Ami organics Limited | IPO Note

August 31, 2021

1

Ami Organics Limited

August 31, 2021

Ami organics was incorporated in 2004, Company is one of the leading Research

& Development driven company. Ami organics deal in different types of

Advanced Pharmaceutical Intermediates and Active Pharmaceutical Ingredients

(API) and materials for agrochemical and fine chemicals. Ami Organics has 3

manufacturing facilities situated in Gujarat with an aggregate installed capacity

of 6060 Mtpa.

Positives:

(a)

Ami Organics is having high market share in key APIs like

Dolutegravir, Nintedanib, and Trazodone. (b). Company has a diversified

business, company has developed and commercialized 450 pharma intermediates

for API across 17 Key therapeutic area. (c). Companies has recently completed an

acquisition of 2 additional manufacturing capacity from GOL. (d). More than half

of revenue comes from Export, Ami organics export to Italy, Finland, China and

other countries.

Investment concerns: (a) In some of the API company already having market

share of 70-90%, it reduces scope of increasing market share in near future. (b)

Some of the companies key product like – Nintedanib, got covid related

benefit in FY2021, which we don’t expect to continue in future. (c) Company has

recently acquire 2 new manufacturing units, both the facility having low EBITDA

margins and higher working capital requirement, this will create pressure on

companies financials.

Outlook & Valuation: Based on FY2021 numbers, the IPO is priced at a Price to

Earnings of 35.6 times and EV/EBITDA of 25.7 times at the upper price band of

the IPO, which is on the higher side, compared to the listed peer group. Company

already has a higher market share of 70%-90% in Key API’s which will limit

growth in near future. Given the expensive valuation, we are assigning a

NEUTRAL recommendation to the Ami Organics Limited IPO.

