Please refer to important disclosures at the end of this report

1

Aditya Birla Sun Life AMC Limited (“ABSLAMC”) is ranked as the largest non-bank

affiliated AMC in India by Quarterly Average Assets Under Management

(“QAAUM”) since March 31, 2018, and among the four largest AMCs in India.

Company managed total AUM of ₹2,93,642 crores under the suite of mutual fund

(excluding our domestic FoFs), portfolio management services, offshore and real

estate offerings, as of June 30, 2021. It established a geographically diversified

Pan-India distribution presence covering 284 locations spread over 27 states and

six union territories.

Positives: (a) Largest Non-Bank Affiliated Asset Manager in India (b) Well-

Recognized Brand with Experienced Promoters (c) Growing Individual Investor

Customer Base Driven by Strong Systematic Flows and B-30 Penetration (d) Diverse

Product Portfolio with Fund Performance supported by Research Driven Investment

Philosophy.

Investment concerns: (a) The effect of pandemic is uncertain and unpredictable to

the business. (b) Any adverse change in AUM may result in a decline in overall

revenue and profit. (c) Underperformance of investment products could lead to loss

of investors and subsequently loss of AUM & adverse impact on operation. (d)

Credit risks related to the debt portfolio of managed funds may expose the funds

to losses.

Outlook & Valuation: Aditya Birla AMC has witnessed a steady growth in AUM

since 2016 and has also been constantly increasing the share of Individual AUM

within the mix. Moreover, the share of high margin Equity AUM has normalized to

36.5% of AUM in Q1FY2022 as compared to 30.5% of AUM at the end of

FY2020. At the higher end of the price band the AMC will be trading at

Market/AUM of 7.3xQ1FY22 Avg. AUM which is at a discount to Nippon Life AMC

and at a similar level to that of UTI AMC. Given the discount to Nippon AMC and

strong growth prospects of the AMC due to a buoyant capital market we would

recommend to SUBSCRIBE to the IPO.

