Initiating Coverage | Infrastructure

December 16, 2011

ASHOKA BUILDCON

BUY

CMP

`189

At the crossroads

Target Price

`245

Ashoka Buildcon (ABL), traditionally a state player, has transformed into a

Investment Period

12 Months

national player by winning four NHAI projects totaling to a TPC of ~`5,156cr.

However, this transition has come at a cost, as it entails premium commitments to

Stock Info

NHAI (~`220cr per year, albeit covered by toll collections during the construction

Sector

Infrastructure

period) and huge equity contributions from ABL’s side, which we believe would

Market Cap (` cr)

994

stretch its leverage (consolidated net D/E is expected to rise from 1.4x in FY2011

Beta

0.4

to 3.0x by FY2013E). We have valued ABL on an SOTP basis - by assigning 5.0x

EV/EBITDA to its standalone business (`104/share) and valued its BOT projects on

52 Week High / Low

312/180

NPV basis (`141/share). We initiate coverage with a Buy rating on the stock and

Avg. Daily Volume

2,134

a SOTP target price of `245/share and key catalyst being raising equity from

Face Value (`)

10

capital markets.

BSE Sensex

15,476

Integrated business model: ABL boasts of an integrated business model in place

Nifty

4,652

with strong in-house execution capabilities, which helps it to have control over

Reuters Code

ABDL.BO

time and cost - the two key essentials of road development business. In the past,

Bloomberg Code

ASBL@IN

many industry players have witnessed severe strain on the financials and

profitability of their projects because of their inability to control these important

factors. Even in current times, there are developers who do not have an integrated

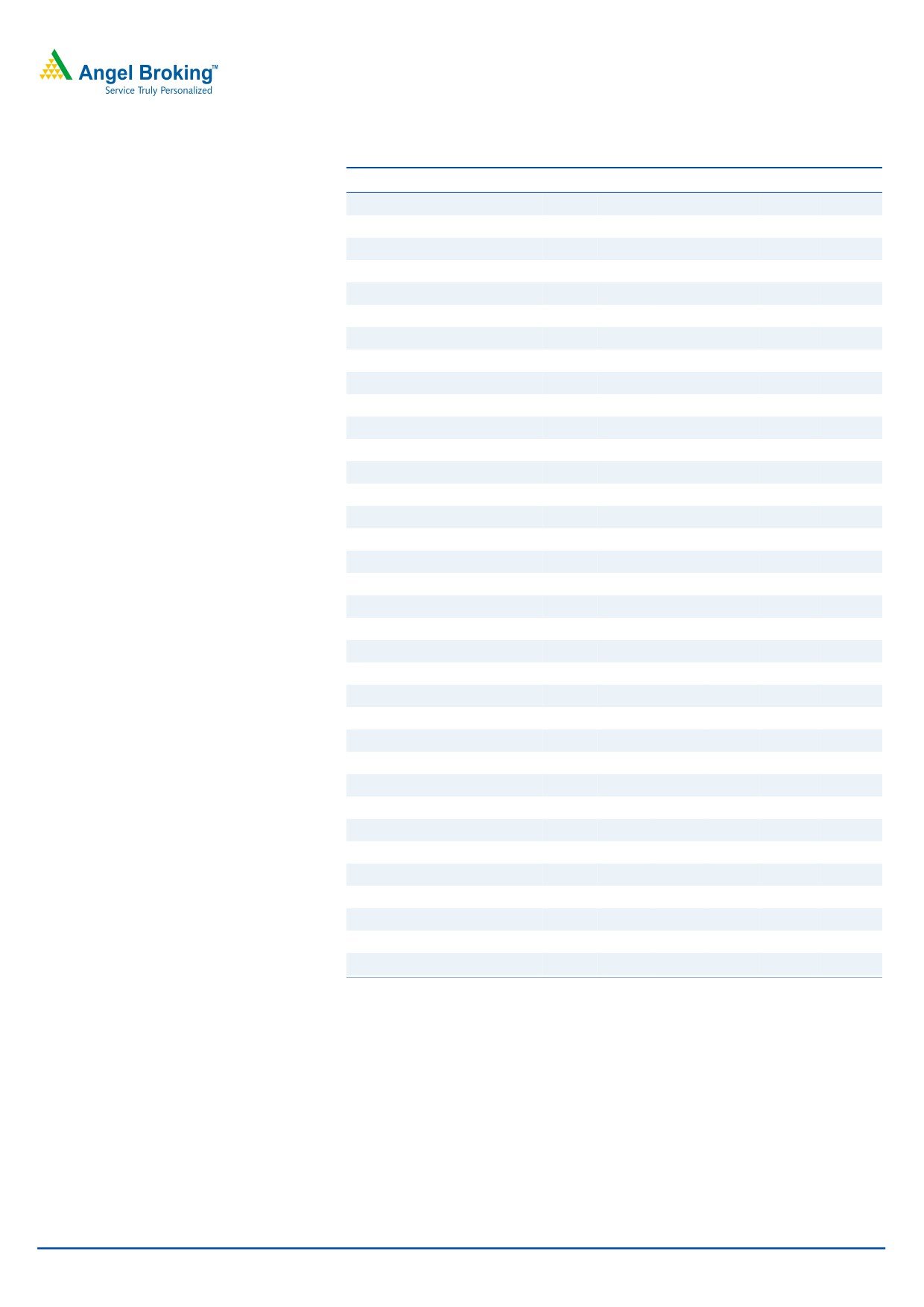

Shareholding Pattern (%)

business model and are dependent on contractors for construction activities,

Promoters

73.2

making them vulnerable. Hence, we believe players (read ABL) having an

MF / Banks / Indian Fls

23.7

integrated business model are better placed.

FII / NRIs / OCBs

1.6

Road sector; opportunities galore: NHAI has set itself an aggressive target of

Indian Public / Others

1.5

awarding ~9,371km of road projects in FY2012 against ~5,000km in FY2011.

NHAI has done a commendable job by handing out ~4,000km so far in FY2012.

Going ahead, NHAI, state and rural projects are expected to garner investments

Abs. (%)

3m

1yr

3yr

of `6.1trillion over FY2012-16E, which augurs well for road developers.

Sensex

(8.5)

(22.0)

55.3

Prefer IRB over ABL in the Road BOT space: We initiate coverage on ABL with a

ABL

(28.1)

(34.4)

#

Buy rating and a SOTP target price of `245. Our analysis indicates that ABL

Note: # listed in Oct 2010

would need to infuse equity up to ~`990cr (FY2012-14E) in various SPVs; this

would be substantially funded by the PE route, as per management. However, we

have not factored the same in our estimates, given the gloomy market conditions;

instead, we have penciled in the increase in debt levels. In recent times, markets

have been harsh on companies with loose financial discipline and, hence, we are

conservative in assigning trading multiples to ABL. Therefore, we prefer IRB over

ABL, considering ABL’s comparatively smaller size, dependency on capital

markets for equity and projects at nascent stage.

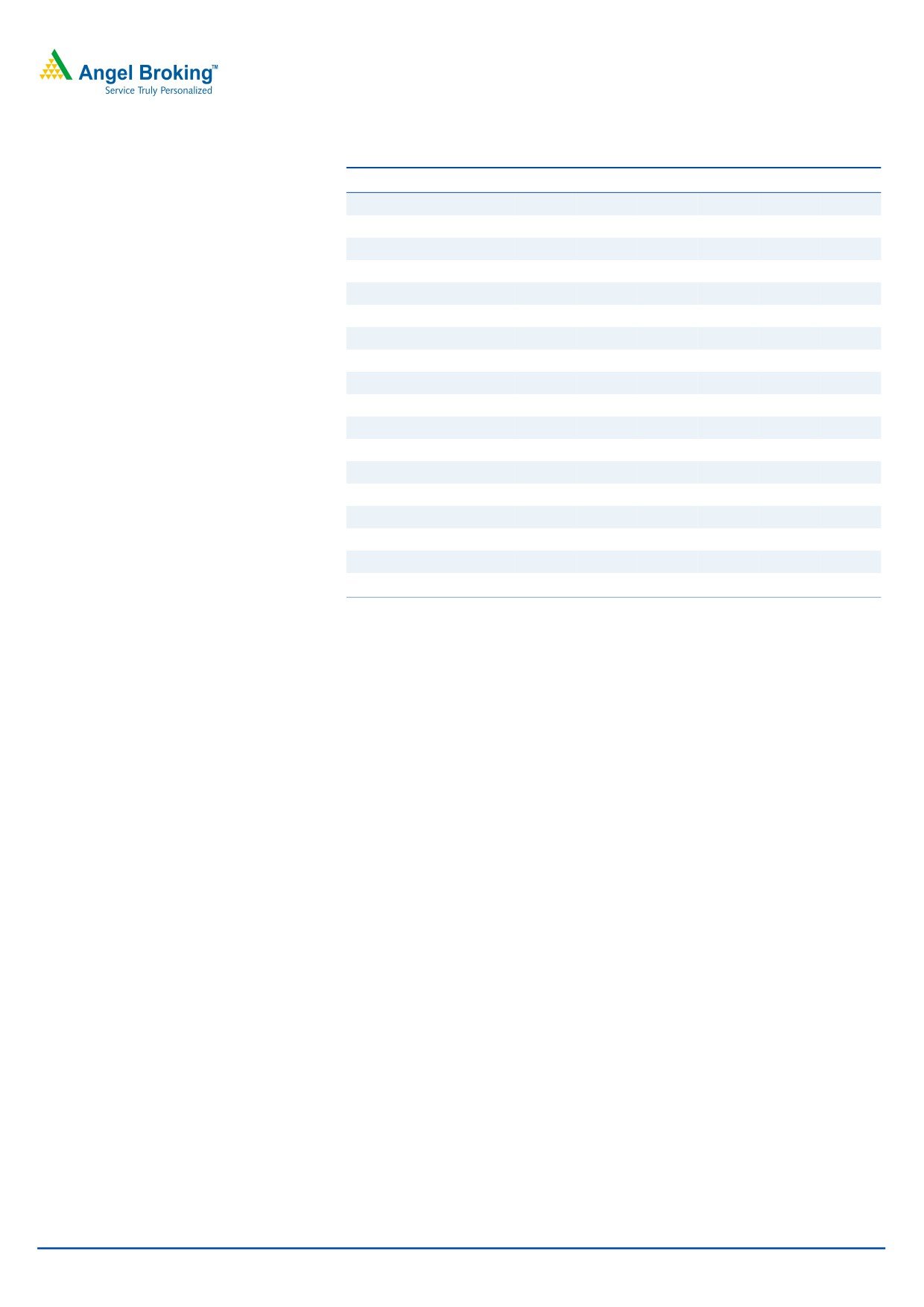

Key financials (Consolidated)

Y/E March (` cr)

FY2010

FY2011 FY2012E

FY2013E

Net Sales (incl op. income)

796

1,302

1,627

1,831

% chg

53.5

63.7

25.0

12.5

Adj. Net Profit

80.4

100.8

110.7

130.2

% chg

130.8

25.5

9.8

17.6

FDEPS (`)

15.3

19.2

21.0

24.7

EBITDA Margin (%)

26.9

19.4

21.7

23.1

Shailesh Kanani

P/E (x)

12.4

9.9

9.0

7.6

022-39357800 Ext: 6829

RoAE (%)

21.2

14.9

11.7

12.2

RoACE (%)

10.7

9.3

8.5

7.5

P/BV (x)

2.2

1.1

1.0

0.9

Nitin Arora

EV/Sales (x)

2.6

1.7

1.9

2.4

022-39357800 Ext: 6842

EV/EBITDA (x)

9.5

8.8

8.8

10.3

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Initiating Coverage | Infrastructure

Investment arguments

Integrated business model

We believe the BOT business has three most important aspects, namely:

1) Project planning; 2) C&EPC activities; and 3) Post construction activities (O&M).

