IPO Note | Financial Services

April 27, 2016

Ujjivan Financial Services

SUBSCRIBE

Issue Open: April 28, 2016

IPO Note

Issue Close: May 02, 2016

Ujjivan Financial Services (Ujjivan) is the third largest micro finance company on

Issue Details

AUM basis and one of the largest in terms of geographical reach with 470

branches across 24 states in India. It is one of the 10 NBFCs which were granted

Face Value: `10

an in-principle approval for setting up a small finance bank.

Present Eq. Paid up Capital: `86.1crs

Transition to small finance bank to be smooth; will enable scalability: The

proposed small finance bank (SFB) will have access to low cost funds, ie below the

Fresh Issue**: `358crs (1.7cr Shares)

current 11.8% rate via deposits. However, there will be initial expenses while

Offer for sale: `525crs (2.5cr Shares)

transitioning to be a SFB as new processes will have to be implemented along

with maintenance of CRR and SLR. Meeting the 75% Priority Sector Lending (PSL)

Post Eq. Paid up Capital: `103crs

target will however not be a challenge for Ujjivan as its entire portfolio qualifies for

Market Lot: 70 Shares

PSL; hence, the migration from being an NBFC to a SFB should be smooth. With

leverage of only 5.6x, we believe there is enough scalability without further dilutions.

Fresh Issue (amount): `358crs

Huge scope in the micro finance business as reflected in its strong AUM CAGR:

Price Band: `207-210

Ujjivan reported a CAGR of 59% in its AUM over FY2013-9MFY2016 to

Post-issue implied mkt. cap `2,136*-

`4,589cr. There is a huge untapped opportunity in this segment as micro finance

2,167cr**

is targeted to the lower income segment which often lacks access to formal

Note:*at Lower price band and **Upper price band

financing sources. With a loan portfolio of ~`43,300cr the micro finance industry

is expected to report 30% CAGR over the next 3-4 years and Ujjivan with its pan-

India presence will be able to encash on the opportunity.

Book Building

Geographically diversified AUM with historically low NPAs: Ujjivan is present

QIBs

50%

across 24 states and has successfully diversified its AUM with no single state

contributing more than 20% to its AUM, thereby mitigating concentration risk.

Non-Institutional

15%

Karnataka, West Bengal, Maharashtra and Tamil Nadu together account for 56%

of its AUM; this makes a key differentiating point for Ujjivan as other micro

Retail

35%

finance institutions are largely focused on the southern states of India. Though the

company largely extends loans in a joint lending system, it also offers individual

loans which accounted for ~10% of the AUM. We expect the company’s overall

Post Shareholding Pattern(%)

individual loans portfolio to see strong growth going ahead.

Promoters

0.0%

Improving Cost/Income ratio: The company has been able to reduce its costs over

the past few years, thereby leading its Cost/Income ratio to come down to ~52%

Foreign Holding

77.1%

in 9MFY2016 from 60% in FY2015. However, as the company migrates to

Others

22.9%

becoming a SFB, the cost structure might spike up again. Nevertheless, we believe

new avenues of lending should help in maintaining the ratio in the long run.

Outlook Valuation: At the upper end of the offer price band (`210), the issue is

priced at 1.8x its diluted BV of `118 (2.1x pre-dilution). The company has decent

ROE and ROA of 19.9% and 3.6%, respectively. Although the return ratios might

get a bit compressed post the company’s conversion to a SFB, but we expect the

same to scale up subsequently. We believe the issue is attractively priced looking

at the growth options the company offers in the long run. We recommend a

SUBSCRIBE on the issue.

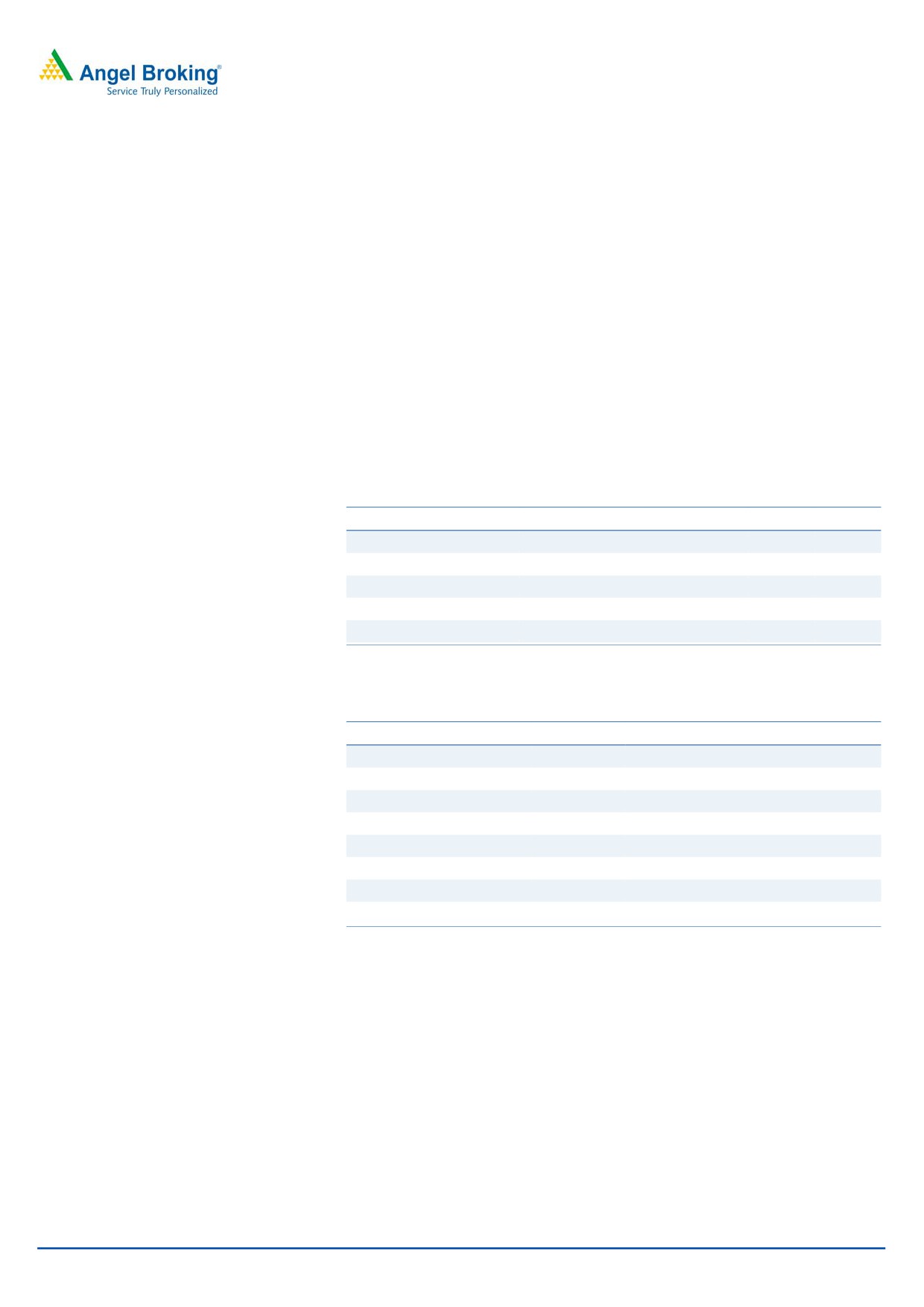

Key Financials

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

9MFY2016

NII

87.3

140.4

208.0

327.9

407.6

% chg

(15.9)

60.8

48.1

57.6

24.3

Siddharth Purohit

Net profit

0.1

32.9

58.4

75.8

122.3

+91 22 39357800 Ext: 6872

% chg

77.7

29.7

61.4

NIM (%)

11.26

13.76

13.57

11.62

12.31

Book Value (`)

42.0

48.5

56.8

85.5

99.7

P/ABV (x)

5.0

4.3

3.7

2.5

2.1

Chintan Shah

RoA (%)

0

2.9

3.4

2.5

3.6

+91 22 4000 3600 Ext: 6828

RoE (%)

0.1

11.8

16.9

13.7

19.9

Source: Company, Angel Research; Note: Valuation ratios based on pre-issue outstanding shares

and at upper end of the price band

Please refer to important disclosures at the end of this report

1

Ujjivan Financial Services | IPO Note

Company background

Ujjivan is one of the fastest growing micro finance companies in India.