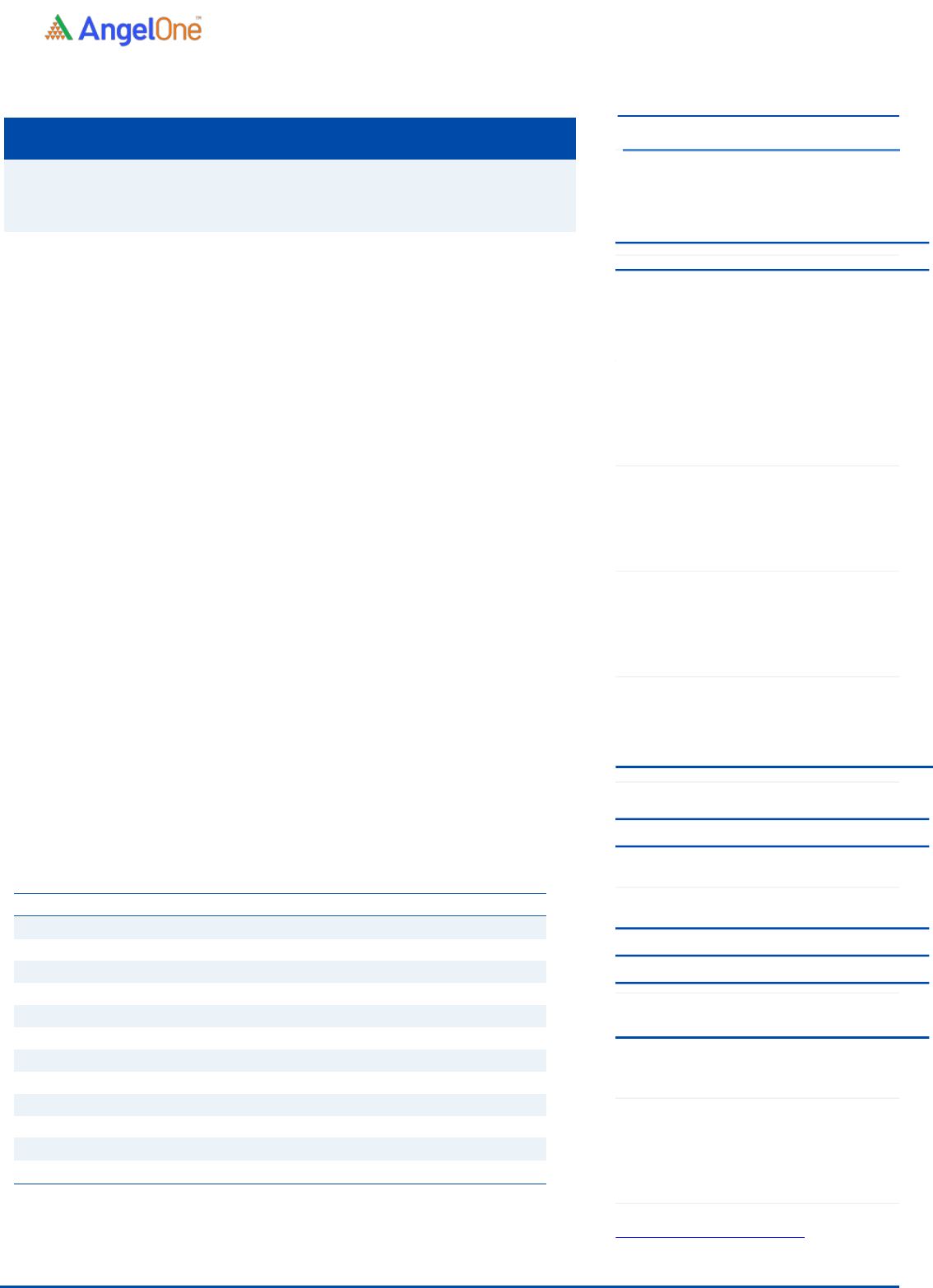

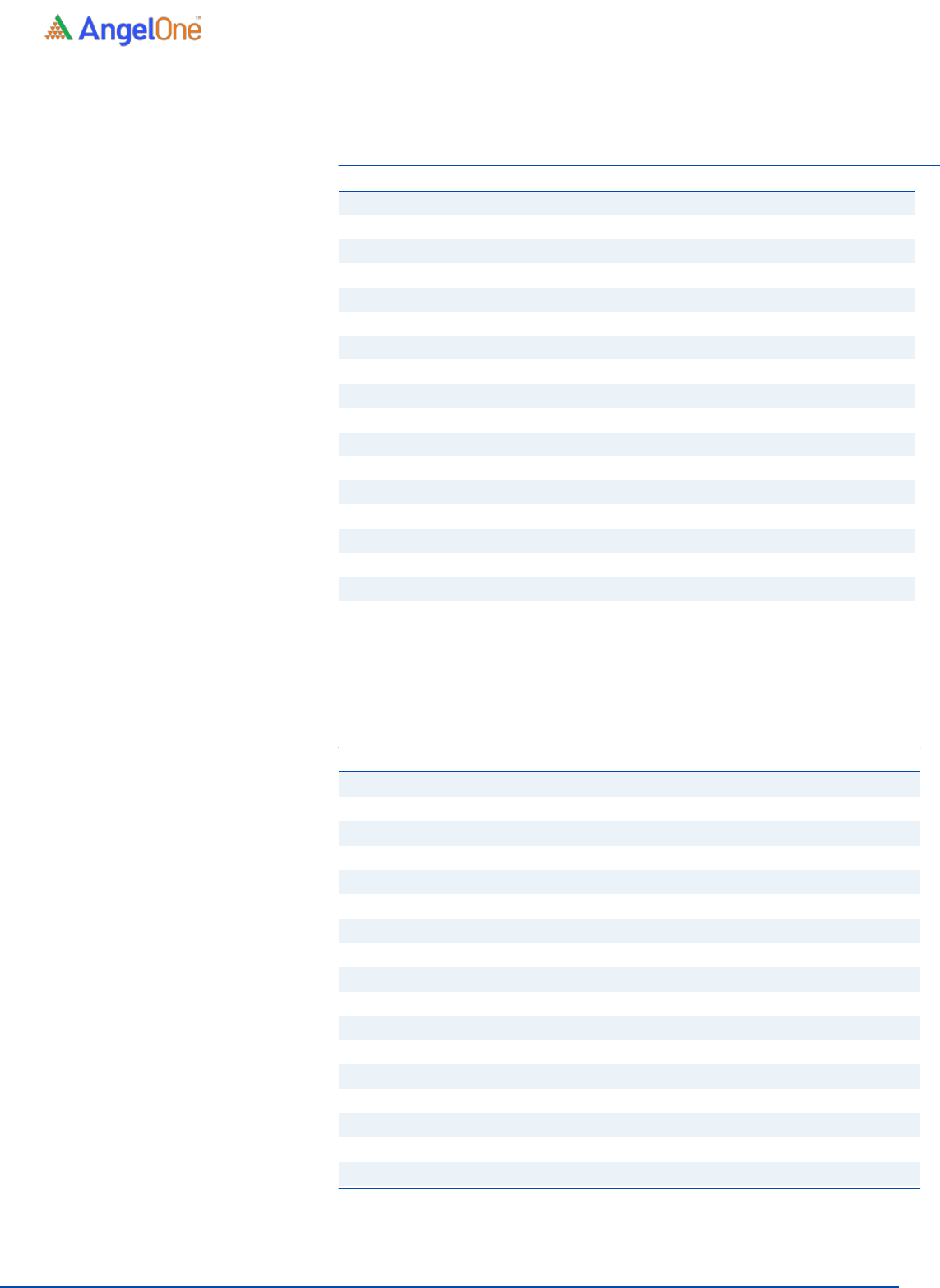

Key Financials

Y/E March (₹ cr)

FY19

FY20

FY21

Net Sales

238.5

239.6

340.6

% chg

-

0.5

42.2

Net Profit

23.5

27.6

54.4

% chg

-

17.5

96.9

EBITDA (%)

17.8

18.3

24.0

EPS (₹)

7.4

8.7

17.14

P/E (x)

82.4

70.0

35.6

P/BV (x)

24.6

18.1

12.1

RONW (%)

29%

25%

33%

ROCE (%)

37%

29%

31%

EV/EBITDA

48.1

46.6

25.7

EV/Sales

8.6

8.5

6.2

Source: Company, Angel Research

NEUTRAL

Issue Open: September 1, 2021

Issue Close: September 3, 2021

Issue Details

Face Value: ₹10

Present Eq. Paid up Capital: ₹31.5 Cr

Issue Size: ₹570 Cr

Fresh Issue: ₹200 Cr.

Offer for Sale: ₹370 Cr

Price Band: ₹603-610

Lot Size: 24 shares and in multiple thereafter

Expected Listing : 14th September 2021

Post-issue mkt. cap: * ₹2,199 Cr - ** ₹2,223 Cr

Promoters holding Pre-Issue: 47.22%

Promoters holding Post-Issue: 41.1%

*Calculated on lower price band

** Calculated on upper price band

Book

Building

QIBs

50% of issue

Non-Institutional

15% of issue

Retail

35% of issue

Post issue Shareholding pattern

Promoters

Others

41.1%

58.9%

Ami organics Limited | IPO Note

August 31, 2021

2

Company background

Ami Organics Limited was incorporated on January 3, 2004. The company is one of the

leading research and development driven manufacturers of specialty chemicals with

varied end usage, focussed towards the development and manufacturing of advanced