1) Project planning (PP): Given the back-ended nature of cash flows from

ABL’s long stint in the road BOT

BOT assets, reliable assessment of future traffic growth, cost estimates etc

business has helped it to gain rich

become pertinent. Over the course of more than 15 years in toll-based

experience - strengthening its ability to

BOT projects, ABL has developed an in-house traffic study team, which

accurately plan for BOT projects.

has the dual responsibility of conducting pre-bidding traffic surveys and

monitoring toll collections. This process has helped ABL’s team in gaining

experience - by comparing the actual performance with the forecasted

traffic numbers. Therefore, we believe this experience strengthens its

ability to plan accurately for future BOT projects.

ABL has its own construction equipment

2) C&EPC activities: The company’s EPC division, with its experienced team

and in-house RMC and bitumen

of engineers and skilled workmen and its fleet of construction equipment,

division.

constructs and maintains the projects - leading to control over time and

cost. ABL’s in-house RMC and bitumen division manufactures and

supplies concrete and bitumen - leading to better operating margins.

ABL utilizes its own toll collection audit

3) Post construction activities: Once the projects are operational, the main

system to minimize the chance of cash

source of revenue, toll collection, is received in cash. There are numerous

pilferages and the in-house construction

surveys and papers on this subject, indicating cash pilferage of ~10% in

team ensures smooth O&M throughout

toll collections. To seal this loophole, ABL utilizes its own toll collection

the life of the project.

audit system, which includes cameras installed at toll booths and own

proprietary software. The system enables to monitor toll collection on a

real-time basis. Also, having an in-house construction team ensures

smooth operations and maintenance (O&M) throughout the project’s life.

Exhibit 1: ABL and IRB - Both have an integrated business model covering major pivotal points of road projects

Life cycle of a road project

PP

LoA

FC

Designing

Construction

Operation

Revenue stream for ABL

Y

n.a.

N

Y

Y

Y

Revenue stream for IRB

Y

n.a.

N

Y

Y

Y

Revenue stream for ITNL

Y

n.a.

Y

Y

N

Y

Revenue stream for other operators

N

n.a.

N

N

Y

Y

Source: Company, Angel Research

ABL’s integrated structure allows to

This integrated business model ensures the timely completion of projects, reduces

capture the entire value in the BOT

its reliance on subcontractors and controls costs. In the past, many industry players

development business, including EPC

have witnessed severe strain on the financials and profitability of their projects

margins, developer returns and

because of their inability to control these important factors. Even in current times,

operation and maintenance margins.

there are developers who do not have an integrated business model and are

dependent on contractors for construction activities, thus making them vulnerable.

December 16, 2011

2

Initiating Coverage | Infrastructure

Completed Projects

Date of completion

ABL has been able to timely execute its projects, owing to its integrated business

Scheduled

Actual

model (as depicted in the table). Further, it results in extended period of toll

collection, which in turn helps in increasing overall revenue. It also allows

Dewas Bypass

Jul-04 May-04

capturing the entire value in the BOT development business, including EPC

Wainganga Bridge

May-01 Mar-01

margins, developer returns and operation and maintenance margins. Hence, we

Nashirabad RoB

Nov-00 Jul-00

believe players such as ABL, having an integrated business model, are better

Sheri Nallah Bridge

Mar-01 Nov-00

placed in current competitive times.

Anawali-Kasegaon

Jul-04 Mar-04

Road sector - Opportunities galore

The road segment continues to offer plenty of opportunities for road concentrated

NHAI is yet to award 21,117km of the

players such as ABL. Of the 49,254km (refer exhibit below) of the planned NH

planned 49,254km NH, ~7,000km of

under the National Highways Development Project (NHDP), the NHAI is still left

which is likely to be awarded in FY2012

with ~21,117km (refer exhibit below) that has to be awarded. NHAI has set itself

itself.

an aggressive target of awarding ~9,371km (originally 7,300km + 2,071km

added after the PM’s intervention) of road projects in FY2012 against ~5,000km

awarded in FY2011. NHAI has done a commendable job by handing out

~4,000km so far in the current fiscal and is looking on track to achieve over

~7,000km of project awarding in FY2012. Going ahead, even state highways

provide significant opportunities to players. Also, on the anvil, there are plans to

build 18,367km of expressways by 2022 in three phases. Around 1,000km of

expressway is expected to be completed over the next five years, representing an

opportunity of ~`203bn (average capex per km is ~`20cr). The government has

Apart from NH, state highways,

also identified nine mega projects with length ranging from 390km to 700km.

expressways and mega projects provide

Over the next five years, an investment of ~`423bn is expected to flow into mega

a number of opportunities to companies

projects. In all, these initiatives would provide immense opportunity (`6.1trillion

in road infrastructure development.

over FY2012-16E) to companies in road infrastructure development, such as IRB,

ITNL and ABL who have a proven track record and the ability to manage large

projects.

Exhibit 2: Huge opportunities from NHAI

Total 4/6 Laned

Under implementation Balance for award

(km)

(km)

(km) Contracts (No)

(km)

GQ

5,846

5,829

17

8

-

NS and EW corridors

7,142

5,831

891

80

420

Port connectivity

380

330

50

4

-

Other NHs

1,390

945

425

6

20

SARDP-NE

388

-

112

2

276

NHDP phase

III

12,109

2,617

6,112

82

3,380

IV

14,799

-

1,744

11

13,055

V

6,500

655

2,538

20

3,307

VII

700

-

41

2

659

Total

49,254

16,207

11,930

215

21,117

Source: NHAI, Angel Research, Note: As on 30th Sept. 2011

December 16, 2011

3

Initiating Coverage | Infrastructure

Positive developments at NHAI’s end…

Steps such as annual qualification of

NHAI has taken several steps (plans to enact more) to enhance transparency in the

players and e-tendering of projects

working style of the agency. It has introduced annual pre-qualification for bidders,

along with plans to implement e-tolling

as against the earlier each-project basis, which we believe is not only logical and

bring forth increased transparency and

economical but would also lead to shortening of the time cycle (by 2-3 months) in

enhance participation in the sector.

awarding projects. Further, it has initiated e-tendering of projects and intends to

implement e-toll collection going ahead. We believe these changes are taking the

sector forward in the right direction and would lead to greater transparency and

cost savings.

…but intense competition plays the spoil sport for contractors

During the last few quarters, players in the road segment are witnessing enhanced

competition due to scarcity of order inflow across sectors (except road), as evident

from the huge difference in the bidding amount of players and the all-time high

participation of players (refer Exhibit 3).

Exhibit 3: Aggressive bidding was witnessed during the last few months

Project

Length

TPC

Winner

Premium/(Grant)

Diff No of pre-qualified

(Km)

(` cr)

L1 (` cr)

L2 (` cr)

(%)

bidders

A'bad Vadodara

102.0

2,125

IRB

310.0

191.7

61.7

22

Beawer Pali Pindwara

244.0

2,388

L&T

251.0

225.0

11.6

19

Krishangarh A'bad

556.0

5,387

GMR

636.0

516.0

23.3

11

Kota Jhalawar

88.0

530

Keti Const.

3.5

3.4

3.2

41

Barwa Adda Panagarh

123.0

1,665

DSC

106.0

67.9

56.1

20

Source: NHAI, Angel Research

…however some rationality is finally coming to fore

We believe competition in the road

However, recent bid results throw a mixed picture (refer exhibit below), as few bids

segment is here to stay; but considering

witnessed sensible bidding. As shown in the table below, the difference between L1

the tough liquidity environment, better

and L2 has narrowed down significantly in some cases. We believe this

financial discipline on the bidding front

moderation is due to the tight liquidity situation and projects facing difficulty in

from players is also expected.

achieving financial closure, as banks are getting skeptical in lending to

aggressively won projects. However, NHAI is emerging as the winner in this highly

competitive environment, with bidders offering a premium much higher than

NHAI’s expectations. We believe competition is here to stay, considering the

general slowdown in the economy and lack of opportunities in other segments.

However, considering the tough liquidity environment, better financial discipline on

the bidding front from players is also expected.

December 16, 2011

4

Initiating Coverage | Infrastructure

Exhibit 4: Bidding trend in recently awarded road projects

Project

Length

TPC

Winner

Premium/(Grant)

Diff.

No of pre-qualified

(Km)

(` cr)

L1 (` cr)

L2 (` cr)

(%)

bidders

Raipur Bilaspur

126.0

1,220

IVRCL

45.5

43.0

5.7

33

Mah/KNT-Sangareddy

145.0

1,273

L&T

80.0

75.1

6.6

37

Agra Etawah

125.0

1,207

Ramky

128.1

121.9

5.1

33

Bakhtiyarpur Khagaria

113.0

1,635

Essar/KNR

(537.0)

(568.0)

5.5

27

Cuttack Angul

112.0

1,124

Ashoka

61.1

51.2

19.3

27

Hospet Chitradurga

120.0

1,045

Ramky

63.0

45.0

40.0

37

Etawah Chakeri

160.0

1,573

Oriental

91.9

68.1

34.9

35

Rampur Kathgodam

93.0

790

Era

34.0

5.4

529.6

24

Source: NHAI, Angel Research

Prefer IRB over ABL in the road BOT space

We initiate coverage on ABL with a Buy rating and a SOTP target price of `245:

The stock has recently corrected by ~20%; and on a YTD basis, the correction has

been ~38%. The decline in the stock price can mainly be attributed to 1) the

general weakness in stock markets; 2) negatives surrounding the infrastructure

sector; and 3) ABL’s deterioration in leverage position and expectations of the

trend to continue (with the recent Cuttack Angul project win).