Incorporated in 2005 and headquartered in Bengaluru, Ujjivan operates across 24

states through 470 branches. Ujjivan has emerged as the third largest micro

finance company in the country over the last few years and we believe its ability to

spread across the country will drive its next leg of growth. The company has also

received in-principle approval from the RBI to set up a small finance bank and

expects to start operations from April 1, 2017 as a new SFB.

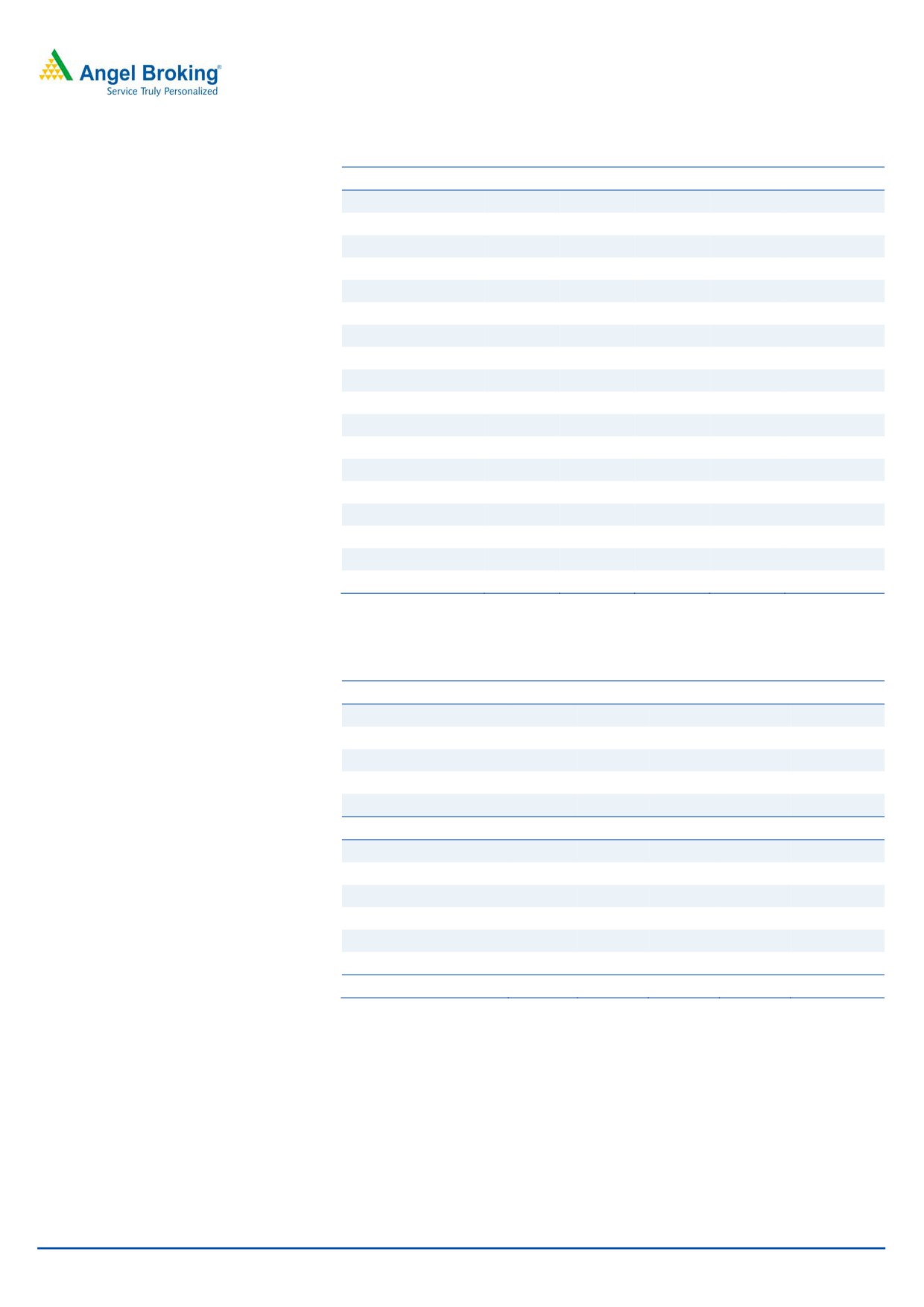

Exhibit 1: Regulatory aspects pertaining to Small Finance Bank (SFB)

Key Regulations

Company’s Plan of Action

With micro finance instituions’ average ticket size of `9,364 and that of

50% of a SFB’s loan portfolio should constitute of loans not exceeding

vehicle finance and MSEs at `3.8lakhs and `2.1 lakhs respectively, the

`25 lakhs.

proposed SFB will meet the guidelines.

As per FDI rules, foreign stake holders share holding in a SFB is capped

The proposed IPO will reduce the foreign investors holding from 93% to

at a maximum of 49%.

35%.

SFBs need to operate 25% of their branches in unbanked rural areas.

Existing branches of the company can be converted to SFB branches.

CRR & SLR to be maintained as per RBI norms.

SFBs need to have 75% of their loans under the priority sector.

Will be complied to as per the guidelines of the RBI.

Maximum exposure to single entity and group to be capped at 10% &

15% of net worth respectively.

SFBs are not permitted to set up any subsidiary.

Minimum CAR of 15% of RWA, with Tier of 7.5%.

With the proposed IPO, capital not to be a concern factor.

Source: Company, Angel Research

Key Management Personnel:

Mr K.R. Ramamoorthy is the Non-executive Chairman and Independent

Director of the company. He holds a bachelors degree in arts from Delhi

University and a bachelor’s degree in Law from Madras University. He is also

a fellow member of the Institute of Company Secretaries of India. He is the

former chairman and managing director of Corporation Bank and former

chairman & CEO of ING Vysya Bank. He has served as an advisor to CRISIL

and as consultant to The World Bank.

Mr Smait Ghosh is the MD & CEO. He founded Ujjivan Financials in 2005.

Mr. Ghosh has an experience of 30 years as a banker and has also served in

South Asia and the Middle East. He started his career with Citibank in 1975

and later worked with Standard Chartered Bank, HDFC Bank and Bank

Muscat. He holds a Master of Business Administration degree from the

Wharton School of Business at the University of Pennsylvania. He was the past

President of Microfinance Institutions Network and the chairman of Association

of Karnataka Microfinance Institutions Network and the chairman of

Association of Karnataka Microfinance Institutions (AKMI). He has been the

driving force behind the growth of the company.

Ms Sudha Suresh is the CFO of the company. She is a Chartered Accountant

with a corporate career spanning over 18 years. She is also a qualified Cost

Accountant. At Ujiivan, she is responsible for areas of strategic business

planning and budgetary controls, treasury management, accounts and

taxation, and management of board and regulatory compliance.

