IPO Note | Recreation / Amusement Parks

March 9, 2015

Adlabs Entertainment

AVOID

Issue Open: March 10, 2015

IPO Note - Valuation expensive; Avoid

Issue Close: March 12, 2015

Company background: Adlabs Entertainment Ltd (AEL) is promoted by

Manmohan Shetty and Thrill Park Ltd. AEL owns and operates Imagica - The

Issue Details

Theme Park, which is one of the upcoming theme parks in India. It features a

Face Value: `10

diverse variety of rides and attractions of international standards, food and

Present Eq. Paid up Capital: `61.57cr

beverages (F&B) outlets, and retail and merchandise shops, designed to appeal to

Fresh Issue: 1.83cr Shares

a broad demography of the Indian populace. Adlabs Mumbai includes

Offer for Sale: 0.2cr Shares

Aquamagica, a water park, which became fully operational on October 1, 2014,

and a family hotel - Novotel Imagica Khopoli, the first phase of which is expected

Post Eq. Paid up Capital: `79.90cr

to be completed by March 2015. Imagica - The Theme Park is a one-of-a-kind

Issue size (amount)**: `449cr - `468cr

offering in India and currently has 25 rides and attractions, which are spread over

Price Band**: `221-230

six theme-based zones. AEL proposes 287 key hotels; the first one - Novotel

Post-issue implied mkt. cap**: `1,766cr-

Imagica Khopoli is to comprise of 116 rooms.

1,838cr

Promoters holding Pre-Issue: 77.0%

Outlook and Valuation: Given that the company is in its initial stage of business

operations, the operating costs are high and utilization level is low. Also, currently

Promoters holding Post-Issue: 56.8%

Note:**at Lower and Upper price band respectively

the company has a sizable debt of `1,256cr on its balance sheet. The debt levels

are likely to remain high even after IPO proceeds are utilized to pare debt. Lower

utilization coupled with higher interest and depreciation is likely to keep the

Book Building

bottom-line in the red in the near-term. For FY2014, Adlabs Imagica reported a

QIBs

At least 75%

top-line of `103.7cr and a loss of `52.4cr on the bottom-line front. For

Non-Institutional

At least 15%

1HFY2015, the company has reported a top-line of `72.2cr and a net loss of

Retail

At least 10%

`53.3cr.

Further, even at the lower end of the price band, the company looks expensive

Post Issue Shareholding Pattern

compared to its close peers like Wonderla Holidays which is already making

Promoters Group

56.8

profits and has a healthy balance sheet. On the EV/sales front, the company is

MF/Banks/Indian

valued at 13.6x (at the lower end of the price band) while its peer Wonderla

FIs/FIIs/Public & Others

43.2

Holidays is trading at 6.9x on the basis of 9MFY2015 annualized numbers.

Hence, considering all the above factors, we recommend an Avoid on the issue.