pharmaceutical intermediates for regulated and generic active pharmaceutical ingredients

(APIs) and New Chemical Entities and key starting material for agrochemical and fine

chemicals, especially from their recent acquisition of the business of Gujarat Organics

Ltd.

Company supply their products to more than 150 customers, which including

international customers and company supply to more than 25 countries. Currently Ami

Organics has 8 process patent applications and 3 additional pending process patent

applications for which applications were made recently, in March 2021.

Company have developed and commercialised over 450 Pharma Intermediates

for APIs across 17 key therapeutic areas since inception. Ami Organics has 3

manufacturing units located at Sachin, Ankleshwar and Jhagadia in Gujarat with overall

installed capacity of 6,060 MTPA. Further, the Jhagadia Facility has 15,830 square metre

free land available for future expansion

Issue details

The issue comprises of offer for sale of upto ₹370 crore (60.59 lakhs share) and

Fresh issue of 200 crores with the price band of ₹603-610.

Pre & Post Share Holding

(Pre-issue)

(Post-issue)

Particular

No of shares

%

No of shares

%

Promoter

1,56,58,710

47.2%

1,49,58,710

41.1%

Public

1,74,99,664

52.8%

2,14,78,352

58.9%

Total

3,31,58,374

100%

3,64,37,062

100%

Source: Company, Angel Research

Objectives of the Offer

Repayment of current borrowing. (140 Cr)

Funding incremental working capital requirements of the Company. (90 Cr)

To meet general corporate purposes.