April 27, 2016

2

Ujjivan Financial Services | IPO Note

Issue details

The company is raising `358cr through fresh issue of equity shares in the price

band of `207-210. The fresh issue will constitute 19.8% of the pre-issue and

16.5% post-issuance paid-up equity share capital of the company assuming the

issue is subscribed at the upper end of the price band. Along with the fresh issue of

equity shares, there is also an Offer for Sale (OFS) of 2.5cr equity shares from the

existing shareholders.

Exhibit 2: Offer Details

Offer Details

No. of equity shares ( In cr)

Amount (in crs.)

Fresh Issue

1.7

358

Offer for Sale

2.5

525

Total Offering

4.2

883

Source: Company, Angel Research

The top 10 shareholders of the company are as follows:

Exhibit 3: Top10 Shareholders - Pre Issue

Name of the Shareholder

Shareholding %

CDC Group Plc

10.8

Alena Private Ltd

10.7

IFC

10.1

New Quest Asia Investments Ltd

8.1

Elevar Equity Maurituius

6.3

Sarva Capital LLC

5.8

Women’s World Banking Capital Partners

5.3

Bajaj Holdings & Investment Ltd

5.1

Sequoia Capital Investments III

4.2

India Financial Inclusion Fund

3.5

Total

69.8

Source: Company, Angel Research

Objects of the offer

Ujjivan have received the in-principle approval for operating as a SFB. Post

conversion to a SFB, the new bank will need additional capital and hence the

Management intends to use the entire proceeds from the fresh issue of equity

to shore up its capital base.

As per RBI norms, foreign ownership in banks can’t be more than 49%. In

order to reduce its existing foreign ownership, which is at 77.1%, the company

needs its existing foreign shareholders to sell their stake. Post the issue, the

foreign share holding in the company will come down to 40.2%.

April 27, 2016

3

Ujjivan Financial Services | IPO Note

Investment rationale

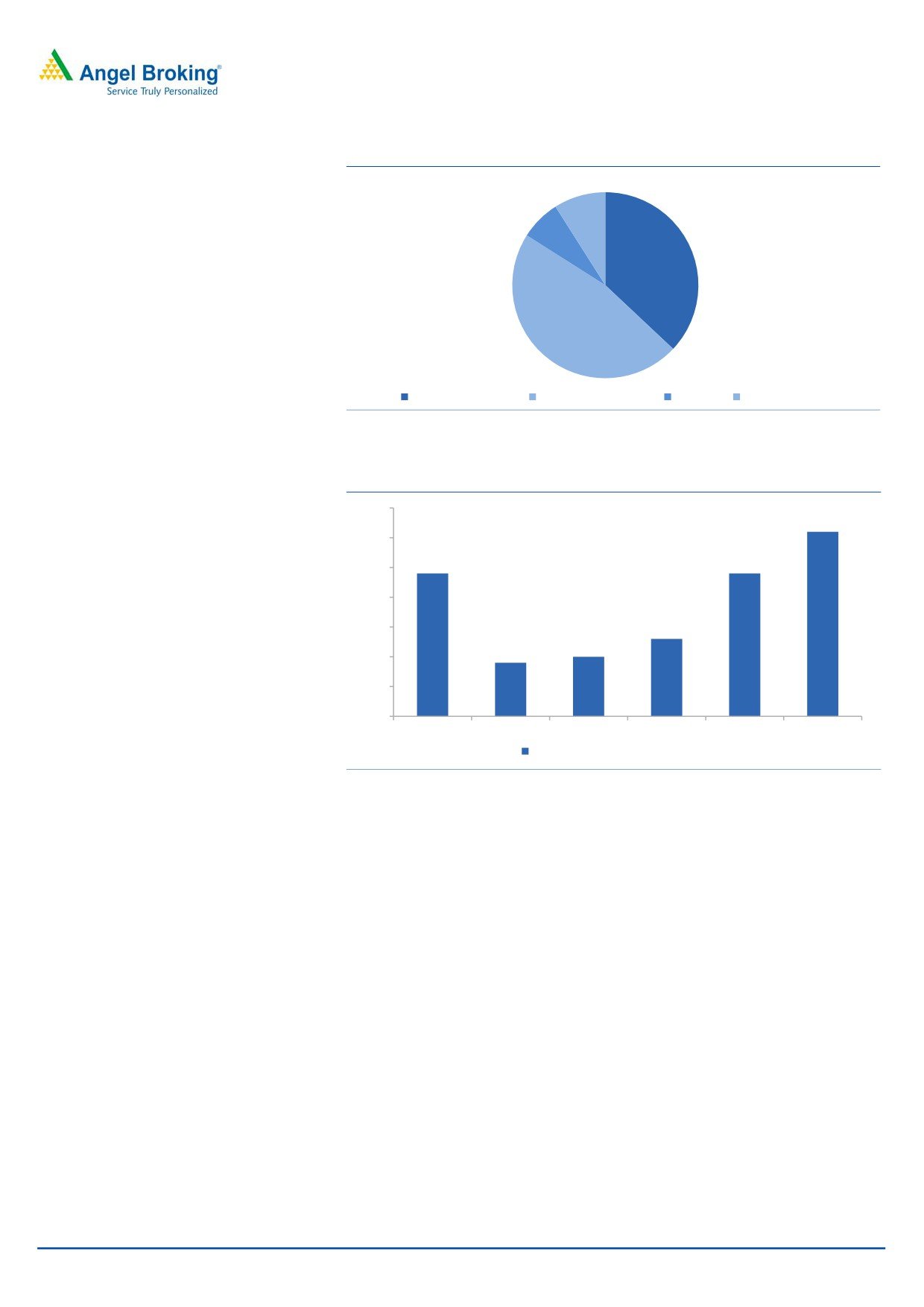

Micro finance business has huge scalability: Ujjivan’s AUM has reported a CAGR

of

59% over FY2013-9MFY2016 to

`4,589cr. There is a huge untapped

opportunity in this segment as micro finance is targeted to the lower income

segment which often lacks access to formal financing sources. Ideally the ticket size

of the loans ranges from `2,000-`35,000 (in the group lending scheme) and

more than 90% of the borrowers are female, who access loans via group

borrowings (Self Help Group) for very small businesses. Sharing the group liability

has resulted in maintaining credit discipline and hence the delinquency in this type

of business has been very low despite it being an unsecured form of loan. EMIs are

collected on 14 days or 28 days basis, which reduces the risk of any bad loans.

With a loan portfolio of ~`43,300cr the micro finance industry is expected to

report 30% CAGR over the next 3-4 years and Ujjivan with its pan-India presence

will be able to encash on the opportunity. Given the government’s focus on

financial inclusion together with better clarity on regulatory aspects, the micro

finance industry can look forward to healthy growth going ahead.