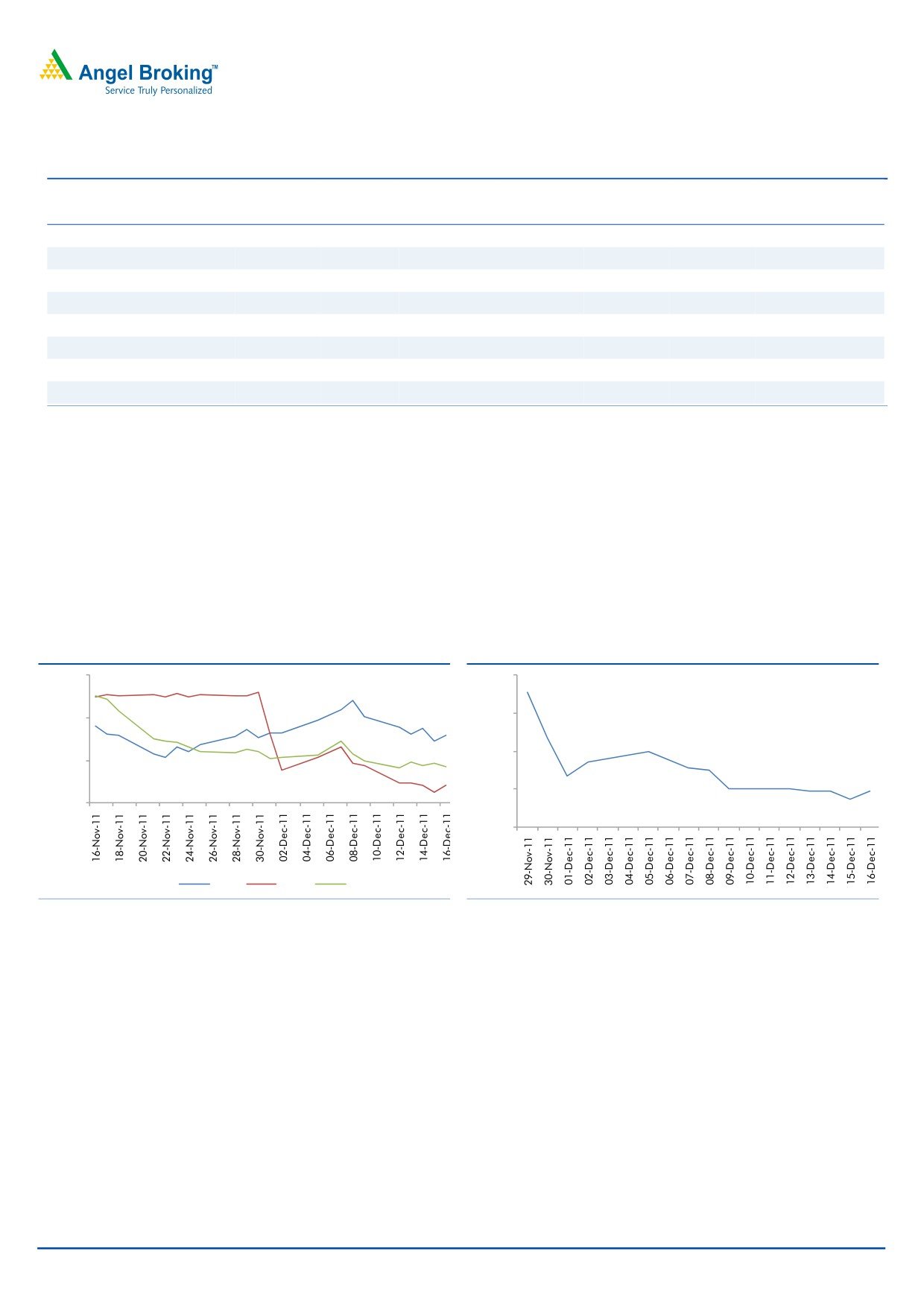

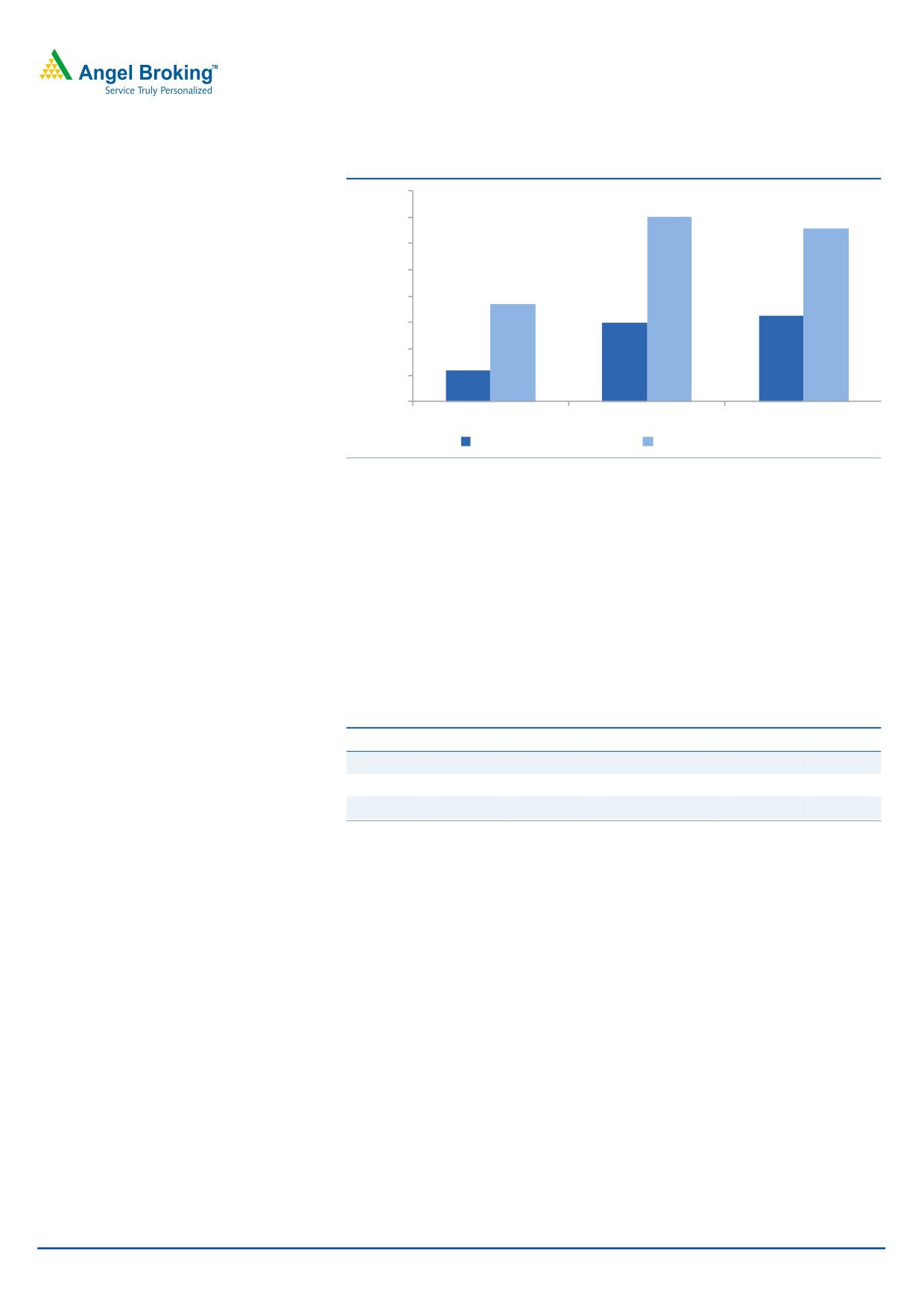

Exhibit 5: Share price movement over the last one

Exhibit 6: Decline in ABL’s share price post winning the

month - Indicates IRB’s outperformance

`1,124cr Cuttack Angul project (`)

105.0

250.0

230.0

95.0

210.0

85.0

190.0

75.0

170.0

IRB

ABL

ITNL

Source: Company, Angel Research

Source: Company, Angel Research

ABL, traditionally a state player, has transformed into a national player by winning

Our analysis indicates that ABL is in

four NHAI projects totaling to a TPC of ~`5,156cr. However, this transition has

need of

~`990cr of equity during

come at a cost, as it entails premium commitments to NHAI (~`220cr per year,

FY12012-14E, which would increase its

albeit covered by toll collections during the construction period) and huge equity

dependence on capital markets.

contributions from ABL’s side. We have analyzed the equity requirement for ABL

over FY2012-14E on the basis of its current portfolio. Our analysis indicates that

ABL is in need of ~`990cr of equity during the same period (as shown in the table

below), which would increase its dependence on capital markets for the same.

In recent times, markets have been harsh on companies with loose financial

discipline and we, therefore, remain conservative in assigning higher trading

multiples to ABL until the time its funding is tied up.

December 16, 2011

5

Initiating Coverage | Infrastructure

Equity requirement of ~`9.9bn - we expect balance sheet to stretch

Management has guided that the PE

As far as funding of equity is concerned, ABL has three sources: 1) internal

route would substantially fund the

accruals, 2) dilution of stake at the SPV level and 3) debt raising at Parent

equity requirement. However, we have

level/refinancing of existing operational projects.

not factored the same in our estimates,

Internal accruals: Internal sources include cash flow from the C&EPC segment and

given the gloomy market conditions;

toll collection. We believe ABL’s C&EPC segment would be able to generate cash

instead, we have penciled in the

flow of ~`209cr over FY2012-14E and the BOT segment would be able to garner

increase in debt levels.

~`400cr over the same period.

Dilution of stake at the SPV level: As per management, ABL is looking to dilute

stake at the SPV level to raise funds worth `700cr-750cr. However, given the

current gloomy market conditions, we believe that PE money would be hard to

come by and, hence, we are reluctant to factor in the same. Also, the recently won

projects are won with high premium commitments towards NHAI; this makes

things tougher by raising a question mark over the profitability of these projects.

Debt raising at Parent level/refinancing of existing operational projects: We are

factoring in the increase of debt at the parent level to fulfill its ~50% of investment

commitments (as shown in the table below); and, thereby, we see further

deterioration in its balance sheet - consolidated net D/E is expected to rise from

1.4x in FY2011 to 3.0x by FY2013E. ABL also has an option to refinance

operational BOT projects to meet this shortfall. This route will give cheaper access

to funds owing to stability in cash flows. In the past as well, ABL has employed this

alternative of re-leveraging to arrange for its funding requirement.

Exhibit 7: Equity requirement and funding over FY2012-14E

ABL

IRB

Projects

` cr Projects

` cr

Pimpalgaon-Nashik-Gonde

44 Pathankot-Amritsar

391

Belgaum -Dharwad

215 Jaipur-Deoli

499

Sambalpur-Baragarh

299 Talegaon Amravati

194

Dhankuni

293 Tumkur-Chitradurga

311

Cuttack Angul

140 Ahmedabad-Vadodara

753

Total

990

2,148

Funding

` cr Funding

` cr

C&EPC cash flows (FY2012E-14E)

209 C&EPC cash flows (FY2012E-14E)

812

BOT cash flows (FY2012E-14E)

400 BOT cash flows (FY2012E-14E)

500

Funding from Parent/refinancing of operational projects

445 Funding from Parent/refinancing of operational projects

250

Cash balance (FY2011 Consol.)

