Please refer to important disclosures at the end of this report

1

Anand rathi Wealth Ltd. (ARWL) is one of the leading non-bank wealth solutions

firms in India and have been ranked amongst one of the three largest non-bank

mutual fund distributors in India by gross commission earned in Fiscal 2019, 2020

and 2021. The company was incorporated on March 22, 1995 & today serve a

wide spectrum of clients through a mix of wealth solutions, financial product

distribution and technology solutions. The company acts as a mutual fund

distributor, (registered with the Association of Mutual Funds in India) and also

purchases non-convertible market linked debentures (“MLDs”) and offers them to

its clients and earn income from sales.

Positives: (a) Focus on the underserved HNI segment of great market potential. (b)

Standardized solutions offered to clients based on an objective-driven approach. (c)

One of the top three leading mutual fund distributors in India. (d) Focus on value-

added services.

Investment concerns: (a) Reduce distribution commission income through regulatory

change. (b) Non-compliance with regulatory guidelines. (c) Any kind of reputational

loss. (d) Continuing impact of the COVID-19.

Outlook & Valuation: ARWL had reported de-growth in revenue by 20.0% YoY in

FY2021 due to the Covid 19 pandemic while net profits contracted by 26.8% YoY.

However asset under management witnessed strong growth of 45.5% YoY to

`26,669 crore led by the private wealth vertical. Moreover AUM has further

registered a growth of 13.3% to `30,209 crore as of 31st Aug’21. AUM growth has

been driven by high yielding equity and MLD assets which have led to strong

performance by the company in the first five months of FY2022. For the first five

months of FY2022 ARWL has reported revenues of `166.9 crore while net profits at

`51.1 crore has already surpassed FY2021 PAT of `45.1 crore. At the higher end

of the price band ARWL will be trading at P/E multiple of 18.7x its annualized EPS

for 5MFY2022 which we believe is reasonable given higher proportion of equity

and MLD assets. Given reasonable valuations and strong growth prospects due to

buoyant capital market, we would recommend SUBSCRIBE to the IPO.