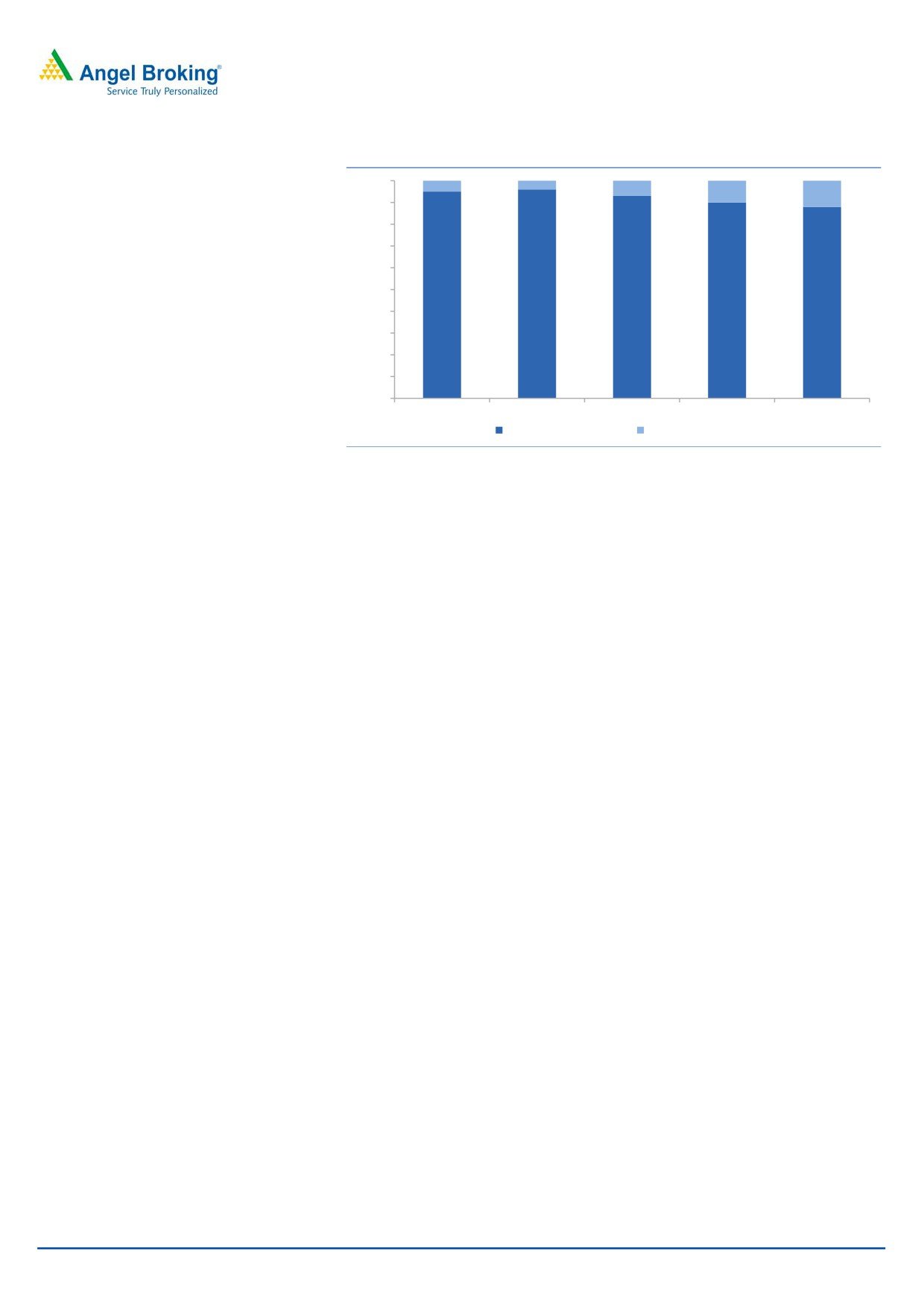

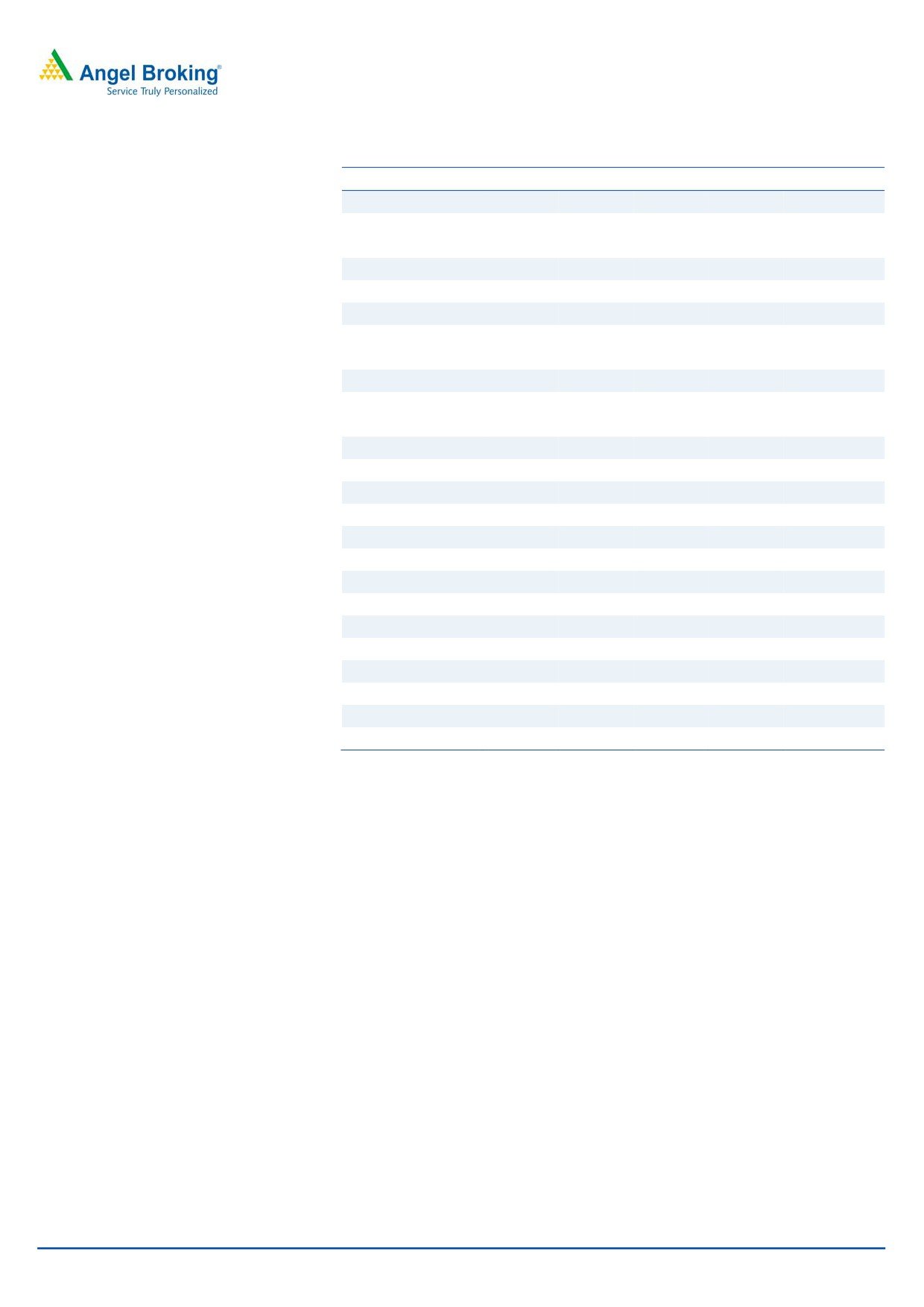

Exhibit 4: 59% AUM CAGR over the last 3 years

5,000

4,589

4,500

4,000

3,500

3,274

3,000

2,500

2,000

1,617

1,500

1,126

1,000

625

703

500

0

FY11

FY12

FY13

FY14

FY15

9MFY16

Assets Under Management (AUM) (`mn)

Source: Company DHRP, Angel Research

Diversified product offerings has helped in growing customer base: The company

has various types of loan products like small and micro business loans, education

loans, house renovation loans as well as emergency loans. Backed by a strong

network and customer satisfaction it has been able to achieve very high repeat

customer ratio and repeat group loans account for ~47% of the loan book, while

new group loans accounted for 37% of the loan book. Ujjivan also has a product

called loyalty loans which is extended to existing customers who have satisfactorily

repaid on time. The company’s customer friendly approach has resulted in 45%

CAGR in number of loan accounts, ie from 1mn in FY2013 to 3.1mn by

9MFY2016.