Ami organics Limited | IPO Note

August 31, 2021

3

Ami Organics 88% of revenue comes from Pharma

intermediates out of which 53% comes from export and 5% of

revenue comes from Speciality chemicals out of which 86%

comes from export market.

Revenue Breakup

Product Category

FY 2021

% of Total

FY 2020

% of Total

FY 2019

% of Total

Pharma Intermediates

301

88%

218

91%

203

85%

Speciality Chemicals

17

5%

7

3%

2

1%

Others

23

7%

14

6%

33

14%

Total

341

100%

240

100%

239

100%

Source: Company, Angel Research

Key Management Personnel

Nareshkumar Ramjibhai Patel is the Promoter, Executive Chairman and

Managing Director of the company and has been associated with the company

since its incorporation. He has 18 years of experience in the specialty chemicals

manufacturing sector.

Chetankumar Chhaganlal Vaghasia is the Promoter, Whole-time Director of

the company and has been associated with the company since its incorporation.

He has 19 years of experience in the specialty chemicals manufacturing sector.

Virendra Nath Mishra is the Whole-time Director of the company. He has been

associated with the company since 2005. He has over 25 years of experience in

the research and operations management specialty chemicals manufacturing

sector.

Girikrishna Suryakant Maniar is the Non-executive, Independent Director of

the company. He was appointed as an Independent Director of the company on

April 23, 2018.

Abhishek Haribhai Patel is the Chief Financial Officer of the company and was

appointed by the company on June 1, 2018.

Ekta Kumari Srivastava is the Company Secretary and Compliance Officer of

the company and was appointed by the company on February 22, 2021.