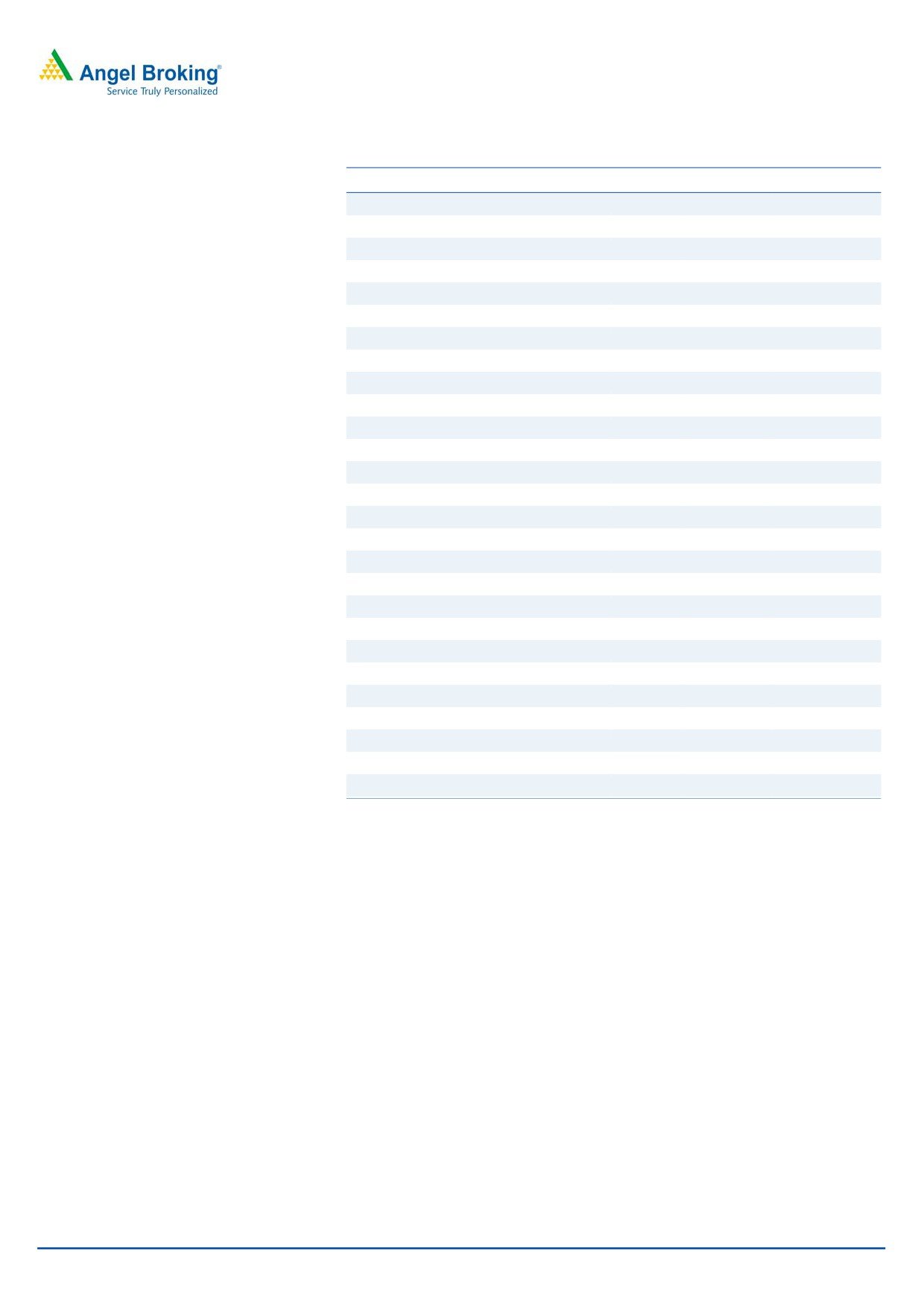

Key Financials

Y/E March (` cr)

FY2013

FY2014

1HFY2015

Net Sales

-

104

72

Net Profit

(2)

(52)

(54)

OPM (%)

-

3.6

4.7

EPS (`)

(0.4)

(10.8)

(11.0)

P/E (x)*

-

-

-

Amarjeet S Maurya

P/BV (x)*

3.5

3.4

-

+91 22 3935 7800 Ext: 6831

EV/Sales (x)*

-

21.0

-

Source: Company, Angel Research; Note: *The above numbers are considering subscription at the

lower end of the price band

Please refer to important disclosures at the end of this report

1

Adlabs Entertainment | IPO Note

Issue details

The company is offering 2.03cr equity shares of `10 each via book building route

in a price band of `221-230, consisting of fresh equity issue of 1.83cr shares and

offer for sale by promoters group of 0.20cr shares. Further, the company has

offered a discount of `12 per share to retail investors. The issue will constitute

25.44% of the post-issue paid-up equity share capital of company.