April 27, 2016

4

Ujjivan Financial Services | IPO Note

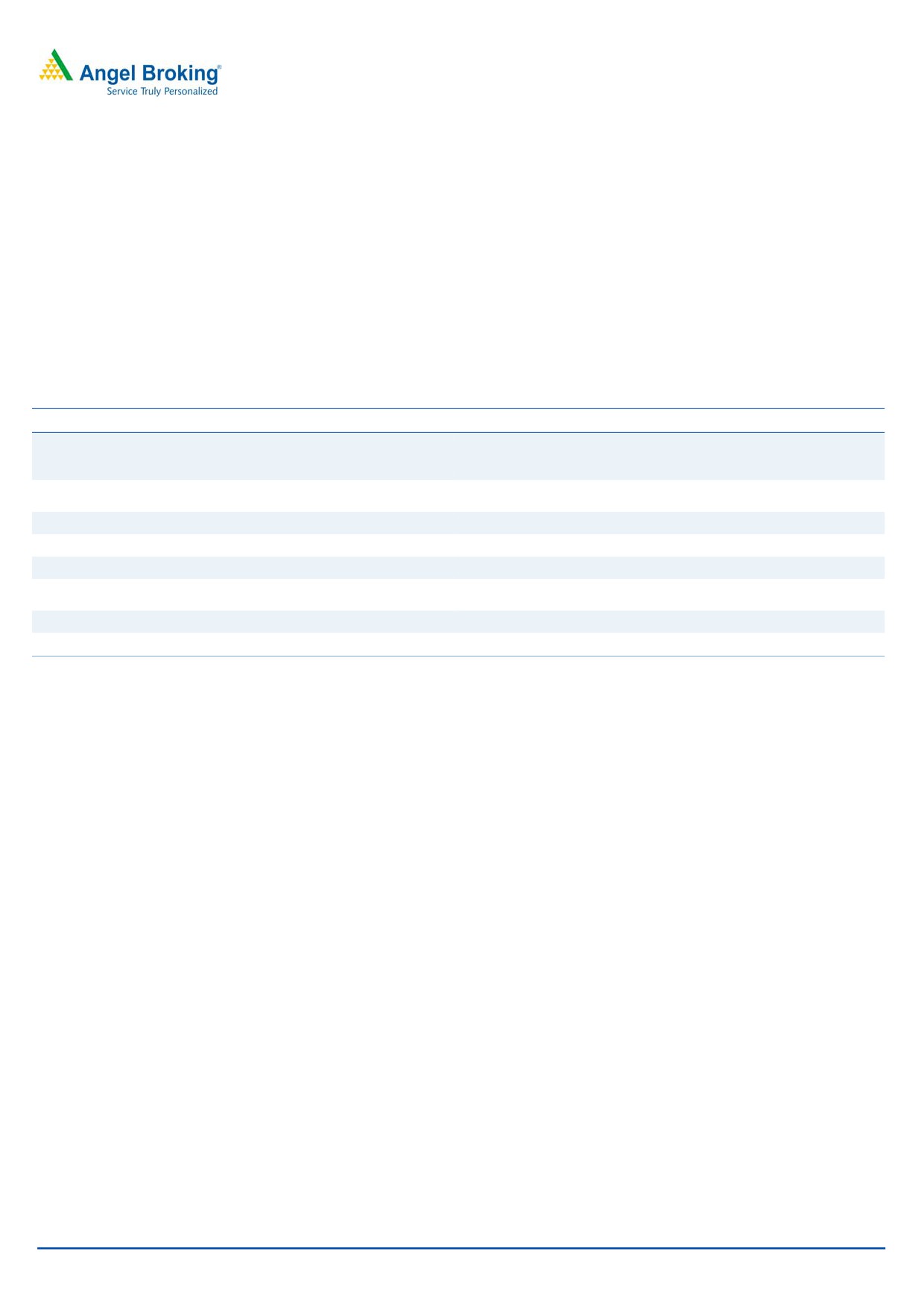

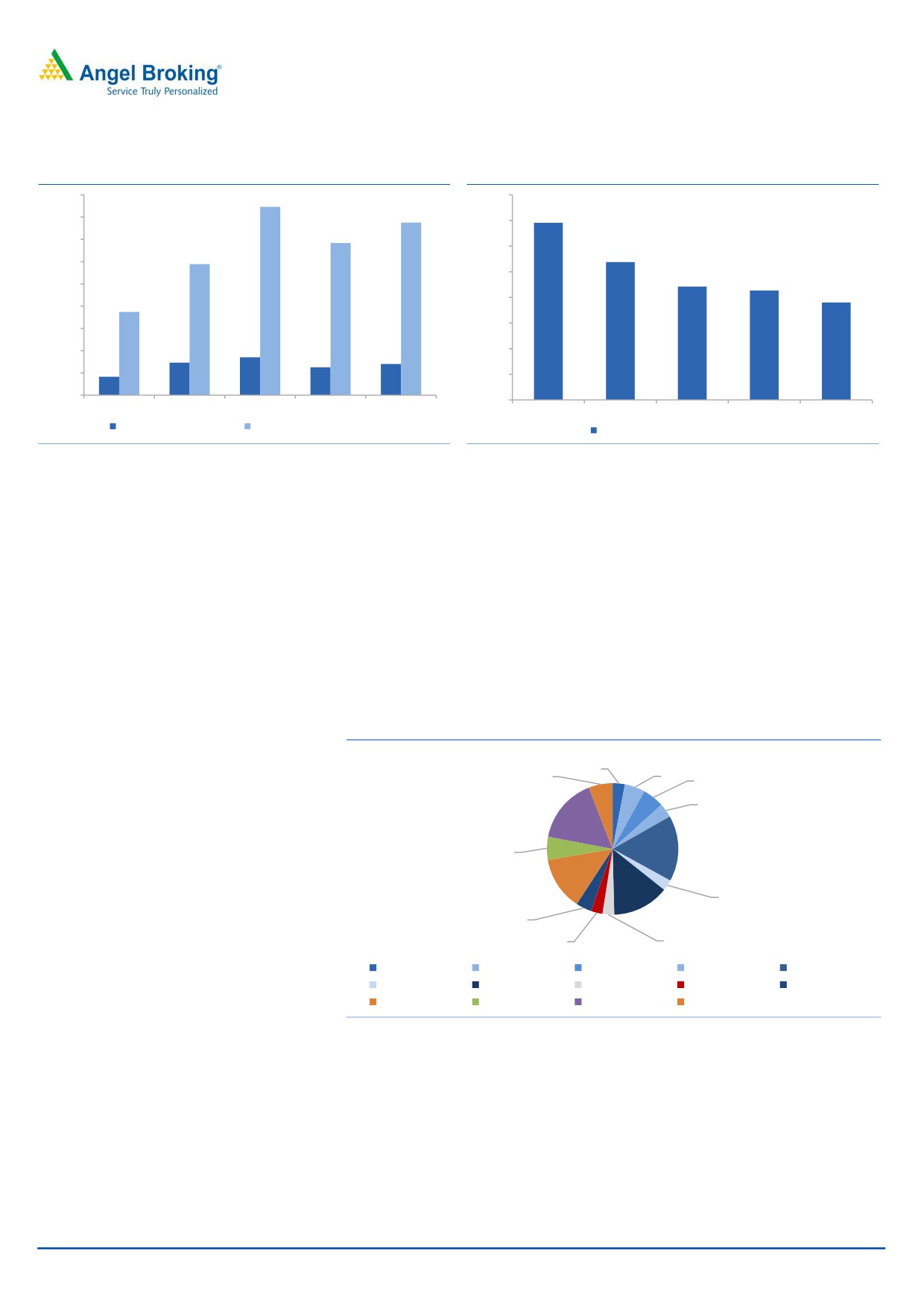

Exhibit 5: Diversified loan offerings

9%

7%

37%

47%

New Group Loans

Repeat Group Loan

Loyality

Individual Loans

Source: Company, Angel Research

Exhibit 6: Growing Customer Base

3.5

3.1

3.0

2.4

2.4

2.5

2.0

1.3

1.5

1.0

0.9

1.0

0.5

0.0

FY11

FY12

FY13

FY14

FY15

9MFY16

Number of loan accounts (in mn)