60 Cash balance (FY2011 Consol.)

1,200

Total

1,114 Total

2,762

Source: Company, Angel Research, Note: ITNL has an equity requirement of only ~`150cr for its projects (current portfolio)

December 16, 2011

6

Initiating Coverage | Infrastructure

Peer comparison on various parameters

Despite being a small player, we believe ABL has done a commendable job of

ramping up its portfolio (bagged four NHAI projects), which has resulted in good

revenue visibility. However, this would lead to increased leverage for the company,

as explained before.

Therefore, we prefer market leaders like IRB (CMP: `148, TP: `182) over ABL,

considering ABL’s comparatively smaller size, dependency on capital markets for

equity and major projects at nascent stage (given that average weighted age of its

portfolio is comparatively lower).

Exhibit 8: Comparison of ABL with IRB and ITNL

ABL

ITNL

IRB

ABL, traditionally a state player, has

Project comparison

transformed into a national player by

No. of projects

18

22

17

winning four NHAI projects totaling to a

Project Type

Toll

Toll + Annuity

Toll

TPC of ~`5,156cr.

Projects in more developed states

no

yes

yes

Foreign presence

no

yes

no

More diversified Portfolio (project type)

no

yes

no

Total lane km (stake adjusted)

3,709

7,026

6,579

Lane km under operation (stake adjusted)

1,204

2,979

3,270

Average weighted age of portfolio

Lane km under development (stake adjusted)

2,505

4,047

3,309

(years) indicates ABL’s portfolio is at a

TPC (stake adjusted) (` cr)

6,016

15,048

16,966

nascent stage in comparison to IRB.

Equity Commitment (` cr) For current portfolio

1,288

150

2,815

Order book

5,150

8,900

9,635

OB/Sales (x) (FY2011 EPC rev.)

5.0

5.2

5.8

Revenue collection/day (` cr) 2QFY2012

1.0

1.8

3.2

Average Weighted Age of Portfolio (years)

2.4

2.8

3.3

Financial comparison

We expect deterioration in ABL’s

Net debt/Equity (FY2013E) (x)

3.0

3.2

2.0

balance sheet - consolidated net D/E is

PE (FY2013E)

7.6

6.4

11.4

expected to rise from 1.4x in FY2011 to

P/BV (FY2013E)

0.9

1.0

1.6

3.0x by FY2013E.

EV/EBITDA (x) (FY2013E)

10.3

8.3

7.4

Source: Company, Angel Research Note: Average Weighted Age of Portfolio (years) = Age of

project x Weights, Weights= TPC of SPV/ TPC of All SPVs

December 16, 2011

7

Initiating Coverage | Infrastructure

Order book position

ABL has an order book of ~`5,150cr

ABL has an order book of ~`5,150cr, including the recently won Cuttack Angul

(5.0x FY2011 EPC revenue), which

project (5.0x FY2011 EPC revenue), which provides good revenue visibility. The

provides good revenue visibility.

road segment constitutes a major share of the order book (97.1%), while the T&D

segment contributes the rest. The stunning yoy growth of 189.3% in the company’s

order book in FY2011 came on the back of three project wins from NHAI.

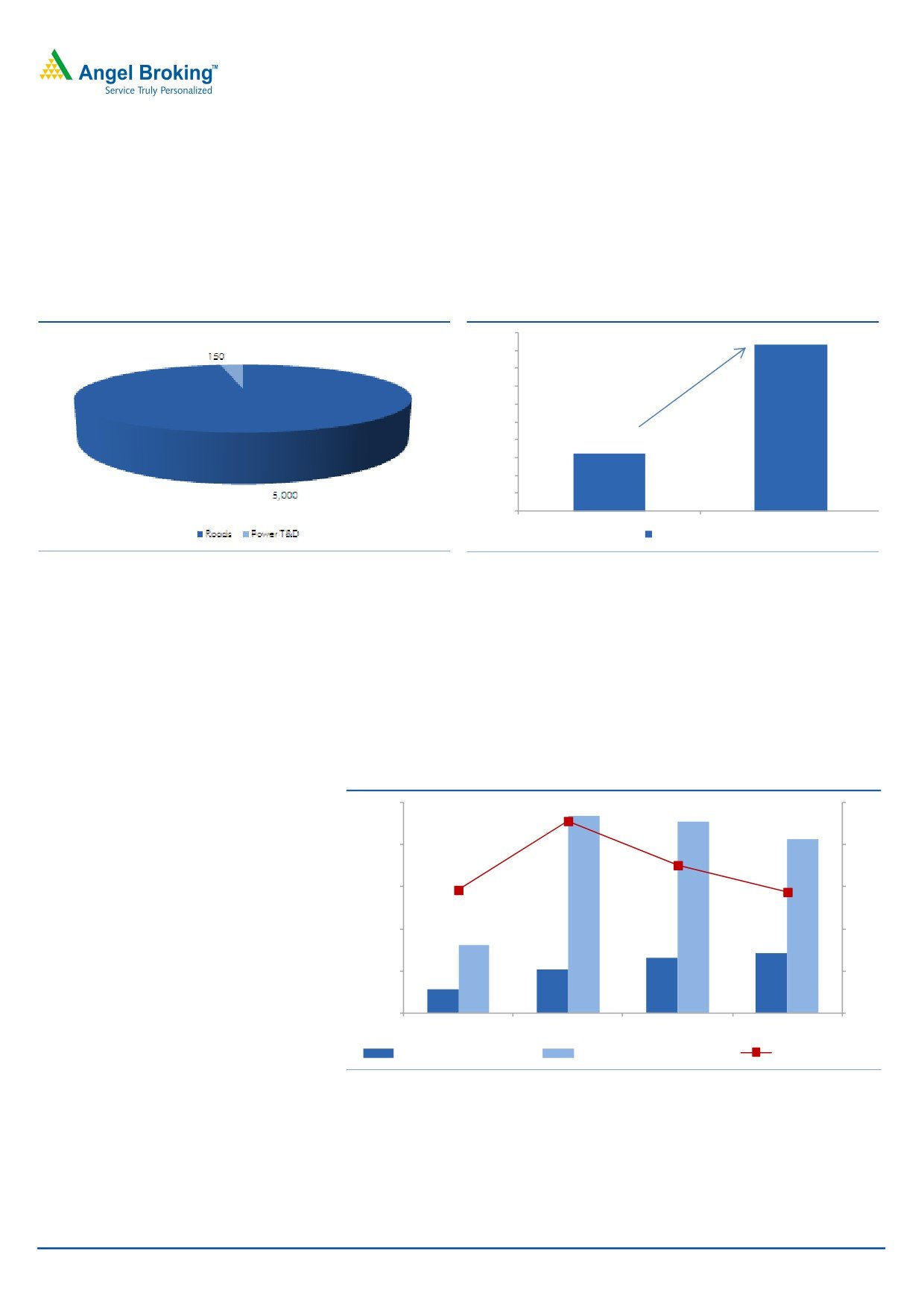

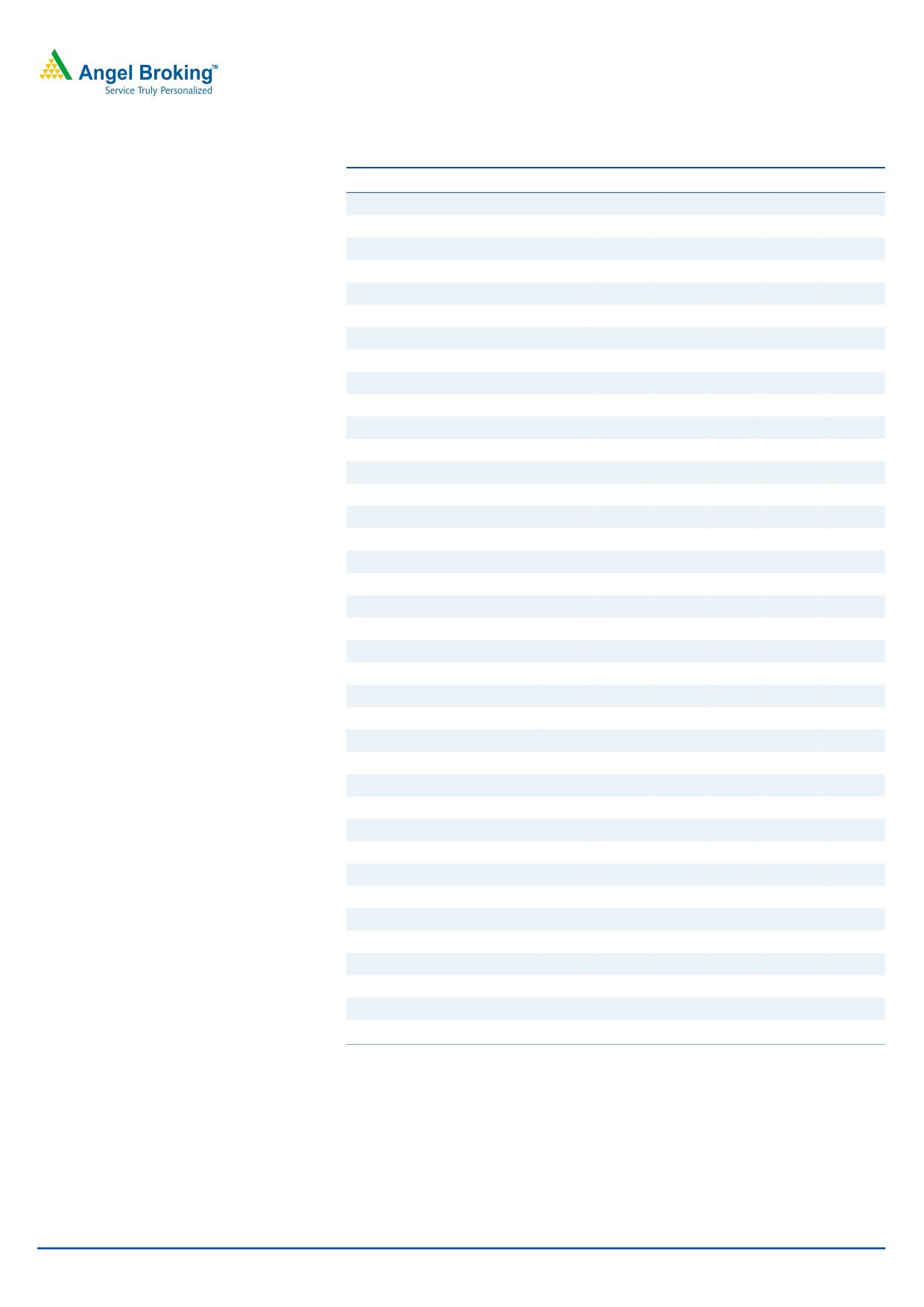

Exhibit 9: Current OB break-up (` cr)

Exhibit 10: Growth in OB due to recent project wins

5,000

4,672

4,500

4,000

3,500

3,000

2,500

2,000

1,615

1,500

1,000

500

-

FY2010

FY2011

Order book (` cr)

Source: Company, Angel Research

Source: Company, Angel Research

For FY2012 and FY2013, we are

Going ahead, we believe ABL will be more conservative while bidding, owing to:

factoring an order inflow of `1,120cr

1) strong order book in hand (`5,150cr 5.0x FY2011 C&EPC revenue) and 2)

(recently won Cuttack Angul project)

focus on arranging the equity required for the current portfolio. We have factored

and `1,000cr, respectively.

in no further order inflow for the remaining part of FY2012 and subdued order

inflow for FY2013, which would be mainly aided by the T&D segment. Therefore,

for FY2012 and FY2013, we are factoring an order inflow of `1,120cr (recently

won Cuttack Angul project) and `1,000cr, respectively.