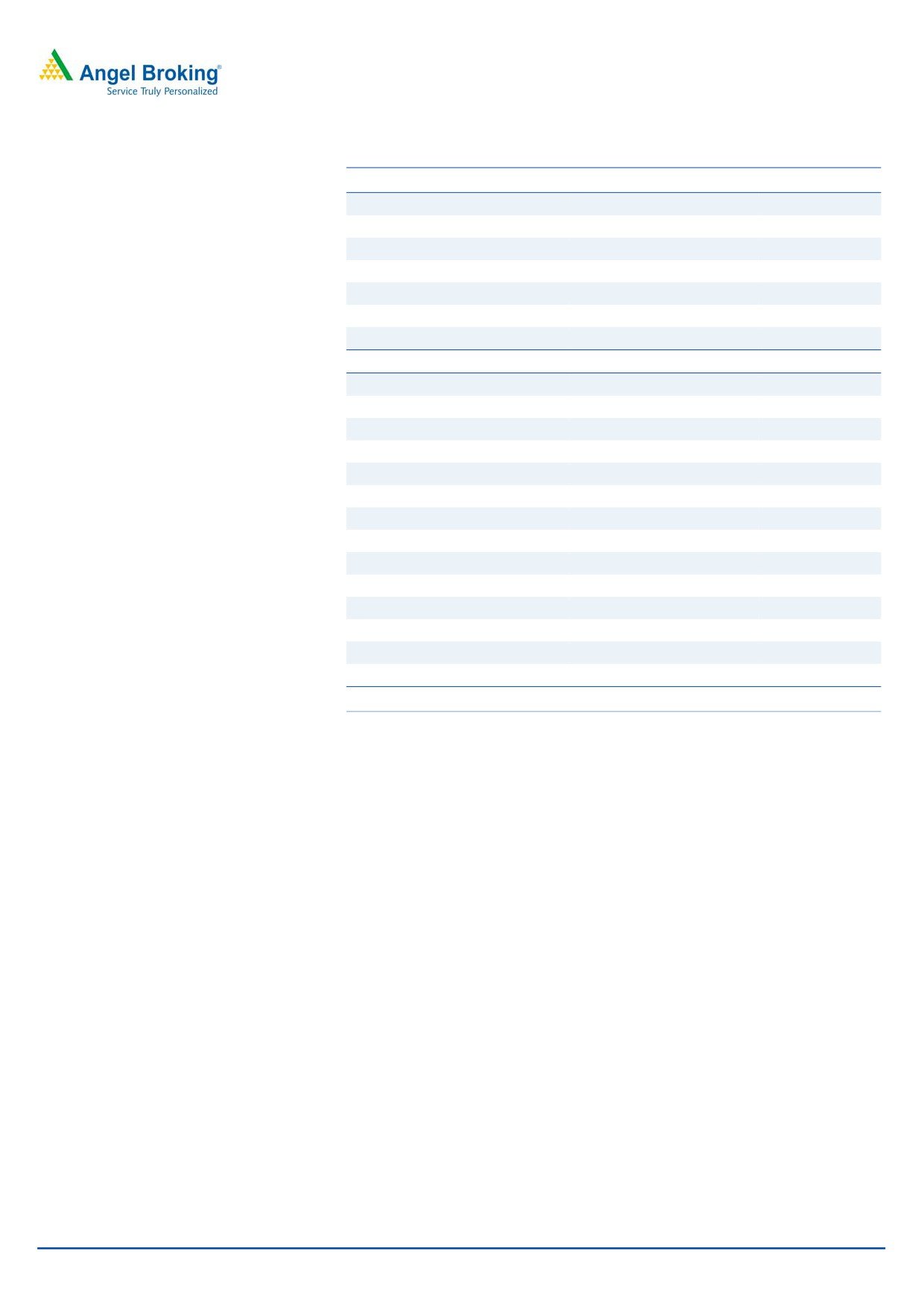

Exhibit 1: Share Holding pattern

Particulars

Pre-Issue

Post-Issue

No. of shares

(%)

No. of shares

(%)

Promoter group

47,417,239

77.0%

45,417,239

56.8%

Others

14,154,344

23.0%

34,480,571

43.2%

Total

61,571,583

100.0%

79,897,810

100.0%

Source: Company, Angel Research

Objects of the Offer

Utilize the fund for debt repayment of `330cr.

General corporate purposes.

Company Details

Adlabs Entertainment Ltd (AEL) is promoted by Manmohan Shetty and Thrill Park

Ltd. AEL owns and operates Imagica - The Theme Park, which is one of the

upcoming theme parks in India. ‘Imagica’ and ‘Aquamagica’ is spread over an

area of 132 acres in Khopoli district of Maharashtra. It features a diverse variety of

rides and attractions of international standards, food and beverages (F&B) outlets,

and retail and merchandise shops, designed to appeal to a broad demography of

the Indian populace. Adlabs Mumbai includes Aquamagica, a water park, which

became fully operational on October 1, 2014, and a family hotel - Novotel

Imagica Khopoli, the first phase of which is expected to be completed by March

2015. Imagica - The Theme Park is a one-of-a-kind offering in India and currently

has 25 rides and attractions, which are spread over six theme-based zones. AEL

proposes 287 key hotels; the first one - Novotel Imagica Khopoli is to comprise of

116 rooms.