Ami organics Limited | IPO Note

August 31, 2021

4

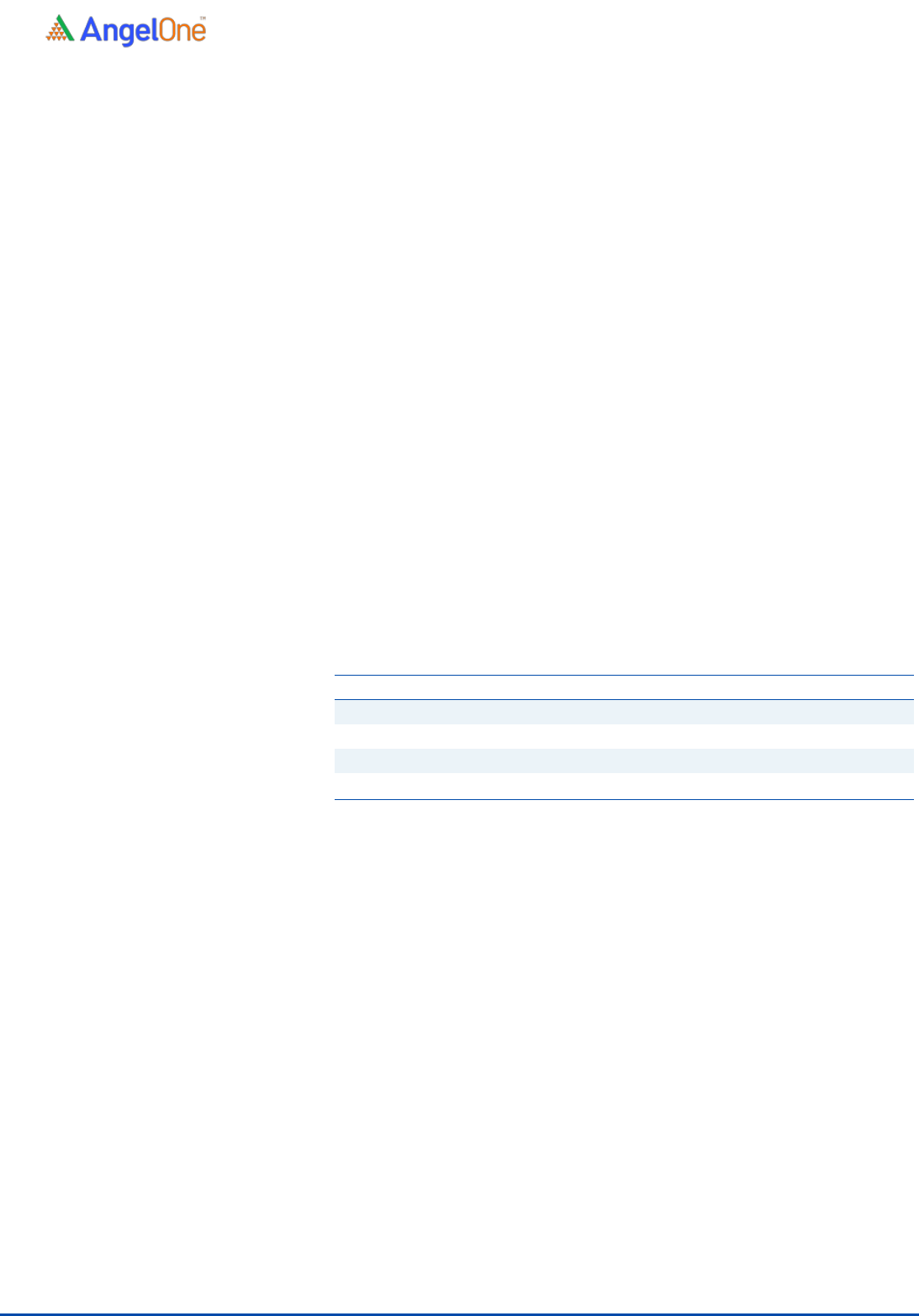

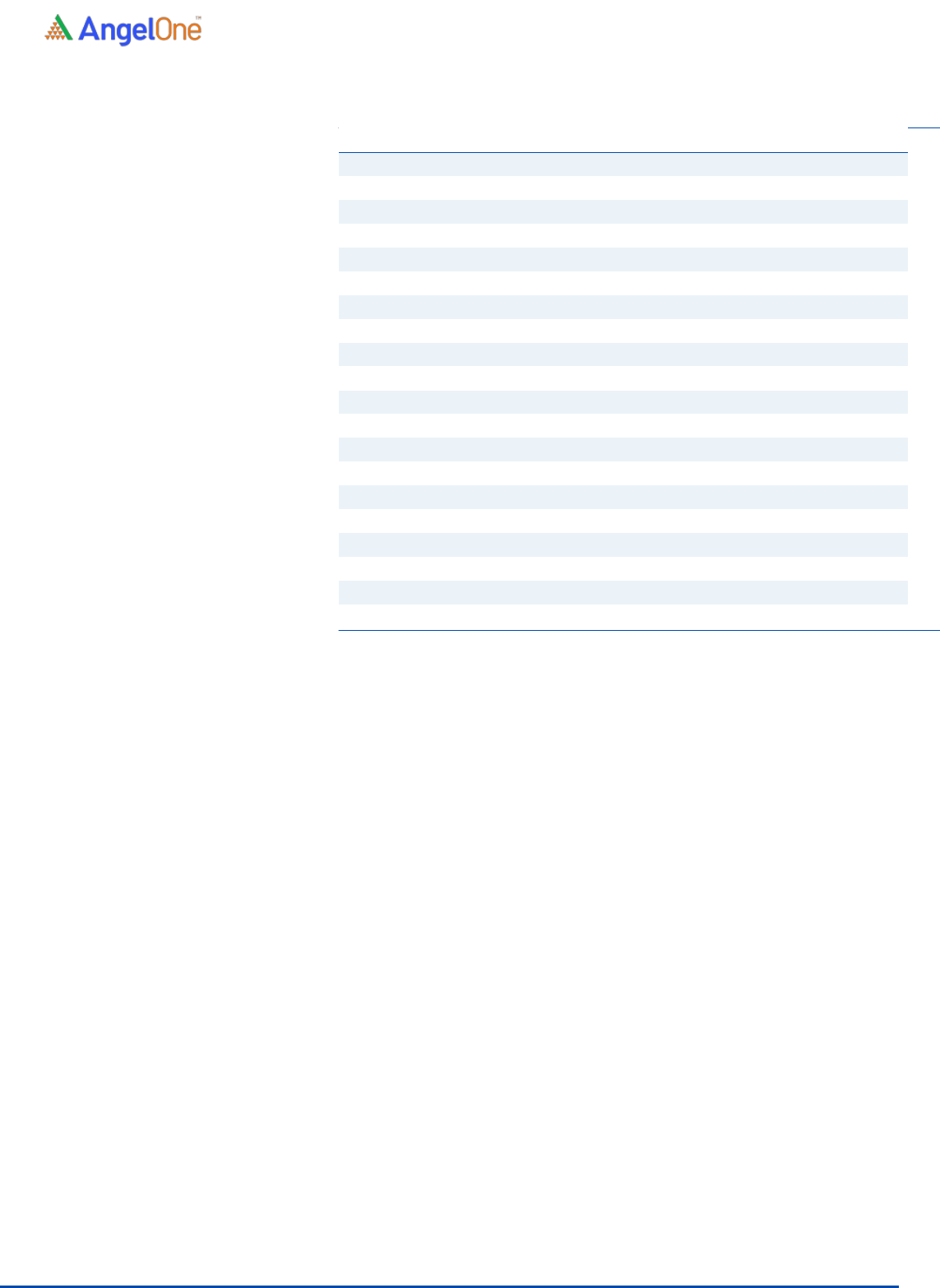

Consolidated Profit & Loss Account

Y/E March (₹ cr)

FY19

FY20

FY21

Total operating income

238.5

239.6

340.6

% chg

-

0.5

42.2

Total Expenditure

196.3

198.6

260.3

Raw Material cost

148.4

128.9

179.4

Employee Benefit Expense

11.7

17.8

21.0

Other Expenses

36.2

51.9

59.9

EBITDA

42.2

41.0

80.3

% chg

-

(2.8)

95.9

(% of Net Sales)

17.7

17.1

23.6

Depreciation& Amortization

2.6

3.5

4.1

EBIT

39.6

37.5

76.2

% chg

-

(5.3)

103.2

(% of Net Sales)

16.6

15.7

22.4

Interest & other Charges

4.7

5.5

5.6

Other Income

0.3

2.8

1.4

(% of Sales)

0.1

1.2

0.4

Recurring PBT

35.2

34.8

72.0

(% of Net Sales)

14.8

14.5

21.1

Tax

11.7

7.2

17.6

PAT (reported)

23.5

27.6

54.4

% chg

-

17.5

96.9

(% of Net Sales)

9.9

11.5

16.0

EPS (as stated)