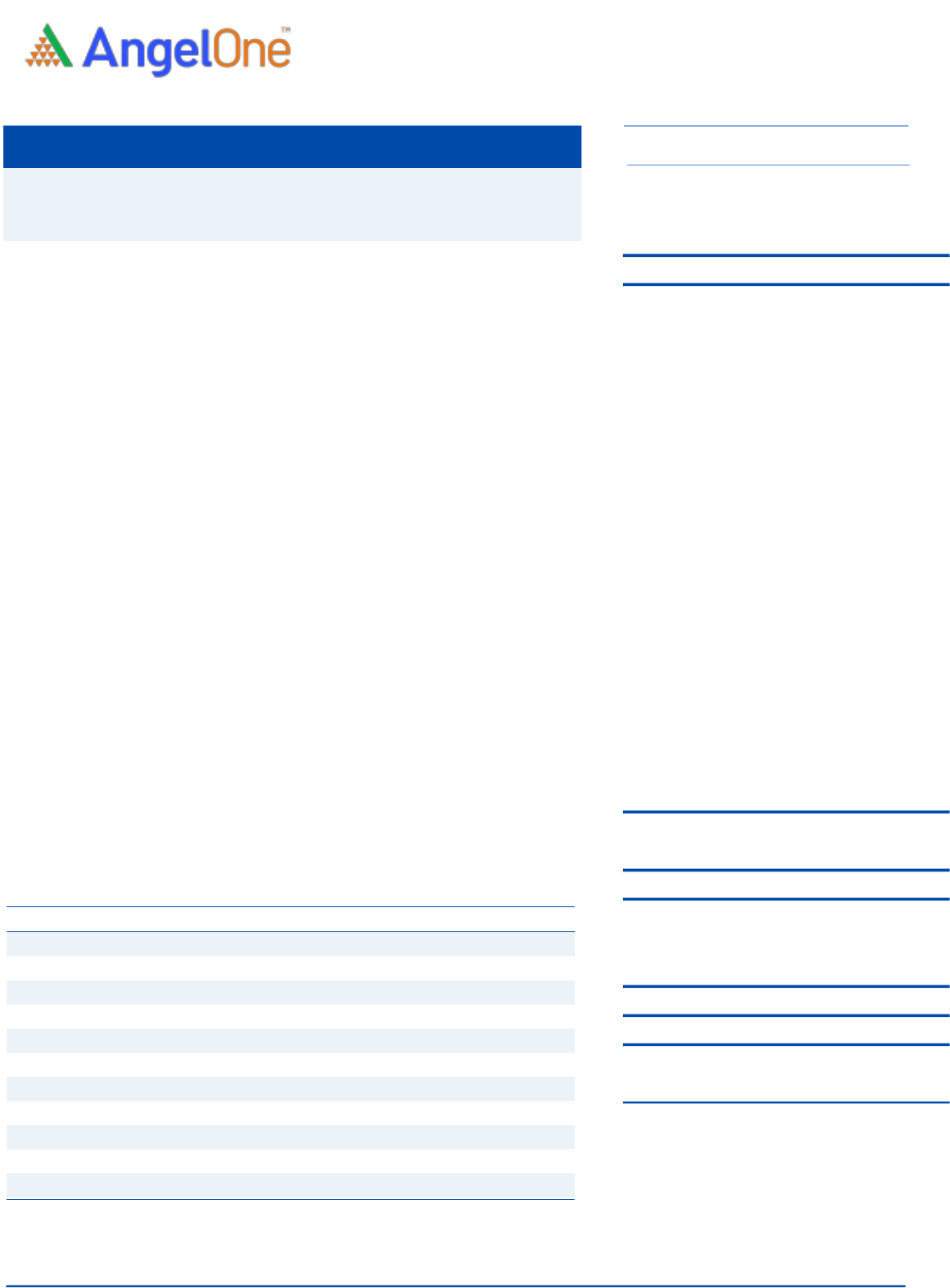

Key Financials

Y/E March (` cr)

FY2019

FY2020

FY2021

5MFY22

Net Sales

276.6

331.8

265.3

166.9

% chg

-

20.0

-20.0

-

Net Profit

58.2

60.5

45.4

51.2

% chg

-

4.0

-25.0

-

EBITDA (%)

35.4

32.2

26.3

44.2

EPS (Rs)

14.0

14.8

10.8

-

P/E (x)

39.2

37.1

50.8

-

P/BV (x)

18.5

12.3

9.5

-

ROE (%)

42.8

31.3

17.8

-

ROCE (%)

50.7

33.3

17.9

-

EV/Sales

8.2

7.1

8.5

-

Source: Company, Angel Research; Note: Valuation ratios at upper price band; *Consolidated

SUBSCRIBE

Issue Open: Dec 02, 2021

Issue Close: Dec 06, 2021

Offer for Sale: `660 cr

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 48.8%

Others 51.2%

Fresh issue: --

Issue Details

Face Value: `5

Present Eq. Paid up Capital: `20.8 cr

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: `20.8cr

Issue size (amount): `660 cr

Price Band: `530-550

Lot Size: 27 shares and in multiple thereafter

Post-issue mkt. cap: * `2,206 cr - ** `2,289 cr

Promoters holding Pre-Issue: 74.7%

Promoters holding Post-Issue: 48.8%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Anand Rathi Wealth Limited

Anand Rathi Wealth Limited | IPO Note

December 01, 2021

Anand Rathi Wealth Limited | IPO Note

Dec 01, 2021

2

Company background

Anand Rathi Wealth Limited (“ARWL”) is a mumbai-based company incorporated

on March 22, 1995. It commenced activities in Fiscal 2002 as an AMFI registered

mutual fund distributor and have evolved into providing, well researched solutions

to its’ Clients by facilitating investments in financial instruments through an

objective driven process.