Exhibit 2: Novotel Imagica Khopoli (Hotels)

Phase 1

Phase 2

Expected to be operational

01-Apr-15

FY2017

No of key

116

171

Source: RHP, Angel Research

March 9, 2015

2

Adlabs Entertainment | IPO Note

Exhibit 3: Adlabs' tariff card

Weekdays

Weekends and Public Holidays

(`)

Adult

Child Senior Citizen Adult

Child Senior Citizen

Regular

1,500

1,200

1,200 1,900

1,600

1,600

Imagica Express

2,200

2,000

2,000 3,000

2,600

2,600

College Pack

1,300

1,500

School Packages

800-1,000

1,200 - 1,300

Source: RHP, Angel Research

Exhibit 4: Aquamagica tariff card

Weekdays

Weekends and Public Holidays

(`)

Adult Child

Senior Citizen

Adult

Child

Senior Citizen

Regular

950

650

650

1150

800

800

College Pack

800

950

Source: RHP, Angel Research

Exhibit 5: Driving distance to Adlabs Mumbai from key cities

City

Km

Mumbai

74

Navi Mumbai

46

Pune

90

Nashik

204

Aurangabad

319

Surat

337

Lonavla

25

Source: RHP, Angel Research

Key investment concerns

Higher operating cost, Interest and Depreciation cost to keep

pressure on bottom-line:

Considering AEL’s operations are at an initial stage, we sense that AEL would

require more time to absorb its higher fixed cost base. Currently the company has

a lower operating margin compared to its close peer - Wonderla Holidays. Also,

the company has a sizable debt of ~`1,256cr on its balance sheet (Pre-IPO basis),

indicating D/E ratio of 3.6x in FY2014. IPO proceeds are likely to be used towards

part debt repayment. This should lower the debt levels to ~`926cr, with it paying off

`330cr, and D/E ratio to 1.4x (Post-IPO).

Considering the amusement park’s location, huge land parcel over which it is

spread (132acres), and high-end quality of machines deployed, we are of the view

that the company’s financials and fixed cost structure are different from its peers, ie

Wonderla Holidays. Hence, the average realization per person is higher for AEL vs

Wonderla Holidays.

Given higher capex deployed towards land and machinery by AEL, the debt as well

as gross block requirements are higher for AEL vis-a-vis Wonderla Holidays. This

has resulted in higher depreciation and interest expenses. Higher depreciation and

interest expenses coupled with lower utilization rates have eaten into the overall

profitability of the company. Hence, for 9MFY2015, AEL reported a loss of ~`54cr

vs a profit of ~`31cr posted by Wonderla Holidays, during the same period.

