, Angel Research

May 23, 2016

6

Lupin | 4QFY2016 Result Update

Exhibit 9: Recommendation summary

Company

Reco

CMP Tgt. price Upside

FY2017E

FY15-17E

FY2017E

(`)

(`)

(%) PE (x) EV/Sales (x) EV/EBITDA (x) CAGR in EPS (%) RoCE (%) RoE (%)

Alembic Pharma

Neutral

564

-

-

19.7

2.7

13.9

11.4

23.5

21.3

Aurobindo Pharma Accumulate

770

856

11.1

18.0

2.9

12.6

15.6

23.5

30.2

Cadila Healthcare

Buy

321

400

24.6

18.8

2.9

13.0

22.9

24.2

28.8

Cipla

Buy

507

605

19.3

18.4

2.4

12.9

18.3

16.7

16.1

Dr Reddy's

Buy

3,035

3,476

14.5

19.9

2.9

11.8

6.8

19.2

18.7

Dishman Pharma

Neutral

157

-

-

15.7

1.7

7.8

15.9

9.4

11.0

GSK Pharma*

Neutral

3,382

-

-

49.5

8.7

39.2

6.6

33.7

34.3

Indoco Remedies

Neutral

258

-

-

19.0

2.1

11.4

23.0

19.7

19.7

Ipca labs

Buy

450

750

66.7

16.1

1.7

9.1

17.9

11.8

14.9

Lupin

Buy

1,505

1,809

20.2

25.9

4.3

16.3

4.2

19.3

21.4

Sanofi India

Accumulate

4,292

4,738

12.4

27.5

3.8

21.8

34.2

21.0

25.6

Sun Pharma

Buy

792

950

19.9

29.4

5.2

16.8

8.4

15.8

16.6

Source: Company, Angel Research; Note: * December year ending

May 23, 2016

7

Lupin | 4QFY2016 Result Update

Company Background

Lupin, established in 1968, is primarily engaged in the manufacture and global

distribution of active pharmaceutical ingredients (APIs) and finished dosages. Over

the years, the company forayed into the US markets through a differentiated export

strategy of tapping branded generics and consequently gaining a large share of

the US prescription market. Further, to expand its footprint in the global markets,

Lupin has prudently adopted the inorganic growth route. In line with this, over the

last two years, the company made small acquisitions across geographies,

prominent among these being the acquisition of Kyowa in the growing Japanese

market. In the US, the company has acquired privately held Gavis Pharmaceuticals

LLC and Novel Laboratories Inc. The acquisitions enhance Lupin’s scale in the US

generic market and also broadens its pipeline in dermatology, controlled

substance products and other high-value and niche generics.

May 23, 2016

8

Lupin | 4QFY2016 Result Update

Profit & Loss Statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

Gross sales

9,524

11,167

12,684

13,797

16,008

18,757

Less: Excise duty

62

80

84

96

96

113

Net sales

9,462

11,087

12,600

13,702

15,912

18,644

Other operating income

180

200

170

507

200

200

Total operating income

9,641

11,287

12,770

14,208

16,112

18,844

% chg

36.1

17.1

13.1

11.3

13.4

17.0

Total expenditure

7,371

8,284

9,150

10,455

11,718

13,667

Net raw materials

3,548

3,817

4,157

4,309

5,092

5,864

Other mfg costs

757

847

963

1,047

1,216

1,425

Personnel

1,249

1,465

1,747

2,108

2,069

2,868

Other

1,818

2,155

2,283

2,580

3,342

3,511

EBITDA

2,090

2,803

3,449

3,247

4,194

4,977

% chg

58.2

34.1

23.1

(5.9)

29.2

18.7

(% of Net Sales)

22.1

25.3

27.4

23.7

26.4

26.7

Depreciation& Amortization

332

261

435

464

933

1,013

EBIT

1,758

2,542

3,015

2,783

3,261

3,964

% chg

60.7

44.6

18.6

(7.7)

17.2

21.5

(% of Net Sales)

18.6

22.9

23.9

20.3

20.5

21.3

Interest & other charges

41

27

10

45

10

10

Other Income

28

116

240

188

188

188

(% of PBT)

1

4

7

5

5

4

Share in profit of associates

-

-

-

-

-

-

Recurring PBT

1,925

2,832

3,415

3,433

3,639

4,342

% chg

60.9

47.1

20.6

0.5

6.0

19.3

Extraordinary expense/(Inc.)

-

-

-

-

-

-

PBT (reported)

1,925

2,832

3,415

3,433

3,639

4,342

Tax

584

962

970

1,154

1,019

1,216

(% of PBT)

30.4

34.0

28.4

33.6

28.0

28.0

PAT (reported)

1,340

1,870

2,444

2,279

2,620

3,126

Add: Share of earnings of asso.

-

-

-

-

-

-

Less: Minority interest (MI)

26

33

41

9

9

9

Prior period items

-

-

-

-

-

-

PAT after MI (reported)

1,314

1,836

2,403

2,271

2,611

3,117

ADJ. PAT

1,314

1,836

2,403

2,271

2,611

3,117

% chg

51.5

39.7

30.9

(5.5)

15.0

19.4

(% of Net Sales)

13.9

16.6

19.1

16.6

16.4

16.7

Basic EPS (`)

29.4

41.0

53.5

50.5

58.1

69.3

Fully Diluted EPS (`)

29.4

41.0

53.5

50.5

58.1

69.3

% chg

51.0

39.5

30.5

(5.5)

15.0

19.4

May 23, 2016

9

Lupin | 4QFY2016 Result Update

Balance Sheet (Consolidated)