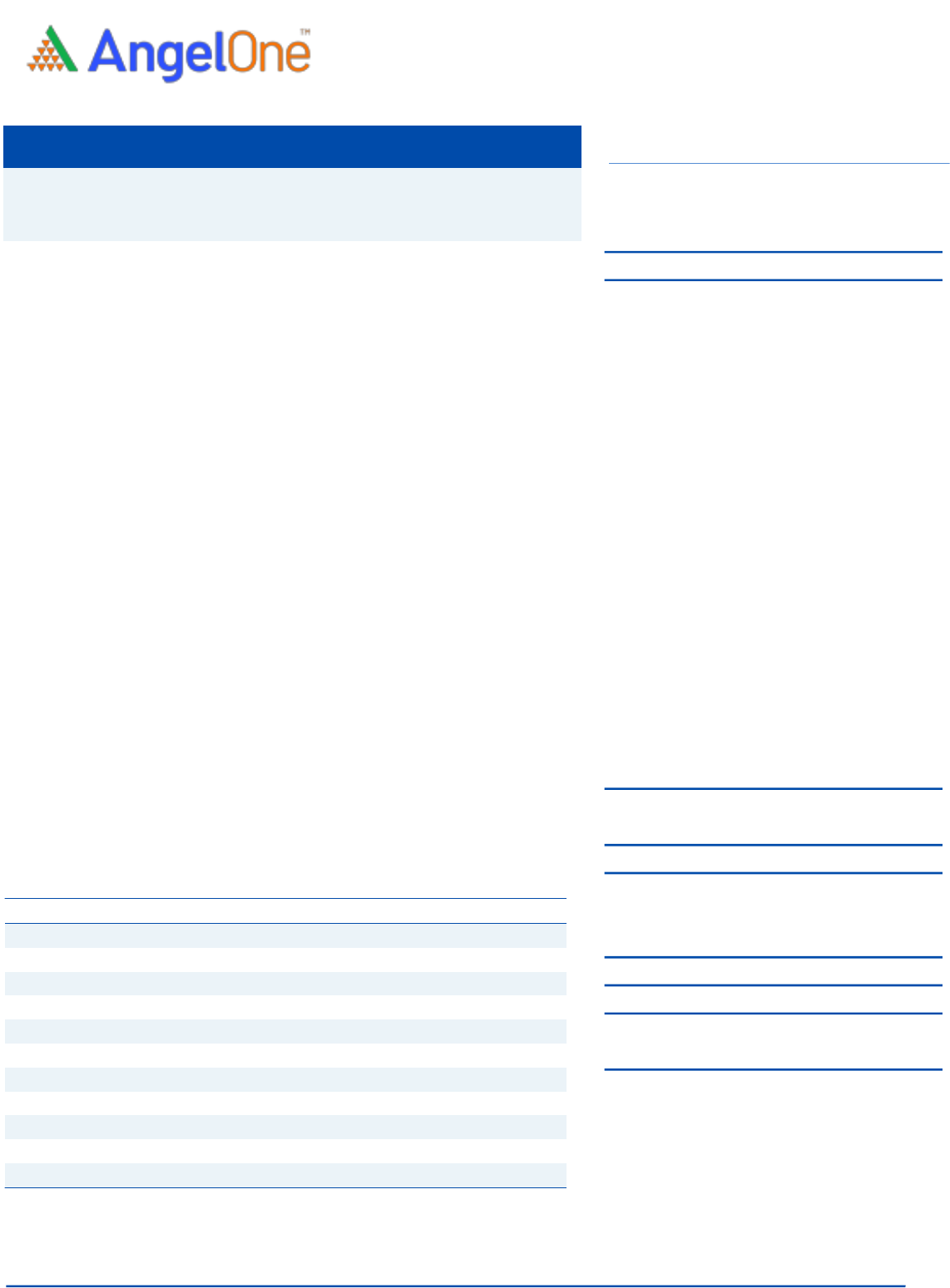

Key Financials

Y/E March (` cr)

FY2019

FY2020

FY2021

Net Sales

1,406.1

1,233.8

1,191.0

% chg

-

-12.2

-3.5

Net Profit

446.8

494.4

526.3

% chg

-

10.7

6.4

EBITDA (%)

48.6

56.9

60.8

EPS (Rs)

15.5

17.2

18.3

P/E (x)

45.9

41.5

39.0

P/BV (x)

16.8

15.6

12.0

ROE (%)

36.6

37.5

30.9

ROCE (%)

48.3

46.7

37.9

Market Cap/Avg. AUM (%)

8.0

9.5

7.6

Source: Company, Angel Research.

Note: Valuation ratios at upper price band.

SUBSCRIBE

Issue Open: Sep 29, 2021

Issue Close: Oct 01, 2021

Offer for Sale: `2768.26 cr

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 86.5%

Others 13.5%

Fresh issue: `0 cr

Issue Details

Face Value: `5

Present Eq. Paid up Capital: `144 cr

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: `144cr

Issue size (amount): `2,768.26 cr

Price Band: `695-712

Lot Size: 20 shares and in multiple thereafter

Post-issue mkt. cap: * `20,016 cr - ** `20,506 cr

Promoters holding Pre-Issue: 100%

Promoters holding Post-Issue: 86.5%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Aditya Birla Sun Life AMC Ltd

Aditya Birla AMC|IPO Note

September 28, 2021

Aditya Birla AMC | IPO Note

Sep 28, 2021

2

Company background

Company incorporated in 1994, Aditya Birla Sun Life AMC is set up as a joint

venture between ABCL and Sun Life AMC. Company managed total AUM of

₹2,93,642 crores under the suite of mutual fund (excluding our domestic FoFs),

portfolio management services, offshore and real estate offerings, as of June 30,

2021. The company managed 135 schemes comprising 35 equity, 93 debt, 2

liquid schemes, 5 ETFs, and 6 domestics FoFs as of December 31, 2020.