March 9, 2015

3

Adlabs Entertainment | IPO Note

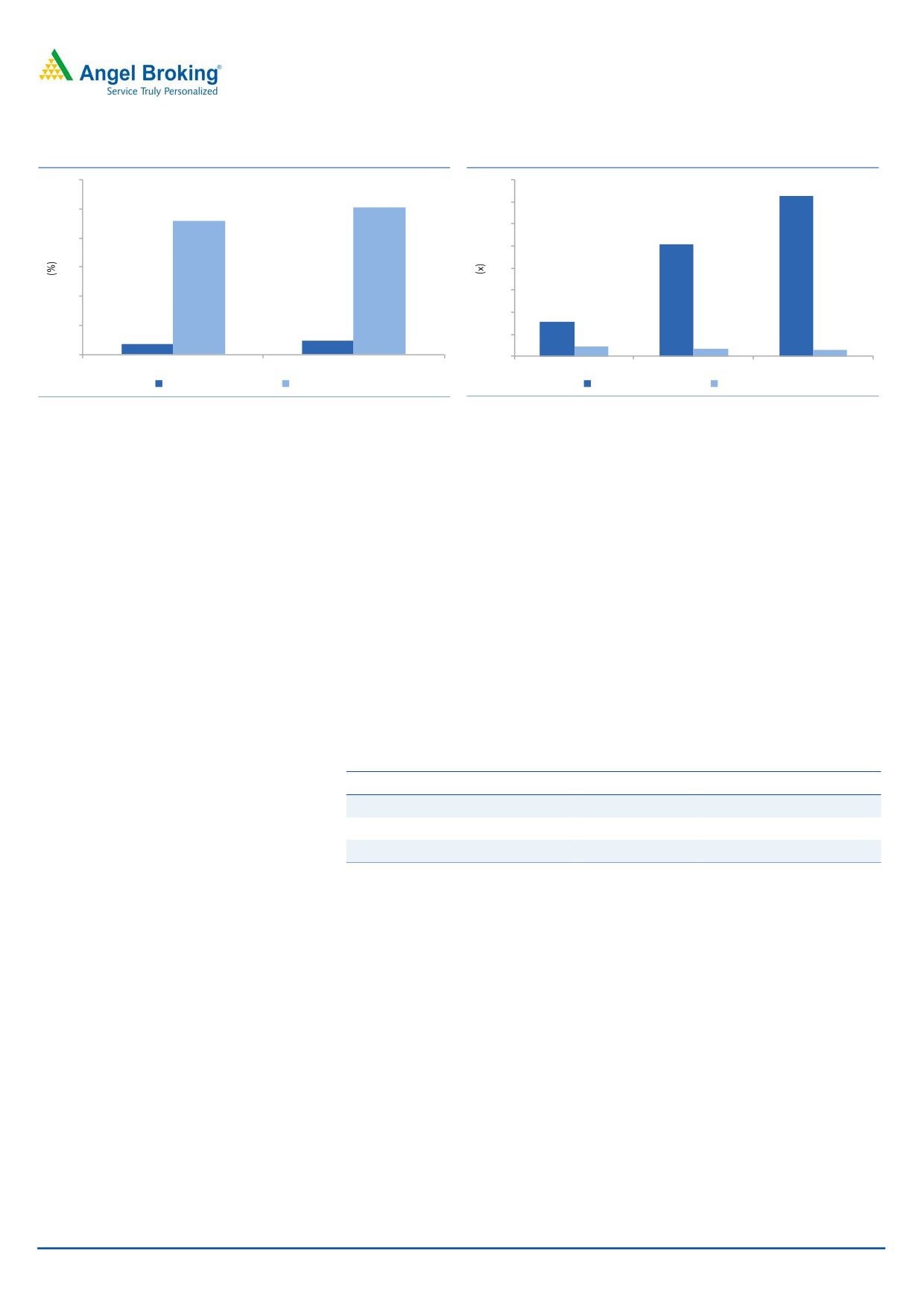

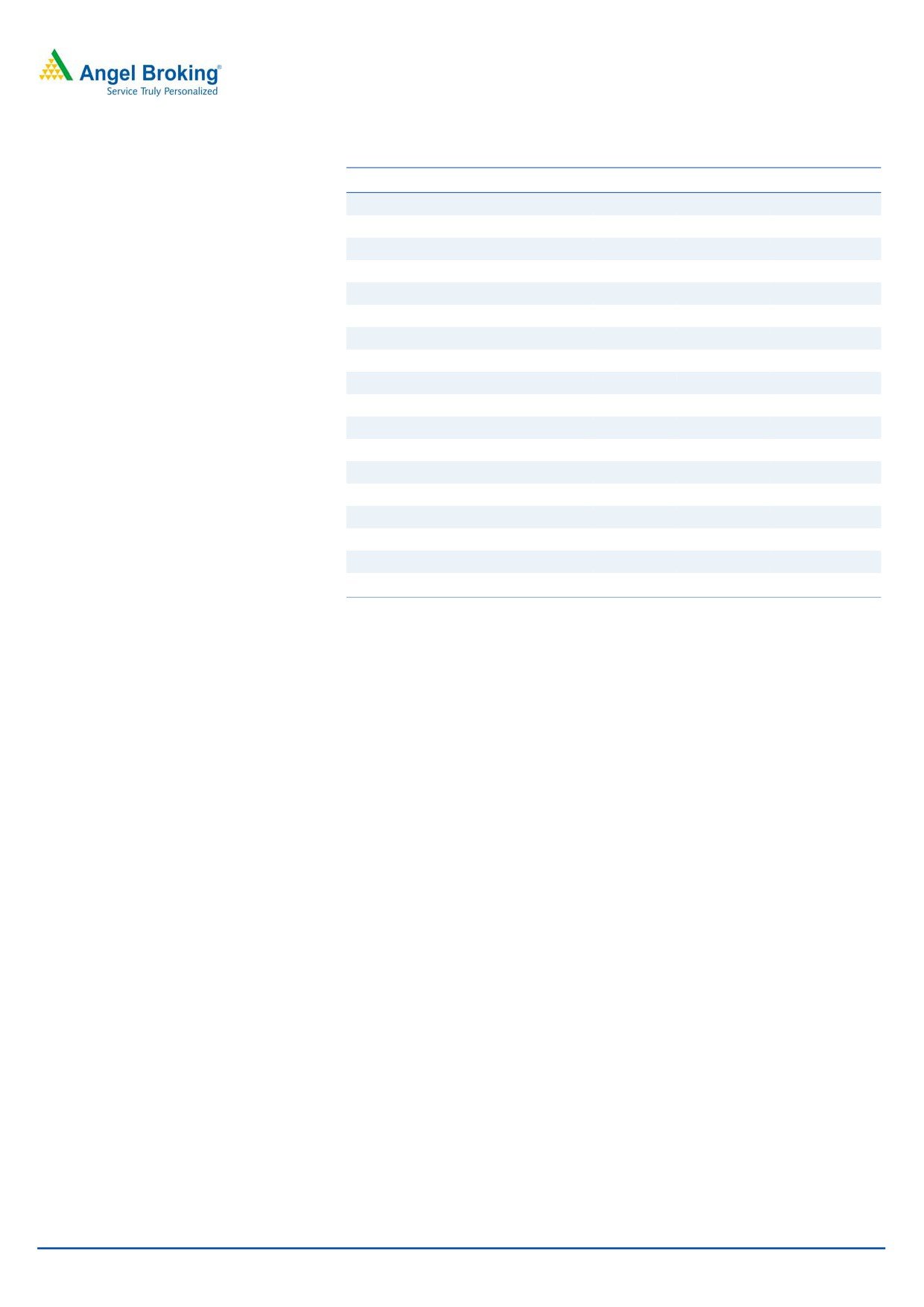

Exhibit 6: Operating margins comparison

Exhibit 7: Debt to equity comparison

60

4.0

3.6

50.5

3.5

50

45.8

3.0

2.6

40

2.5

30

2.0

1.5

20

1.0

0.8

10

3.6

4.6

0.5

0.2

0.2

0.2

0

0.0

FY2014

1HFY2015

FY2012

FY2013

FY2014

Adlabs Entertainment

Wonderla Holidays

Adlabs Entertainment

Wonderla Holidays

Source: RHP, Angel Research

Source: Company, Angel Research

Expensive Valuation

For FY2014, Adlabs Imagica reported a top-line of `103.7cr and a loss of `52.4cr

on the bottom-line front. For 1HFY2015, the company has reported a top-line of

`72.2cr and a net loss of `53.3cr.

On the Price to Book value (P/BV; pre-IPO) front, the company is valued at 5.2x

9MFY2015 annualized numbers while its peer Wonderla Holidays is trading at

4.3x 9MFY2015 annualized numbers. The company looks expensive compared to

its close peers like Wonderla Holidays which is already making profits and has a

healthy balance sheet. Alternatively on EV/sales front, the company is valued at

13.6x (at the lower end of the price band) while its peer Wonderla Holidays is

trading at 6.9x (on 9MFY2015 annualized numbers). Hence, considering all the

above factors, we recommend an Avoid on the issue.