Source: Company DHRP, Angel Research

Advances out of group lending scheme should result in new

scope of growth

Though the company largely lends in joint lending system, it also offers individual

loans which account for ~10% of the overall AUM. Individual loans could see

strong growth going ahead. Post conversion to a SFB and in order to scale up its

balance sheet the company will have to grow its individual loan portfolio.

April 27, 2016

5

Ujjivan Financial Services | IPO Note

Exhibit 7: Portfolio Distribution

100%

5%

4%

7%

10%

12%

90%

80%

70%

60%

50%

95%

96%

93%

90%

88%

40%

30%

20%

10%

0%

FY 12

FY 13

FY 14

FY 15

9M16

Group lending AUM

Individual lending AUM

Source: Company, Angel Research

Expect smooth transition to a SFB: Ujjivan is amongst the ten players to have

received a SFB license from the RBI. Migrating to become a SFB from being a

NBFC has its own pros and cons. On the positive side the proposed SFB will have

access to low cost funds via deposits and even borrowing costs could reduce

further via NCDs and CP/CDs. It can also start other retail loans at par with other

banks. While on the flip side there will be initial expenses associated with being a

bank as new processes will have to be implemented. Further, the SFB will have to

comply with CRR and SLR requirements. Meeting 75% Priority Sector Lending (PSL)

target will not be a challenge for the company as its entire portfolio qualifies for

PSL and hence the migration from NBFC to SFB should be smooth. These will

impact the overall NIM and ROA during the initial 2-3 years. Having said that, we

believe with an experienced Management the migration from NBFC to SFB would

be smooth.

Enjoys strong return ratios and is backed by reducing cost structure: In the last few

years Ujjivan has been able to improve its leverage from 4x in FY2013 to 5.5x in

9MFY2016. This has resulted in ROE improving from 11.8% to 19.9% during the

same period. With a new capital base the company will have further scope for

leveraging and hence we believe its ROE will remain strong. However, during the

process of migration to the SFB the company might see its cost structure escalating

which will temporarily pressurize the ROE.