Issue details

The issue comprises of OFS of upto `2,768.26 crore and no Fresh issue

Pre and post IPO shareholding pattern

No of shares

(Pre-issue)

%

(Post-issue)

%

Promoter

288,000,000

100.0

249,120,000

86.5

Public

0

0.0

38,880,000

13.5

Total

288,000,000

100.0

288,000,000

100.0

Source: Company, Angel Research & RHP.

Objectives of the Offer

Carry out the Offer for Sale of up to 38,880,000 Equity Shares by the

Selling Shareholders.

Achieve the benefits of listing the Equity Shares on the Stock Exchanges

and General corporate purposes.

Key Management Personnel

Kumar Mangalam Birla is the Non-Executive Chairman of the Company. He is

also the chairman of the Aditya Birla group and the chairman on the boards of key

group companies in India and globally.

Ajay Srinivasan is a Non-Executive Director of the Company with over three

decades of experience in financial services and has been on the Board of the

Company since August 2, 2007. He has experience in leadership positions

with financial institutions having operations in India and internationally such as

Prudential ICICI AMC and Prudential Corporation Asia.

Sandeep Asthana is a Non-Executive Director of the Company and has been

on the Board of our Company since April 27, 2011. He holds a bachelor’s

degree in chemical engineering from Indian Institute of Technology. His

experience covers leadership roles in Reinsurance Group of America (RGA Re),

Unit Trust of India (UTI) and Zurich Risk Management Services (India) Private

Limited.

A Balasubramanian is the Managing Director and Chief Executive Officer of

the Company and has been associated as an employee of the Company since

1994. He has completed advanced management programs from Indian

Institute of Management, Bangalore and Harvard Business School. He also

holds a bachelor’s degree in science (mathematics) and a master’s degree in

business administration from GlobalNxt University.