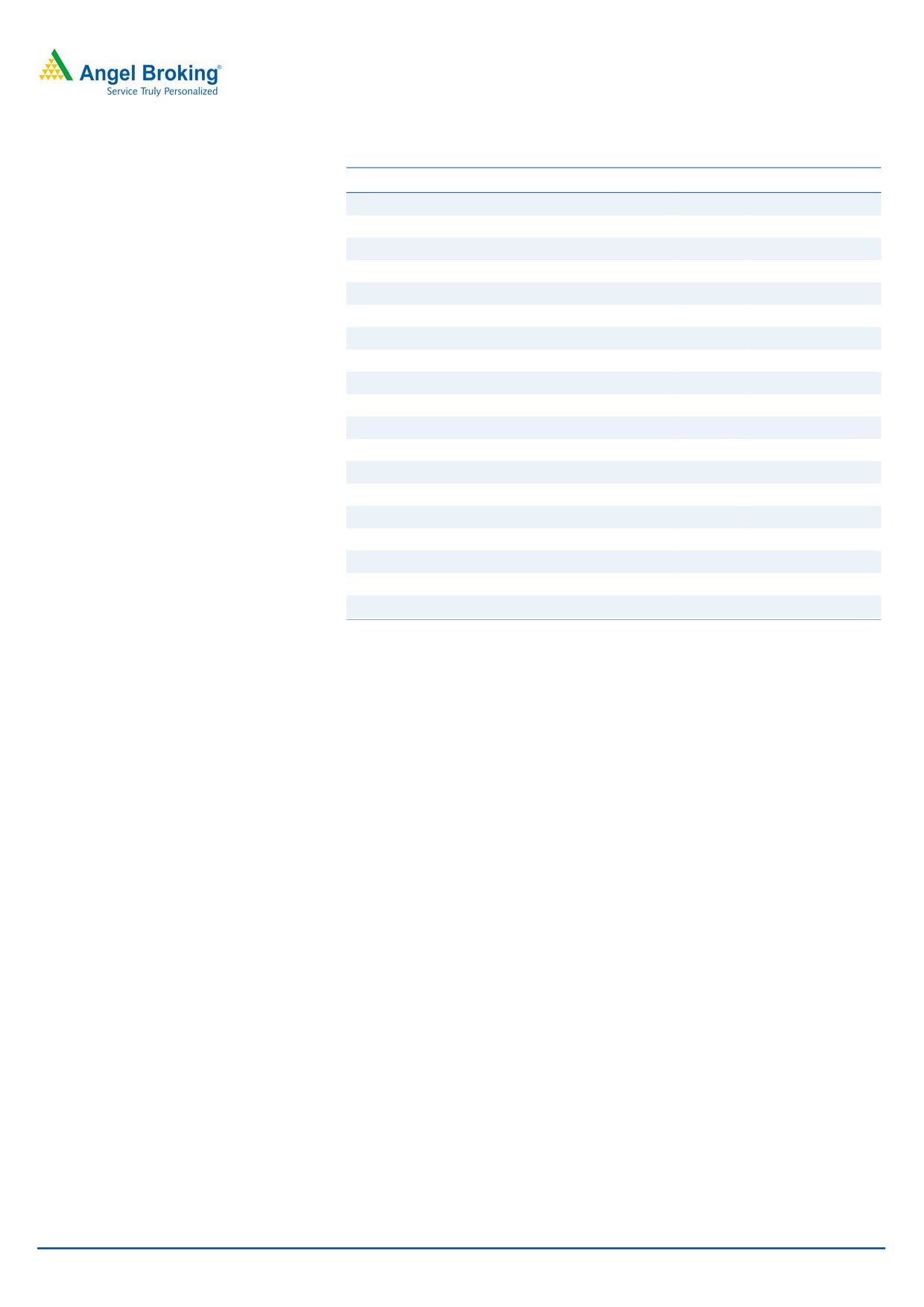

Exhibit 8: Valuation table (9MFY2015 annualized)

AEL

Wonderla Holidays

EV/Sales

13.6

6.9

Price/BVPS (Pre-IPO)

5.2

4.3

Price/BVPS (Post-IPO)

2.7

4.3

Source: Company, Angel Research, Note: Considered lower price band to arrive at implied

market cap, EV and Book value

Risks to upside

For 9MFY2015, the company has reported ~17% yoy growth in the amusement

park business (excludes Aqua Imagica, which has been operational since

3QFY2015). During 3QFY2015 (October to December 2014) the park had

footfalls of 2,91,706 which is surprisingly lower than the 2,92,633 footfalls in only

two months of 3QFY2014 i.e. (November to December 2013) when the park

commenced operations fully. Going forward, if the company reports much higher

growth than in the aforementioned 9-month period, then it would be a risk to our

recommendation.

March 9, 2015

4

Adlabs Entertainment | IPO Note

Profit & Loss

Y/E March (` cr)

FY2013

FY2014

1HFY2015

Total operating income

-

104

72

Total Expenditure

6

100

69

Cost of Materials

-

10

6

Personnel Expenses

3

20

20

Others Expenses

3

70

43

EBITDA

(6)

4

3

(% of Net Sales)

3.6

4.7

Depreciation& Amortisation

0

31

37

EBIT

(6)

(27)

(33)

(% of Net Sales)

(25.8)

(46.2)

Interest & other Charges

-

43

54

Other Income

4

3

1

(% of PBT)

(141.9)

(4.9)

(1.3)

Share in profit of Associates

-

-

-

Recurring PBT

(3)

(66)

(86)

Prior Period & Extraordinary Expense/(Inc.)