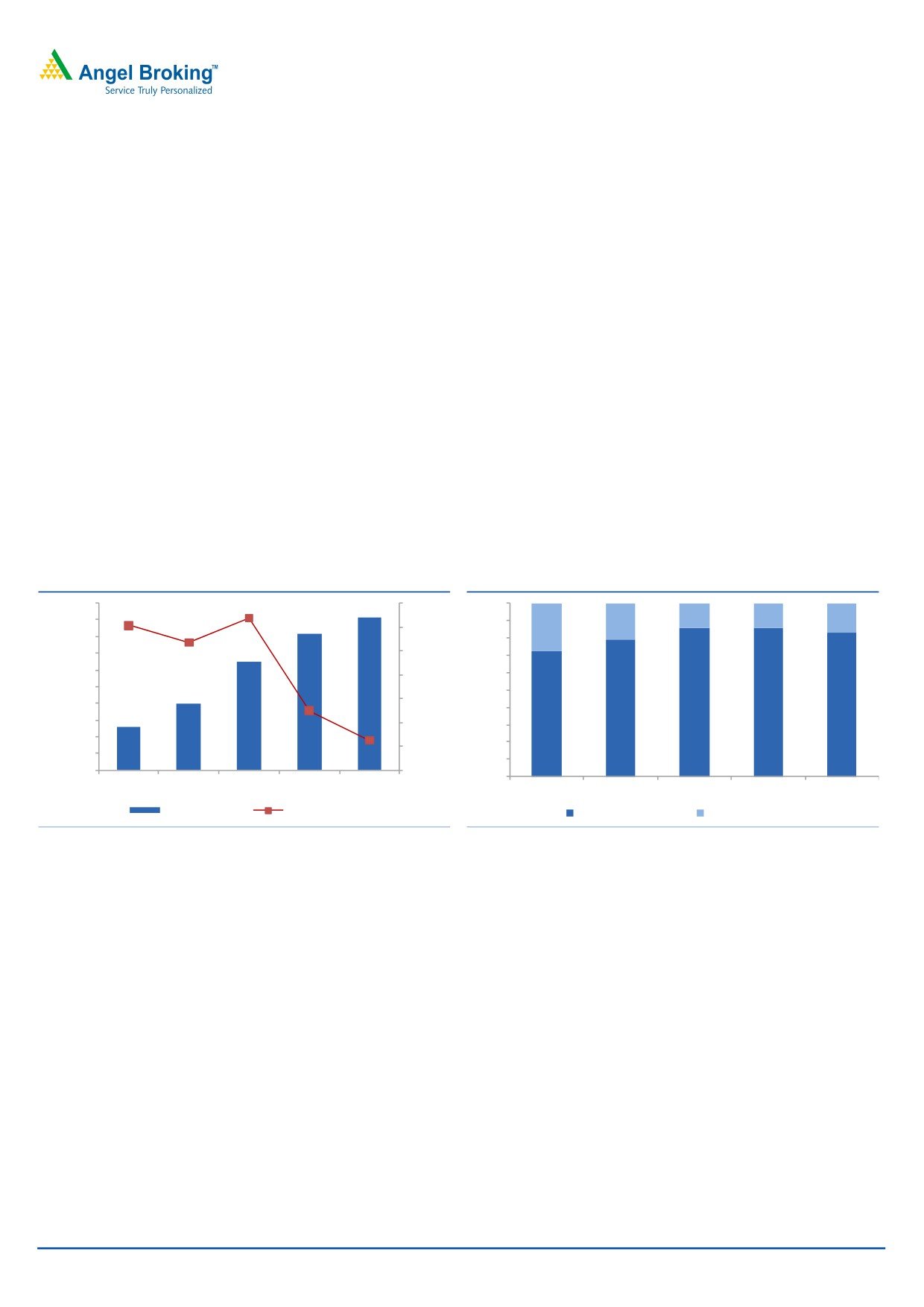

Exhibit 11: OB/Sales expected to drop due to pick-up in execution and

subdued order inflow

5,000

5.0

4.6

4,000

4.0

3.5

3,000

3.0

2.9

2.9

2,000

2.0

1,000

1.0

-

-

FY2010

FY2011

FY2012E

FY2013E

C&EPC Rev. (` cr)

Order Backlog (` cr)

OB/Sales (x)

Source: Company, Angel Research

December 16, 2011

8

Initiating Coverage | Infrastructure

Financials - Consolidated performance

Top-line growth will be driven by under construction captive BOT

projects

We expect ABL to post a CAGR of 18.6% during FY2011-13 on the top-line front

on the back of strong C&EPC order book (~`5,150cr, 5.0x FY2011 C&EPC

revenue) and addition in toll income owing to commissioning of projects.

C&EPC revenue is expected to grow yoy by 26.6% and 10.5% to `1,298cr and

`1,434cr in FY2012 and FY2013, respectively. ABL has seven projects under the

construction/development phase, which will drive its EPC revenue going ahead.

On the toll collection front, ABL is expected to post yoy growth of 25.3% and

28.3% for FY2012 and FY2013, respectively. Toll revenue will increase on the

back of completion of Jaora-Nayagaon, Pimpalgaon-Nashik-Gonde and Durg

projects. It should be noted that ABL has a different accounting policy for toll

collection of projects under construction i.e., toll collections during the construction

period net of O&M expenses would be credited to capital WIP - unlike IRB and

ITNL. Consequently, we have incorporated the same while estimating toll revenue.

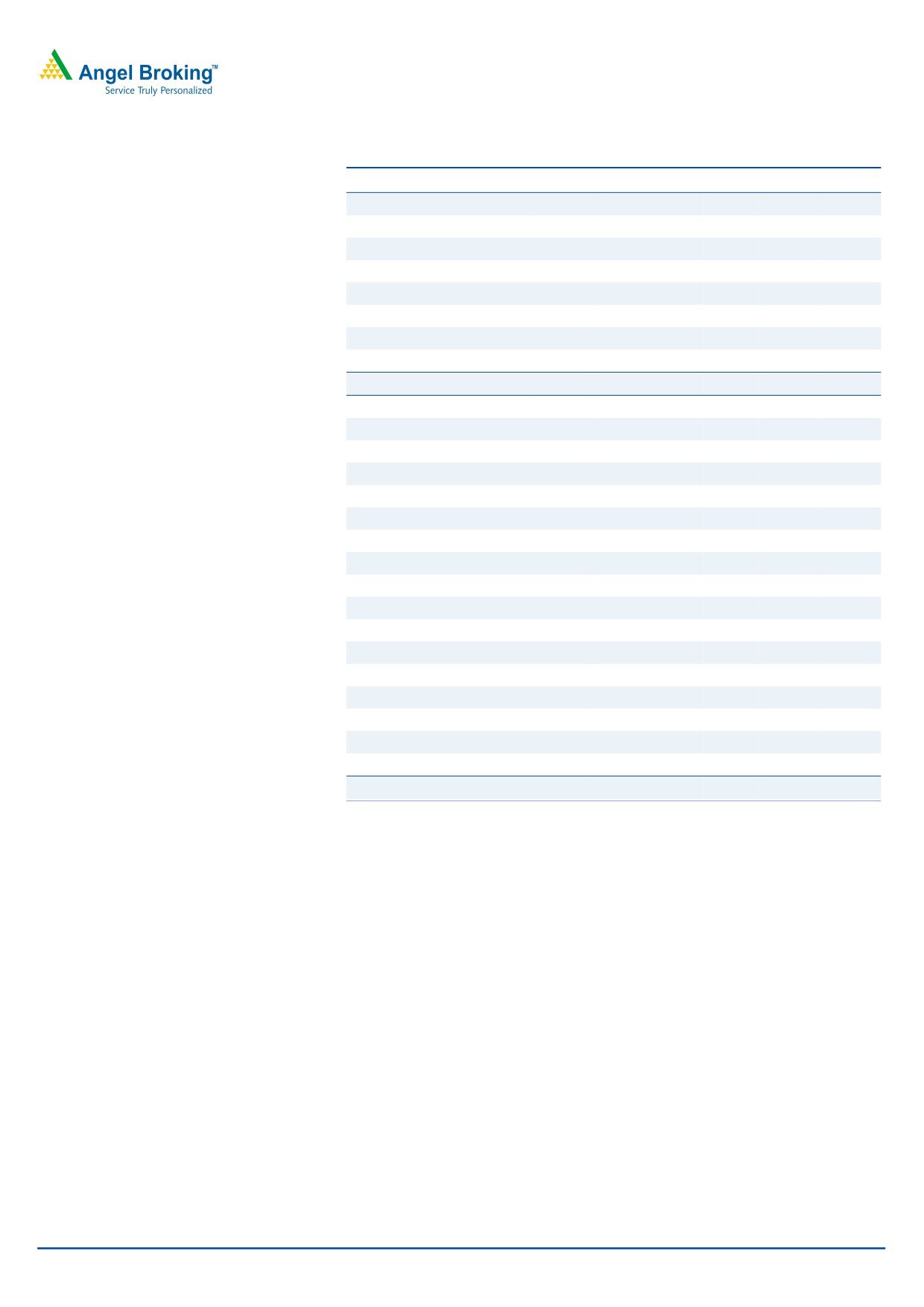

Exhibit 12: Consolidated revenue to grow at an 18.6%

Exhibit 13: C&EPC segment will continue to dominate

CAGR of over FY11-13E

the overall scheme of things

2,000

63.7

70.0

100

60.6

15

15

17

1,800

90

21

53.5

60.0

28

1,600

80

1,831

1,400

50.0

70

1,627

1,200

60

40.0

1,000

50

25.0

30.0

800

85

85

83

40

79

1,302

72

600

12.5

20.0

30

400

796

20

518

10.0

200

10

-

-

-

FY2009

FY2010

FY2011

FY2012E FY2013E

FY2009

FY2010

FY2011

FY2012E

FY2013E

Revenue ( ` cr)

yoy growth (%)

C&EPC revenues (%)

BOT revenues (%)

Source: Company, Angel Research

Source: Company, Angel Research

Blended EBITDAM to marginally improve due to change in

revenue mix

For FY2011, ABL’s blended EBITDAM stood at 19.4%, owing to toll disruption in

toll collections for two projects (Pune Shirur and Nagar Karmala) and major O&M

work done by the company for few projects. Going ahead, we expect ABL to post

blended EBITDAM of 21.7% and 23.1% for FY2012 and FY2013, respectively, as

we are factoring normalized C&EPC margin at 12.5% and BOT margin at 85.0%

for both FY2012 and FY2013. Marginal improvement in FY2013 would come

from higher contribution from the high-margin BOT segment.