Aditya Birla AMC | IPO Note

Sep 28, 2021

3

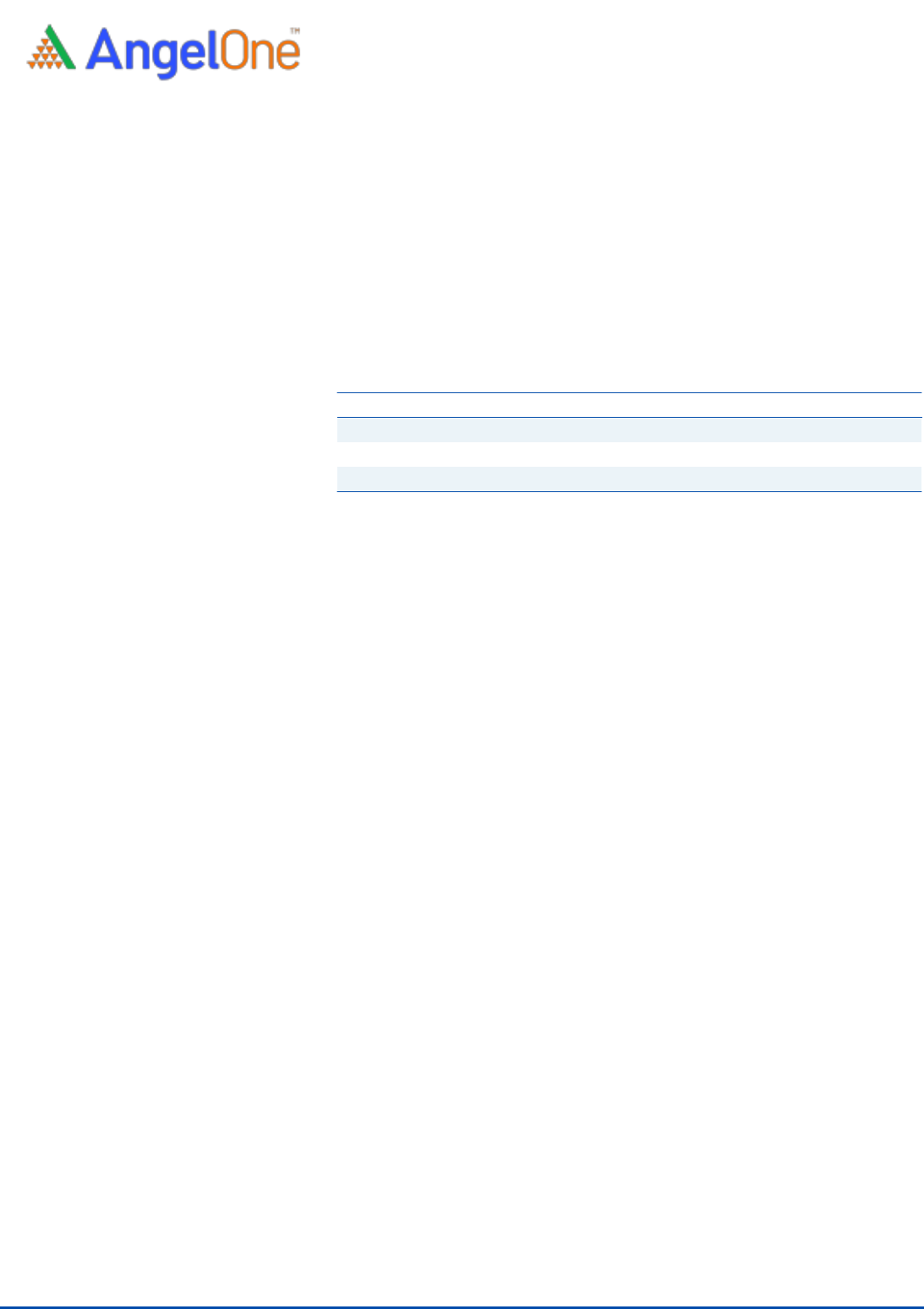

Exhibit 1: Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2019

FY2020

FY2021

Q1FY2022

Total Revenue From Operation

1,406.1

1,233.8

1,191.0

333.2

% chg

-

-12.2

-3.5

29.9

Total Expenditure

723.3

532.1

467.0

120.0

Fees and commission expense

143.5

75.0

47.0

6.2

Employee benefit expense

277.5

242.0

240.7

68.9

Other expense

302.3

215.0

179.2

44.9

EBITDA

682.7

701.8

724.1

213.2

% chg

-

2.8

3.2

55.6

(% of Net Sales)

48.6

56.9

60.8

64.0

Depreciation& Amortisation

32.4

36.5

37.4

9.0

EBIT

650.3

665.2

686.6

204.2

% chg

-

2.3

3.2

60.2

(% of Net Sales)

46.3

53.9

57.7

61.3

Finance costs

5.7

5.4

5.6

1.3

Other income

1.2

0.9

14.8

3.0

(% of Sales)

0.1

0.1

1.2

0.9

Recurring PBT

645.8

660.7

695.9

205.9

% chg

-

2.3

5.3

58.2

Exceptional item

-

-

-

-

Tax

199.0

166.3

169.6

50.9

PAT (reported)

446.8

494.4

526.3

154.9

% chg

-

10.7

6.4

59.2

(% of Net Sales)

31.8

40.1

44.2

46.5

Basic & Fully Diluted EPS (Rs)