7.40

8.72

17.14

% chg

-

17.8

96.6

Source: Company, Angel Research

Ami organics Limited | IPO Note

August 31, 2021

5

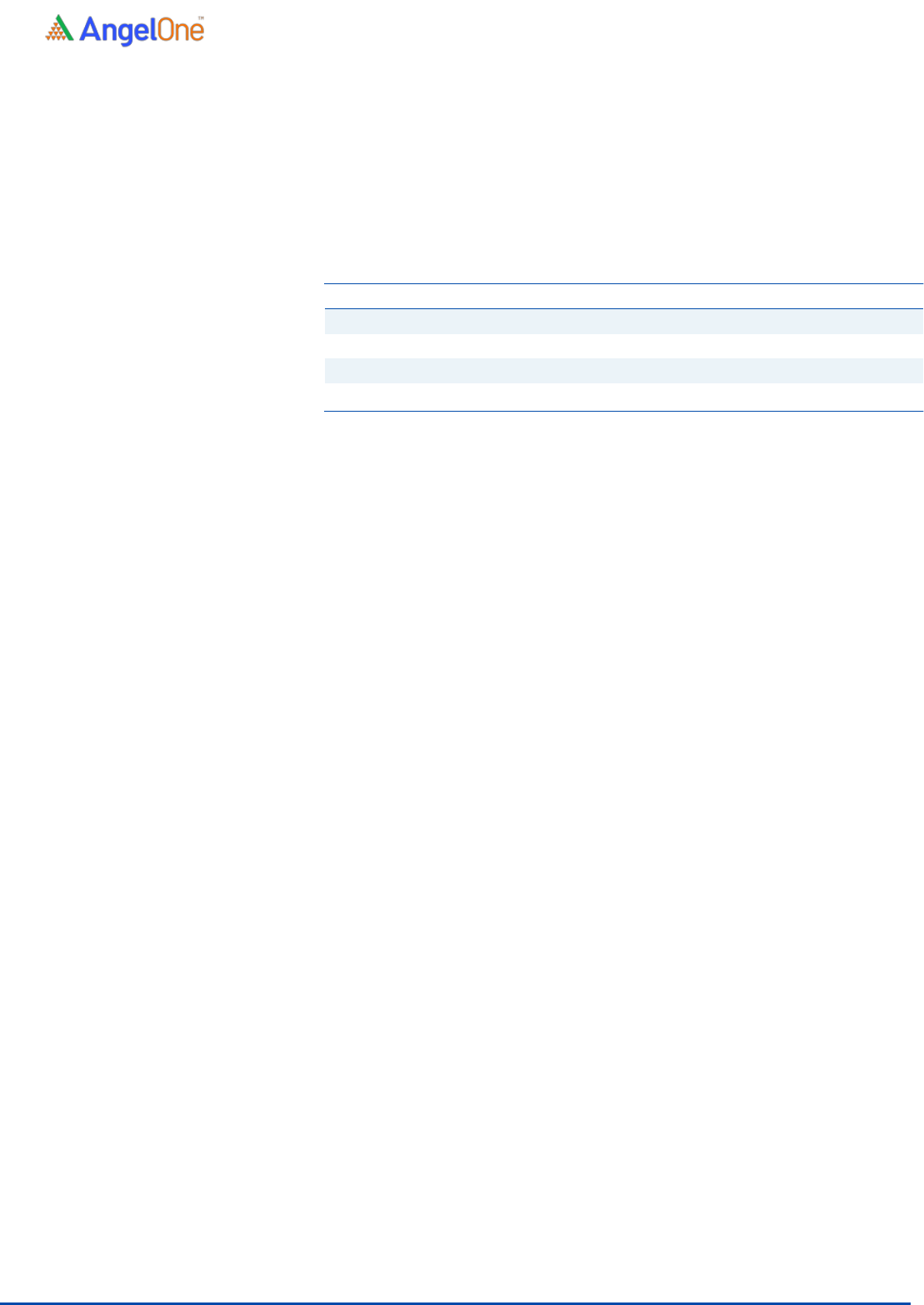

Consolidated Cash Flow Statement

Y/E March (₹ cr)

FY19

FY20

FY21

Profit before tax

35.1

34.7

71.7

Depreciation

2.6

3.5

4.1

Change in Working Capital

(13.1)

(9.6)

(39.2)

Interest Expense

4.5

5.3

5.1

Direct Tax Paid

(13.7)

(8.5)

(14.1)

Others

4.9

7.5

4.1

Cash Flow from Operations

14.9

26.9

27.2

(Inc.)/ Dec. in Fixed Assets

(21.3)

(21.4)

(104.0)

Investment

0.2

(2.7)

3.4

Interest received

0.1

0.1

0.2

Cash Flow from Investing

(21.1)

(24.0)

(100.4)

Procees/Repayment of Borrowing

10.0

5.5

77.2

Dividend paid on equity shares

(4.4)

(5.3)

(5.1)

Cash Flow from Financing

5.6

0.2

72.1

Inc./(Dec.) in Cash

(0.4)

3.3

(1.1)

Opening Cash balances

0.9

0.5

3.8

Closing Cash balances

0.5

3.8

2.7

Source: Company, Angel Research

Consolidated Balance Sheet

Y/E March (₹ cr)