December 16, 2011

9

Initiating Coverage | Infrastructure

FY2012E

FY2013E

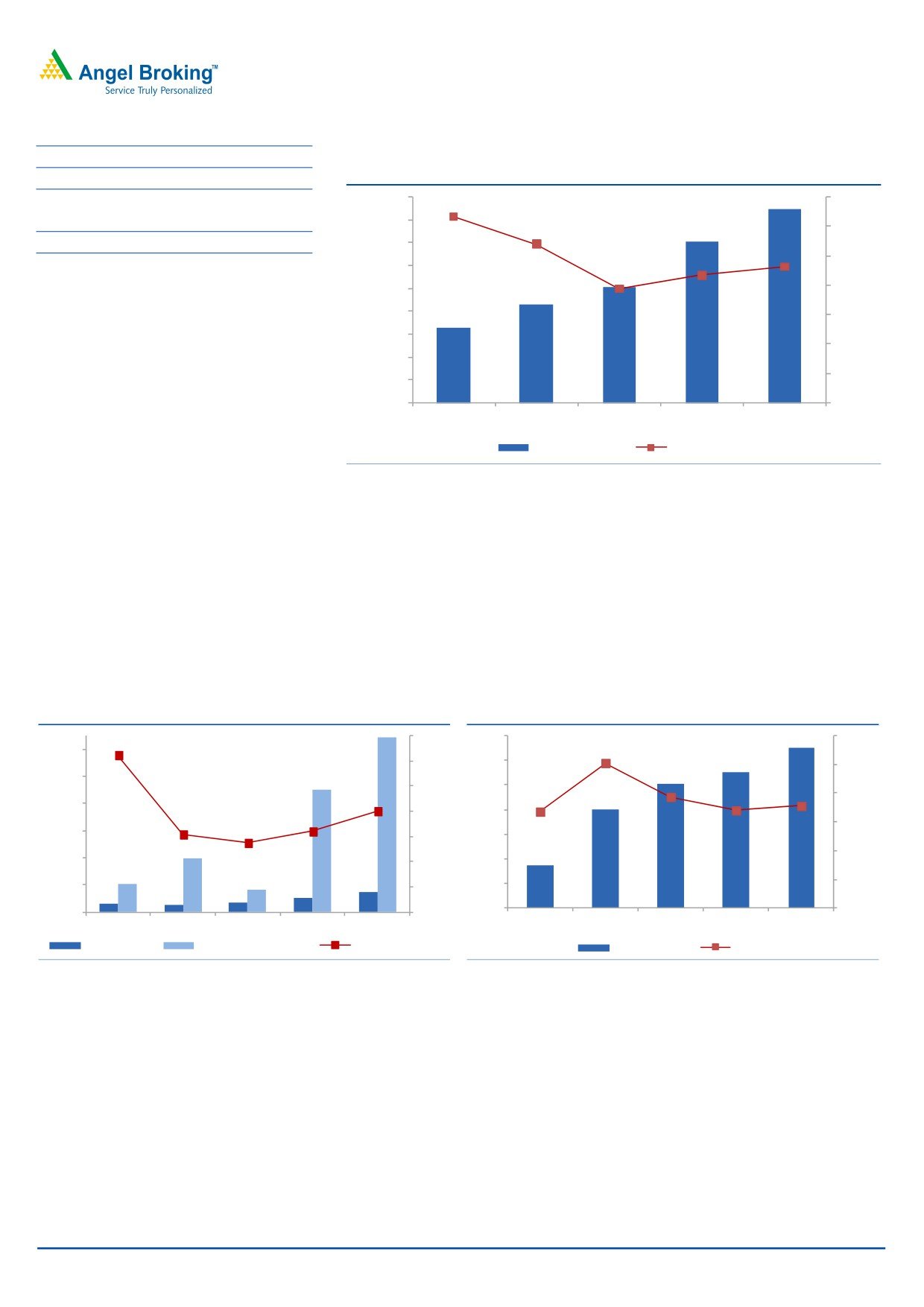

Exhibit 14: EBITDAM set to improve in FY2013 on the back of increased

EBITDA (` cr)

352.7

423.6

toll revenue contribution

C&EPC EBITDA

162.6

179.0

450

31.6

35.0

BOT EBITDA

190.1

244.6

400

26.9

30.0

EBITDAM (%)

21.7

23.1

350

21.7

23.1

25.0

C&EPC EBITDA

12.5

12.5

300

19.4

BOT EBITDA

85.0

85.0

250

20.0

424

200

15.0

353

150

252

10.0

100

214

164

5.0

50

-

-

FY2009

FY2010

FY2011

FY2012E

FY2013E

EBITDA (` cr)

EBITDA (%)

Source: Company, Angel Research

Earnings growth to be under check due to rising interest cost

ABL is expected to register a subdued CAGR of 13.6% on the earnings front for

FY2011-13, primarily on the back of higher interest cost in spite of growth in

revenue and improvement in EBITDA margin. For FY2012 and FY2013, we are

factoring interest cost of `103.8cr and `143.9cr, respectively. We expect ABL’s

debt to bloat to `3,468cr in FY2013E from `1,283cr in FY2011 (owing to debt

draw down for under construction projects).

Exhibit 15: Debt level to

increase

substantially over

Exhibit 16: Earnings to be driven by growth in revenue

FY2011-13E

and better EBITDAM

12.5

14.0

140

12.0

1,200

10.1

12.0

120

10.0

1,000

7.7

10.0

100

7.1

8.0

6.7

6.8

8.0

800

8.0

80

6.2

6.4

5.5

6.0

600

130

6.0

60

111

101

4.0

400

4.0

40

80

20

2.0

200

2.0

35

-

-

0

-

FY2009

FY2010

FY2011

FY2012E

FY2013E

FY2009

FY2010

FY2011

FY2012E

FY2013E

Interest (` cr)

yoy inc. in Debt (` cr)

Int. as % of sales

Adj. PAT (` cr)

PATM (%)

Source: Company, Angel Research

Source: Company, Angel Research

December 16, 2011

10

Initiating Coverage | Infrastructure

Outlook

History has showed that a world-class road network is a basic requirement for any

economy hopeful to maintain high economic growth rates. However, India’s road

network is barely adequate to maintain its current growth trajectory - indicating an

urgent attention towards the same and putting it on the priority list. Positively, the

political will to acknowledge and address these issues in now visible.

Records till date are mixed for road development in India - with PMGSY doing

reasonably well and NHDP lagging behind on meeting its targets. However,

matters have improved gradually with positive developments happening (as

mentioned earlier) and with experience gained on both sides - government

agencies and private sector. Some issues have been addressed on the ground and

at the policy level. But still the sector faces quite a lot of issues - for e.g., land

acquisition, environment clearance and dispute on certain aspects on the Model

Concession Agreement. Having said that, the pace of awarding has definitely

picked up considerably as compared to the past, though lower than targets.

Therefore, there are ample of opportunities for the private sector, especially for

road-focused players like IRB, ABL and ITNL.

However, we believe ABL is little differently placed than its peers on account of its

leverage position. In recent times, ABL has won large orders, which has resulted in

huge premium commitments to NHAI (~`220cr) and equity contributions from

ABL’s side, which we believe would further stretch its leverage (net D/E is expected

to rise from 1.4x in FY2011 to 3.0x by FY2013E). Also, the current cash flow

generation from BOT projects and the EPC segment would not fully suffice the

equity requirements for under development projects. Hence, we believe the only

two options for ABL would be to raise equity, which seems extremely tough in

current times, or raise debt for equity funding of its subsidiaries, which we have

factored in after considering ~50% of requirement been met from internal

accruals/refinancing of operational projects. We believe tying up of funds is the

biggest catalyst markets would watch out for in case of ABL and any delay in that

would negatively impact its stock performance on the bourses.

December 16, 2011

11

Initiating Coverage | Infrastructure

Valuation

We have valued ABL on a SOTP basis - by assigning 5.0x EV/EBITDA to its

standalone business (`104/share) (lower multiple as compared to IRB/ITNL given

the scale of operation) and valued its BOT projects on NPV basis (`141/share) (it

should be noted we have been conservative than management on revenues

estimates (toll receipts) for under construction projects keeping an eye on revenue

yield given the current competitive environment) - to arrive at a target price of

`245, which implies an upside of 29.4% from current levels. We initiate coverage

on the stock with a Buy rating and key catalyst being raising equity from capital

markets.

Exhibit 17: SOTP valuation break-up

Business Segment

Methodology

` cr

ABL's stake (%)

ABL's share

`/share

% to Target Price

Indore -Edalabad

NPV

242.7

87.0

211.2

40.1

16.4

Ahmednagar-Aurangabad

NPV

51.2

100.0

51.2

9.7

4.0

Wainganga Bridge

NPV

62.5

50.0

31.2

5.9

2.4

Dewas Bypass

NPV

28.5

100.0

28.5

5.4

2.2

Katni Bypass

NPV

28.0

99.9

28.0

5.3

2.2

Pune-Shirur

NPV

60.7

100.0

60.7

11.5

4.7

Nagar -Karmala

NPV

62.9

100.0

62.9

11.9

4.9

Bhandara

NPV

150.9

51.0

76.9

14.6

6.0

Jaora-Nayagaon

NPV

335.0

14.5

48.6

9.2

3.8

Durg

NPV

110.9

51.0

56.5

10.7

4.4

Pimpalgaon-Nashik-Gonde

NPV

68.2

26.0

17.7

3.4

1.4

Belgaum -Dharwad

NPV

(47.4)

100.0

(47.4)

(9.0)

(3.7)

Sambalpur-Baragarh

NPV

57.0

100.0

57.0

10.8

4.4

Dhankuni-Kharagpur

NPV

4.9

100.0

4.9

0.9

0.4

Cuttack Angul

P/BV

20.0

100.0

20.0

3.8

1.6

Others

NPV

33.8

100.0

33.8

6.4

2.6

EPC (Parent)

5.0x EV/EBITDA

952.8

181.0

74.0

Net debt at standalone level

(406.9)

(77.3)

(31.6)

Total

1,287.7

244.6

100.0

Source: Company, Angel Research, Note: Discount rate 14% and 16% for operational and under construction projects, respectively, *Others include

Nashirabad ROB, Sherinallah bridge and FOBs; We have valued Cuttack Angul project on P/BV basis due to pending detail

December 16, 2011

12

Initiating Coverage | Infrastructure

Exhibit 18: ABL - BOT projects details/assumptions

(` cr)

Project

Client Lane Kms

ABL's Stake

TPC SPV Equity

Debt

Grant/(Prem.)