As of August 31, 2021, PW (Private Wealth) vertical caters to 6,564 active client

families, serviced by a team of 233 RMs. Company is currently present across 11

cities in India, namely, Mumbai, Bengaluru, Delhi, Gurugram, Hyderabad,

Kolkata, Chennai, Pune, Chandigarh, Jodhpur and Noida and have a

representative office in Dubai. The company’s Promoters are Anand Rathi, Pradeep

Gupta and Anand Rathi Financial Services Limited.

Issue details

The IPO is made up of offer for sale of `660 Cr by promoter & investor

shareholders.

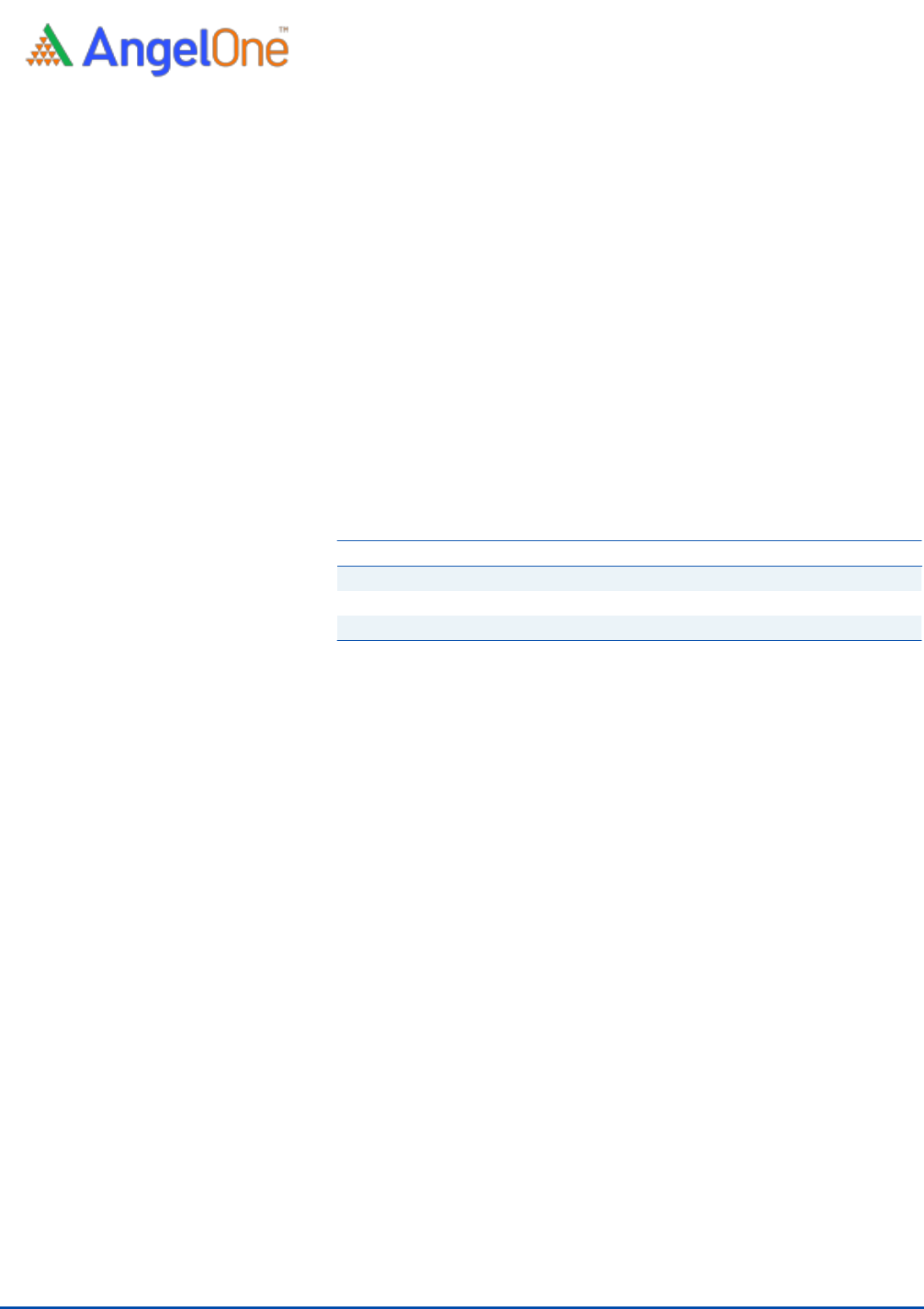

Pre and post IPO shareholding pattern

No of shares

(Pre-issue)