-

-

-

PBT (reported)

(3)

(66)

(86)

Tax

1

14

33

(% of PBT)

(29.6)

(20.6)

(37.9)

PAT (reported)

(2)

(52)

(54)

Add: Share of earnings of associate

-

-

-

Less: Minority interest (MI)

-

-

-

PAT after MI (reported)

(2)

(52)

(54)

ADJ. PAT

(2)

(52)

(54)

(% of Net Sales)

(50.6)

(74.2)

Basic EPS (`)

(0.4)

(10.8)

(11.0)

Fully Diluted EPS (`)

(0.4)

(10.8)

(11.0)

March 9, 2015

5

Adlabs Entertainment | IPO Note

Balance sheet

Y/E March (` cr)

FY2013

FY2014

1HFY2015

SOURCES OF FUNDS

Equity Share Capital

46

48

48

Reserves& Surplus

263

265

212

Shareholders Funds

309

314

261

Minority Interest

-

-

-

Total Loans

788

1,140

1,256

Deferred Tax Liability

-

-

-

Total Liabilities

1,097

1,454

1,517

APPLICATION OF FUNDS

Fixed Assets

248

1,294

1,269

Capital Work-in-Progress

819

100

196

Investments

-

-

0

Current Assets

87

91

77

Inventories

-

5

9

Sundry Debtors

-

1

20

Cash

30

36

7

Loans & Advances

10

10

11

Other Assets

46

40

30

Current liabilities

57

47

73

Net Current Assets

29

45

4

Deferred Tax Asset

1

14

47

Mis. Exp. not written off

-

-

-

Total Assets

1,097

1,454

1,517

March 9, 2015

6

Adlabs Entertainment | IPO Note

Cash flow statement

Y/E March (` cr)

FY2013

FY2014

1HFY2015

Profit before tax

(3)

(66)

(86)

Depreciation

0

31

37

Change in Working Capital

66

(9)

26

Interest / Dividend (Net)

0

42

54

Direct taxes paid

(0)

(0)

(0)

Others

0

0

0

Cash Flow from Operations

63

(3)

30

(Inc.)/ Dec. in Fixed Assets

(690)

(358)

(108)

(Inc.)/ Dec. in Investments

Cash Flow from Investing

(690)

(358)

(108)

Issue of Equity

0

0

0

Inc./(Dec.) in loans

650

366

62

Dividend Paid (Incl. Tax)

0

0

0

Interest / Dividend (Net)

0

0

0

Cash Flow from Financing

650

366

62

Inc./(Dec.) in Cash

24

6

(16)

Opening Cash balances

6

30

36

Closing Cash balances

30

36

19

March 9, 2015

7

Adlabs Entertainment | IPO Note

Key Ratios

Y/E March

FY2013

FY2014

Valuation Ratio (x)

P/E (on FDEPS)

-

-

P/CEPS

-

-

P/BV

3.5

3.4

EV/Sales

-

21.0

EV/EBITDA

-

579.4

EV / Total Assets

4.2

-

Debt/Equity

2.6

3.6

Per Share Data (`)

EPS (Basic)

(0.4)

(10.8)

EPS (fully diluted)

(0.4)

(10.8)

Cash EPS

(0.2)

(2.7)

Book Value

63.8

64.7

Turnover ratios (x)

Asset Turnover (Gross Block)

0.0

0.1

Inventory / Sales (days)

-

17

Receivables (days)

-

2

Payables (days)

-

52

Working capital cycle (ex-cash) (days)

-

(32)

Note: *Valuation Ratio at the lower price band

March 9, 2015

8

Adlabs Entertainment | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel has received in-principal approval

from SEBI for registering as a Research Entity in terms of SEBI (Research Analyst) Regulations, 2014. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its associates

including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the company covered by

Analyst. Angel or its associates/analyst has not received any compensation / managed or co-managed public offering of securities of

the company covered by Analyst during the past twelve months. Angel/analyst has not served as an officer, director or employee of

company covered by Analyst and has not been engaged in market making activity of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

March 9, 2015

9