Con. sign Int. Rate Toll Inc Traffic Inc

Operational Projects

(%)

(%)

(%)

(%)

Indore -Edalabad

MPRDC

407

87

165.0

64.7

55.6

45.0

22-Sep-01

11.9

7.0

5.0

Ahmednagar-Aurangabad

PWD

168

100

103.0

36.0

67.0

-

18-Dec-06

10.0

15.0*

5.0

Wainganga Bridge

MORTH

26

50

41.0

14.5

26.5

-

16-Nov-98

9.5

6.0

5.0

Dewas Bypass

PWD

40

100

61.0

25.0

36.0

-

31-Aug-01

13.8

25.0*

5.0

Katni Bypass

PWD

35

100

71.0

28.0

43.0

-

19-Aug-02

14.0

5.0

5.0

Pune-Shirur

PWD

216

100

161.0

55.0

106.0

-

7-May-03

11.0

18.0*

5.0

Nagar -Karmala

PWD

160

100

50.0

31.5

18.5

-

19-Feb-99

11.3

18.0*

5.0

Bhandara

NHAI

377

51

535.0

150.0

375.0

10.0

18-Sep-07

11.0

6.0

5.0

Dhule Bypass

PWD

12

100

6.0

0.6

5.4

-

28-Aug-97 No debt

-

5.0

Nashirabad

MORTH

8

100

15.0

14.5

0.5

-

16-Nov-98 No debt

21.0#

5.0

Sherinala

PWD

7

100

14.0

7.0

7.1

-

23-Mar-99 No debt

16.0

5.0

Anawali Kasegaon

PWD

22

5

7.4

3.3

4.1

-

1-Mar-04 No debt

n.a.

5.0

Under cons./develop.

Jaora-Nayagaon

MPRDC

340

15

835

273.0

562.0

(15.3)^

20-Aug-07

11.0

5.0

5.0

Durg

NHAI

368

51

587

201.0

386.0

(1.0)

23-Jan-08

13.3

5.0

5.0

PNG

NHAI

452

26

1,691

339.0

1,352.0

6.2%@

8-Jul-09

10.3

5.0

5.0

Belgaum -Dharwad

NHAI

454

100

694

215.0

479.0

(31.0)^

29-Jun-10

12.3

5.0

5.0

Sambalpur-Baragarh

NHAI

408

100

1,142

332.0

810.0

(1.3)^

29-Jun-10

11.8

5.0

5.0

Dhankuni-Kharagpur

NHAI

840

100

2,200

450.0

1,750.0

(126.1)^

21-Jun-11

11.0

5.0

5.0

Total

3,611

8,378

2,240

6,084

Source: Company, Angel Research, Note:* Every three years, # Every five years, ^ 5% increment per annum, @ 6.19% of revenue payable as premium and

increment of 1% per annum

December 16, 2011

13

Initiating Coverage | Infrastructure

Concerns

Interest rate risks

ABL’s business model is vulnerable to

The inherent nature of the BOT project requires high leverage. Going by the thumb

interest rate fluctuations, and any hike

rule, most road BOT projects have a debt-equity blend of 70:30. In recent times,

in interest rates could increase its

ABL has won large orders, which is expected to result in stretch in its leverage

interest costs.

position (net D/E is expected to rise from 1.4x in FY2011 to 3.0x by FY2013E).

Hence, the company’s business model is vulnerable to interest rate fluctuations,

and any hike in interest rates could increase its interest costs. However, we believe

that interest rates are at peak and don’t expect any further increase from here on.

Traffic growth risks

The thumb rule for traffic growth is a

Revenue from BOT toll-based projects is directly affected by traffic growth.

factor of 0.8-0.9x of real GDP growth.

Companies bid for projects assuming long-term traffic growth patterns, which may

Therefore, we have conservatively

be higher/aggressive than actual growth. This aberration in traffic growth

factored in 5% traffic growth in ABL’s

estimates could result in lower returns for companies. Moreover, any economic

BOT projects.

slowdown or competing road development could impact our estimates. The thumb

rule for traffic growth is a factor of 0.8-0.9x of real GDP growth. Therefore, we

have conservatively factored in 5% traffic growth in ABL’s BOT projects.

Commodity risks

Prices of commodities like cement, steel and bitumen play an important role in

If the movement in the prices of

shaping EBITDAM. We have factored in flat EBITDAM for ABL for the C&EPC and

commodities (bitumen, steel and

BOT segment owing to inclusion of escalation clause while estimating costs and

cement) is higher than the estimates, it

due to the integrated business model of ABL. However, if the movement in prices

would have a negative impact on the

of these commodities is higher than the estimates, it would have a negative impact

EBITDAM.

on the company’s EBITDAM.

December 16, 2011

14

Initiating Coverage | Infrastructure

Company background

ABL’s business is organized into four divisions: 1) BOT division, 2) Engineering,

procurement and construction (EPC) division, 3) RMC and bitumen division and 4)

Toll collection contract division.

ABL is an integrated road player involved in building and operating roads and

bridges in India on a BOT basis. The company’s head office is in Nashik,

Maharashtra, and its operations currently reach across the states of Maharashtra,

Madhya Pradesh, Chhattisgarh and Rajasthan. In addition to BOT projects, the

company engineers and designs; procures raw material and equipment; and

constructs roads, bridges, distribution transformers, electricity substations,

commercial buildings, industrial buildings and institutional buildings along with

providing maintenance services. ABL is also involved in the manufacturing and

selling of ready-mix concrete (RMC) and bitumen and collecting tolls on roads and

bridges owned by it and constructed by third parties.

Prior to 1997, ABL was engaged solely in the engineering and construction of

residential, commercial, industrial and institutional buildings. In

1997, after

acquiring EPC skills, ABL turned its attention towards bidding for contracts for

roads and bridges on a BOT basis. The company was awarded its first BOT

project, the Dhule bypass in Maharashtra, in

1997 and it completed the

construction of the road in the same year. In 2000, ABL began manufacturing

RMC solely for use by its EPC division, while in 2002 the company began to

manufacture RMC to sell to third parties. In 2005, ABL began processing bitumen

to a higher grade at its Pune facility for use in road projects. Having developed

systems and procedures for collecting tolls on its BOT projects, including

developing its own proprietary computerized toll revenue auditing system, ABL

bided for and was awarded the first contract to collect tolls on a road owned and

constructed by a third party. In FY2009, the company began undertaking EPC

work in the power sector and was awarded a contract by Maharashtra State

Electricity Distribution Company Limited for the construction and commissioning of

sub-transmission lines, distribution lines, power transformers and new sub-stations.

In September 2008, ABL entered into agreements for constructing and developing

two shopping malls on a BOT basis.

Seasoned player in the road BOT segment

ABL has a rich experience of 15 years

Rich experience: ABL has a rich experience of 15 years in the road segment with

in the road segment with 59 road and

59 road and bridge projects under its name. ABL was an early mover in the BOT

bridge projects under its name.

project sector, as it bagged its first BOT project, the Dhule bypass (TPC - `5.8cr) in

Maharashtra, in 1997 and completed the construction in the same fiscal year. In

terms of lane km, ABL has executed 3,095 lane km (1,155 lane km - third party

and 1,941 lane km - captive), making it one of the most seasoned players in the

road segment.

December 16, 2011

15

Initiating Coverage | Infrastructure

Exhibit 19: Portfolio across road focused players

8,000

7,026

7,000

6,579

6,000

5,000

3,709

4,000

3,270

2,979

3,000

2,000

1,204

1,000

-

ABL

ITNL

IRB

Operational Lane km

Portfolio Lane km

Source: Company, Angel Research, Note: Adjusted for stake

We believe ABL’s enviable reputation in

Changeover from a state to a national level player: ABL primarily started as a state

the road segment will augur well for the

level construction player and slowly moved to become a national player (recently

company to further develop its BOT

bagged four big NH projects worth `5,150cr). ABL’s early-mover status and

portfolio and to win EPC contracts for

continued presence in the road BOT sector provides it with a platform to further

road and bridge construction projects.

develop a BOT portfolio and to win EPC contracts for road and bridge construction

projects. Further, the company has worked with well-established players such as

L&T, IDFC and SREI Infrastructure Finance, which can lead to future opportunities

for ABL in the form of EPC contract for road projects from these players.

Exhibit 20: Project capitalization (` cr)

Oper.

% to Total

Under Develop

% to Total

Total

ABL

917

15.2

5,099

84.8

6,016

IRB

3,339

19.7

13,627

80.3

16,966

ITNL

3,563

23.7

11,485

76.3

15,048

Source: Company, Angel Research, Note: Adjusted for stake

NH-6 ABL’s forte: ABL has been concentrating on NH-6 as far as road BOT

projects are concerned, which is evident from the fact that it is the largest BOT

player on NH-6 with ~1,745 lane km of projects and 57% PPP market share on

the same. The company has won BOT projects on NH-6 and is present in four out

of six states linked to NH-6. We believe ABL’s experience and dominance on this

stretch equips it with credible traffic data, which aides while bidding for new

projects. Further, it makes it easier to mobilise resources from one project to the

other, thus leading to cost savings.

December 16, 2011

16

Initiating Coverage | Infrastructure

Under construction BOT projects - Update

Exhibit 21: ABL’s under construction projects

ABL's stake

TPC

EPC Toll Revenue* Revenue yield#

Status

Toll collection

(%)

(` cr)

(` cr)

(` cr)

(%)

expected to start

Jaora-Nayagaon

15

835

460

84.3

10.1

99% completed

4QFY12

Durg

51

587

539

58.0

9.9

99% completed

4QFY12

Pimpalgaon-Nashik-Gonde

26

1,691

650

171.0

10.1

47% completed

Jul-12

Belgaum -Dharwad

100

694

630

64.2

9.3

16% completed Already operational

Sambalpur-Baragarh

100

1,142

1,008

96.0

8.4

10% completed

Jul-13

Dhankuni-Kharagpur

100

2,200

2,016

217.2

9.9 FC expected in 4QFY12

4QFY12

Cuttack Angul

100

1,120

1,000

n.a

n.a

CA yet to be signed

n.a.