15.5

17.2

18.3

-

Source: Company, Angel Research

Aditya Birla AMC | IPO Note

Sep 28, 2021

4

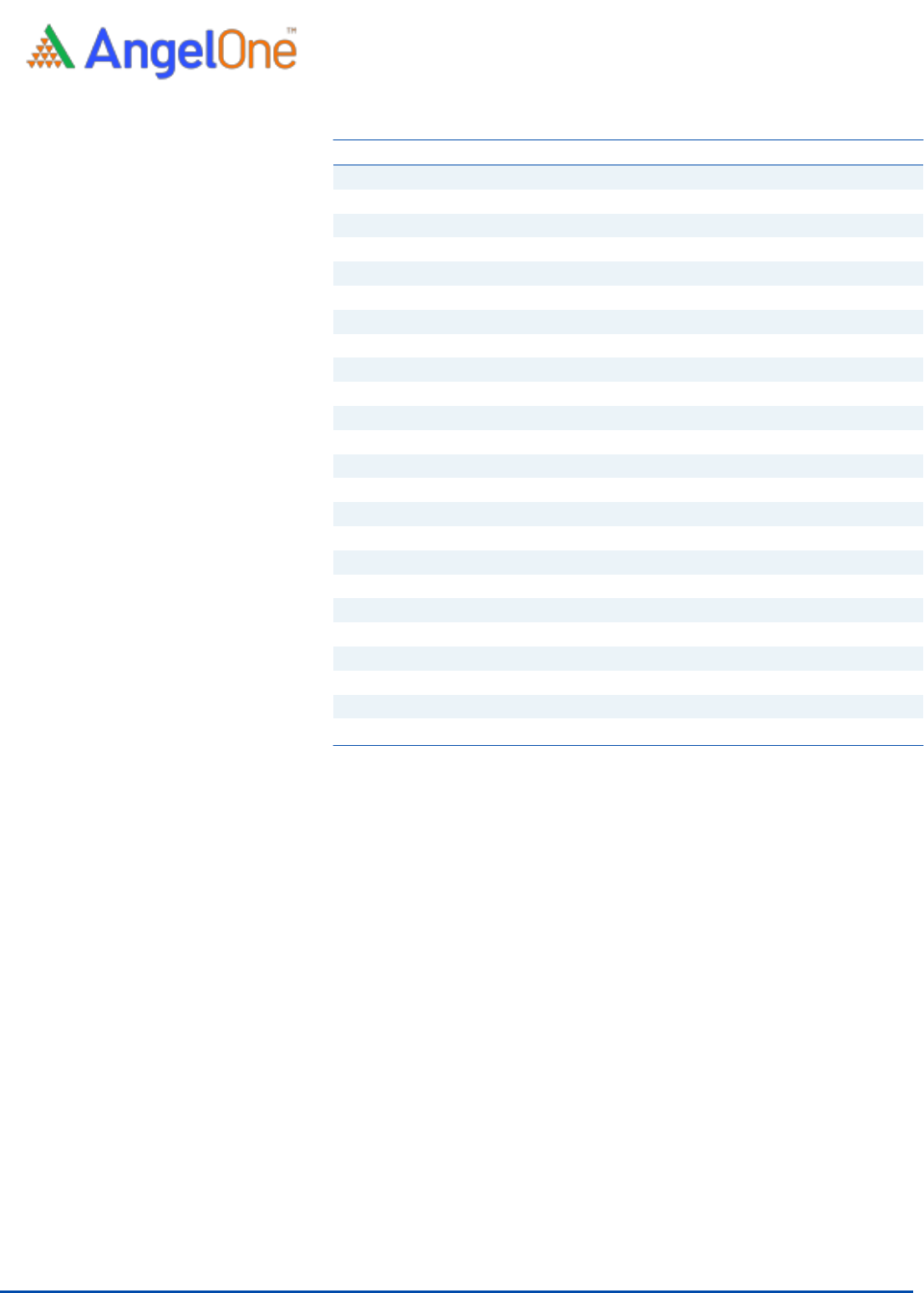

Exhibit 2: Consolidated Balance Sheet

Y/E March (` cr)

FY2019

FY2020

FY2021

Q1FY2022

SOURCES OF FUNDS

Equity Share Capital

18.0

18.0

18.0

144.0

Other equity (Retained Earning)