Y/E March

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

SOURCES OF FUNDS

Equity share capital

90

90

90

90

90

90

Reserves & surplus

5,115

6,842

8,784

10,894

13,337

16,286

Shareholders funds

5,204

6,932

8,874

10,984

13,427

16,376

Minority interest

59

67

24

32

41

50

Total loans

1,164

553

471

7,119

1,000

500

Other Long-Term Liabilities

50

46

74

75

76

77

Long-Term Provisions

112

132

132

380

380

380

Deferred tax liability

163

178

118

124

124

124

Total liabilities

6,754

7,908

9,693

18,715

15,049

17,507

APPLICATION OF FUNDS

Gross block

4,114

4,564

5,355

11,160

12,160

13,160

Less: Acc. depreciation

1,684

1,928

2,363

2,827

3,759

4,772

Net block

2,430

2,635

2,992

8,334

8,401

8,388

Capital work-in-progress

311

304

304

304

304

304

Goodwill

570

720

1,648

2,964

2,964

2,964

Investments

2

178

1,658

8

8

8

Long-Term Loans and Adv.

387

373

275

970

1,126

1,320

Current assets

5,143

5,924

6,176

9,777

6,489

9,495

Cash

435

798

1,306

838

338

2,288

Loans & advances

340

302

671

737

847

993

Other

3,154

4,825

4,199

8,202

5,303

6,214

Current liabilities

2,089

2,227

3,360

3,642

4,243

4,972

Net current assets

3,054

3,697

2,816

6,135

2,245

4,523

Mis. Exp. not written off

-

-

-

-

-

-

Total assets

6,754

7,908

9,693

18,715

15,049

17,507

May 23, 2016

10

Lupin | 4QFY2016 Result Update

Cash Flow Statement (Consolidated)

Y/E March (` cr)

FY2013 FY2014 FY2015 FY2016 FY2017E FY2018E

Profit before tax

1,925

2,832

3,415

3,433

3,639

4,342

Depreciation

332

261

435

464

933

1,013

(Inc)/Dec in working capital

620

(1,481)

1,487

(4,482)

3,233

(521)

Direct taxes paid

(584)

(962)

(970)

(1,154)

(1,019)

(1,216)

Cash Flow from Operations

2,293

649

4,367

(1,739)

6,786

3,618

(Inc.)/Dec.in Fixed Assets

(353)

(443)

(791)

(5,805)

(1,000)

(1,000)

(Inc.)/Dec. in Investments

-

-

-

-

-

-

Cash Flow from Investing

(353)

(443)

(791)

(5,805)

(1,000)

(1,000)

Issue of equity

-

-

-

-

-

-

Inc./(Dec.) in loans

(476)

(611)

(82)

6,648

(6,119)

(500)

Dividend Paid (Incl. Tax)

(209)

(157)

(168)

(168)

(168)

(168)

Others

499

(795)

(2,816)

597

1

-

Cash Flow from Financing

(186)

(1,564)

(3,067)

7,077

(6,287)

(668)

Inc./(Dec.) in Cash

1,753

(1,358)

509

(468)

(500)

1,950

Opening Cash balances

402

435

798

1,306

838

338

Closing Cash balances

435

798

1,306

838

338

2,288

May 23, 2016

11

Lupin | 4QFY2016 Result Update

Key Ratios

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

51.3

36.8

28.2

29.8

25.9

21.7

P/CEPS

40.9

32.2

23.8

24.7

19.1

16.4

P/BV

12.9

9.7

7.6

6.2

5.0

4.1

Dividend yield (%)

0.3

0.4

0.5

0.5

0.5

0.5

EV/Sales

7.2

6.0

5.3

5.4

4.3

3.5

EV/EBITDA

32.5

23.9

19.4

22.6

16.1

13.1

EV / Total Assets

10.0

8.5

6.9

3.9

4.5

3.7

Per Share Data (`)

EPS (Basic)

29.4

41.0

53.5

50.5

58.1

69.3

EPS (fully diluted)

29.4

41.0

53.5

50.5

58.1

69.3

Cash EPS

36.8

46.8

63.1

60.8

78.8

91.9

DPS

4.0

6.0

8.0

8.0

8.0

8.0

Book Value

116.3

154.6

197.4

244.4

298.7

364.3

Dupont Analysis

EBIT margin

18.6

22.9

23.9

20.3

20.5

21.3

Tax retention ratio

69.6

66.0

71.6

66.4

72.0

72.0

Asset turnover (x)

1.6

1.7

1.6

1.1

1.0

1.3

ROIC (Post-tax)

20.9

25.4

28.2

14.6

14.6

19.3

Cost of Debt (Post Tax)

2.0

2.0

1.4

0.8

0.2

1.0

Leverage (x)

0.0

0.0

0.0

0.0

0.2

0.0

Operating ROE

20.9

25.4

28.2

14.6

17.2

19.6

Returns (%)

ROCE (Pre-tax)

27.5

34.7

34.3

19.6

19.3

24.4

Angel ROIC (Pre-tax)

35.0

44.1

48.2

26.4

25.0

33.9

ROE

28.5

30.3

30.4

22.9

21.4

20.9

Turnover ratios (x)

Asset Turnover (Gross Block)

2.5

2.6

2.6

1.7

1.4

1.5

Inventory / Sales (days)

70

66

62

74

66

56

Receivables (days)

75

75

66

78

71

59

Payables (days)

72

84

78

86

86

86

WC cycle (ex-cash) (days)

88

89

63

87

82

40

Solvency ratios (x)

Net debt to equity

0.1

(0.0)

(0.1)

0.6

0.0

(0.1)

Net debt to EBITDA

0.3

(0.1)

(0.2)

1.9

0.2

(0.4)

Interest Coverage

42.9

95.4

307.3

62.4

326.1

396.4

May 23, 2016

12

Lupin | 4QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Lupin

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

May 23, 2016

13