Total

8,269

6,303

Source: Company, Angel Research, Note: *Toll revenues are for first full year of operation, # Revenue yield=Toll Revenue/TPC

December 16, 2011

17

Initiating Coverage | Infrastructure

Profit and Loss (Consolidated)

Y/E March (` cr)

FY2008

FY2009

FY2010

FY2011

FY2012E

FY2013E

Net sales

323

518

796

1,302

1,627

1,831

% growth

(19.9)

60.6

53.5

63.7

25.0

12.5

Other operating income

-

-

-

-

-

-

Total operating income

323

518

796

1,302

1,627

1,831

% chg

(19.9)

60.6

53.5

63.7

25.0

12.5

Total expenditure

199

354

581

1,050

1,274

1,407

Construction/Contract expenses

120

265

484

928

1,128

1,242

Cost of material sold

52.5

58.2

58.5

61.3

71.3

80.2

Administrative and other exp.

14.2

15.6

17.8

26.8

33.5

37.7

Personnel

12.9

15.9

21.3

33.3

41.6

46.8

Other

-

-

-

-

-

-

EBITDA

123.3

164.0

214.3

252.2

352.9

423.7

% chg

16.9

33.0

30.6

17.7

39.9

20.1

(% of Net sales)

38.2

31.6

26.9

19.4

21.7

23.1

Depreciation & amortization

53.2

64.5

66.1

69.0

115.1

121.6

EBIT

70.1

99.5

148.1

183.2

237.8

302.1

% chg

26.4

41.9

48.8

23.7

29.8

27.0

(% of Net Sales)

21.7

19.2

18.6

14.1

14.6

16.5

Interest & other charges

47.4

64.6

49.0

71.5

103.8

143.9

Other income

17.6

15.0

18.6

33.9

23.7

27.3

Share in profit of associates

-

-

-

-

-

-

Recurring PBT

40.3

49.9

117.7

145.6

157.7

185.4

% chg

53.9

23.8

135.9

23.7

8.3

17.6

Extraordinary expense/(inc.)

-

-

-

(89.2)

-

-

PBT (reported)

40.3

49.9

117.7

234.8

157.7

185.4

Tax

3.8

11.6

31.9

24.5

45.7

53.8

(% of PBT)

9.4

23.3

27.1

10.4

29.0

29.0

PAT (reported)

36.5

38.3

85.9

210.3

112.0

131.7

Add: Share of earnings of asso.

-

-

-

-

-

-

Less: Minority interest (MI)

3.4

3.5

5.5

2.4

1.3

1.5

Prior period items

-

-

-

-

-

-

PAT after MI (reported)

33.1

34.8

80.4

208.0

110.7

130.2

Adj. PAT

33.1

34.8

80.4

100.8

110.7

130.2

% chg

36.5

5.2

130.8

25.5

9.8

17.6

(% of Net Sales)

10.3

6.7

10.1

7.7

6.8

7.1

Basic EPS (`)

7.4

7.6

17.6

19.2

21.0

24.7

Fully diluted EPS (`)

6.3

6.6

15.3

19.2

21.0

24.7

% chg

36.5

5.2

130.8

25.5

9.8

17.6

December 16, 2011

18

Initiating Coverage | Infrastructure

Balance Sheet (Consolidated)

Y/E March (` cr)

FY2008

FY2009

FY2010

FY2011

FY2012E

FY2013E

SOURCES OF FUNDS

Equity Share Capital

46

46

46

53

53

53

Preference Capital

13

13

12

10

10

10

Reserves& Surplus

253

289

404

830

941

1,071

Shareholder’s Funds

311

347

462

893

1,003

1,134

Total Loans

512

723

1,122

1,283

2,181

3,468

Deferred Tax Liability

1

2

3

2

2

2

Minority Interest

16

24

81

111

111

111

Total Liabilities

841

1,095

1,669

2,289

3,297

4,714

APPLICATION OF FUNDS

Gross Block

623

749

791

1,389

1,809

2,249

Less: Acc. Depreciation

191

259

330

368

483

605

Net Block

432

491

461

1,020

1,326

1,644

Capital Work-in-Progress

129

373

814

673

1,149

2,047

Goodwill

-

-

-

-

-

-

Investments

72

91

149

139

160

168

Balance of unutilised monies

-

-

-

11

-

-

Current Assets

291

306

685

815

1,172

1,485

Inventories

91

67

196

241

362

489

Sundry Debtors

33

35

182

285

392

486

Cash

99

69

85

60

75

87

Loans & Advances

67

135

222

229

343

424

Other

-

-

-

-

-

-

Current liabilities

83

165

440

371

509

631

Net Current Assets

208

141

245

445

663

855

Misc. Exp. not written off

-

-

-

-

-

-

Total Assets

841

1,095

1,669

2,289

3,297

4,714

December 16, 2011

19

Initiating Coverage | Infrastructure

Cash Flow (Consolidated)

Y/E March (` cr)

FY2008 FY2009 FY2010 FY2011 FY2012E FY2013E

Profit before tax

40

50

118

235

156

184

Depreciation

53

64

66

69

115

122

Change in Working Capital

37

(49)

38

224

192

180

Less: Other income

5

4

5

34

24

27

Direct taxes paid

6

11

31

24

46

54

Cash Flow from Operations

46

148

111

21

10

44

(Inc.)/ Dec. in Fixed Assets

(152)

(367)

(478)

(457)

(896)

(1,339)

(Inc.)/ Dec. in Investments

(5)

(19)

(58)

9

(20.9)

(8)

Other income

5

4

47

34

24

27

Cash Flow from Investing

(153)

(382)

(489)

(414)

(893)

(1,319)

Issue of Equity

(8)

-

-

220

-

-

Inc./(Dec.) in loans

75

211

399

161

898

1,287

Dividend Paid (Incl. Tax)

-

-

-

-

-

-

Others

1

(7)

(6)

(13)

-

-

Cash Flow from Financing

67

203

393

368

898

1,287

Inc./(Dec.) in Cash

(40)

(30)

15

(24)

15

12

Opening Cash balances

139

99

69

85

60

75

Closing Cash balances

99

69

85

60

75

87

December 16, 2011

20

Initiating Coverage | Infrastructure

Key Ratios

Y/E March

FY2008

FY2009

FY2010

FY2011

FY2012E FY2013E

Valuation Ratio (x)

P/E (on FDEPS)

30.1

28.6

12.4

9.9

9.0

7.6

P/CEPS

11.5

10.0

6.8

5.9

4.4

4.0

P/BV

3.2

2.9

2.2

1.1

1.0

0.9

EV/Sales

4.4

3.2

2.6

1.7

1.9

2.4

EV/EBITDA

11.4

10.0

9.5

8.8

8.8

10.3

EV / Total Assets

1.7

1.5

1.2

1.0

0.9

0.9

Per Share Data (`)

EPS (Basic)

7.4

7.6

17.6

19.2

21.0

24.7

EPS (fully diluted)

6.3

6.6

15.3

19.2

21.0

24.7

Cash EPS

16.4

18.9

27.8

32.3

42.9

47.8

DPS

-

-

-

-

-

-

Book Value

59.1

66.0

87.8

169.7

190.6

215.4

DuPont Analysis

EBIT margin

21.7

19.2

18.6

14.1

14.6

16.5

Tax retention ratio

0.9

0.8

0.7

0.9

0.7

0.7

Asset turnover (x)

0.5

0.6

0.6

0.7

0.6

0.5

ROIC (Post-tax)

9.5

8.6

8.3

8.6

6.2

5.5

Cost of Debt (Post Tax)

9.0

8.0

3.9

5.3

4.3

3.6

Leverage (x)

1.2

1.6

2.1

1.7

1.8

2.6

Operating ROE

10.0

9.6

17.5

14.1

9.6

10.2

Returns (%)

ROACE (Pre-tax)

8.9

10.3

10.7

9.3

8.5

7.5

Angel ROIC (Pre-tax)

10.4

11.3

11.3

9.6

8.7

7.7

ROAE

11.1

11.6

21.2

14.9

11.7

12.2

Turnover ratios (x)

Asset Turnover (Gross Block)

0.6

0.8

1.0

1.2

1.0

0.9

Inventory / Sales (days)

84

55

60

61

68

85

Receivables (days)

32

24

50

66

76

88

Payables (days)

134

128

190

141

126

148

Work. cap. cycle (ex-cash) (days)

100

63

53

76

109

135

Solvency ratios (x)

Net debt to equity

1.3

1.9

2.2

1.4

2.1

3.0

Net debt to EBITDA

3.3

4.0

4.8

4.8

6.0

8.0

Interest Coverage

1.5

1.5

3.0

2.6

2.3

2.1

December 16, 2011

21

Initiating Coverage | Infrastructure

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please

refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and

its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

ABL

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors.

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to 15%)

Sell (< -15%)

December 16, 2011

22

Initiating Coverage | Infrastructure

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 39357800

Research Team

Fundamental:

Sarabjit Kour Nangra

VP-Research, Pharmaceutical

Vaibhav Agrawal

VP-Research, Banking

Shailesh Kanani

Infrastructure

Srishti Anand

IT, Telecom

Bhavesh Chauhan

Metals, Mining

Sharan Lillaney

Mid-cap

V Srinivasan

Research Associate (Cement, Power)

Yaresh Kothari

Research Associate (Automobile)

Shrinivas Bhutda

Research Associate (Banking)

Sreekanth P.V.S

Research Associate (FMCG, Media)

Hemang Thaker

Research Associate (Capital Goods)

Nitin Arora

Research Associate (Infra, Real Estate)

Ankita Somani

Research Associate (IT, Telecom)

Varun Varma

Research Associate (Banking)

Sourabh Taparia

Research Associate (Cement, Power)

Technicals:

Shardul Kulkarni

Sr. Technical Analyst

Sameet Chavan

Technical Analyst

Sacchitanand Uttekar

Technical Analyst

Derivatives:

Siddarth Bhamre

Head - Derivatives

Institutional Sales Team:

Mayuresh Joshi

VP - Institutional Sales

Hiten Sampat

Sr. A.V.P- Institution sales

Meenakshi Chavan

Dealer

Gaurang Tisani

Dealer

Akshay Shah

Dealer

Production Team:

Simran Kaur

Research Editor

Dilip Patel

Production

CSO & Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.Tel.: (022) 3083 7700. Angel Broking Ltd: BSE Sebi Regn No: INB010996539 / PMS Regd Code: PM/INP000001546 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / NSE Sebi Regn Nos: Cash: INB231279838 / NSE

F&O: INF231279838 / Currency: INE231279838 / MCX Currency Sebi Regn No: INE261279838 / Member ID: 10500 / Angel Commodities Broking Pvt. Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

December 16, 2011

23