1,202.6

1,298.9

1,686.6

1,658.2

Shareholders’ Funds

1,220.6

1,316.9

1,704.6

1,802.2

Total Loans

-

-

-

-

Other liabilities

125.5

109.0

105.9

102.2

Total Liabilities

1,346.0

1,425.9

1,810.5

1,904.3

APPLICATION OF FUNDS

Property, plant and equipment

20.5

19.1

12.2

10.5

Right of use assets

64.6

54.7

51.6

49.1

Intangible assets under development

1.1

0.8

1.0

0.8

Other intangible assets

9.5

12.4

13.3

12.4

Current Assets

1,246.7

1,391.2

1,850.2

1,949.3

Cash and cash equivalents

38.2

46.6

56.5

52.0

Bank balances other than (a) above

0.3

0.3

0.3

0.3

Trade receivables

25.7

40.5

31.0

25.7

Loans

0.1

0.1

0.0

0.0

Investments

1,138.1

1,263.4

1,726.3

1,852.1

Other financial assets

28.5

12.9

19.2

12.7

Current tax assets (net)

16.0

27.4

16.9

6.4

Current Liability

152.4

146.1

174.0

181.6

Net Current Assets

1,094.3

1,245.1

1,676.1

1,767.7

Other Non-Current Asset

156.0

93.7

56.3

63.8

Total Assets

1,346.0

1,425.9

1,810.5

1,904.3

Source: Company, Angel Research

Aditya Birla AMC | IPO Note

Sep 28, 2021

5

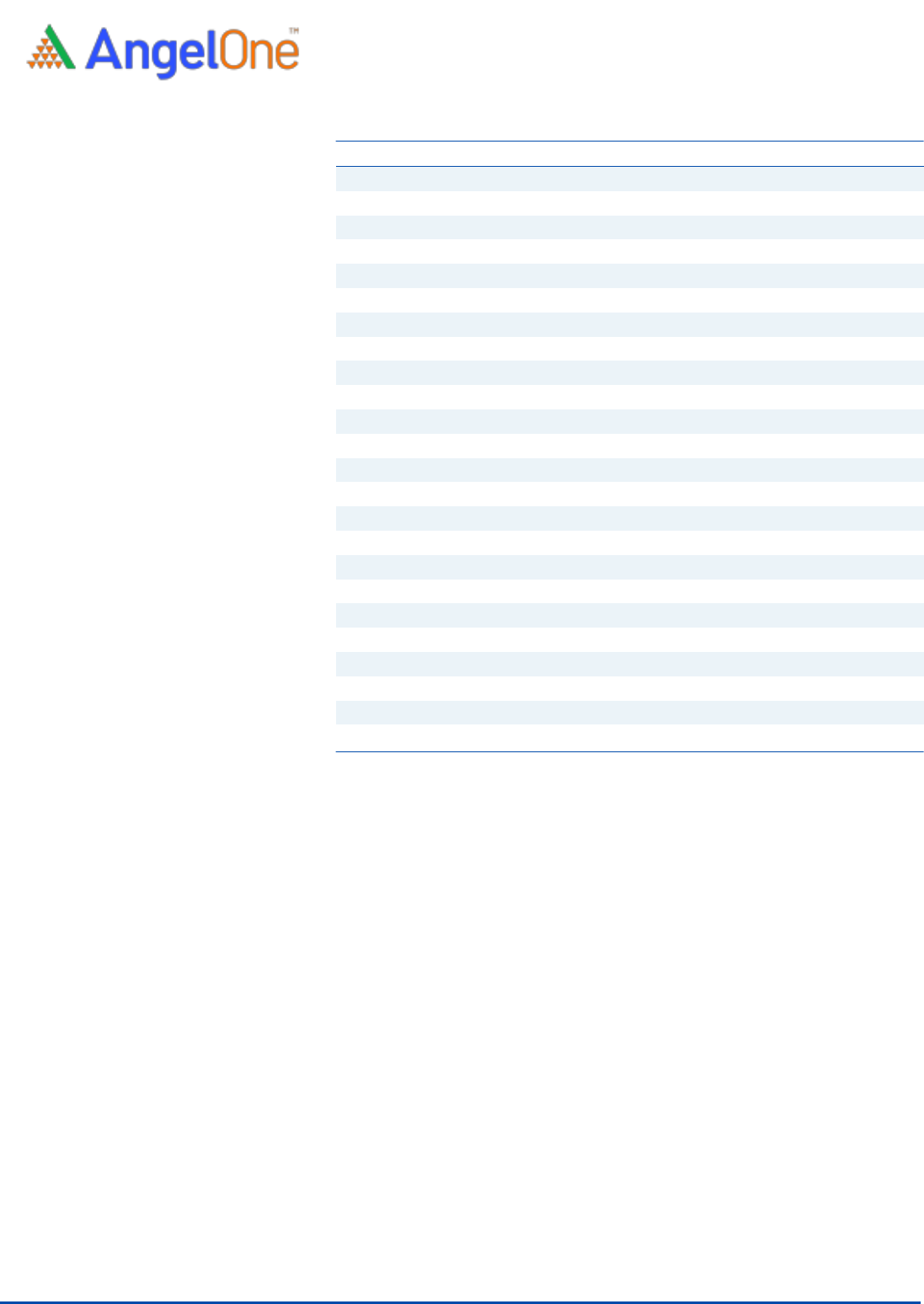

Exhibit 3: Consolidated Cash flows

Y/E March (` cr)

FY2019

FY2020

FY2021

Q1FY2022

Operating profit

600.7

629.9

601.9

196.0

Net changes in working capital

-57.1

37.4

61.4

8.7

Cash generated from operations

543.6

667.4