FY19

FY20

FY21

SOURCES OF FUNDS

Equity Share Capital

10.5

10.5

31.5

Other equity

71.7

101.3

135.4

Shareholders Funds

82.2

111.8

166.9

Total Loans

24

23

76

Other liabilities

1.1

2.4

4.3

Total Liabilities

108

137

247

APPLICATION OF FUNDS

Net Block

81

97

187

Current Assets

124

121

216

Sundry Debtors

76

56

121

Inventories

38.6

52.3

60.3

Cash & Bank Balance

0

4

3

Other Assets

9

8

32

Current liabilities

105

94

166

Net Current Assets

19

26

50

Other Non Current Asset

8

14

10

Total Assets

107

137

247

Source: Company, Angel Research

Ami organics Limited | IPO Note

August 31, 2021

6

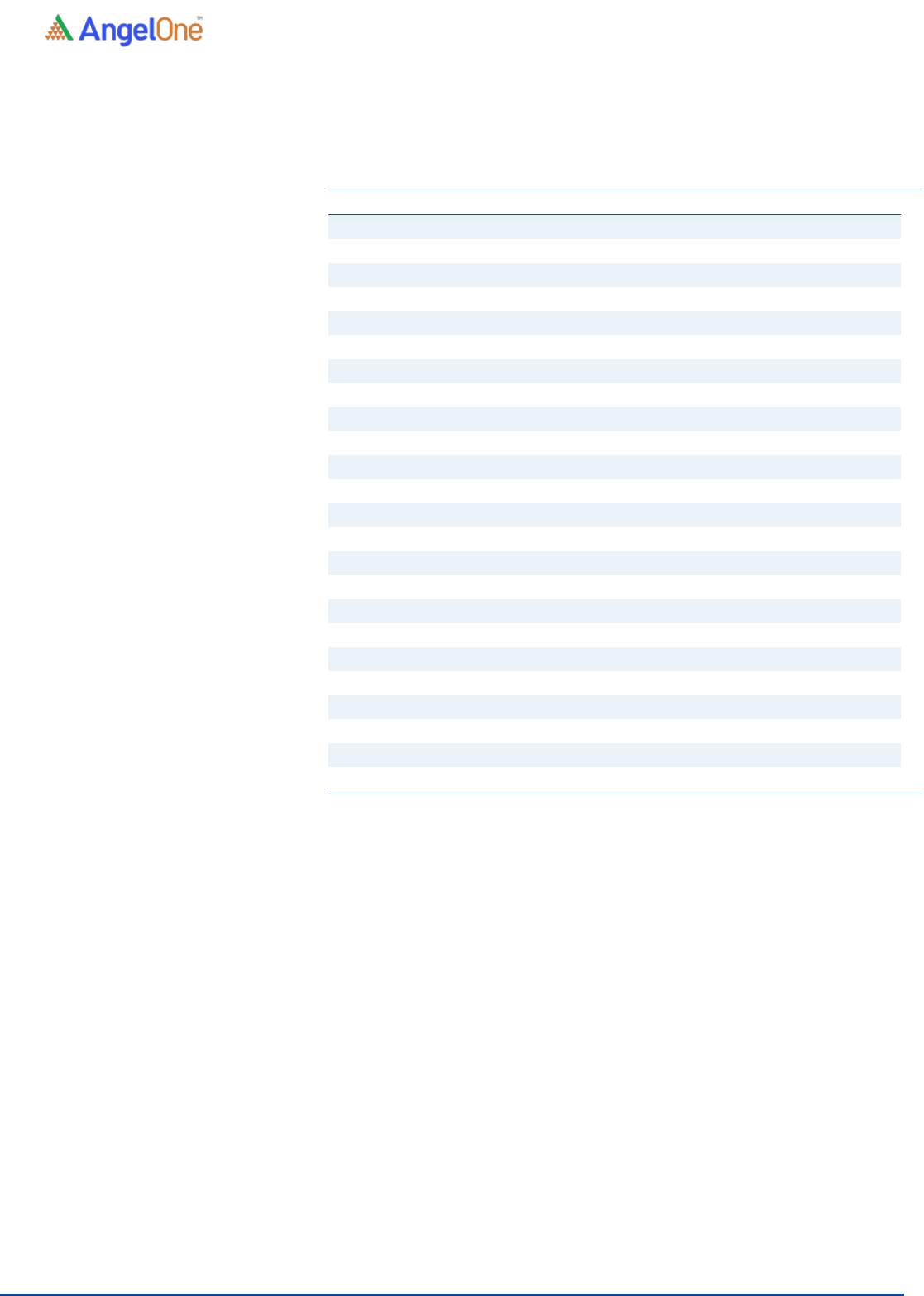

Key Ratio

Y/E March

FY19

FY20

FY21

Valuation Ratio (x)

P/E (on FDEPS)

82.4

70.0

35.6

P/CEPS

71.7

64.0

34.5

P/BV

24.6

18.1

12.1

EV/Sales

8.6

8.5

6.2

EV/EBITDA

48.1

46.6

25.7

Per Share Data (Rs)

EPS (fully diluted )

7.40

8.72

17.14

Cash EPS

8.5

9.5

17.7

Book Value

24.8

33.7

50.3

Number of share

3.32

3.32

3.32

Returns (%)

RONW

28.6%

24.7%

32.6%

ROCE

37.1%

29.4%

31.4%

Turnover ratios (x)

Asset Turnover (net)

3.0

2.8

1.8

Receivables (days)

116.3

85.9

129.2

Inventory Days

156.4

172.4

136.5

Payables (days)

168.0

145.5

171.7

Working capital cycle (days)

104.7

112.9

94.1

Source: Company, Angel Research

Ami organics Limited | IPO Note

August 31, 2021

7

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.