April 27, 2016

6

Ujjivan Financial Services | IPO Note

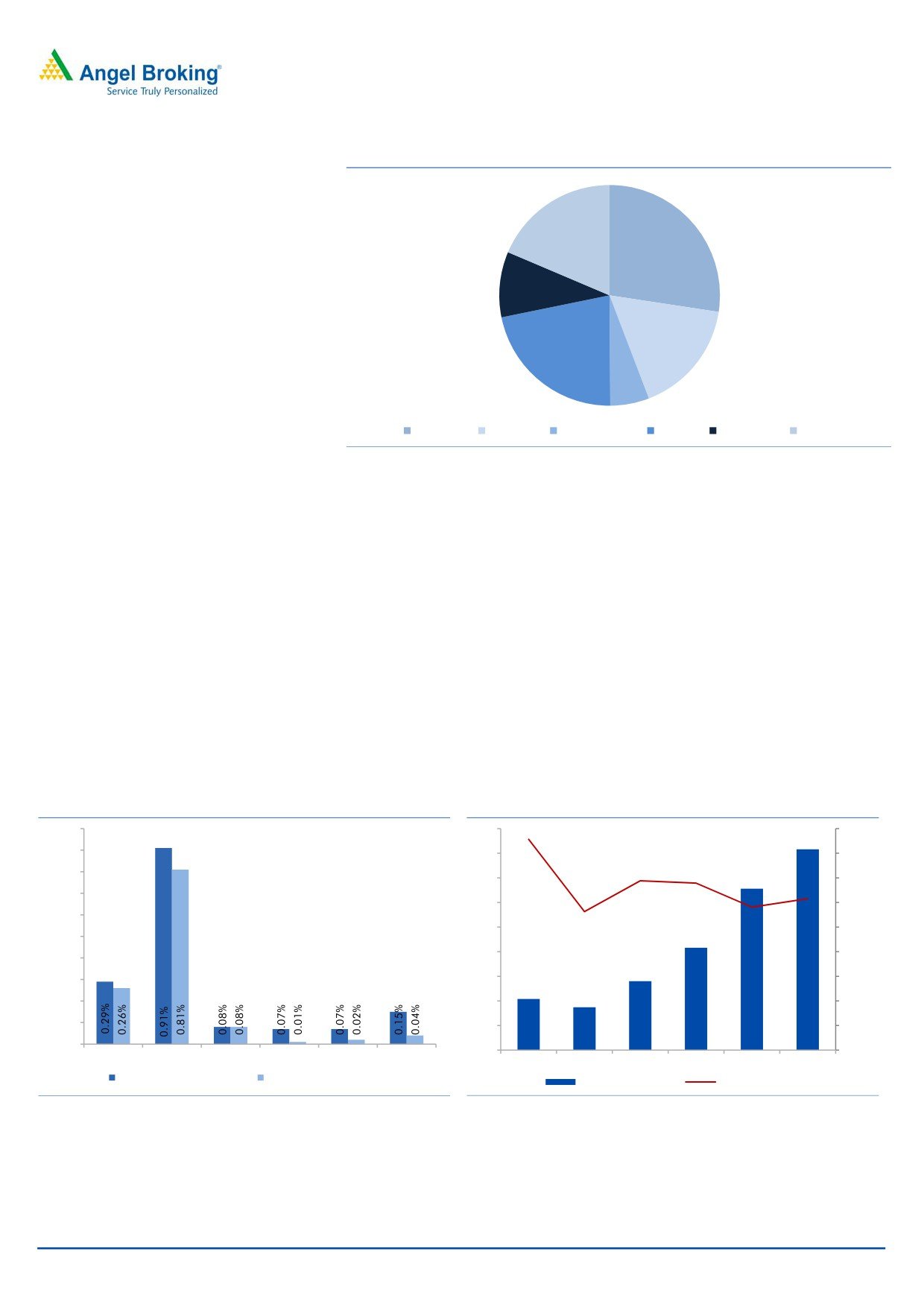

Exhibit 8: Return ratios decent; lower leverage allows

Exhibit 9: Operating expense/Average AUM

scope for RoA & RoE expansion

18.0%

16.9%

16.0%

15.5%

13.8%

16.0%

14.0%

13.7%

14.0%

12.0%

10.8%

12.0%

11.8%

10.0%

8.8%

8.5%

10.0%

7.6%

7.5%

8.0%

8.0%

6.0%

6.0%

3.4%

4.0%

4.0%

2.9%

2.5%

2.8%

1.7%

2.0%

2.0%

0.0%

0.0%

FY12

FY13

FY14

FY15

9MFY16

FY12

FY13

FY14

FY15

9MFY16

Return on average assets Return on average net worth

Operating expense/ Average AUM

Source: Company, Angel Research

Source: Company, Angel Research

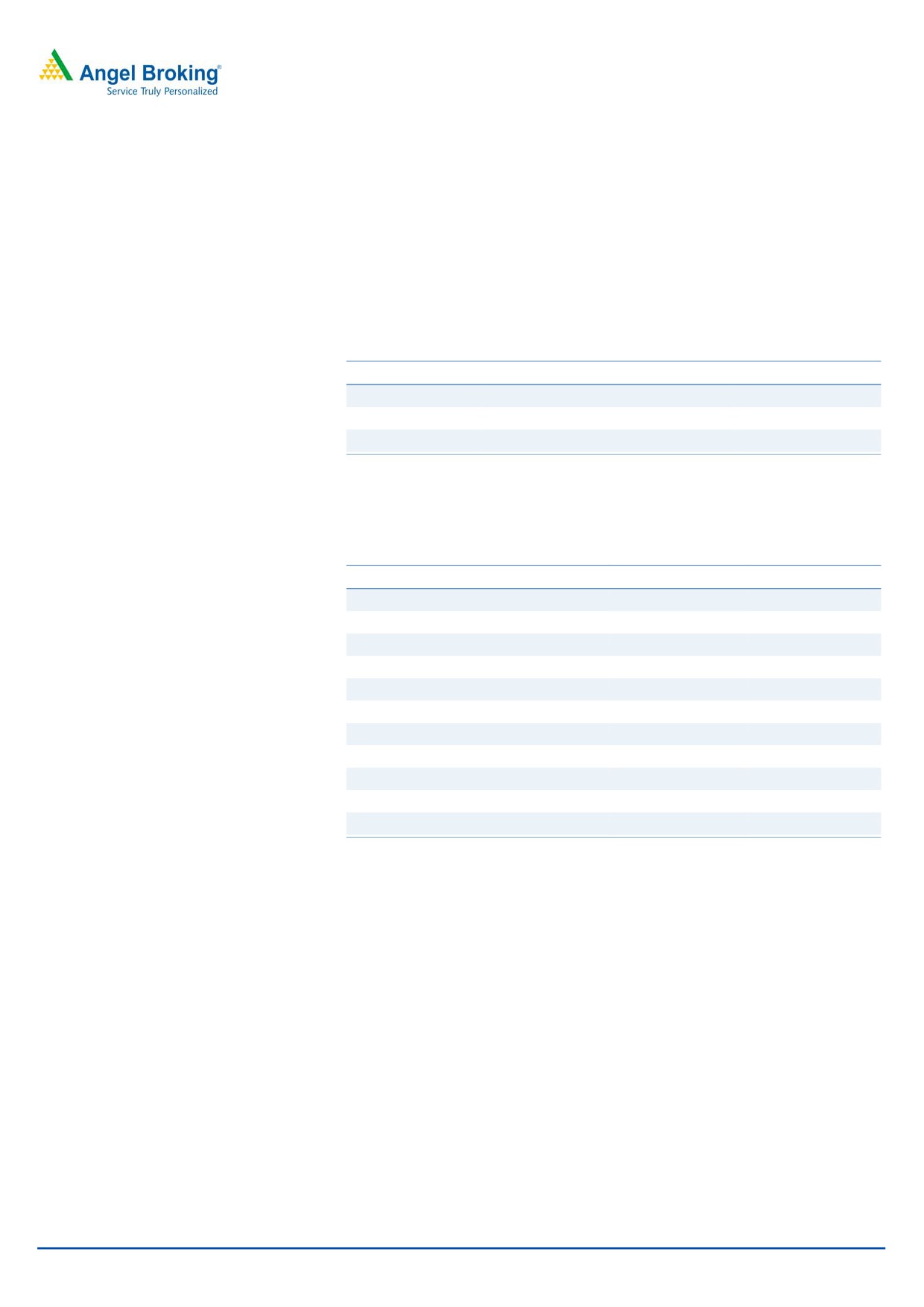

Geographically diversified AUM

Ujjivan is present across 24 states and has successfully diversified its AUM with no

single state contributing >20% to the overall AUM. This mitigates the concentration

risk. Karnataka, West Bengal, Maharashtra and Tamil Nadu account for 56% of

the AUM; this makes a key differentiating point for Ujjivan as other micro finance

institutions are largely focused on the southern states of the country. Once the

company converts itself into a SFB, its diversified presence will come in as a great

help in scaling up the balance sheet as it already has the operating knowledge

and brand name in respective geographies.

Exhibit 10: State-wise distribution of AUM

3.0%

5.9%

5.0%

5.3%

3.5%

16.1%

5.7%

16.2%

13.1%

13.9%

2.7%

3.9%

2.8%

2.9%

Assam

Gujarat

Haryana

Jharkhand

Karnataka

Kerala

Maharashtra

Orissa

Punjab

Rajasthan

Tamil Nadu

Uttar Pradesh

West Bengal

Others

Source: Company, Angel Research

April 27, 2016

7

Ujjivan Financial Services | IPO Note

Exhibit 11: Geographical distribution of branches

18.6%

27.4%

9.6%

16.8%

21.9%

5.7%

South

North

North East

East

Central

West

Source: Company, Angel Research

Ujjivan has maintained impressive NIM and Asset Quality

The company has managed its NPA level quite strong despite aggressive growth in

the last 3-4 years. Micro finance is an unsecured form of loan, but still the

company has achieved an excellent track record of maintaining Gross NPA below

0.15% which is a commendable job. The same is also much lower than its nearest

peer and newly listed micro finance company - Equitas Holdings Ltd (Equitas).

However, unlike Equitas, Ujjivan’s presence so far is largely concentrated in the

micro finance business and once the company gets into other segments of lending

the asset quality could come under pressure initially. This will be a key area of

observation going ahead. The company’s NIM has been on a declining trend over

the past few years and we expect the same to decline further over the next few

quarters before it stabilizes.

Exhibit 12: Reducing Gross & Net NPA (%)

Exhibit 13: Healthy NII growth & NIM

1.00%

450

17.1%

18.0%

408

0.90%

400

16.0%

13.8%

0.80%

13.6%

350

328

14.0%

0.70%

12.3%

300

12.0%

11.6%

0.60%

11.3%

250

10.0%

0.50%

208

200

8.0%

0.40%

140

0.30%

150

6.0%

104

87

0.20%

100

4.0%

0.10%

50

2.0%

0.00%

0

0.0%

FY11

FY12

FY13

FY14

FY15

9MFY16

FY11

FY12

FY13

FY14

FY15

9MFY16

Gross NPA / On-Book AUM Net NPA / On-Book AUM

Net interest income

Net interest margin

Source: Company, Angel Research

Source: Company, Angel Research

April 27, 2016

8

Ujjivan Financial Services | IPO Note

Overview of Micro finance industry:

The micro finance industry witnessed rapid growth after 2001, after the RBI

granted priority sector status to bank loans advanced to micro finance companies.

However, the micro finance industry had a problem of high cost of funds; in order

to tackle the problem the Union Budget 2016 announced setting up MUDRA Bank

to refinance the micro finance sector. As a result micro finance companies have

better access to funds at lower costs and can now scale up. Though there are ~60

micro finance companies in India, nearly 70% of the gross loan portfolio is

accounted by the top 10 players.