%

(Post-issue)

%

Promoter

31,102,025

74.7

20,317,042

48.8

Public

10,514,202

25.3

21,299,185

51.2

Total

41,616,227

100.0

41,616,227

100.0

Source: Company, Angel Research & RHP.

Objectives of the Offer

To achieve the benefits of listing the Equity Shares on the Stock Exchanges.

Key Management Personnel

Anand Rathi is the Promoter, Chairman and Non-Executive Director of the

company. He has been associated with the company since March 18, 2005. Prior

to joining the company, he was with Aditya Birla Nuvo Ltd, with BSE (where he also

held the position of President) and was one of the first directors of CDSL.

Pradeep Gupta is the Non-Executive Director of the company. He has been with

the company since March 18, 2005. He has promoted Anand Rathi Share and

Stock Brokers Ltd (formerly known as Navratan Capital and Securities Pvt Ltd) and

thereafter he joined ARFSL (formerly known as Anand Rathi Securities Pvt Ltd) with

Anand Rathi in the year 1998. He has over 30 years of experience in capital

markets.

Amit Rathi is the Non-Executive Director of the company. He has been associated

with the company since March 18, 2005. He is associated with the private wealth

management and investment banking businesses of the Anand Rathi Group. He is

also a director on the board of their corporate Promoter, ARFSL (formerly known as

Anand Rathi Securities Pvt Ltd).

Ramesh Chandak is the Independent Director of the company. He has been

associated with the company since March 15, 2018. He was also the managing

director of KEC International Ltd.