663.2

204.8

Direct taxes paid (net of refunds)

-228.2

-170.4

-151.0

-38.2

Net cash flow Operating

315.3

497.0

512.3

166.6

Purchase of Investments

-1,885.4

-1,053.6

-2,039.7

-604.7

Sale of Investments

1,967.3

1,002.5

1,702.0

509.0

Others

-19.5

-15.0

-2.1

1.4

Cash Flow from Investing

62.4

-66.1

-339.8

-94.3

Final / Interim Dividend Paid

-360.6

-397.8

-140.0

-70.6

Lease Liability - Interest portion

-5.7

-5.4

-5.6

-1.3

Lease Liability - Principal portion

-17.3

-19.3

-16.9

-4.9

Cash Flow from Financing

-383.6

-422.5

-162.5

-76.8

Inc./(Dec.) in Cash

-5.8

8.4

9.9

-4.5

Opening Cash balances

44.0

38.2

46.6

56.5

Closing Cash balances

38.2

46.6

56.5

52.0

Source: Company, Angel Research

Key Ratios

Y/E March

FY2019

FY2020

FY2021

Valuation Ratio (x)

P/E (on FDEPS)

45.9

41.5

39.0

P/CEPS

42.8

38.6

36.4

P/BV

16.8

15.6

12.0

Market Cap/Avg. AUM (%)

8.0

9.5

7.6

Per Share Data (Rs)

EPS (Basic)

15.5

17.2

18.3

EPS (fully diluted)

15.5

17.2

18.3

Cash EPS

16.6

18.4

19.6

Book Value

42.4

45.7

59.2

Returns (%)

ROE

36.6

37.5

30.9

ROCE

48.3

46.7

37.9

Other Ratios (x)

Revenue/Avg. AUM (%)

0.56

0.52

0.49

PAT/Avg. AUM (%)

0.18

0.21

0.22

Source: Company, Angel Research

Aditya Birla AMC | IPO Note

Sep 28, 2021

6

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.