Exhibit 14: Top10 Micro Finance Companies in India

Top MFIs, gross loan portfolio (Rs. cr)

Q3FY16

Market Share (%)

Janalakshmi

8,096

19.1

SKS

6,177

14.5

Ujjivan

4,088

9.6

Satin

2,538

6.0

Equitas

2,320

5.5

Grameen Koota

1811

4.3

L & T Finance

1700

4.0

ESAF

1495

3.5

Spandana

1221

2.9

Grama Vidiyal

1147

2.7

Total of Top 10

30,593

72.0

Source: MFIN

Exhibit 15: State-wise distribution of gross loan portfolio of the industry

State-wise distribution of gross loan portfolio

Q3FY16

Tamil Nadu

16.1%

Karnataka

13.8%

Maharashtra

11.9%

Uttar Pradesh

10.9%

Madhya Pradesh

7.8%

Odisha

6.1%

West Bengal

5.8%

Bihar

5.4%

Kerela

4.4%

Gujarat

3.7%

Others

14.1%

Total

100.0%

Source: MFIN

April 27, 2016

9

Ujjivan Financial Services | IPO Note

Valuation

At the upper end of the offer price band (`210), the issue is priced at 1.8x its

diluted BV of `118 (2.1x pre-dilution). The company has decent ROE and ROA of

19.9% and

3.6%, respectively. Although the return ratios might get a bit

compressed post the company’s conversion to a SFB, but we expect the same to

scale up subsequently. We believe the issue is attractively priced looking at the

growth options the company offers in the long run. We recommend a SUBSCRIBE

on the issue.

Comparative table

Within the listed space, we believe SKS Microfinance is the best comparable

company. Recently another micro finance company and expected SFB, Equitas

Holdings, came out with an IPO. We believe Equitas would be the best

comparable company for Ujjivan while on other parameters we have tried to make

a comparison with other listed NBFCs as well.

Exhibit 16: Comparative - Micro Finance

Micro-Finance

Equitas

SKS

Janlakshmi

Ujjivan

Satin

Gross Loan Portfolio (crs)

2,935

6,177

8,096

4,088

2,538

Avg loan o/s per client

9,634

14,857

21,146

15,739

15,873

Branches

377

1,167

338

469

364

Employees

4,255

11,086

7,978

7,786

3,419

Clients (lakhs)

24.1

41.6

38.3

26.0

16.0

Source: MFIN

Exhibit 17: Comparative - Micro Finance

Ujjivan

Equitas

SKS Micro Fin

NIM (%)

12.3

11.1

5.6

ROA (%)

3.6

2.9

4.5

ROE (%)

19.9

19.1

25.0

CAR (%)

19.6

21.0

23.9

GNPAs (%)

0.2

0.2

0.1

NNPAs (%)

0.0

0.1

0.1

P/BV (x)

2.1

2.3

4.2

Leverage (%)

5.5

4.0

4.5

Source: Company, Angel Research

April 27, 2016

10

Ujjivan Financial Services | IPO Note

Risks

No prior experience of secured lending: Ujiivan is largely present in the micro

finance business only and doesn’t have any prior experience in large scale secured

lending. Post conversion to SFB, Ujjivan will have to lend secured loans as well with

higher average ticket size and this could a testing time. Though secured loans are

considered to be safer, higher ticket sizes need close monitoring of the accounts

and hence the company will have to set up proper systems for the same.

Ability to scale up its operations fast: The company is raising `358cr through fresh

issuance of shares, amounting to 56% of the existing net worth. Inability to scale

up its operations will result in ROE dilution in the near term.

Ability to meet deposit targets post SFB conversion: Post conversion to a SFB,

Ujjivan will be allowed to raise deposits from customers. Ability to raise deposits

from its existing client base will be limited looking at the average income profile of

the said borrowers. It might have to offer higher rates vis-a-vis other banks which

might have a negative impact on the NIM.

April 27, 2016

11

Ujjivan Financial Services | IPO Note

Income statement

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

9MFY2016

NII

87.3

140.4

208.0

327.9

407.6

- YoY Growth (%)

60.8%

48.1%

57.6%

24.3%

Other Income

8.1

11.4

9.8

12.6

16.4

- YoY Growth (%)

41.6%

-14.3%

28.6%

30.8%

Operating Income

95.4

151.9

217.8

340.5

424.1

- YoY Growth (%)

59.2%

43.4%

56.3%

24.5%

Operating Expenses

89.8

97.2

120.7

204.9

219.4

- YoY Growth (%)

8.3%

24.1%

69.8%

7.0%

Pre - Provision Profit

5.6

54.6

97.1

135.6

204.7

- YoY Growth (%)

872.8%

77.9%

39.6%

51.0%

Prov. & Cont.

5.8

6.9

8.3

21.0

17.0

- YoY Growth (%)

!

19.8%

20.1%

153.8%

-19.1%

Profit Before Tax

-0.1

47.7

88.8

114.5

187.7

- YoY Growth (%)

86.3%

28.9%

63.9%

Prov. for Taxation

-0.3

14.8

30.4

38.7

65.4

- as a % of PBT

31.1%

34.2%

33.8%

34.8%

PAT

0.1

32.9

58.4

75.8

122.3

- YoY Growth (%)

77.7%

29.7%

61.4%

Balance sheet

Y/E March (` cr)

FY2012 FY2013 FY2014 FY2015

9MFY2016

Share Capital

57.3

65.6

65.6

86.1

86.1

Reserve & Surplus

183.0

252.4

306.9

650.3

813.4

Loan Funds

639.2

1,018.5

1,675.4

3,179.6

3,814.6

- Growth (%)

9.7%

59.3%

64.5%

89.8%

20.0%

Other Liab.& Prov.

16.0

20.0

31.0

60.0

39.0

Total Liabilities

895.5

1,356.5

2,078.9

3,976.0

4,753.2

Cash and Cash Equivalents

161

179

394

645

56

Investments

3

3

5

7

14

Advances

700

1,136

1,626

3,229

4,588

- Growth (%)

10.1%

62.4%

43.1%

98.6%

42.1%

Fixed Assets

11

11

13

18

22

Other Assets

182

206

435

723

129

Total Assets

895.5

1,356.5

2,078.9

3,976.0

4,753.2

April 27, 2016

12

Ujjivan Financial Services | IPO Note

Ratio analysis

Y/E March

FY2012

FY2013

FY2014

FY2015

9MFY2016

Profitability ratios (%)

NIMs

11.26%

13.76%

13.57%

11.62%

12.31%

RoA

0.0

2.9

3.4

2.5

3.6

RoE

0.1

11.8

16.9

13.7

19.9

Asset Quality (%)

Gross NPAs

0.91%

0.08%

0.07%

0.07%

0.15%

Net NPAs

0.81%

0.08%

0.01%

0.02%

0.04%

Per Share Data (`)

EPS

0.0

5.0

8.9

8.8

14.2

BVPS

42.0

48.5

56.8

85.5

99.7

Valuation Ratios

PER (x)

41.9

23.6

23.9

14.8

P/ABVPS (x)

5.0

4.3

3.7

2.5

2.1

DuPont Analysis

NII

10.9

12.5

12.1

10.8

12.0

(-) Prov. Exp.

0.7

0.6

0.5

0.7

0.5

Adj. NII

10.2

11.9

11.6

10.1

11.5

Other Inc.

1.0

1.0

0.6

0.4

0.5

Op. Inc.

11.2

12.9

12.2

10.6

12.0

Opex

11.2

8.6

7.0

6.8

6.4

PBT

0.0

4.2

5.2

3.8

5.5

Taxes

(0.0)

1.3

1.8

1.3

1.9

RoA

0.0

2.9

3.4

2.5

3.6

Leverage

4.5

4.0

5.0

5.5

5.6

RoE

0.1

11.8

16.9

13.7

19.9

April 27, 2016

13

Ujjivan Financial Services | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

April 27, 2016

14