Anand Rathi Wealth Limited | IPO Note

Dec 01, 2021

3

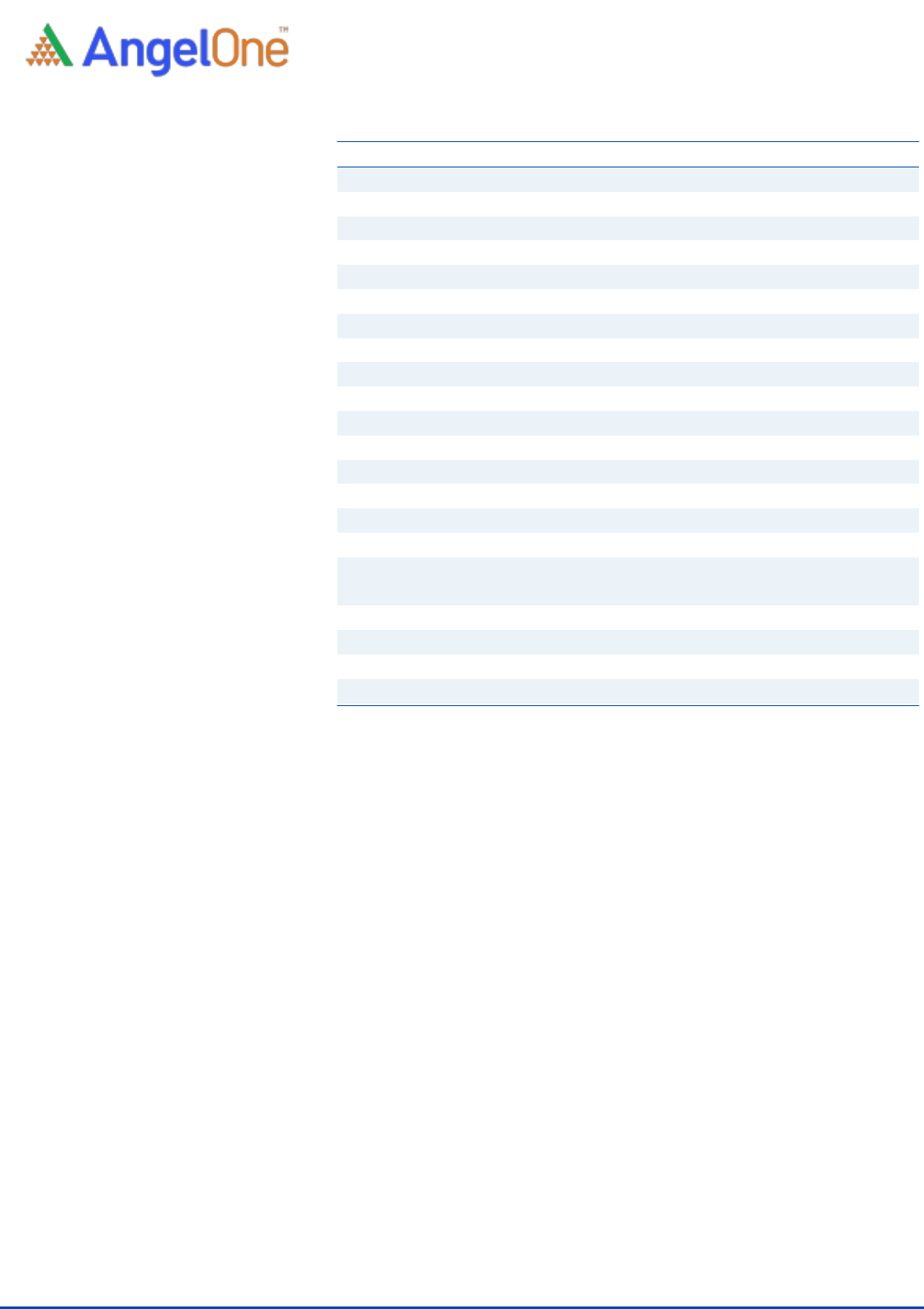

Exhibit 1: Profit & Loss Statement

Y/E March (` cr)

FY2019

FY2020

FY2021

5MFY22

Total operating income

276.6

331.8

265.3

166.9

% chg

-

20.0

-20.0

-

Total Expenditure

178.7

225.1

195.5

93.2

Employee Benefit Expenses

132.2

166.6

150.8

74.4

Other Expenses

46.5

58.5

44.7

18.8

EBITDA

97.9

106.7

69.9

73.7

% chg

-

9.0

-

5.5

(% of Net Sales)

35.4

32.2

26.3

44.2

Depreciation& Amortization

16.3

21.0

17.3

6.5

EBIT

81.6

85.7

52.6

67.2

% chg

-

-

-38.6

-

(% of Net Sales)

29.5

25.8

19.8

40.3

Finance costs

6.1

3.3

2.9

0.9

Other income

7.6

4.6

13.9

2.0

(% of Sales)

2.7

1.4

5.2

1.2

Recurring PBT

83.1

87.0

63.6

68.3

% chg

-

4.6

-26.9

7.5

Tax

24.7

25.3

18.5

17.3

PAT

58.4

61.6

45.1

51.1

% chg

-

5.4

-26.8

(% of Net Sales)

21.1

18.6

17.0

30.6

Basic & Fully Diluted EPS (Rs)

14.0

14.8

10.8

-

Source: Company, Angel Research

Anand Rathi Wealth Limited | IPO Note

Dec 01, 2021

4

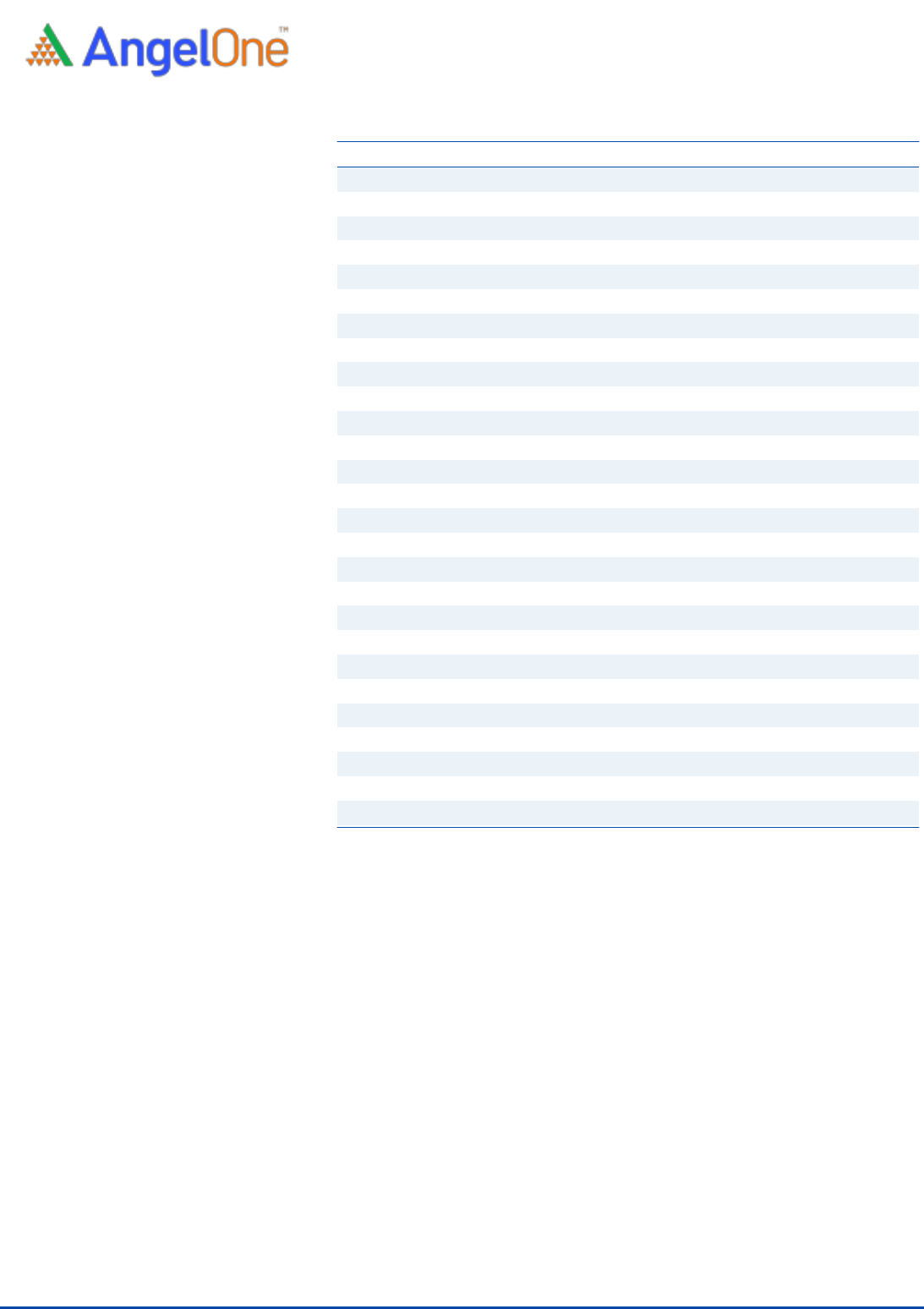

Exhibit 2: Consolidated Balance Sheet

Y/E March (` cr)

FY2019

FY2020

FY2021

5MFY22

SOURCES OF FUNDS

Equity Share Capital

13.5

13.5

13.8

20.8

Other equity (Retained Earning)

110.5

172.0

227.5

266.0

Non-Controlling interest

12.5

11.6

11.6

11.6

Shareholders’ Funds

136.5

197.1

252.9

298.4

Total Loans

0.6

41.7

33.4

31.2

Other liabilities

23.8

18.7

7.5

5.3

Total Liabilities

160.9

257.5

293.8

335.0

APPLICATION OF FUNDS

Property, Plant and Equipment

7.5

8.9

7.2

6.7

Right-of-use Asset

31.3

25.1

12.3

8.7

Capital work in progress

-

65.4

69.0

70.2

Goodwill

2.9

2.9

2.9

2.9

Other Intangible assets

7.9

37.3

32.2

30.1

Intangible assets under development

31.7

-

-

-

Current Assets

112.4

150.6

94.1

147.6

Investments

75.1

1.8

2.7

2.8

Trade Receivables

11.0

9.1

10.9

12.9

Cash and cash equivalents

11.4

28.3

65.3

57.3

Bank balances other than above

0.0

0.0

0.0

0.0

Loans

0.2

64.9

-

26.8

Other Financial Assets

12.2

33.3

13.7

46.4

Other Current Assets

2.4

13.2

1.5

1.4

Current Liability

70.0

151.6

45.6

67.3

Net Current Assets

42.4

-0.9

48.5

80.3

Other Non-Current Asset

37.2

118.8

121.7

136.2

Total Assets

160.9

257.5

293.8

335.0

Source: Company, Angel Research

Anand Rathi Wealth Limited | IPO Note

Dec 01, 2021

5

Exhibit 3: Consolidated Cash flows

Y/E March (`cr)

FY2019

FY2020

FY2021

5MFY22

Operating profit before changes

101.8

110.6

83.2

74.6

Net changes in working capital

0.1

49.7

-80.3

-10.7

Cash generated from operations

101.9

160.2

2.9

63.9

Direct taxes paid (net of refunds)

-34.8

-19.9

-23.9

-29.1

Net cash flow operating activities

67.1

140.3

-21.0

34.8

Sale/(Purchase) of Plant and Equipment

-3.9

-49.8

-1.3

-1.6

Dilution of NCI

-2.0

-

0.0

0.0

Acquisition of Intangible Assets

-0.2

-0.8

-

-

Intangible Assets

-8.2

-5.2

-

-

Dividend received

-

0.0

0.0

0.0

Interest Income

1.0

1.0

4.7

1.4

Others

-29.0

-96.8

71.3

-29.0

Cash Flow from Investing

-42.3

-151.7

74.8

-29.1

Loan Taken/(Repayment)

-0.1

41.1

-8.4

-2.1

Interest Paid

-3.3

-0.6

-1.0

-0.4

Issue of Shares

0.0

0.1

10.8

0.1

Dividend paid

-

-

-6.9

-6.9

Lease Payments

-10.5

-12.4

-11.2

-4.3

Cash Flow from Financing

-13.9

28.2

-16.7

-13.6

Inc./(Dec.) in Cash

10.8

16.8

37.1

-8.0

Opening Cash balances

0.57

11.41

28.25

65.32

Closing Cash balances

11.4

28.3

65.3

57.3

Source: Company, Angel Research

Key Ratios

Y/E March

FY2019

FY2020

FY2021

Valuation Ratio (x)

P/E (on FDEPS)

39.2

37.1

50.8

P/CEPS

30.6

27.7

36.7

P/BV

18.5

12.3

9.5

EV/Sales

8.2

7.1

8.5

Per Share Data (Rs)

EPS (Basic)

14.0

14.8

10.8

EPS (fully diluted)

14.0

14.8

10.8

Cash EPS

18.0

19.9

15.0

Book Value

29.8

44.6

58.0

Returns (%)

ROE

42.8

31.3

17.8

ROCE

50.7

33.3

17.9

Source: Company, Angel Research

Anand Rathi Wealth Limited | IPO Note

Dec 01, 2021

6

Research Team Tel: 022 - 40003600 E-mail: [email protected] Website: www.angelone.in

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.